Earnings summaries and quarterly performance for SANMINA.

Executive leadership at SANMINA.

Board of directors at SANMINA.

Research analysts who have asked questions during SANMINA earnings calls.

Recent press releases and 8-K filings for SANM.

Sanmina Reports Strong Q1 2026 Results and Provides Q2 Outlook

SANM

Earnings

Guidance Update

New Projects/Investments

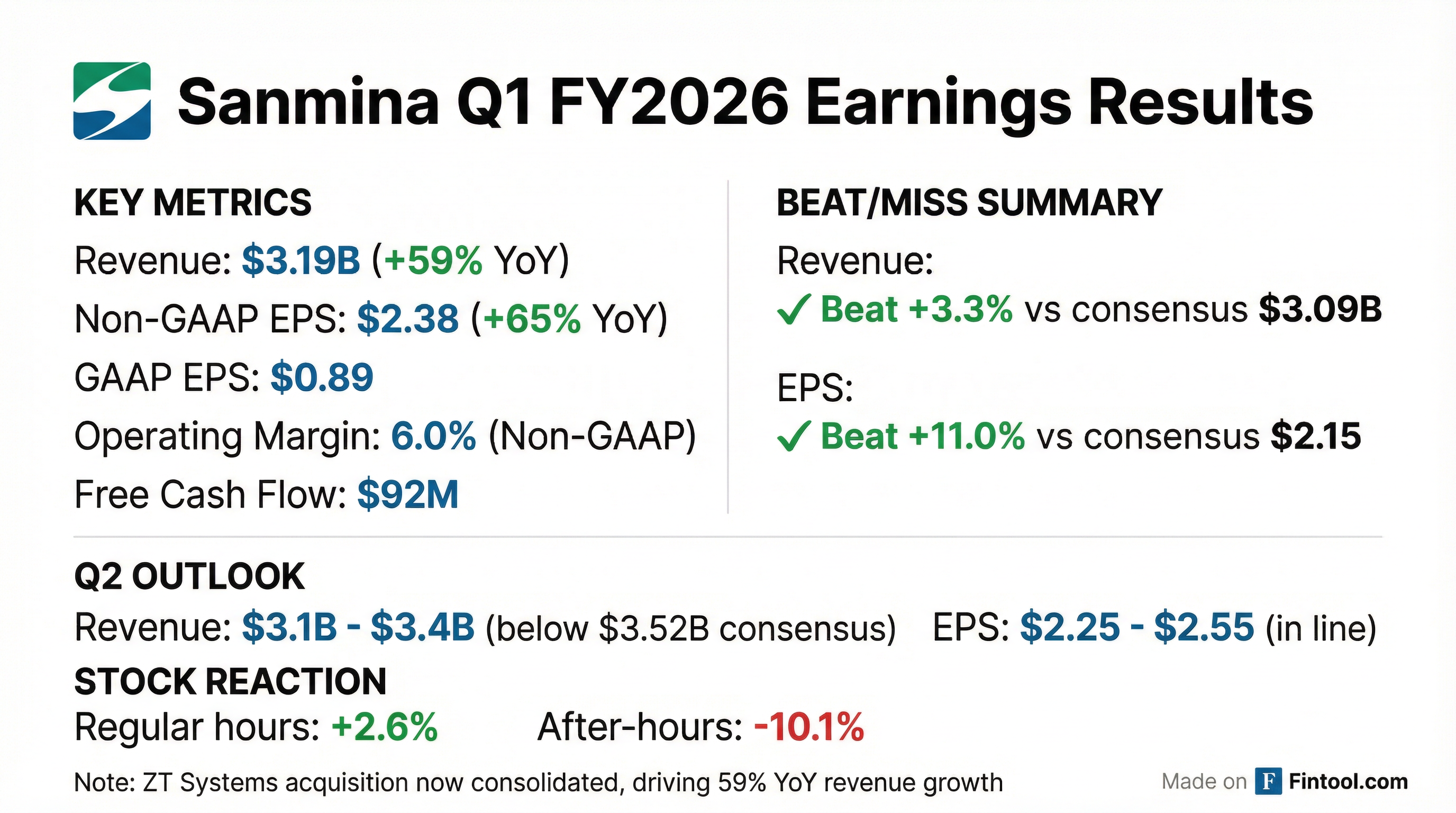

- Sanmina reported strong Q1 2026 results, with revenue of $3.19 billion, a non-GAAP operating margin of 6.0%, and non-GAAP diluted earnings per share of $2.38, all meeting or exceeding their outlook.

- For Q2 2026, the company expects revenue between $3.1 billion and $3.4 billion and non-GAAP diluted earnings per share in the range of $2.25 to $2.55.

- The ZT Systems business performed in line with expectations and contributed to revenue growth, with the company comfortable with the consensus estimate of $14 billion in revenue for fiscal year 2026.

- Sanmina is strategically investing in areas like AI data centers and the energy business, including a new factory in Houston, Texas, and aims for longer-term operating margins of 6%-7%+.

Jan 26, 2026, 10:00 PM

Sanmina Reports Strong Q1 FY'26 Results and Provides Q2 FY'26 Outlook

SANM

Earnings

Guidance Update

M&A

- Sanmina reported Q1 FY'26 revenue of $3.19 billion, exceeding its outlook and increasing significantly from $2.006 billion in Q1 FY'25.

- Non-GAAP diluted EPS for Q1 FY'26 was $2.38, also surpassing the company's outlook and up from $1.44 in Q1 FY'25.

- The company generated $179 million in cash flow from operations and $92 million in free cash flow during Q1 FY'26, and repurchased 516 thousand shares for $79 million.

- Q1 FY'26 results include two months of ZT Systems operations, with the integration on track and immediately accretive to EPS.

- For Q2 FY'26, Sanmina projects revenue between $3.1 billion and $3.4 billion and non-GAAP diluted EPS between $2.25 and $2.55.

Jan 26, 2026, 10:00 PM

Sanmina Reports Q1 2026 Results and Provides Q2 Outlook

SANM

Earnings

Guidance Update

New Projects/Investments

- Sanmina reported Q1 2026 revenue of $3.19 billion, marking a 59% increase compared to the same period a year ago, and non-GAAP diluted earnings per share of $2.38, up 66.1% year-over-year.

- For Q2 2026, the company expects revenue between $3.1 billion and $3.4 billion (midpoint $3.25 billion) and non-GAAP diluted earnings per share in the range of $2.25 to $2.55 (midpoint $2.40).

- Management is comfortable with the consensus estimate for fiscal year 2026 revenue of $14 billion, indicating expectations for a growth year.

- The ZT Systems business is performing well, with AI opportunities projected to deliver $16+ billion in calendar year 2027, supporting the goal to double Sanmina's revenue in two years.

- Strategic investments include expanding capacity for AI data centers and a new state-of-the-art factory in Houston for the energy business, with full production planned for calendar year 2027.

Jan 26, 2026, 10:00 PM

Sanmina Reports Strong Q1 Fiscal 2026 Results and Provides Q2 Outlook

SANM

Earnings

Guidance Update

New Projects/Investments

- Sanmina reported Q1 Fiscal 2026 revenue of $3,190 million, a 59% increase compared to the same period a year ago, and non-GAAP diluted earnings per share of $2.38, up 66.1% year-over-year.

- The company achieved a non-GAAP operating margin of 6% and generated strong cash flow from operations of $179 million in Q1 Fiscal 2026.

- For Q2 Fiscal 2026, Sanmina expects revenue between $3.1 billion and $3.4 billion and non-GAAP diluted EPS in the range of $2.25 to $2.55.

- Management is comfortable with consensus estimates for $14 billion in revenue for fiscal 2026 and aims to double Sanmina's revenue in the next two years, with AI opportunities projected to deliver over $16 billion in calendar year 2027.

- Growth was primarily driven by the communications networks and cloud and AI infrastructure markets, including the ZT Systems business, which is immediately accretive to EPS.

Jan 26, 2026, 10:00 PM

Sanmina Reports Q1 Fiscal 2026 Financial Results and Provides Q2 Fiscal 2026 Outlook

SANM

Earnings

Guidance Update

Share Buyback

- Sanmina reported Q1 Fiscal 2026 revenue of $3.19 billion, GAAP diluted EPS of $0.89, and Non-GAAP diluted EPS of $2.38 for the quarter ended December 27, 2025.

- The company generated $179 million in cash flow from operations and $92 million in free cash flow during Q1 Fiscal 2026.

- Sanmina repurchased 516 thousand shares for $79 million in Q1 Fiscal 2026, ending the quarter with $1.42 billion in cash and cash equivalents.

- For Q2 Fiscal 2026, Sanmina anticipates revenue between $3.1 billion to $3.4 billion and Non-GAAP diluted earnings per share between $2.25 to $2.55.

Jan 26, 2026, 9:04 PM

Sanmina Reports Q1 Fiscal 2026 Financial Results and Q2 Outlook

SANM

Earnings

Guidance Update

Share Buyback

- Sanmina reported Q1 Fiscal 2026 revenue of $3.19 billion and non-GAAP diluted EPS of $2.38 for the quarter ended December 27, 2025.

- The company provided an outlook for Q2 Fiscal 2026 revenue between $3.1 billion to $3.4 billion and non-GAAP diluted EPS between $2.25 to $2.55.

- In Q1 Fiscal 2026, cash flow from operations was $179 million and free cash flow was $92 million, with $79 million used for share repurchases.

- Management highlighted strong performance in Communications Networks and Cloud & AI Infrastructure end-markets driven by AI-driven hardware demand, and the ZT Systems integration is progressing as expected.

Jan 26, 2026, 9:01 PM

Sanmina Expands Energy Business with New Texas Factory

SANM

New Projects/Investments

Product Launch

- Sanmina Corporation announced a significant expansion of its Energy business, including a new state-of-the-art factory in Houston, Texas.

- The new facility will focus on the US energy market, producing medium-voltage distribution transformers, instrument transformers, and switchgear.

- Production is expected to begin in 2027, with initial customer commitments already in place.

- Sanmina has also entered into an agreement with Končar - Electrical Industry Inc. to co-design a custom medium-voltage transformer and explore further collaboration for Končar's US market growth.

Dec 16, 2025, 8:01 AM

Sanmina Discusses ZT Systems Acquisition Impact and Future Growth at UBS Conference

SANM

M&A

Guidance Update

Revenue Acceleration/Inflection

- Sanmina's acquisition of ZT Systems is expected to transform the company, establishing it as a leader in North America AI manufacturing and significantly expanding its presence in the cloud and data center markets.

- The company provided an operating margin guidance of 5.6%-6.1% for Q1, with a longer-term target of 6%-7% for the combined entity, including ZT Systems, which is expected to have a similar operating margin to the legacy business.

- Sanmina aims to double its revenue from $8 billion to $16 billion within two years (revised from three years), with the ZT Systems acquisition contributing an average of $5.7 billion over 11 months.

- For the current year, including the ZT acquisition, Sanmina expects revenue growth of well over 50% and EPS growth of at least 50-plus%.

- The company highlighted ongoing supply chain challenges, including extended lead times for components like memory, connectors, and circuit boards, but noted its global and regionalized supply chain strategy and customer-guaranteed material purchases.

Dec 3, 2025, 6:35 PM

Sanmina Discusses ZT Systems Acquisition, AI Growth, and Financial Outlook

SANM

M&A

Guidance Update

Revenue Acceleration/Inflection

- Sanmina's recent acquisition of ZT Systems is a transformative move, positioning the company as a leader in North American AI manufacturing and significantly expanding its capabilities in the data center market.

- The company projects substantial financial growth, expecting to double its overall size in two years from $8 million to $16 million, with over 50% growth in revenue and at least +50% growth in EPS this year, including the ZT acquisition.

- Sanmina targets long-term operating margins of 6%-7%, building on its legacy business's 5.7% last year and 6% in Q4, with ZT Systems' existing business expected to achieve similar margins.

- Operationally, Sanmina is addressing supply chain challenges, particularly with memory, connectors, and circuit boards, by leveraging its global and regionalized manufacturing strategy and customer-guaranteed material purchases.

Dec 3, 2025, 6:35 PM

Sanmina Discusses ZT Systems Acquisition Impact and Growth Outlook

SANM

M&A

Guidance Update

Revenue Acceleration/Inflection

- Sanmina's acquisition of ZT Systems is a transformative deal, positioning the company as a leader in North American AI manufacturing and expanding its presence in the data center market through a strategic partnership with AMD.

- The company anticipates significant growth from the ZT Systems acquisition, aiming to double its size from approximately $8 billion to $16 billion in revenue within two years.

- Sanmina expects its operating margin for the combined business, including ZT Systems, to be around 6%, with a longer-term target of 6%-7%.

- For the current fiscal year (2026), Sanmina projects overall revenue growth of over 50% and EPS growth of at least 50-plus%, including the ZT acquisition.

- The company is implementing a regional manufacturing strategy and managing extended lead times in the supply chain due to component shortages in areas such as memory, connectors, and circuit boards.

Dec 3, 2025, 6:35 PM

Quarterly earnings call transcripts for SANMINA.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more