Earnings summaries and quarterly performance for PLEXUS.

Research analysts who have asked questions during PLEXUS earnings calls.

Anja Soderstrom

Sidoti & Company, LLC

8 questions for PLXS

David Williams

The Benchmark Company

8 questions for PLXS

James Ricchiuti

Needham & Company, LLC

6 questions for PLXS

Steve Barger

KeyBanc Capital Markets Inc.

6 questions for PLXS

Steven Fox

Fox Research

5 questions for PLXS

Melissa Fairbanks

Raymond James

4 questions for PLXS

Ruben Roy

Stifel Financial Corp.

4 questions for PLXS

Melissa Dailey Fairbanks

Raymond James Financial, Inc.

3 questions for PLXS

Chris Grenga

Needham & Company

2 questions for PLXS

Jacob Moore

Sidoti & Company, LLC

2 questions for PLXS

Matthew Sheerin

Stifel

1 question for PLXS

Recent press releases and 8-K filings for PLXS.

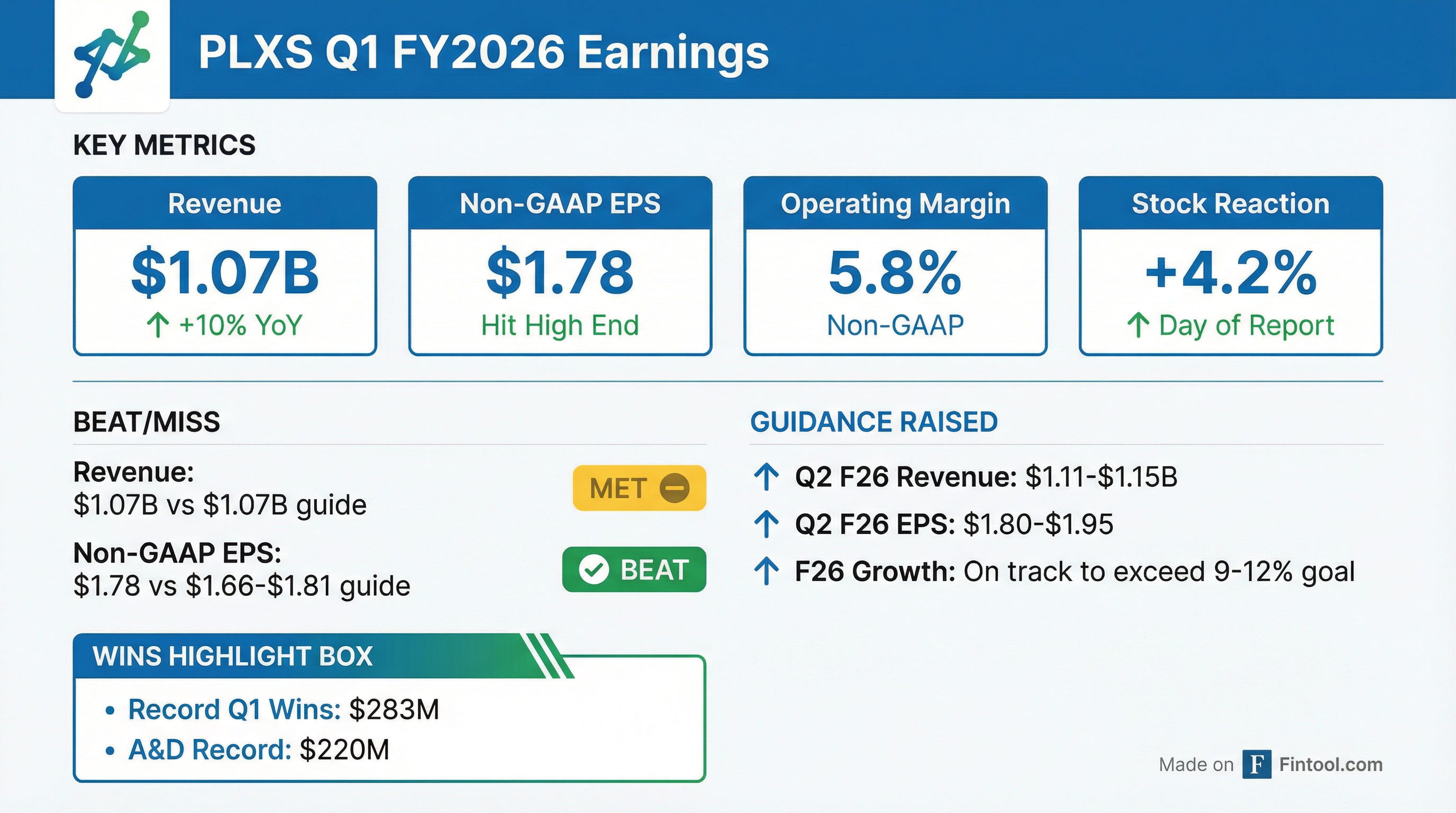

- Plexus reported Q1 2026 revenue of $1.07 billion, a 10% year-over-year increase, and non-GAAP EPS of $1.78.

- For Q2 2026, the company guides revenue between $1.11 billion and $1.15 billion, non-GAAP operating margin of 5.6%-6.0%, and non-GAAP EPS of $1.80-$1.95.

- Plexus now anticipates meeting or exceeding the high end of its 9%-12% revenue growth goal for fiscal 2026, targeting a 6% non-GAAP operating margin and approximately $100 million in free cash flow.

- The company secured 22 new manufacturing programs in Q1 2026, totaling $283 million in annualized revenue when fully ramped, with a record $220 million from the Aerospace and Defense sector.

- Performance is driven by program ramps and demand in healthcare life sciences and aerospace and defense, with an improving outlook for semi-cap and industrial equipment, supported by AI-driven automation and efficiency initiatives.

- Plexus reported Q1 2026 revenue of $1.070 billion and Non-GAAP diluted EPS of $1.78, marking the fourth consecutive quarter of sequential revenue growth and 10% year-over-year revenue growth.

- For Q2 2026, the company provided guidance for revenue between $1.110 billion and $1.150 billion and Non-GAAP diluted EPS between $1.80 and $1.95.

- Plexus forecasts approximately $100 million of F26 free cash flow and expects F26 revenue growth to meet or exceed the high end of its 9-12% goal.

- Total wins for Q1 2026 were $283 million, with a record $220 million coming from the Aerospace/Defense sector.

- Plexus reported Q1 2026 revenue of $1.07 billion, a 10% increase year-over-year, meeting the midpoint of guidance, and non-GAAP EPS of $1.78, meeting the high end of guidance.

- The company now anticipates meeting or exceeding the high end of its 9%-12% revenue growth goal for fiscal 2026, supported by strong performance across its healthcare life sciences, aerospace and defense, and industrial market sectors.

- In Q1 2026, Plexus secured 22 new manufacturing programs worth $283 million in annualized revenue when fully ramped, with the aerospace and defense sector contributing $220 million. The company also forecasts approximately $100 million of free cash flow for fiscal year 2026.

- Plexus reported Q1 2026 revenue of $1.07 billion and non-GAAP EPS of $1.78, meeting the midpoint and high end of their guidance ranges, respectively.

- For Q2 2026, the company is guiding revenue of $1.11-$1.15 billion, non-GAAP operating margin of 5.6%-6.0%, and non-GAAP EPS of $1.80-$1.95.

- Plexus now has the potential to meet or exceed the high end of its 9%-12% revenue growth goal for fiscal 2026, driven by strong year-over-year revenue growth, program ramps, market share gains, and strengthening end-market demand.

- The company secured 22 new manufacturing programs in Q1 2026, valued at $283 million in annualized revenue when fully ramped, including a record performance from the aerospace and defense sector.

- Plexus forecasts approximately $100 million of free cash flow for fiscal 2026 and reported a return on invested capital of 13.2% for Q1 2026.

- Plexus reported fiscal first quarter 2026 revenue of $1.070 billion, GAAP diluted EPS of $1.51, and non-GAAP diluted EPS of $1.78 for the period ended January 3, 2026.

- For the fiscal second quarter 2026, Plexus initiated revenue guidance of $1.110 billion to $1.150 billion, with GAAP diluted EPS guidance of $1.53 to $1.68 and non-GAAP EPS guidance of $1.80 to $1.95.

- During the fiscal first quarter 2026, the company purchased $22.4 million of its shares and won 22 manufacturing programs representing $283 million in annualized revenue when fully ramped.

- Plexus delivered a return on invested capital (ROIC) of 13.2% and reported negative free cash flow of $50.6 million for the fiscal first quarter 2026.

- Plexus Corp. reported fiscal first quarter 2026 revenue of $1.070 billion, GAAP diluted EPS of $1.51, and non-GAAP diluted EPS of $1.78 for the period ended January 3, 2026.

- For the fiscal second quarter ending April 4, 2026, the company initiated guidance for revenue between $1.110 billion and $1.150 billion, GAAP diluted EPS of $1.53 to $1.68, and non-GAAP diluted EPS of $1.80 to $1.95.

- During the first quarter, Plexus won 22 manufacturing programs representing $283 million in annualized revenue when fully ramped into production.

- The company purchased $22.4 million of its shares at an average price of $146.36 per share under its 2026 Share Repurchase Program.

- Plexus, a leading in-house legal technology provider, has launched Marketing Wizard, an AI-powered compliance platform designed to help marketing and legal teams move faster while ensuring compliance.

- The platform references more than 230 industry laws, codes, and regulations, applying an organization's legal and brand intelligence to automatically approve compliant content and flag higher-risk items, which aims to cut legal workloads and turnaround times from days to hours.

- Early adopters have reported campaign launch speeds up to five times faster and a measurable reduction in late-stage agency changes and external legal costs.

- This launch follows Plexus's successful $6 million capital raise in May, which is funding expansion into key international markets, accelerating AI product delivery, and onboarding new talent.

- Plexus reported Q4 2025 revenue of $1.058 billion and non-GAAP EPS of $2.14, which substantially exceeded its guidance. The non-GAAP operating margin was 5.8%.

- For fiscal year 2025, the company achieved a 40 basis point expansion of non-GAAP operating margin, 30% non-GAAP EPS growth, and generated $154 million in free cash flow.

- Plexus secured 141 new manufacturing wins in fiscal 2025, representing $941 million in annualized revenue when fully ramped.

- For Q1 2026, Plexus is guiding revenue between $1.05 billion and $1.09 billion, non-GAAP operating margin between 5.6% and 6.0%, and non-GAAP EPS between $1.66 and $1.81.

- The company anticipates accelerated revenue growth in fiscal 2026 towards its 9%-12% goal and expects capital spending to be in the range of $90 million-$110 million.

- Plexus Corp. reported fiscal fourth quarter 2025 revenue of $1.058 billion, with GAAP diluted EPS of $1.87 and non-GAAP diluted EPS of $2.14.

- For the full fiscal year 2025, the company achieved revenue of $4.033 billion, with GAAP diluted EPS of $6.26 and non-GAAP diluted EPS of $7.43.

- The company initiated fiscal first quarter 2026 revenue guidance of $1.050 billion to $1.090 billion, with GAAP diluted EPS of $1.40 to $1.55 and non-GAAP diluted EPS of $1.66 to $1.81.

- Plexus generated $97 million in free cash flow for Q4 2025 and $154 million for fiscal year 2025.

- During fiscal Q4 2025, Plexus won 28 manufacturing programs representing $274 million in annualized revenue when fully ramped, and purchased $21.5 million of its shares.

Quarterly earnings call transcripts for PLEXUS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more