Earnings summaries and quarterly performance for Sangoma Technologies.

Research analysts who have asked questions during Sangoma Technologies earnings calls.

DK

David Kwan

TD Cowen

10 questions for SANG

Also covers: OTEX, WHTCF

GF

Gavin Fairweather

BMO Capital Markets

10 questions for SANG

Also covers: ALYAF, DCBO

Robert Young

Canaccord Genuity

8 questions for SANG

Also covers: CLS, DCBO, DSGX +2 more

Mike Latimore

Northland Capital Markets

7 questions for SANG

Also covers: AI, AXON, CTLP +22 more

SS

Suthan Sukumar

Stifel Financial Corp.

5 questions for SANG

Also covers: DCBO, GIB, LSPD +1 more

MI

Max Ingram

Canaccord Genuity Group Inc.

1 question for SANG

Recent press releases and 8-K filings for SANG.

Sangoma Reports Q2 2026 Results with Sequential Revenue Growth and Strong Bookings

SANG

Earnings

Guidance Update

Share Buyback

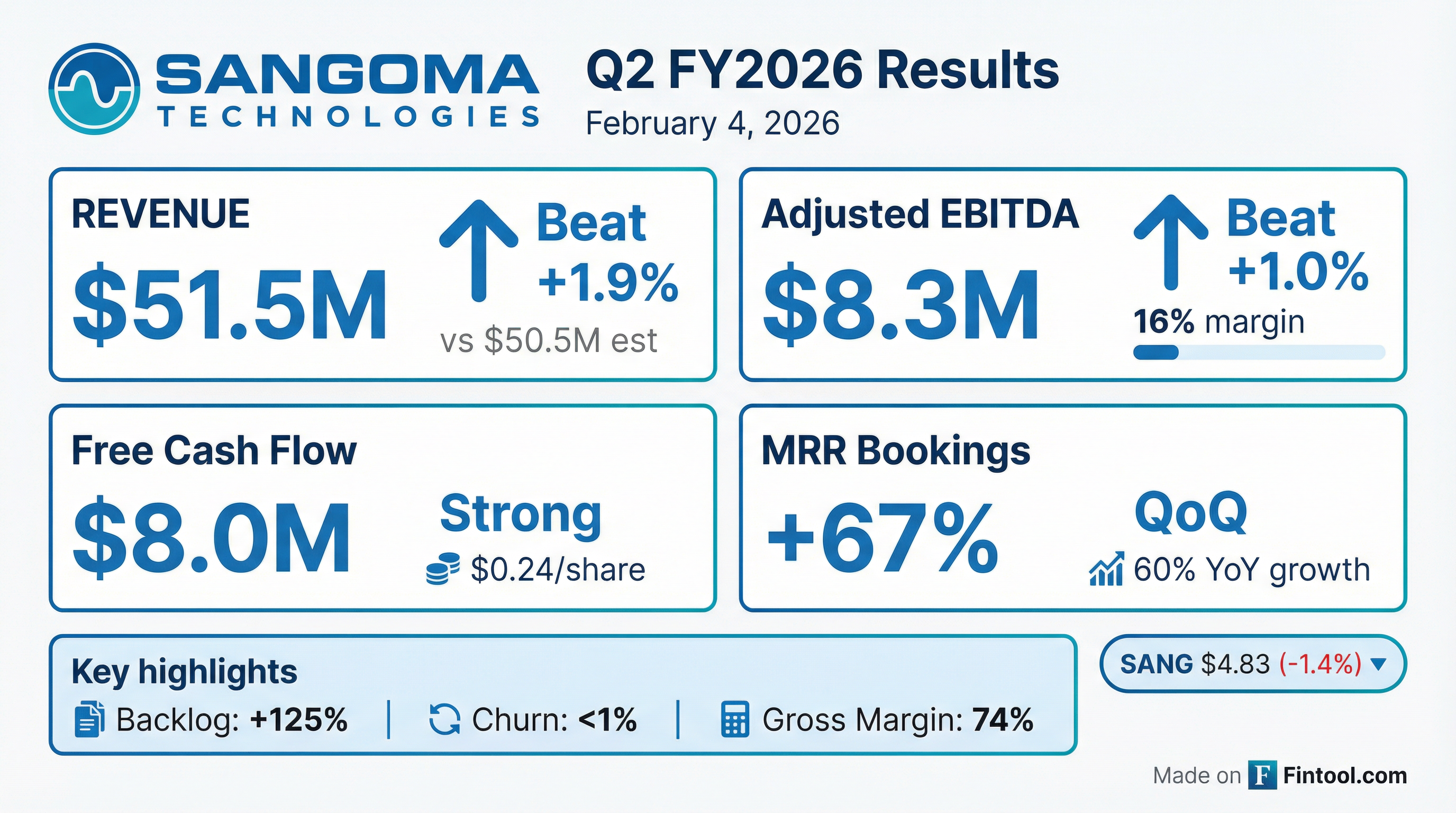

- Sangoma reported Q2 2026 revenue of $51.5 million, representing a 1.2% sequential increase, with service revenue growing 1%. Adjusted EBITDA for the quarter was $8.3 million with 16% margins, and free cash flow reached $8 million.

- Monthly Recurring Revenue (MRR) bookings grew significantly, up 67% sequentially and 60% year-over-year, while the churn rate saw sequential improvement, holding just under 1%.

- The company reduced debt by an additional $5.2 million in Q2, ending the quarter with $37.6 million in total debt, and repurchased approximately 196,000 shares. Fiscal year 2026 guidance was tightened to expected revenue of $205 million-$208 million and an adjusted EBITDA margin of 17%-18%.

2 days ago

Sangoma Technologies Reports Strong Q2 2026 Results and Updates FY 2026 Guidance

SANG

Earnings

Guidance Update

Share Buyback

- Sangoma Technologies reported Q2 2026 revenue of $51.5 million, a 1.2% sequential increase, with adjusted EBITDA of $8.3 million (16% margin) and $8 million in free cash flow.

- The company experienced significant bookings momentum, with MRR bookings growing 67% sequentially and 60% year-over-year, leading to a 125% increase in the Q3 starting backlog compared to Q2.

- Sangoma tightened its FY 2026 guidance, now expecting revenue between $205 million-$208 million and adjusted EBITDA margins in the range of 17%-18%.

- The company continued its capital allocation strategy by repurchasing approximately 196,000 shares in Q2 and reducing debt by an additional $5.2 million, bringing total debt to $37.6 million at quarter-end.

2 days ago

Sangoma Reports Strong Q2 2026 Results and Tightens FY2026 Guidance

SANG

Earnings

Guidance Update

Share Buyback

- Sangoma reported Q2 2026 revenue of $51.5 million, a 1.2% sequential increase, and adjusted EBITDA of $8.3 million with 16% margins.

- The company experienced significant bookings momentum, with MRR bookings growing 67% sequentially and 60% year-over-year, driven by larger strategic deals.

- Free cash flow improved sequentially to $8 million, or $0.24 per fully diluted share, and Sangoma continued to reduce debt by $5.2 million in Q2, bringing total debt to $37.6 million.

- Sangoma tightened its fiscal 2026 guidance, now expecting revenue between $205 million and $208 million and an adjusted EBITDA margin in the range of 17%-18%.

2 days ago

Sangoma Announces Second Quarter Fiscal 2026 Results and Narrows Fiscal 2026 Guidance

SANG

Earnings

Guidance Update

Share Buyback

- Sangoma Technologies Corporation reported Q2 Fiscal 2026 revenue of $51.5 million, a sequential increase of 1%, and a Net Loss of $2.0 million ($0.06 loss per share fully diluted).

- Adjusted EBITDA for Q2 Fiscal 2026 was $8.3 million, representing 16% of total revenue, with gross profit at $38.2 million (74% of total revenue).

- The company generated $8.0 million in Free Cash Flow ($0.24 per share fully diluted) and reduced its total debt to $37.6 million in Q2 Fiscal 2026.

- Sangoma narrowed its Fiscal 2026 guidance for total revenue to a range of $205 – $208 million and Adjusted EBITDA margin to 17%–18%.

- During Q2 Fiscal 2026, 195,949 shares were repurchased under the company's Normal Course Issuer Bid.

2 days ago

Sangoma Announces Second Quarter Fiscal 2026 Results

SANG

Earnings

Guidance Update

Share Buyback

- Sangoma Technologies reported revenue of $51.5 million for the second quarter of fiscal 2026, representing a 1% sequential increase, with a net loss of $2.0 million ($0.06 loss per share fully diluted).

- The company generated $10.1 million in net cash provided by operating activities and $8.0 million in Free Cash Flow ($0.24 per share fully diluted) during the second quarter of fiscal 2026.

- Sangoma narrowed its Fiscal 2026 guidance, now expecting total revenue between $205 million and $208 million and an Adjusted EBITDA margin of 17%–18%.

- Total debt at the end of the second quarter of fiscal 2026 was $37.6 million, a reduction of approximately 38% from the prior year, and the company repurchased 195,949 shares in the quarter.

2 days ago

Sangoma Technologies Corporation Provides Fiscal 2026 Outlook and Details Annual Meeting Proposals

SANG

Guidance Update

Executive Compensation

Auditor Change

- Sangoma Technologies Corporation anticipates tempered revenue in the first half of Fiscal 2026, with growth accelerating in the back half of the year, supported by strong first-quarter results.

- The company will hold its Annual and Special Meeting on December 16, 2025, where shareholders will vote on the appointment of KPMG LLP as auditors and the adoption of an amended and restated omnibus equity incentive plan.

- The proposed amended equity incentive plan fixes the maximum number of common shares that may be issued at 2,785,227, representing approximately 8% of issued and outstanding common shares as of the circular date, and includes limits on awards to non-employee directors.

Nov 26, 2025, 2:36 PM

Sangoma Technologies Reports Mixed Q1 Results Amid Strategic Shift

SANG

Earnings

Guidance Update

M&A

- Sangoma Technologies reported a 3% decrease in revenue to $50.8 million for the fiscal first quarter, following the sale of its VoIP Supply unit to focus on higher-margin software and subscription services, which resulted in a record gross margin of 72%.

- The company posted a net loss of $2.3 million and an adjusted EPS of -$0.06, missing consensus estimates of -$0.04 per share.

- Despite the net loss, adjusted EBITDA reached $8.3 million, and the company reaffirmed its fiscal 2026 guidance of $200 to $210 million in revenue with a 17% to 19% EBITDA margin.

- Sangoma's shares have declined approximately 30.7% year-to-date, underperforming the broader market, despite positive analyst ratings.

Nov 11, 2025, 1:31 AM

Sangoma Reports Q1 2026 Results and Reaffirms FY26 Guidance

SANG

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Sangoma reported Q1 2026 revenue of $50.8 million, adjusted EBITDA of $8.3 million with 16% margins, and $3.2 million in free cash flow.

- The company's recurring revenue now represents over 90% of total revenue, with services accounting for 92%.

- New pipeline creation increased 39% quarter over quarter, and MRR bookings grew 2.4% sequentially and 6.4% year over year.

- Sangoma reaffirmed its fiscal 2026 guidance for $200 million-$210 million in revenue and an adjusted EBITDA margin in the range of 17%-19%, expecting sequential growth from Q2 onwards.

- The company reduced its total debt to $42.8 million and repurchased approximately 710,000 shares, representing 2.1% of shares outstanding.

Nov 10, 2025, 10:30 PM

Sangoma Reports Q1 2026 Results and Reaffirms FY26 Guidance

SANG

Earnings

Guidance Update

New Projects/Investments

- Sangoma reported Q1 2026 revenue of $50.8 million, adjusted EBITDA of $8.3 million with 16% margins, and $3.2 million in free cash flow.

- Recurring revenue now represents over 90% of total revenue, with services accounting for 92%.

- The company saw a 39% quarter-over-quarter increase in new pipeline creation and 6.4% year-over-year growth in MRR bookings.

- Sangoma reaffirmed its fiscal 2026 guidance, projecting $200 million-$210 million in revenue and an adjusted EBITDA margin of 17%-19%, with sequential growth anticipated from Q2.

- Strategic investments include approximately $2 million in incremental SG&A for growth initiatives, alongside continued debt reduction and share repurchases.

Nov 10, 2025, 10:30 PM

Sangoma Reports Q1 2026 Results and Reaffirms FY2026 Guidance

SANG

Earnings

Guidance Update

New Projects/Investments

- Sangoma reported Q1 2026 revenue of $50.8 million, adjusted EBITDA of $8.3 million (16% margin), and $3.2 million in free cash flow.

- The company's business model is transitioning to higher-margin recurring revenue, which now represents over 90% of total revenue.

- Key growth metrics showed positive momentum, with new pipeline creation increasing 39% quarter-over-quarter and MRR bookings growing 2.4% sequentially and 6.4% year-over-year. Average revenue per customer also saw a 19% year-over-year increase.

- Sangoma reaffirmed its fiscal 2026 guidance for $200 million-$210 million in revenue and an adjusted EBITDA margin in the range of 17%-19%, anticipating sequential growth from Q2 onwards.

- The company is investing an additional $2 million in growth initiatives within SG&A, focusing on expanding field capacity, partner recruitment, and marketing, with these investments expected to materialize and drive returns through the year.

Nov 10, 2025, 10:30 PM

Quarterly earnings call transcripts for Sangoma Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more