Earnings summaries and quarterly performance for SITIME.

Executive leadership at SITIME.

Rajesh Vashist

Chairman, President and Chief Executive Officer

Elizabeth Howe

Executive Vice President, Finance and Chief Financial Officer

Fariborz Assaderaghi

Executive Vice President, Engineering and Operations

Lionel Bonnot

Executive Vice President, Worldwide Sales and Business Development

Piyush Sevalia

Executive Vice President, Marketing

Samsheer Ahmad

Senior Vice President, Finance and Chief Accounting Officer

Vincent Pangrazio

Executive Vice President, Chief Legal Officer and Corporate Secretary

Board of directors at SITIME.

Research analysts who have asked questions during SITIME earnings calls.

Quinn Bolton

Needham & Company, LLC

7 questions for SITM

Tore Svanberg

Stifel Financial Corp.

6 questions for SITM

Christopher Caso

Wolfe Research

4 questions for SITM

Chris Caso

Wolfe Research LLC

3 questions for SITM

Gary Mobley

Loop Capital

2 questions for SITM

Sujeeva De Silva

Roth MKM

2 questions for SITM

Sujith Desilva

ROTH Capital

2 questions for SITM

Tom O'Malley

Barclays

2 questions for SITM

James Schneider

Goldman Sachs

1 question for SITM

Jeremy Kwan

Stifel

1 question for SITM

Jim Schneider

Goldman Sachs

1 question for SITM

Melissa Dailey Fairbanks

Raymond James Financial, Inc.

1 question for SITM

Sujeeva De Silva

ROTH Capital Partners

1 question for SITM

Suji Desilva

ROTH MKM

1 question for SITM

Thomas O’Malley

Barclays Capital

1 question for SITM

Recent press releases and 8-K filings for SITM.

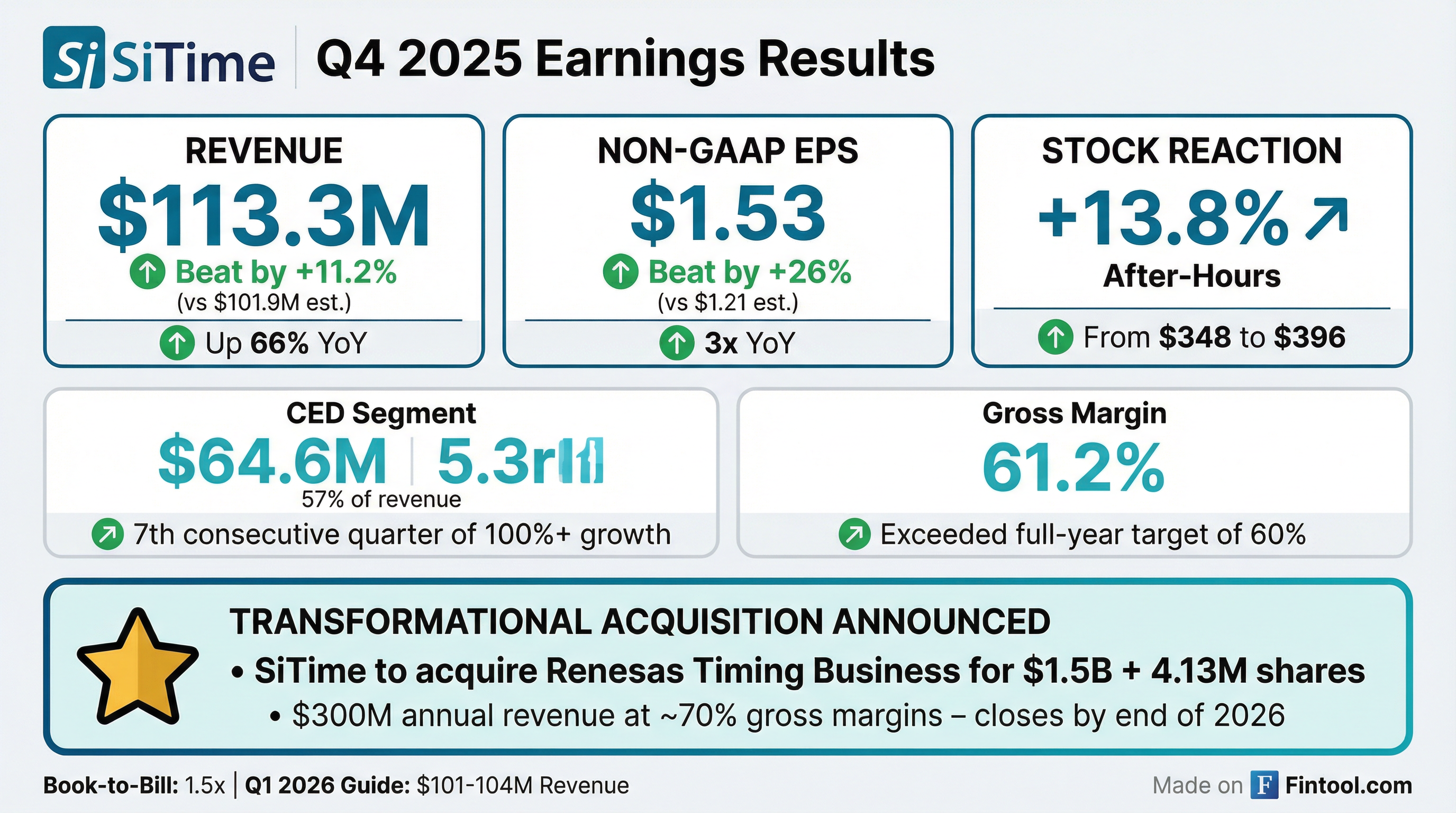

- SiTime Corporation announced the acquisition of Renesas’ timing business for $1.5 billion in cash and approximately 4.13 million shares of SiTime common stock. The transaction will be funded by cash on hand and $900 million of fully committed debt financing from Wells Fargo.

- The acquired business is expected to generate $300 million in revenue in the 12 months following the close of the transaction, with ~70% gross margin. Approximately 75% of this revenue is anticipated from the AI-Datacenter-Comms segment.

- This acquisition accelerates SiTime's path to $1 billion of revenue, with a 2025 pro forma combined revenue of $500M+ (compared to SiTime's $327M 2025 revenue).

- The acquisition is expected to be accretive to SiTime’s non-GAAP earnings per share in the first year post-close and is targeted to close by the end of 2026.

- SiTime reported strong Q4 2025 revenue of $113.3 million, up 66% year-over-year, and non-GAAP EPS of $1.53, tripling from the prior year. For the full year 2025, revenue reached $326.7 million, an increase of 61%, with non-GAAP EPS of $3.20.

- The company announced the acquisition of Renesas's Timing Business for $1.5 billion in cash and approximately 4.13 million newly issued SiTime shares. This acquisition is expected to add $300 million in revenue in the 12 months post-close with approximately 70% gross margins, and is projected to be accretive to non-GAAP EPS in the first full year.

- SiTime provided Q1 2026 revenue guidance in the range of $101-$104 million, representing approximately 70% year-over-year growth at the midpoint, with a projected gross margin of approximately 62% and non-GAAP EPS between $1.10-$1.17.

- The Communications Enterprise Data Center (CED) segment was a primary growth engine, contributing $64.6 million in Q4 2025, up 160% year-over-year, driven by increased AI CapEx spending and demand for 1.6T optical modules. The company also noted a book-to-bill ratio of over 1.5 at the end of Q4 2025, indicating strong demand for 2026.

- SiTime reported strong Q4 2025 results with revenue of $113.3 million, up 66% year-over-year, and earnings per share of $1.53, more than tripling from the prior year. For the full year 2025, revenue reached $326.7 million, a 61% increase, with earnings per share of $3.20.

- The Communications Enterprise Data Center (CED) business was a primary growth engine, contributing $64.6 million or 57% of Q4 revenue, growing 160% year-over-year, and now makes up 53% of total revenue.

- For Q1 2026, SiTime projects revenue in the range of $101 million-$104 million (up approximately 70% year-over-year at the midpoint) and non-GAAP earnings per share between $1.10-$1.17. Gross margins are expected to be approximately 62%.

- SiTime announced its intent to acquire Renesas' timing business for $1.5 billion in cash and approximately 4.13 million newly issued shares, with the transaction expected to close by the end of 2026. This acquisition is anticipated to add $300 million in revenue in the 12 months post-close with approximately 70% gross margins, and is expected to be accretive to non-GAAP EPS in the first full year.

- SiTime reported strong financial results for Q4 2025, with revenue of $113.3 million, up 66% year-over-year, and EPS of $1.53, tripling from the prior year. For the full year 2025, revenue reached $326.7 million, a 61% year-over-year increase, and EPS was $3.20, more than tripling from $0.93.

- The company provided positive guidance for Q1 2026, projecting revenue between $101 million and $104 million, an approximate 70% year-over-year increase at the midpoint, with gross margins around 62% and non-GAAP EPS in the range of $1.10 to $1.17.

- SiTime announced the acquisition of Renesas' timing business for $1.5 billion in cash and approximately 4.13 million newly issued shares, financed by cash on hand and $900 million in committed debt. This acquisition is expected to add $300 million in revenue in the 12 months post-close with approximately 70% gross margins and be accretive to non-GAAP EPS in the first full year.

- Demand remained robust, with a book-to-bill ratio over 1.5 at the end of Q4 2025. Growth was significantly driven by the COMMS Enterprise Data Center (CED) business, which grew 160% year-over-year in Q4, with increased 2026 forecasts for oscillators in 1.6T optical modules and Super-TCXOs due to AI CapEx spending.

- SiTime Corporation announced on February 4, 2026, a definitive agreement to acquire certain assets related to Renesas' timing business for $1.5 billion in cash and approximately 4.13 million shares of common stock.

- The acquisition is expected to accelerate SiTime's path to $1 billion of revenue, with the acquired business projected to generate $300 million in revenue in the 12 months post-close, primarily from high-growth AI Datacenter-Comms (approximately 75% of acquired revenue).

- The transaction is anticipated to have a 70% gross margin for the acquired business and be accretive to SiTime's non-GAAP earnings per share in the first year post-close, with an expected closing by the end of 2026.

- SiTime Corporation has signed a definitive agreement to acquire certain assets related to Renesas’ timing business.

- The acquisition is valued at $1.5 billion in cash and approximately 4.13 million shares of SiTime common stock.

- The acquired business is expected to generate $300 million in revenue in the 12 months post-close with a 70% gross margin, with about 75% of this revenue coming from the AI Datacenter-Comms segment.

- The transaction is expected to accelerate SiTime's path to $1 billion of revenue and be accretive to non-GAAP earnings per share in the first year post-close.

- The acquisition is expected to close by the end of 2026, subject to customary closing conditions and regulatory approvals.

- SiTime Corporation (SITM) reported net revenue of $113.3 million for the fourth quarter of 2025, representing a 66% increase from the year-ago period, and $326.7 million for fiscal year 2025, an increase of 61% from fiscal year 2024.

- For the fourth quarter of 2025, the company achieved GAAP net income of $9.2 million, or $0.34 per diluted share, and non-GAAP net income of $41.3 million, or $1.53 per diluted share.

- For the full fiscal year 2025, SiTime reported a GAAP net loss of $42.9 million, or $1.72 per diluted share, but a non-GAAP net income of $82.6 million, or $3.20 per diluted share.

- The Communications, Enterprise and Datacenter (CED) business recorded its seventh consecutive quarter of over 100% year-over-year growth in Q4 2025, contributing to broad-based growth across all customer segments and regions.

- As of December 31, 2025, total cash, cash equivalents, and short-term investments amounted to $808.4 million.

- SiTime Corporation reported net revenue of $113.3 million in the fourth quarter of 2025, a 36% increase from the prior quarter, and $326.7 million for fiscal year 2025, marking a 61% increase from fiscal year 2024.

- For Q4 2025, GAAP net income was $9.2 million ($0.34 per diluted share), and non-GAAP net income was $41.3 million ($1.53 per diluted share).

- The company's Communications, Enterprise and Datacenter (CED) business achieved its seventh consecutive quarter of over 100% year-over-year growth in Q4 2025, driven by AI.

- Total cash, cash equivalents, and short-term investments reached $808.4 million as of December 31, 2025.

- SiTime is acquiring Renesas' Timing Business, a strategic move expected to accelerate its path to $1 billion of revenue as a premier pure-play precision timing company.

- The transaction consideration involves $1.5 billion in cash and approximately 4.13 million shares of SiTime common stock, with financing including cash on hand and $900 million of fully committed debt.

- Post-close, the acquisition is projected to generate ~$300 million in revenue in the first 12 months and contribute to a 2025 Pro Forma Revenue of $500M+ with 25-30% annual growth.

- The acquisition is expected to achieve a ~70% non-GAAP gross margin and be accretive to SiTime's non-GAAP earnings per share in the first year post-close. The target closing is by the end of 2026.

- SiTime Corporation is in discussions with Renesas Electronics Corporation regarding a potential acquisition of Renesas’ timing business.

- No agreement has been reached, and there is no assurance that any transaction will result from these discussions or on what terms.

- SiTime does not intend to make further comments with respect to the discussions unless and until required to do so.

Fintool News

In-depth analysis and coverage of SITIME.

Quarterly earnings call transcripts for SITIME.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more