Earnings summaries and quarterly performance for Sanofi.

Research analysts who have asked questions during Sanofi earnings calls.

Peter Verdult

Citigroup Inc.

8 questions for SNY

David Risinger

Leerink Partners

7 questions for SNY

Luisa Hector

Berenberg

7 questions for SNY

Seamus Fernandez

Guggenheim Partners

7 questions for SNY

Simon Baker

Redburn Atlantic

7 questions for SNY

Florent Cespedes

Bernstein

6 questions for SNY

Ben Jackson

Jefferies

5 questions for SNY

Graham Parry

Bank of America Corporation

5 questions for SNY

James Quigley

Goldman Sachs

5 questions for SNY

Richard Vosser

JPMorgan Chase & Co.

5 questions for SNY

Sachin Jain

Bank of America

5 questions for SNY

Steve Scala

Cowen

5 questions for SNY

Sarita Kapila

Morgan Stanley

4 questions for SNY

Jo Walton

UBS

3 questions for SNY

Matthew Weston

UBS Group AG

3 questions for SNY

Eric Le Berrigaud

Stifel

2 questions for SNY

James Gordon

JPMorgan Chase & Co.

2 questions for SNY

Michael Leuchten

Jefferies

2 questions for SNY

Shirley Chen

Barclays

2 questions for SNY

Shirley Shin

Barclays

2 questions for SNY

Zane Abraham

JPMorgan Chase & Co.

2 questions for SNY

Colleen Garvey

Guggenheim Securities

1 question for SNY

Emily Field

Barclays

1 question for SNY

Emmanuel Papadakis

Deutsche Bank

1 question for SNY

Gary Steventon

BNP Paribas Exane

1 question for SNY

Luisa Caroline Hector

Berenberg

1 question for SNY

Peter Welford

Jefferies

1 question for SNY

Ricardo Benevides Freitas

Santander

1 question for SNY

Timothy Anderson

BofA Securities

1 question for SNY

Xiaobin Gao

Barclays

1 question for SNY

Recent press releases and 8-K filings for SNY.

- The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has adopted a positive opinion recommending conditional marketing authorisation for Sanofi’s Rezurock (belumosudil) in the EU.

- This recommendation is for the treatment of adults and children aged 12 years and older with chronic graft-versus-host disease (GvHD), to be used when other treatment options are limited, unsuitable, or exhausted.

- The positive opinion follows a re-examination of a prior negative opinion adopted by the CHMP in October 2025, with a final European Commission decision expected in the coming weeks.

- Rezurock is already approved in 20 countries, including the US, UK, and Canada, and has treated over 17,000 patients since its first approval in the US in July 2021.

- The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has adopted a positive opinion recommending conditional marketing authorization for Sanofi’s Rezurock (belumosudil) in the EU.

- This recommendation is for the treatment of adults and children aged 12 years and older with chronic graft-versus-host disease (GVHD) when other treatment options are limited, unsuitable, or exhausted.

- The positive opinion follows a re-examination of a prior negative opinion from October 2025, with the final European Commission decision expected in the coming weeks.

- Rezurock is currently approved in 20 countries, including the US, UK, and Canada, and has treated over 17,000 patients since its first approval in the US in July 2021.

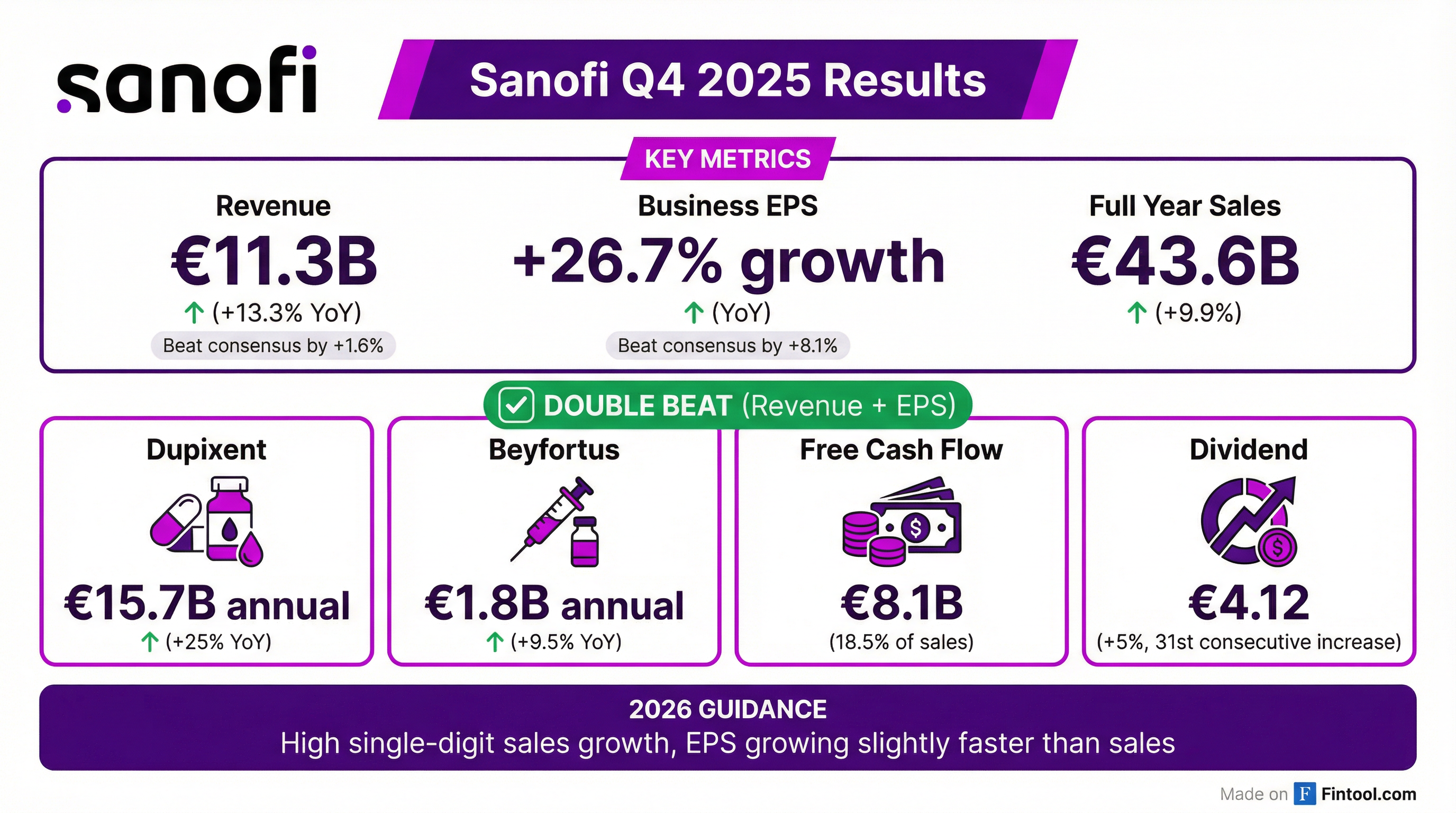

- Sanofi reported Q4 2025 sales growth of 13.3% at constant exchange rates (CER) and business earnings per share (EPS) of €1.53, up 26.7% at CER. For the full year 2025, sales increased by 9.9% at CER, and business EPS improved by 15.0%.

- Pharma launches contributed €1.1 billion to sales, growing 49.4%, while Dupixent sales increased by 32.2% to €4.2 billion in Q4 2025.

- For 2026, Sanofi anticipates sales to grow by a high single-digit percentage at CER and business EPS at CER to grow slightly faster than sales. The company also intends to execute a €1 billion share buyback program in 2026.

- Sanofi announced the Dynavax acquisition, completed the Vicebio acquisition, and finished a €5 billion share buyback program in 2025. A proposed dividend of €4.12 represents a 5.1% increase.

- Sanofi reported Q4 2025 net sales growth of 13.3% to EUR 11.3 billion and full-year 2025 sales of EUR 43.6 billion, a 9.9% increase at constant exchange rates. Business EPS for the full year grew 15% including share buybacks.

- Dupixent achieved EUR 15.7 billion in annual sales, and newly launched medicines and vaccines grew 34% to EUR 1.8 billion in full-year sales.

- For 2026, the company forecasts high single-digit sales growth and business EPS growing slightly faster than sales, with profitable growth expected to continue for at least five years.

- Sanofi completed a EUR 5 billion share buyback program in 2025 and plans a EUR 1 billion share buyback in 2026. The company also strengthened its vaccines portfolio with the acquisition of Vicebio and the proposed acquisition of Dynavax Technologies Corporation.

- Sanofi reported strong financial performance for Q4 2025 with EUR 11.3 billion in sales, representing 13.3% growth, and full-year 2025 sales of EUR 43.6 billion, a 9.9% growth at constant exchange rates. Full-year business EPS grew 15%.

- New product launches contributed EUR 5.7 billion in sales for 2025, with Dupixent reaching EUR 15.7 billion in annual sales and ALTUVIIIO achieving blockbuster status with EUR 1.2 billion in full-year sales.

- The company completed a EUR 5 billion share buyback program and proposed a 5% increase in its dividend to EUR 4.12 per share. Sanofi also deployed EUR 10.4 billion from the Opella divestment into business development and M&A, including the acquisition of Vicebio and the proposed acquisition of Dynavax Technologies Corporation.

- For 2026, Sanofi expects high single-digit sales growth and business EPS to grow slightly faster than sales. The outlook includes a EUR 400 million decrease in R&D reimbursement from Regeneron, which will be largely offset by an estimated EUR 1 billion in Amvutra royalties.

- Sanofi reported full year 2025 sales of EUR 43.6 billion, representing 9.9% growth at constant exchange rates, and Business EPS grew by 15% (including share buyback).

- The company provided 2026 guidance for high single-digit sales growth and Business EPS growing slightly faster than sales, anticipating profitable growth to continue for at least five years.

- Key product performance included Dupixent reaching EUR 15.7 billion in annual sales and ALTUVIIIO achieving blockbuster status with EUR 1.2 billion in full year sales.

- Sanofi completed its EUR 5 billion share buyback program in 2025 and plans a EUR 1 billion share buyback program in 2026, while also proposing a 5% dividend increase to EUR 4.12.

- Strategic M&A included the acquisition of Vicebio and the proposed acquisition of Dynavax Technologies Corporation, which is expected to close in Q1 2026, adding to its vaccines portfolio.

- Sanofi reported Q4 net sales of €11.30 billion, an increase of 13.3% at constant exchange rates, but a net loss attributable to equity holders of €801 million, while business EPS improved to €1.53.

- For fiscal 2026, Sanofi projects high single-digit sales growth at constant exchange rates and expects business EPS to grow slightly faster than sales.

- The company intends to execute a €1 billion share buyback program in 2026 and proposed a 2025 dividend of €4.12 per share.

- Growth was supported by new Pharma launches, including Ayvakit and ALTUVIIIO, and strong performance from assets such as Dupixent (up 32.2%), with the Dynavax acquisition pending.

- In the SHORE phase 3 study, amlitelimab, in combination with topical therapies, met all primary and key secondary endpoints at Week 24, with efficacy progressively increasing throughout the treatment period.

- The COAST 2 phase 3 study demonstrated statistically significant efficacy on vIGA-AD 0/1 for the US and US reference countries, confirming potential for Q12W dosing from the start, though it did not achieve statistical significance for co-primary endpoints in the EU and EU reference countries.

- A preliminary analysis of the ATLANTIS phase 2 study showed continued and progressive improvements with no evidence of plateau through Week 52, demonstrating the potential of OX40-ligand as an important new mechanism in atopic dermatitis.

- Based on the totality of data, Sanofi will move forward with global regulatory submissions for amlitelimab, which are planned for H2 2026.

- Sanofi reported positive Phase 3 results for its drug amlitelimab in two global trials (SHORE and COAST-2) for moderate-to-severe atopic dermatitis, and plans to pursue global regulatory filings.

- While the SHORE trial met all primary and key secondary endpoints, the COAST-2 trial failed to achieve statistical significance on co-primary EU endpoints.

- This has led to tempered investor enthusiasm due to efficacy comparisons with market-leading Dupixent, which generated over €13 billion (about $15 billion-plus) in sales in 2024.

- Analyst sentiment is mixed, with TipRanks rating Sanofi a 'Hold' and Spark AI rating it 'Outperform'.

- Sanofi's amlitelimab demonstrated potential for treating moderate-to-severe atopic dermatitis (AD) with positive results from the SHORE and COAST 2 global phase 3 studies.

- The SHORE phase 3 study met all primary and key secondary endpoints at Week 24, showing progressively increasing efficacy.

- The COAST 2 phase 3 study met its primary endpoint for the US and US reference countries but did not achieve statistical significance for the co-primary endpoints in the EU and EU reference countries.

- Amlitelimab was well-tolerated across studies, with its safety profile consistent with prior data.

- Sanofi intends to proceed with global regulatory submissions for amlitelimab in H2 2026.

Quarterly earnings call transcripts for Sanofi.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more