Earnings summaries and quarterly performance for SCANSOURCE.

Executive leadership at SCANSOURCE.

Board of directors at SCANSOURCE.

Research analysts who have asked questions during SCANSOURCE earnings calls.

KH

Keith Housum

Northcoast Research

6 questions for SCSC

Also covers: AXON, BRC, CDW +10 more

Adam Tindle

Raymond James

4 questions for SCSC

Also covers: ALRM, ARLO, CDW +15 more

GB

Gregory Burns

Sidoti & Company

4 questions for SCSC

Also covers: ACCO, ALG, ATNI +13 more

GH

Guy Hardwick

Freedom Capital Markets

3 questions for SCSC

Also covers: APH, CGNX, GWW +9 more

GB

Greg Burns

Sidoti & Company, LLC

2 questions for SCSC

Also covers: BKSY, HNI, MLKN +2 more

DK

Damian Karas

UBS

1 question for SCSC

Also covers: ALH, AOS, CGNX +14 more

LK

Logan Katzman

Raymond James Financial

1 question for SCSC

Also covers: ARLO, NTGR, SONO

Mike Latimore

Northland Capital Markets

1 question for SCSC

Also covers: AI, AXON, CTLP +22 more

Recent press releases and 8-K filings for SCSC.

ScanSource Reports Q2 2026 Results, Updates Full-Year Guidance

SCSC

Earnings

Guidance Update

New Projects/Investments

- ScanSource reported Q2 2026 net sales growth of 3% year-over-year and gross profit growth of 1% year-over-year across both segments, alongside strong free cash flow.

- Profitability was negatively affected by unexpected expenses and higher period expenses in the Specialty Technology Solutions segment, including freight costs, mix, and a customer-specific bad debt reserve.

- The company launched a new converged communication sales team to integrate ScanSource and Intelisys offerings, aiming to accelerate growth and capture new end-user solution opportunities.

- Full-year fiscal 2026 revenue projections were updated to $3 billion-$3.1 billion and Adjusted EBITDA to $140 million-$150 million, primarily due to the delay of large deals rather than product shortages.

- Annual free cash flow expectations were maintained at at least $80 million.

Feb 5, 2026, 3:30 PM

ScanSource Reports Q2 2026 Results and Updates FY 2026 Guidance

SCSC

Earnings

Guidance Update

Demand Weakening

- For Q2 2026, ScanSource reported 3% year-over-year net sales growth and 1% year-over-year gross profit growth, but profitability was negatively impacted by unexpected expenses. The company subsequently updated its full-year FY 2026 guidance, lowering revenue expectations to $3 billion - $3.1 billion and Adjusted EBITDA to $140 million - $150 million, while maintaining free cash flow at at least $80 million.

- The reduction in full-year guidance is primarily attributed to a slowdown in large deals being invoiced, which are being broken into smaller pieces or pushed out, rather than product shortages.

- ScanSource launched a new converged communication sales team to unify its communications and Intelisys products and services, aiming to accelerate growth and capture new end-user solution opportunities.

- The company repurchased $18 million in shares during Q2 2026, with $179 million remaining under its share repurchase authorization, and ended the quarter with approximately $83 million in cash and a net debt leverage ratio of approximately 0.

Feb 5, 2026, 3:30 PM

ScanSource Reports Q2 2026 Results and Updates Full-Year Guidance

SCSC

Earnings

Guidance Update

Demand Weakening

- ScanSource reported Q2 2026 net sales growth of 3% year-over-year and gross profit growth of 1% year-over-year, although profitability was negatively impacted by unexpected period expenses.

- The company updated its full-year FY 2026 guidance, projecting revenue between $3 billion-$3.1 billion and Adjusted EBITDA between $140 million and $150 million, while maintaining annual free cash flow expectations of at least $80 million.

- This revised guidance is primarily attributed to slower-than-expected organic net sales growth in the Specialty Technology Solutions segment, due to large deals being broken up or delayed.

- ScanSource launched a new converged communication sales team to unify its communications products and Intelisys offerings, aiming to accelerate growth and enhance partner solutions.

- The company repurchased $18 million in shares during Q2 2026 and ended the quarter with approximately $83 million in cash and a net debt leverage ratio of approximately 0.

Feb 5, 2026, 3:30 PM

ScanSource Reports Second Quarter Results and Updates FY26 Outlook

SCSC

Earnings

Guidance Update

Board Change

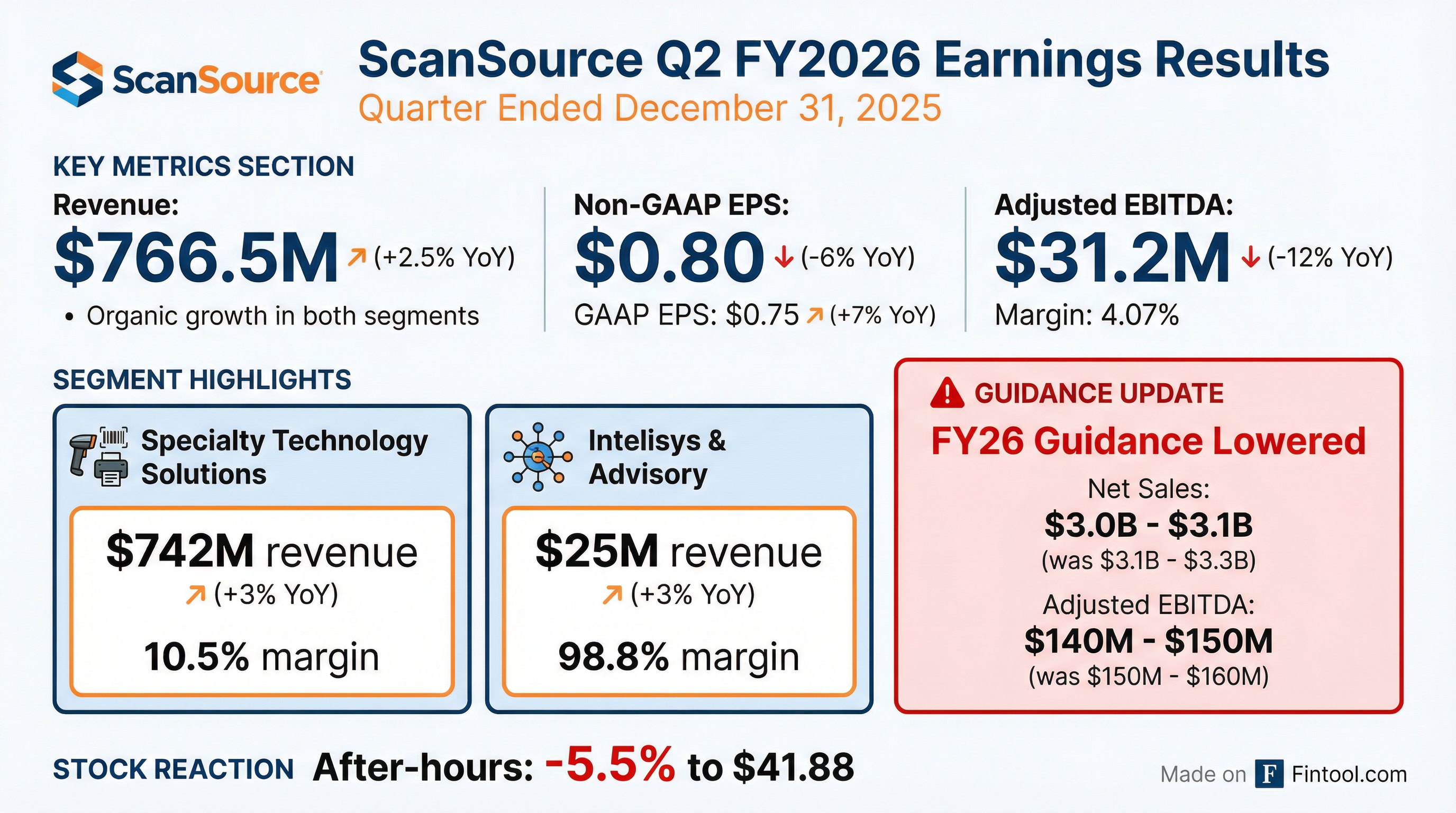

- ScanSource reported net sales of $766.5 million for the second quarter of fiscal year 2026, an increase of 2.5% year-over-year.

- GAAP diluted EPS was $0.75 for Q2 FY26, up from $0.70 in the prior-year quarter, while non-GAAP diluted EPS decreased to $0.80 from $0.85.

- For the six months ended December 31, 2025, the company generated $49.7 million in free cash flow and had $83.5 million in cash and cash equivalents as of that date.

- ScanSource updated its annual financial outlook for FY26, revising net sales guidance to $3.0 billion to $3.1 billion and Adjusted EBITDA guidance to $140 million to $150 million.

- The Board of Directors appointed Charles A. Mathis as Lead Independent Director and Vernon J. Nagel as Chair of the Audit Committee, effective January 29, 2026.

Feb 5, 2026, 1:30 PM

ScanSource Reports Q2 FY26 Results and Updates FY26 Outlook

SCSC

Earnings

Guidance Update

Share Buyback

- For the second quarter of fiscal year 2026, ScanSource reported net sales of $766.5 million, a 2.5% year-over-year increase, and gross profit of $102.9 million, up 1.2% year-over-year.

- GAAP diluted EPS for Q2 FY26 was $0.75, a 7.1% increase year-over-year, while non-GAAP diluted EPS was $0.80, a 5.9% decrease year-over-year. Adjusted EBITDA for the quarter decreased 11.6% year-over-year to $31.2 million.

- The company updated its fiscal year 2026 annual outlook, revising net sales to $3.0 billion to $3.1 billion (from a prior outlook of $3.1 billion to $3.3 billion) and Adjusted EBITDA to $140 million to $150 million (from a prior outlook of $150 million to $160 million), while maintaining free cash flow guidance of at least $80 million.

- ScanSource generated $54.1 million in operating cash flow and $49.7 million in free cash flow year-to-date for fiscal year 2026, and completed $38.7 million in share repurchases during the first six months of fiscal 2026.

Feb 5, 2026, 1:29 PM

ScanSource, Inc. enters into new credit facilities

SCSC

Debt Issuance

- ScanSource, Inc. entered into a new credit agreement on December 18, 2025, establishing a five-year, $400 million multicurrency senior secured revolving credit facility and a five-year $100 million senior secured term loan facility, under which the Company immediately borrowed $100 million.

- The new credit facilities include an "accordion feature" allowing for an increase in borrowings by up to the greater of $250 million or 150% of the Company's EBITDA.

- Interest rates for U.S. dollar loans vary based on the Company's leverage ratio, with margins ranging from 1.00% to 1.75% over Term SOFR/daily simple SOFR, or 0% to 0.75% over the base rate. A commitment fee of 0.15% to 0.30% applies to the unused revolving credit facility.

- The agreement includes financial covenants requiring a leverage ratio of less than or equal to 3.50 to 1.00 and an Interest Coverage Ratio of at least 3.00:1.00 as of the end of each fiscal quarter.

Dec 19, 2025, 10:15 PM

ScanSource Discusses Business Evolution, Financial Profile, and Strategic Direction

SCSC

M&A

New Projects/Investments

Demand Weakening

- ScanSource has transformed its business model since 2016 to include a significant recurring revenue stream through its Intelisys acquisition, complementing its traditional hardware distribution.

- The company now reports two segments: Specialty Technologies (hardware with 3-4% EBITDA margins) and Intelisys Advisory (recurring revenue with 30-40% EBITDA margins), with a key focus on achieving 5-6% gross profit dollar growth.

- ScanSource is strategically focused on the convergence of hardware, software, and services, aiming to enable partners to sell comprehensive solutions, and is experimenting with integrated sales teams.

- Management observes a trend of large orders being fragmented due to IT budget allocation towards AI, and while price increases have boosted margins, there is concern about their future impact on demand.

- The company believes its Intelisys business is undervalued by investors, especially when compared to private equity valuations in the same space.

Dec 9, 2025, 6:40 PM

ScanSource Discusses Business Transformation, Segment Performance, and Market Dynamics at Raymond James Conference

SCSC

New Projects/Investments

Revenue Acceleration/Inflection

Demand Weakening

- ScanSource has undergone a significant transformation since 2016, shifting from a traditional hardware distributor to a focus on the convergence of hardware, software, services, and connectivity, aiming to provide comprehensive solutions through a single partner.

- The company now operates with two distinct segments: Specialty Technologies (hardware-focused) with 3%-4% EBITDA margins and Intelisys Advisory (recurring revenue-focused) with 30%-40% EBITDA margins, which contributes approximately 25% of gross profit dollars.

- Management noted a recent trend of large orders being broken into smaller chunks, partly due to IT budgets prioritizing AI projects. While price increases have led to higher hardware margins, there is concern about a potential negative impact on demand if prices continue to rise.

- Key financial goals include a 5%-6% three-year growth target for gross profit dollars and improved EBITDA margins. Capital allocation priorities involve share repurchases and M&A, with a recent acquisition (DataZoom) aimed at expanding recurring revenue streams.

- ScanSource believes its Intelisys business is undervalued, citing private equity investments in the broader Intelisys channel at 15-18 times EBITDA.

Dec 9, 2025, 6:40 PM

ScanSource discusses business transformation and financial outlook

SCSC

New Projects/Investments

Demand Weakening

M&A

- ScanSource has undergone a significant business transformation since 2016, evolving to include a high-margin, recurring revenue Intelisys Advisory segment, which now contributes 25% of gross profit dollars.

- The company operates with two distinct segments: Specialty Technologies (traditional hardware with 3%-4% EBITDA margins) and Intelisys Advisory (almost all recurring revenue with 30%-40% EBITDA margins).

- Management's key financial metrics include a three-year goal of 5%-6% gross profit dollar growth, along with EBITDA targets, cash flow generation, and Return on Invested Capital (ROIC).

- Current demand shows large orders being broken into smaller chunks, potentially due to IT budgets shifting to AI projects, and while price increases have aided margins, there are concerns about their impact on future demand.

- ScanSource's capital allocation priorities include share repurchases and incremental M&A, with growth expected from physical security and networking, and management believes its Intelisys business is currently undervalued.

Dec 9, 2025, 6:40 PM

ScanSource Reports Q1 2026 Results and Reaffirms Full-Year Outlook

SCSC

Earnings

Guidance Update

M&A

- ScanSource delivered strong profits and free cash flow generation in Q1 2026, with gross profits growing 6% and non-GAAP EPS increasing 26% year over year. The company achieved 5.2% adjusted EBITDA margins and an 88% cash conversion of non-GAAP net income.

- Net sales in the Specialty Technology Solutions segment declined 5% year over year and 9% quarter over quarter, partly due to approximately $40 million of large deal pull-ins that benefited Q4 results. Despite this, gross profits for the segment increased 7% year over year. The Intelisys and Advisory segment saw net sales increase 4% year over year, with annualized net billings rising to approximately $2.78 billion.

- The company completed the acquisition of DataZoom in October 2025, a leading provider of B2B mobile data connectivity solutions, which builds upon the August 2024 acquisition of Advantix. ScanSource is strategically investing in its Intelisys and Advisory segment to accelerate new order growth, which saw double-digit growth year over year and quarter over quarter.

- ScanSource reaffirmed its full-year FY 2026 outlook, projecting net sales growth between $3.1 billion and $3.3 billion, adjusted EBITDA between $150 million and $160 million, and at least $80 million in free cash flow. Management expects revenue growth to accelerate in the second half of the fiscal year, attributing current large deal delays to timing rather than a weakness in overall demand.

Nov 6, 2025, 3:30 PM

Quarterly earnings call transcripts for SCANSOURCE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more