Earnings summaries and quarterly performance for Sila Realty Trust.

Executive leadership at Sila Realty Trust.

Board of directors at Sila Realty Trust.

Research analysts who have asked questions during Sila Realty Trust earnings calls.

ML

Michael Lewis

Truist Securities, Inc.

6 questions for SILA

Also covers: ALX, BDN, BXP +12 more

NC

Nate Crossett

BNP Paribas

4 questions for SILA

Also covers: IRM

Robert Stevenson

Janney Montgomery Scott LLC

3 questions for SILA

Also covers: ADC, AHH, AIV +17 more

John Pawlowski

Green Street

2 questions for SILA

Also covers: AIV, AMH, AVB +15 more

RS

Rob Stevenson

Janney Montgomery Scott

1 question for SILA

Also covers: ADC, ALEX, CSR +8 more

Recent press releases and 8-K filings for SILA.

Sila Realty Trust Reports Q4 2025 Financial Results and Strategic Updates

SILA

Earnings

M&A

New Projects/Investments

- Sila Realty Trust reported strong financial results for 2025, with Cash NOI increasing 0.8% to $169.9 million and FFO per share rising 3.6% to $2.16, though AFFO per share decreased 5.8% to $2.18.

- The company executed on its growth strategy in 2025 by acquiring 6 healthcare facilities for approximately $150 million and further optimized its portfolio through planned dispositions in early 2026, including the sale of the Saginaw facility for $14.5 million.

- Portfolio quality improved with the investment grade rated tenant percentage increasing 2.3% year-over-year to 40.6% and a weighted average remaining lease term of 10 years at year-end 2025.

- Sila maintains a conservative balance sheet with net debt to EBITDAre at 3.9 times and over $480 million in total liquidity, providing substantial capacity to deploy $225 million to $375 million for acquisitions or investments in existing properties.

3 days ago

Sila Realty Trust Reports Q4 and Full-Year 2025 Financial Results and Strategic Updates

SILA

Earnings

M&A

New Projects/Investments

- Sila Realty Trust reported full-year 2025 Cash NOI of $169.9 million, a 0.8% increase from 2024, and FFO per share of $2.16, a 3.6% increase year-over-year, while AFFO per share decreased by 5.8% to $2.18.

- The company acquired 6 healthcare facilities for approximately $150 million in 2025 and closed on another $43.1 million facility after year-end. It also executed purchase and sale agreements for three properties toward year-end 2025, with one sale closing for $14.5 million after year-end.

- Sila maintained a strong balance sheet with net debt to EBITDAre at 3.9 times at year-end 2025, below its target range, and total liquidity exceeding $480 million. The company has the capacity to deploy $225 million to reach the midpoint of its target leverage.

- Portfolio quality improved, with investment grade rated tenant guarantor and affiliate percentage increasing to 40.6% and the weighted average remaining lease term extending to 10 years by year-end 2025. The portfolio-wide EBITDARM rent coverage ratio was 5.9x in 2025.

3 days ago

Sila Realty Trust Announces Q4 and Full Year 2025 Financial Results

SILA

Earnings

New Projects/Investments

Debt Issuance

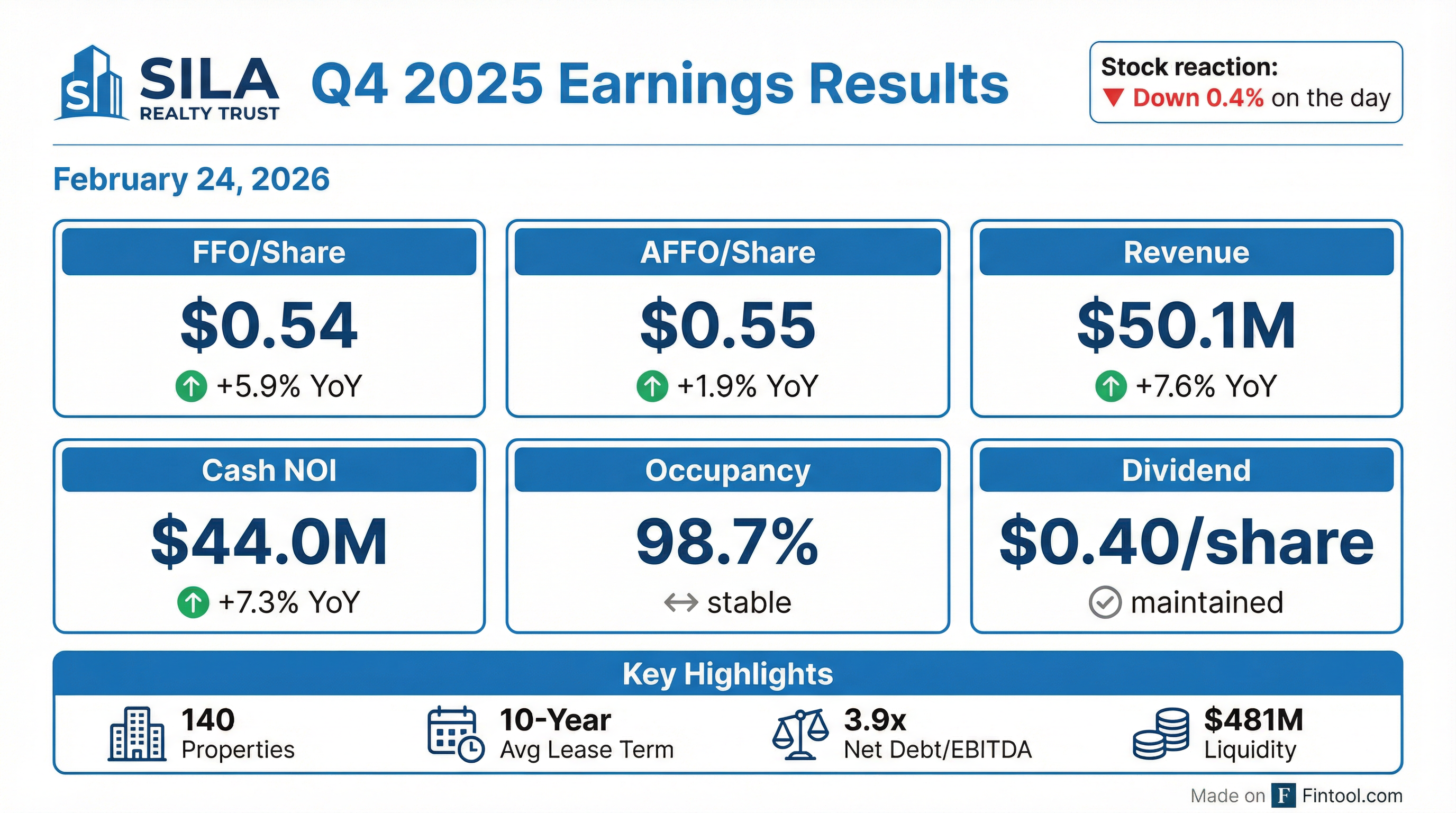

- Sila Realty Trust reported Q4 2025 total revenues of $50,700 thousand and net income attributable to common stockholders of $5,015 thousand, resulting in diluted EPS of $0.09. For the full year 2025, total revenues reached $197,536 thousand and diluted EPS was $0.60.

- Key non-GAAP metrics for Q4 2025 included diluted FFO per common share of $0.54, diluted Core FFO per common share of $0.57, and diluted AFFO per common share of $0.55.

- As of December 31, 2025, the company's portfolio comprised 140 properties with a leased rate of 98.7% and a weighted average remaining lease term of 10.0 years. Sila Realty Trust completed $148,877 thousand in acquisitions during 2025.

- Financial health indicators as of December 31, 2025, included an interest coverage ratio of 4.3x, a net debt to EBITDAre ratio of 3.9x, and liquidity of $481,288 thousand.

3 days ago

Sila Realty Trust Reports Q4 2025 Earnings, Highlights Acquisitions and Strong Balance Sheet

SILA

Earnings

New Projects/Investments

M&A

- Sila Realty Trust reported FY 2025 FFO per share of $2.16, a 3.6% increase year-over-year, and Cash NOI of $169.9 million, up 0.8% from FY 2024.

- In 2025, the company acquired 6 healthcare facilities for approximately $150 million and completed over $7 million in redevelopment opportunities. After year-end, another facility was acquired for $43.1 million.

- The balance sheet remains strong with net debt to EBITDAre at 3.9 times and over $480 million in total liquidity at year-end 2025, providing capacity to invest up to $375 million.

- Tenant credit quality improved, with the investment grade rated tenant percentage increasing by 2.3% year-over-year to 40.6%, and the portfolio-wide EBITDARM rent coverage ratio rising to 5.9x in 2025.

- The company executed purchase and sale agreements for three properties, closing one for $14.5 million after year-end, and anticipates further dispositions in Q1/Q2 2026.

3 days ago

Sila Realty Trust Announces Fourth Quarter and Year Ended 2025 Results

SILA

Earnings

Dividends

New Projects/Investments

- Sila Realty Trust reported net income of $5.0 million and AFFO of $30.4 million for the fourth quarter of 2025, resulting in $0.09 per diluted share and $0.55 per diluted share, respectively. For the full year ended December 31, 2025, net income was $33.1 million and AFFO was $120.9 million, or $0.60 per diluted share and $2.18 per diluted share, respectively.

- The company declared and paid cash distributions of $0.40 per share for the fourth quarter of 2025, totaling $1.60 per share for the full year. The Board authorized a quarterly cash dividend of $0.40 per share on February 23, 2026, payable on March 18, 2026. The AFFO payout ratio for Q4 2025 was 72.6%.

- As of December 31, 2025, Sila's portfolio consisted of 140 properties comprising approximately 5.3 million rentable square feet, with a 98.7% leased rate and a 10.0-year weighted average remaining lease term. During 2025, the company acquired six operating healthcare properties for $148.9 million.

- Sila ended 2025 with a strong liquidity position of approximately $481.3 million and a net debt to annualized EBITDAre ratio of 3.9x.

- Subsequent to year-end, on January 15, 2026, Sila acquired one inpatient rehabilitation facility for $43.1 million, and on January 29, 2026, sold the Saginaw Healthcare Facility for $14.5 million.

4 days ago

SILA announces Q3 2025 financial results

SILA

Earnings

Debt Issuance

Revenue Acceleration

- SILA reported rental revenue of $49,421 thousand and net income attributable to common stockholders of $11,609 thousand for Q3 2025.

- For Q3 2025, diluted FFO per common share, Core FFO per common share, and AFFO per common share were all $0.56.

- As of September 30, 2025, the company's net debt to EBITDAre ratio was 3.9x and its interest coverage ratio was 4.7x.

- Total debt amounted to $676.0 million as of Q3 2025, with notable maturities including $250 million in 2025 and $275 million in 2026.

- The largest tenant, PAM Health, accounts for 15.1% of revenue, and 39.5% of tenants/guarantors are investment grade rated.

Nov 5, 2025, 4:00 PM

Sila Realty Trust Reports Q3 2025 Financial Results and Strategic Investments

SILA

Earnings

New Projects/Investments

Share Buyback

- Sila Realty Trust reported Q3 2025 cash NOI of $42.8 million, a 4.9% increase from Q3 2024, with 1.2% same-store cash NOI growth. AFFO per share decreased by 0.8% compared to Q3 2024 but increased 4.2% compared to Q2 2025.

- During Q3 2025, the company completed approximately $87 million in acquisitions, including the $16.3 million Southlake portfolio and the $70.5 million Reunion Novus portfolio.

- Sila is also deploying capital for property redevelopments and expansions, with approximately $5 million for a Pam Health facility, an anticipated $12.5 million for the Dover facility, and $16 million for the Overland Park facility, all expected to yield attractive returns.

- The company's board authorized a share repurchase program of up to $75 million over three years, limited to $25 million annually, effective August 4, 2025, though no shares were purchased in Q3. An at-the-market (ATM) program was also established.

- Sila maintains a strong financial position with over $476 million in total liquidity and a net debt-to-EBITDA ratio of 3.9 times. The company expects 2025 G&A to be at the low end or slightly below the previously communicated range of $22.5 million to $23.5 million.

Nov 5, 2025, 4:00 PM

Sila Realty Trust Announces Third Quarter 2025 Results

SILA

Earnings

Share Buyback

New Projects/Investments

- Sila Realty Trust, Inc. reported net income of $11.6 million, or $0.21 per diluted share, and Adjusted Funds From Operations (AFFO) of $31.1 million, or $0.56 per diluted share, for the third quarter ended September 30, 2025.

- Cash Net Operating Income (Cash NOI) for Q3 2025 was $42.8 million, an increase from $40.8 million in Q3 2024, driven by acquisitions and 1.2% same-store Cash NOI growth.

- During the quarter ended September 30, 2025, the company acquired two medical outpatient buildings for $16.3 million and two inpatient rehabilitation facilities for $70.5 million, along with additional land for $2.7 million.

- The Board authorized a share repurchase program of up to $75.0 million over three years, with a $25.0 million limit in any twelve-month period, effective August 4, 2025.

- Sila declared and paid cash distributions of $0.40 per share for the quarter ended September 30, 2025, and authorized a quarterly cash dividend of $0.40 per share payable on December 4, 2025.

Nov 4, 2025, 9:30 PM

Quarterly earnings call transcripts for Sila Realty Trust.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more