Earnings summaries and quarterly performance for BENCHMARK ELECTRONICS.

Executive leadership at BENCHMARK ELECTRONICS.

Jeffrey W. Benck

President and Chief Executive Officer

Bipin Jayaraj

Senior Vice President, Chief Digital and Information Officer

Bryan R. Schumaker

Executive Vice President, Chief Financial Officer

David A. Clark

Senior Vice President, Chief Procurement Officer

David A. Moezidis

President and Chief Commercial Officer

David A. Valkanoff

Executive Vice President, Chief Operating Officer

Jan M. Janick

Senior Vice President, Chief Technology Officer

Rhonda R. Buseman

Senior Vice President, Chief Human Resources Officer

Stephen J. Beaver

Senior Vice President, General Counsel and Chief Legal Officer; Corporate Secretary

Board of directors at BENCHMARK ELECTRONICS.

Research analysts who have asked questions during BENCHMARK ELECTRONICS earnings calls.

Steven Fox

Fox Research

6 questions for BHE

Anja Soderstrom

Sidoti & Company, LLC

5 questions for BHE

Jaeson Schmidt

Lake Street Capital Markets

3 questions for BHE

James Ricchiuti

Needham & Company, LLC

2 questions for BHE

Jim Ricchiuti

Needham & Company

2 questions for BHE

Max Michaelis

Lake Street Capital

2 questions for BHE

Melissa Dailey Fairbanks

Raymond James Financial, Inc.

2 questions for BHE

Jason Smith

Lake Street Capital Markets

1 question for BHE

Melissa [indiscernible]

Raymond James & Associates, Inc.

1 question for BHE

Recent press releases and 8-K filings for BHE.

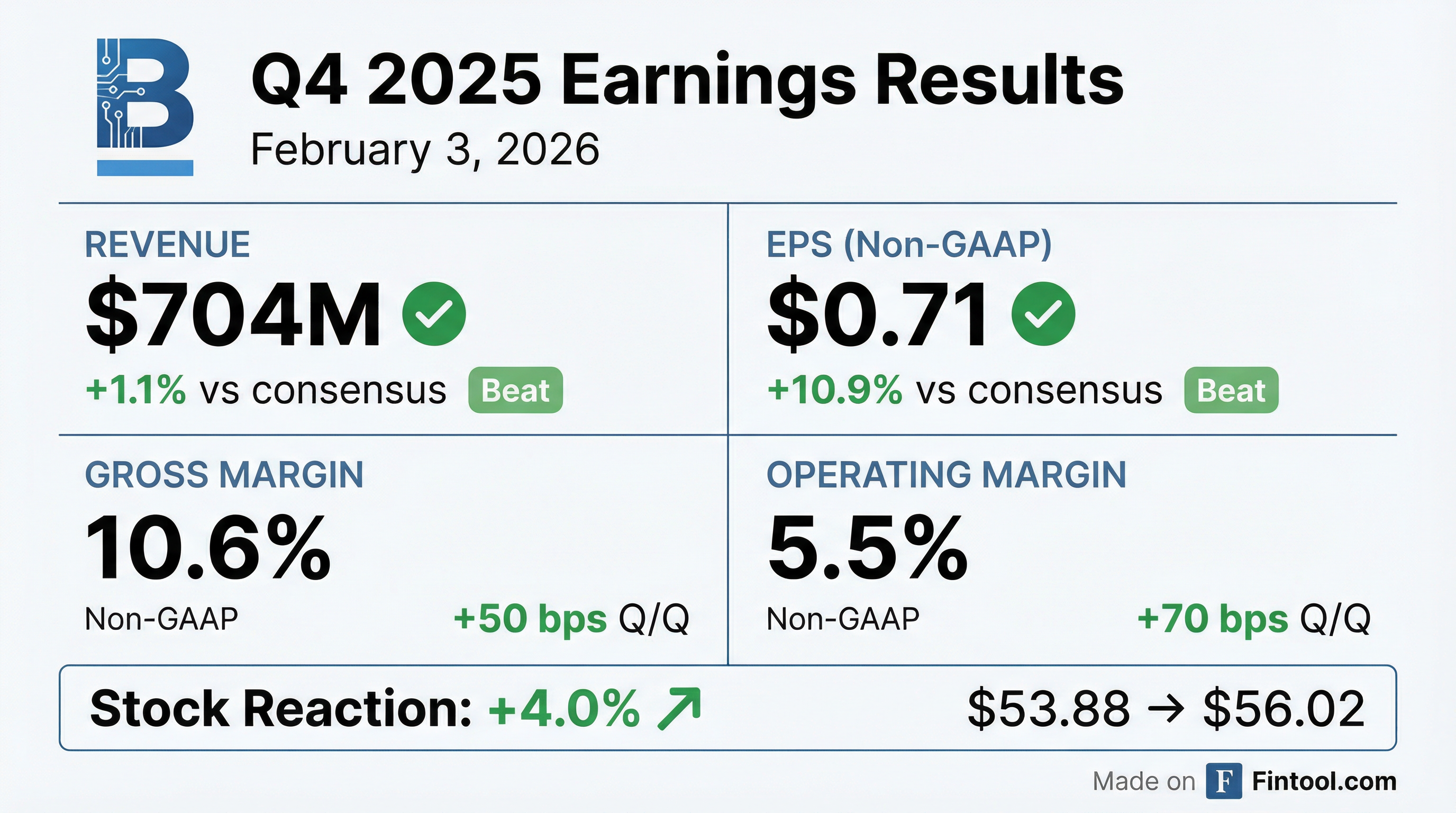

- Benchmark (BHE) reported Q4 2025 revenue of $704 million and non-GAAP EPS of $0.71, exceeding guidance. For the full fiscal year 2025, revenue was $2.66 billion (flat year-over-year) and non-GAAP EPS was $2.40 (up 5% year-over-year).

- The company provided Q1 2026 guidance, expecting revenue between $655 million and $695 million (up 7% year-over-year at the midpoint) and non-GAAP diluted EPS in the range of $0.53 to $0.59.

- Q4 2025 saw double-digit revenue growth in AC&C, Medical, and A&D, with AC&C up 27% year-over-year and Medical up 23% year-over-year. While Semi-Cap revenue decreased in Q4 2025, it is poised for a strong recovery in 2026.

- Benchmark generated $85 million in free cash flow for fiscal year 2025, ending with a net cash positive position of $111 million, and returned value through $24 million in dividends and $27 million in stock repurchases.

- Jeff Benck will transition out of the CEO role at the end of Q1 2026, with David Moezidis succeeding him.

- Benchmark reported Q4 2025 revenue of $704 million, up high single digits year-over-year, and non-GAAP EPS of $0.71, exceeding the high end of its guidance range. For the full year 2025, revenue was $2.66 billion, with non-GAAP EPS of $2.40, and the company generated $85 million in free cash flow.

- For Q1 2026, Benchmark expects revenue to be between $655 million and $695 million and non-GAAP diluted earnings per share in the range of $0.53 to $0.59.

- In Q4 2025, the company saw double-digit growth across AC&C, Medical, and A&D sectors, with Semi-Cap expected to recover in 2026 after a softer Q4 2025. Benchmark is investing in capacity expansion, including a fourth building in Penang, driven by strong bookings in space, MedTech, and enterprise AI.

- Jeff Benck will transition out of the CEO role at the end of Q1 2026, with David Moezidis assuming the position.

- Benchmark Electronics reported Q4 2025 revenue of $704 million and non-GAAP EPS of $0.71, exceeding guidance, and full-year 2025 non-GAAP EPS increased 5% to $2.40 on flat revenue of $2.66 billion.

- The company issued Q1 2026 guidance for revenue between $655 million and $695 million and non-GAAP diluted EPS in the range of $0.53 to $0.59.

- Key sectors like AC&C (up 27% year-over-year) and Medical (up 23% year-over-year) showed strong Q4 2025 growth, with Semi-Cap poised for a strong recovery in 2026 after a softer Q4 2025.

- Benchmark generated $85 million in free cash flow for fiscal year 2025 and returned value to shareholders through $24 million in dividends and $27 million in stock repurchases.

- Jeff Benck will transition out of the CEO role at the end of Q1 2026, with David Moezidis succeeding him.

- BHE reported Q4 2025 Non-GAAP Revenue of $704 million and Non-GAAP EPS of $0.71, exceeding prior guidance, contributing to full fiscal year 2025 Non-GAAP Revenue of $2,659 million and Non-GAAP EPS of $2.40.

- The company maintained strong profitability with a Non-GAAP Gross Margin of 10.6% in Q4 2025 and 10.2% for the full year, with year-over-year revenue growth led by AC&C, Medical, and Aerospace & Defense sectors.

- BHE generated $48 million in Free Cash Flow in Q4 2025 and $85 million for the full fiscal year 2025, and repurchased $27 million in stock during the year.

- For Q1 2026, BHE provided guidance for Net Sales between $655 million and $695 million and Non-GAAP Diluted EPS between $0.53 and $0.59.

- An immaterial error related to income tax calculation for 2024 was identified and corrected, which had understated income tax expense by $2.2 million and overstated shareholder's equity by $8.7 million as of December 31, 2024.

- Benchmark Electronics reported Q4 2025 revenue of $704 million and diluted non-GAAP earnings per share of $0.71. For the full year 2025, revenue was $2,659 million and diluted non-GAAP EPS was $2.40.

- The company issued Q1 2026 guidance, projecting revenue between $655 million and $695 million and diluted non-GAAP earnings per share between $0.53 and $0.59.

- Jeff Benck will transition out of the CEO role at the end of the quarter.

- The cash conversion cycle improved to 67 days in Q4 2025, down from 89 days in Q4 2024.

- Benchmark Electronics reported fourth quarter 2025 revenue of $704 million and diluted non-GAAP earnings per share of $0.71. For the full year 2025, revenue was $2,659 million and diluted non-GAAP earnings per share was $2.40.

- CEO Jeff Benck announced his transition out of the CEO role at the end of the quarter, with David Moezidis continuing as President.

- The company provided first quarter 2026 guidance, projecting revenue between $655 million and $695 million and diluted non-GAAP earnings per share between $0.53 and $0.59.

- David Moezidis will succeed Jeff Benck as CEO of Benchmark Electronics on April 1, 2026, following other recent executive appointments including a new Chief Commercial Officer and CTO.

- The company anticipates a stronger second half of 2026 for semi-cap equipment after a two-year slowdown, with recent upward forecast adjustments and orders. The medical sector has "turned a corner," and while Aerospace & Defense has seen double-digit growth, it is expected to moderate in 2026.

- Benchmark has consistently delivered gross margins upwards of 10% over the last nine quarters. They have also significantly improved working capital, reducing inventory by $270 million since Q1 2023 and achieving a cash conversion cycle of 77 days at the end of Q3.

- The company sees direct participation opportunities in sovereign AI and enterprise commercial AI by leveraging its expertise in high-performance computing and water-cooled infrastructure.

- David Moezidis will assume the role of CEO on April 1, 2026, succeeding Jeff Benck, who will retire but remain as a special advisor for a year. The company also appointed David Cummings as Chief Commercial Officer and Josh Holland as CTO.

- Benchmark Electronics anticipates a stronger second half of 2026 for its semi-cap equipment sector (27% of revenue), driven by recent upward forecast adjustments from customers after a two-year slowdown. The company has gained market share and invested in new facilities in Malaysia to support this growth.

- The medical sector (20% of business) has "turned a corner" after an 18-month slowdown, with the company securing a significant program from a competitor by utilizing automation to enhance product quality.

- The Advanced Communications and Compute (ACC) sector (13-15% of business) is experiencing a resurgence due to AI and high-performance computing, with opportunities in sovereign AI and enterprise commercial markets, leveraging the company's expertise in water-cooled infrastructure.

- The company has consistently delivered upwards of 10% in gross margin profile over the last nine quarters and aims to grow earnings faster than revenue. Benchmark Electronics has also improved working capital, reducing inventory by $270 million since Q1 2023 and lowering days of inventory to 75.

- Benchmark (BHE) reported Q3 2025 revenue of $681 million and non-GAAP EPS of $0.62, both at the high end of prior guidance, marking a return to year-over-year growth.

- For Q4 2025, the company expects revenue between $670-$720 million and non-GAAP diluted EPS in the range of $0.62-$0.68.

- The company saw double-digit year-over-year revenue growth in Medical (18%) and A&D (26%) in Q3 2025, with AC&C revenue up 18% sequentially, while Semicap revenue decreased 1% year-over-year.

- Benchmark generated $25 million in free cash flow in Q3 2025, contributing to over $74 million generated over the last 12 months, and repurchased $10 million in stock.

- David Moezidis has been promoted to President and will become the next CEO effective March 31, 2026, upon Jeff Benck's retirement.

Quarterly earnings call transcripts for BENCHMARK ELECTRONICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more