Earnings summaries and quarterly performance for Solaris Energy Infrastructure.

Executive leadership at Solaris Energy Infrastructure.

Amanda M. Brock

Co-Chief Executive Officer

William A. Zartler

Co-Chief Executive Officer

Christopher M. Powell

Chief Legal Officer and Corporate Secretary

Christopher P. Wirtz

Chief Accounting Officer

Cynthia M. Durrett

Chief Administrative Officer

Kyle S. Ramachandran

President and Chief Financial Officer

Board of directors at Solaris Energy Infrastructure.

Research analysts who have asked questions during Solaris Energy Infrastructure earnings calls.

Derek Podhaizer

Piper Sandler Companies

3 questions for SEI

Michael Dudas

Vertical Research Partners

3 questions for SEI

Scott Gruber

Citigroup

3 questions for SEI

David Arcaro

Morgan Stanley

2 questions for SEI

Derrick Whitfield

Texas Capital

2 questions for SEI

Don Crist

Johnson Rice & Company L.L.C.

2 questions for SEI

Jeff LeBlanc

TPH&Co.

2 questions for SEI

Stephen Gengaro

Stifel

2 questions for SEI

Blake McLean

Daniel Energy Partners

1 question for SEI

Bobby Brooks

Northland Capital Markets

1 question for SEI

J. David Anderson

Barclays

1 question for SEI

J.F. LeBlanc

TPH&Co.

1 question for SEI

J.R. Weston

Raymond James

1 question for SEI

Keaton B. Schiki

Northland Capital Markets

1 question for SEI

Keaton Schuelke

Northland Capital Markets

1 question for SEI

Nate Pendleton

Texas Capital

1 question for SEI

Stephen Gengaro

Stifel Financial Corp.

1 question for SEI

Thomas Sellers Meric

Stephens Inc.

1 question for SEI

Recent press releases and 8-K filings for SEI.

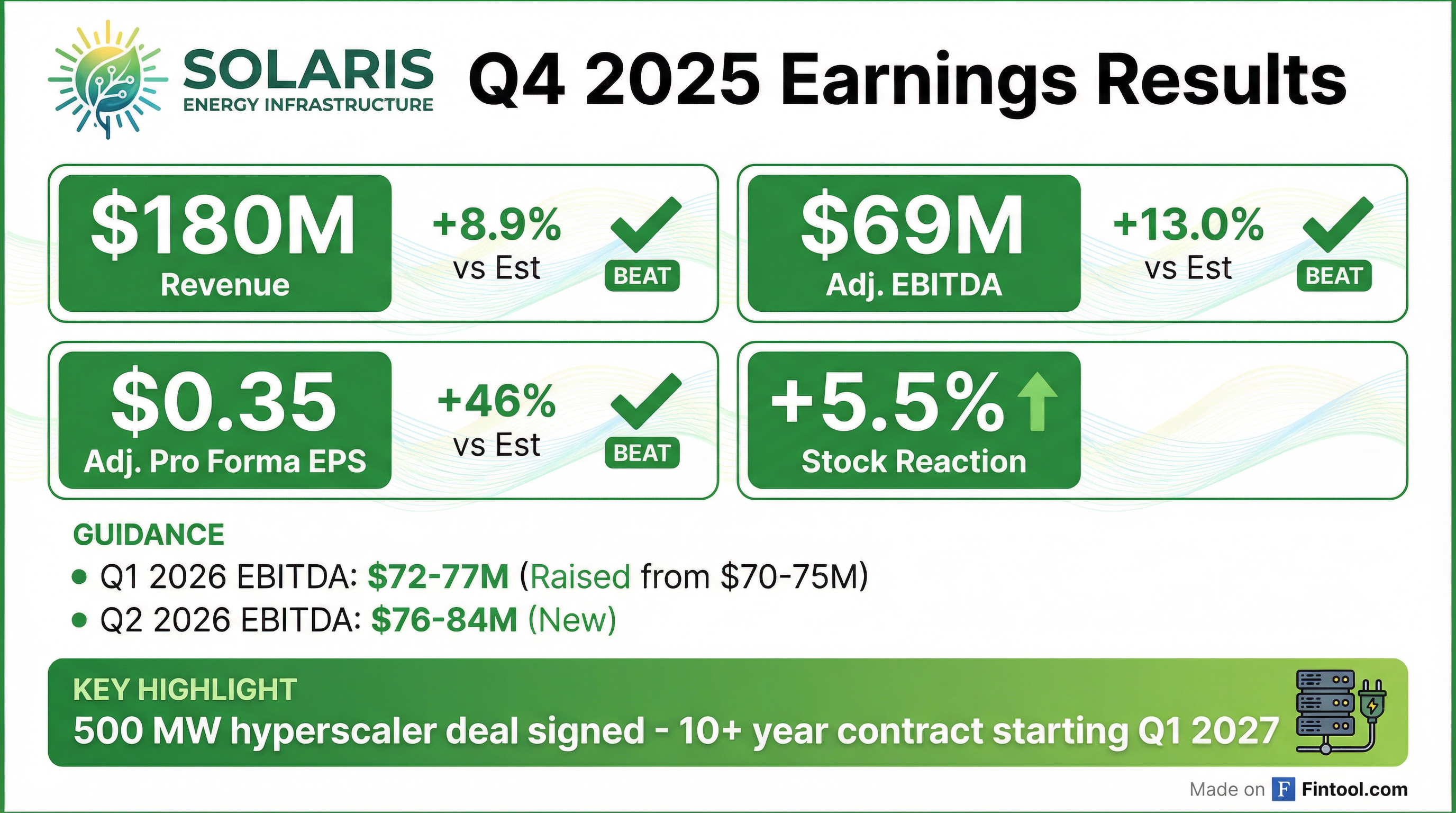

- Solaris Energy Infrastructure (SEI) reported strong Q4 2025 performance with Adjusted EBITDA of approximately $69 million and total revenue of $180 million, alongside Pro Forma Adjusted Earnings per Share of $0.35.

- The company established a new commercial contract for over 500 MW for a minimum term of 10 years (plus a 5-year option) to support data center compute needs, with services beginning in January 2027.

- SEI raised its Q1 2026 guidance for Adjusted EBITDA to $72-77 million (from $70-75 million) and introduced Q2 2026 Adjusted EBITDA guidance of $76-84 million.

- The balance sheet was strengthened by completing a $748 million 0.25% Convertible Bond issuance, which was used to retire Term Loan B obligations and fully fund planned capital expenditures through 2028.

- Solaris Energy Infrastructure (SEI) reported full year 2025 revenue of $622 million, nearly doubling year-over-year, and Adjusted EBITDA of $244 million, which more than doubled. For Q4 2025, the company generated nearly $180 million in revenue and $69 million in Adjusted EBITDA.

- The Solaris Power Solutions segment was the primary growth engine, contributing roughly 70% of earnings in 2025. SEI secured a new 10-year agreement (with a five-year extension option) to provide over 500 megawatts of power generation to an investment-grade global technology company, with energization targeted for Q1 2027.

- SEI also expanded its partnership with an initial major data center customer, finalizing a 15-year joint venture and upsizing a long-term power agreement for approximately 500-900 megawatts. The company is fully funded for expected deliveries to reach 2,200 megawatts of power generation and is in advanced negotiations for additional capacity.

- The Logistics Solutions Segment contributed over $80 million of free cash flow in 2025 , with its Top Fill System utilization rate in the mid-90% in Q4 2025 and nearing 100% in Q1 2026.

- For Q1 2026, Solaris expects its power segment Adjusted EBITDA to increase by more than 20%.

- Solaris Energy Infrastructure reported full year 2025 revenue of $622 million and Adjusted EBITDA of $244 million, both nearly doubling or more than doubling year-over-year, primarily driven by the Power Solutions segment. For Q4 2025, the company generated nearly $180 million in revenue and $69 million in Adjusted EBITDA.

- The company secured a new 10-year agreement (with a five-year extension option) to provide over 500 megawatts of power generation to an investment-grade global technology company, and expanded a joint venture with an existing major data center customer for approximately 500-900 megawatts.

- Solaris provided Q1 2026 Adjusted EBITDA guidance of $72 million-$77 million and Q2 2026 guidance of $76 million-$84 million, anticipating continued growth in the Power Solutions segment.

- Steve Tompsett officially joined as Solaris' new Chief Financial Officer earlier in February 2026.

- Solaris Energy Infrastructure reported full year 2025 revenue of $622 million and Adjusted EBITDA of $244 million, both nearly doubling year-over-year, primarily driven by its Power Solutions segment, which now contributes 70% of earnings.

- The company secured a new 10-year agreement (with a 5-year extension option) to provide over 500 MW of power generation to an investment-grade global technology company, with energization targeted for Q1 2027. This follows a significant expansion of a partnership with an initial major data center customer, involving a 15-year joint venture and an upsized long-term power agreement for approximately 500-900 MW.

- For Q4 2025, Solaris generated consolidated revenue of nearly $180 million and Adjusted EBITDA of $69 million.

- Solaris provided Q1 2026 Total Adjusted EBITDA guidance of $72 million-$77 million and Q2 2026 guidance of $76 million-$84 million.

- The company strengthened its balance sheet through two convertible bond issuances and is fully funded for expected deliveries to reach 2,200 MW of power generation. Steve Tompsett was also introduced as the new Chief Financial Officer.

- Solaris Energy Infrastructure reported Q4 2025 revenue of $180 million, an 8% sequential increase, and an Adjusted EBITDA of $69 million, up 1% sequentially, despite a net loss of $4 million.

- For the full year 2025, the company achieved substantial growth with revenue up 99% and Adjusted EBITDA up 137% compared to 2024.

- The company increased its first quarter 2026 Adjusted EBITDA guidance to $72-77 million and established second quarter 2026 Adjusted EBITDA guidance at $76-84 million.

- On February 12, 2026, Solaris Energy Infrastructure entered into an agreement to provide over 500 MW of power to a hyperscaler for an initial 10-year term, beginning in Q1 2027.

- The board of directors approved a first quarter 2026 dividend of $0.12 per share, payable on March 20, 2026, marking the company's 30th consecutive dividend.

- Solaris Energy Infrastructure (SEI) achieved record quarterly revenue of $167 million and adjusted EBITDA of $68 million in Q3 2025, with the power solutions segment contributing over 60% of revenue and more than three quarters of segment-level adjusted EBITDA.

- The company significantly expanded its power solutions, operating approximately 760 MW during Q3 2025, up from 150 MW a year ago, and secured an additional 500 MW of generation capacity, projecting a total pro forma capacity of approximately 2,200 MW by early 2028.

- In early October, SEI raised approximately $748 million through senior convertible notes due 2031 with a 0.25% coupon to repay its existing term loan and fund the new 500 MW order, expecting to save approximately $45 million in interest and amortization over the next four quarters.

- SEI acquired HVMVLV to strengthen its power solutions offering and appointed Amanda Brock as Co-CEO.

- The company provided Q4 2025 total adjusted EBITDA guidance of $65 million-$70 million and Q1 2026 guidance of $70 million-$75 million.

- Solaris achieved record levels of quarterly revenue and profit in Q3 2025, with consolidated revenue of $167 million and adjusted EBITDA of $68 million, representing a 12% sequential increase and more than three times year-over-year growth in adjusted EBITDA.

- The company significantly increased its pro forma generation capacity to approximately 2,200 megawatts by early 2028, up from a prior plan of 1,700 megawatts, driven by new orders totaling 500 megawatts.

- Solaris raised approximately $748 million in senior convertible notes in early October 2025, repaying its existing term loan and funding new generation orders, which is expected to save approximately $45 million in interest and amortization over the next four quarters. Additionally, the company acquired HVMV LV in Q3 2025, expanding its power solutions offering.

- Solaris upgraded its Q4 2025 total adjusted EBITDA guidance to $65 million to $70 million and introduced Q1 2026 guidance of $70 million to $75 million.

- Solaris Energy Infrastructure reported record quarterly revenue and profit in Q3 2025, with consolidated revenue of $167 million and Adjusted EBITDA of $68 million, marking a 12% sequential increase and more than three times year-over-year growth in Adjusted EBITDA.

- The company expanded its operational capacity to approximately 760 megawatts in Q3 2025 and secured an additional 500 megawatts of generation capacity, projecting a pro forma total of 2,200 megawatts by early 2028.

- Solaris raised approximately $748 million via senior convertible notes due 2031 to refinance debt and fund new orders, anticipating $45 million in interest and amortization savings over the next four quarters.

- The company provided Q4 2025 total adjusted EBITDA guidance of $65-$70 million and Q1 2026 guidance of $70-$75 million.

- Strategic developments include the acquisition of HVMVLV to enhance power solutions and the appointment of Amanda Brock as Co-CEO.

- Solaris (SEI) achieved record Q3 2025 results, with $167 million in revenue and $68 million in Adjusted EBITDA, representing a 12% increase from the prior quarter and more than three times the Adjusted EBITDA compared to the same quarter last year. The power solutions segment was a primary driver, contributing over 60% of revenue and over three-quarters of segment-level Adjusted EBITDA.

- The company significantly expanded its generation capacity, securing an additional 500 megawatts (80 MW previously announced and an additional 400 MW order), bringing its pro forma expected generation capacity to approximately 2,200 megawatts by early 2028, an increase from the prior plan of 1,700 megawatts by the first half of 2027.

- Solaris raised approximately $748 million in senior convertible notes due 2031 to repay its existing term loan and fund the new 500 MW order, which is expected to result in approximately $45 million in interest and amortization savings over the next four quarters.

- Strategic developments in Q3 2025 included the acquisition of HVMVLV, a provider of specialty voltage distribution and regulation equipment, and the appointment of Amanda Brock as Co-CEO to accelerate growth.

- For Q4 2025, Solaris provided total Adjusted EBITDA guidance of $65-$70 million, and for Q1 2026, the guidance is $70-$75 million.

- Solaris Energy Infrastructure reported Total Adjusted EBITDA of $68 million for Q3 2025.

- The company provided guidance for Q4 2025 Total Adjusted EBITDA of $65-70 million and introduced Q1 2026 guidance of $70-75 million.

- Consolidated Capital Expenditures were $63 million in Q3 2025, with forecasts of $405 million for Q4 2025 and $160 million for Q1 2026.

- Total Consolidated Debt was $548 million as of September 30, 2025, which increased to $975 million pro forma for the October 2025 convertible issuance.

- Solaris plans to grow its operated fleet to 2,200 MW by early 2028.

Fintool News

In-depth analysis and coverage of Solaris Energy Infrastructure.

Quarterly earnings call transcripts for Solaris Energy Infrastructure.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more