Earnings summaries and quarterly performance for Skyline Bankshares.

Executive leadership at Skyline Bankshares.

Blake M. Edwards, Jr.

President and Chief Executive Officer

Beth R. Worrell

Executive Vice President and Chief Risk Officer

Jonathan L. Kruckow

Executive Vice President and Regional President, Virginia

Lori C. Vaught

Executive Vice President and Chief Financial Officer

Matthew C. Martin

Executive Vice President and Chief Credit Officer

Milo L. Cockerham

Executive Vice President and Chief Retail Banking Officer

Rodney R. Halsey

Executive Vice President and Chief Operations Officer

Ronald S. Pearson

Executive Vice President and Regional President, North Carolina

Board of directors at Skyline Bankshares.

A. Melissa Gentry

Director

Bryan L. Edwards

Director

Christopher D. Reece

Director

Dr. J. Howard Conduff, Jr.

Director

Frank A. Stewart

Director

Israel D. O’Quinn

Director

J. David Vaughan

Director

Jacky K. Anderson

Director

John Michael Turman

Director

R. Devereux Jarratt

Director

T. Mauyer Gallimore

Director

Theresa S. Lazo

Director

Thomas M. Jackson, Jr.

Chairman of the Board

W. David McNeill

Vice Chairman

Research analysts covering Skyline Bankshares.

Recent press releases and 8-K filings for SLBK.

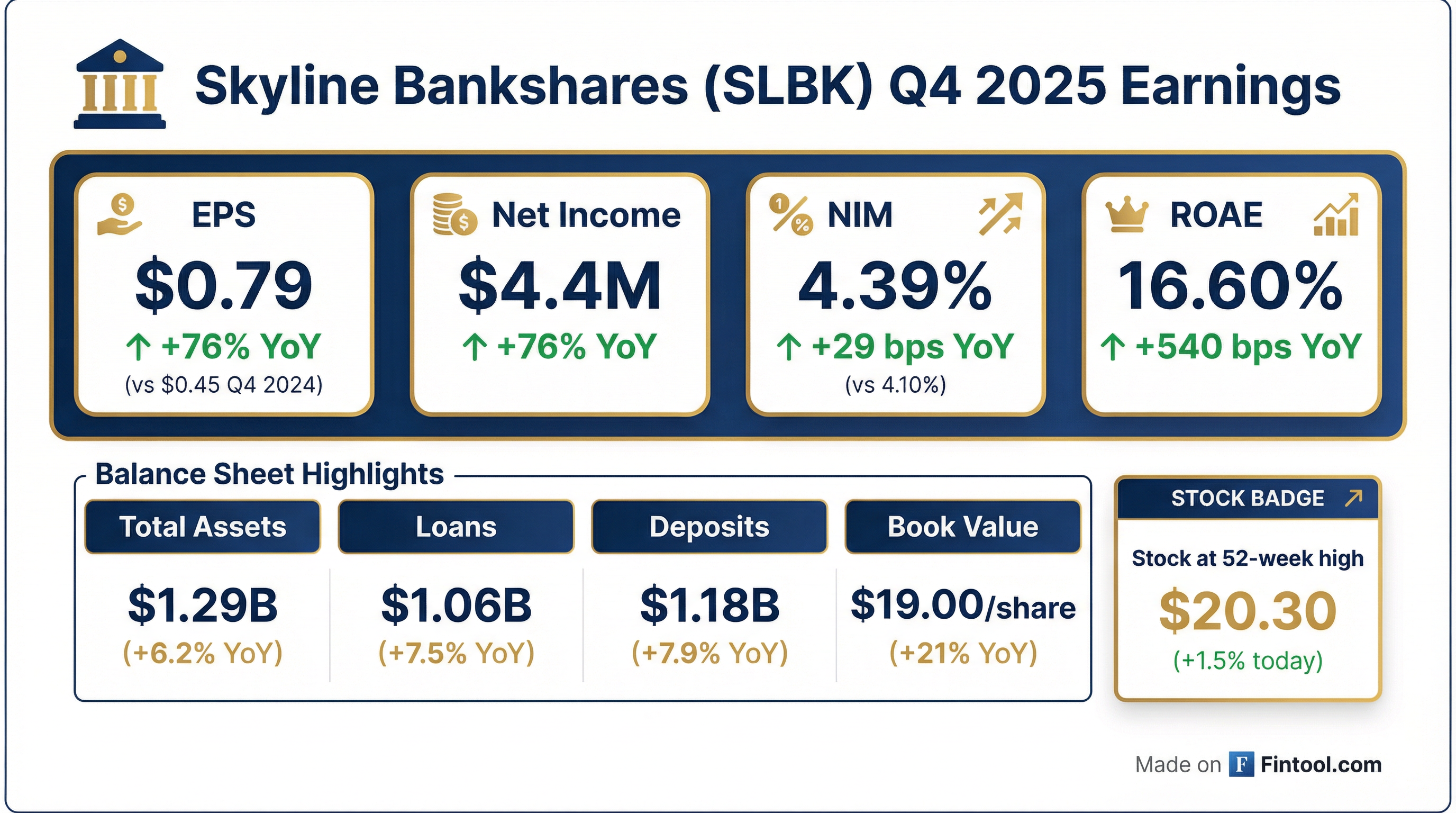

- Net income for Q4 2025 was $4.4 million ($0.79 per share), a significant increase from $2.5 million ($0.45 per share) in Q4 2024. For the full year 2025, net income reached $15.8 million ($2.84 per share), up from $7.4 million ($1.34 per share) in 2024.

- Profitability metrics showed strength, with Q4 2025 annualized return on average assets (ROAA) at 1.34% and return on average equity (ROAE) at 16.60%. The net interest margin (NIM) also improved to 4.39% in Q4 2025 from 4.10% in Q4 2024.

- The company experienced solid balance sheet growth in 2025, with total assets increasing 6.22% to $1.29 billion, net loans growing 7.49% to $1.05 billion, and total deposits rising 7.87% to $1.18 billion by December 31, 2025.

- Shareholder value increased with book value per share reaching $19.00 at December 31, 2025 , and dividends per share increasing 13.04% to $0.52 in 2025. The ratio of nonperforming loans to total loans increased to 0.45% at December 31, 2025.

- Skyline Bankshares, Inc. reported net income of $4.1 million, or $0.73 per share, for the third quarter of 2025, a significant increase from $1.1 million, or $0.19 per share, in the third quarter of 2024.

- The company's Net Interest Margin (NIM) was 4.27% for the third quarter of 2025, up from 3.78% for the same period last year.

- Total assets grew to $1.31 billion at September 30, 2025, an increase of 7.30% from $1.22 billion at December 31, 2024.

- Total deposits reached $1.17 billion at September 30, 2025, an increase of 7.14% from $1.09 billion at December 31, 2024.

- The semi-annual dividend was increased to $0.27 per share, representing a 17.39% rise compared to the $0.23 per share paid in the third quarter of 2024.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more