Earnings summaries and quarterly performance for StepStone Group.

Executive leadership at StepStone Group.

Board of directors at StepStone Group.

Research analysts who have asked questions during StepStone Group earnings calls.

Kenneth Worthington

JPMorgan Chase & Co.

6 questions for STEP

Michael Cyprys

Morgan Stanley

6 questions for STEP

Alexander Blostein

Goldman Sachs

4 questions for STEP

Benjamin Budish

Barclays PLC

3 questions for STEP

John Dunn

Evercore ISI

3 questions for STEP

Alex Blostein

Goldman Sachs Group, Inc.

2 questions for STEP

Brennan Hawken

UBS Group AG

2 questions for STEP

Christoph Kotowski

Oppenheimer & Co. Inc.

2 questions for STEP

Ben Budish

Barclays PLC

1 question for STEP

Recent press releases and 8-K filings for STEP.

- StepStone Group has partnered with Utmost, a global provider of insurance-based wealth solutions, to offer its suite of evergreen global private markets strategies to Utmost's UK-based clients.

- This collaboration provides UK investors with access to StepStone's strategies across Private Equity, Venture Capital & Growth, Private Credit, and Private Infrastructure.

- The partnership aims to support portfolio diversification and improve long-term financial outcomes for UK clients, building on StepStone's private wealth business momentum, which has tripled its AUM in the past fifteen months.

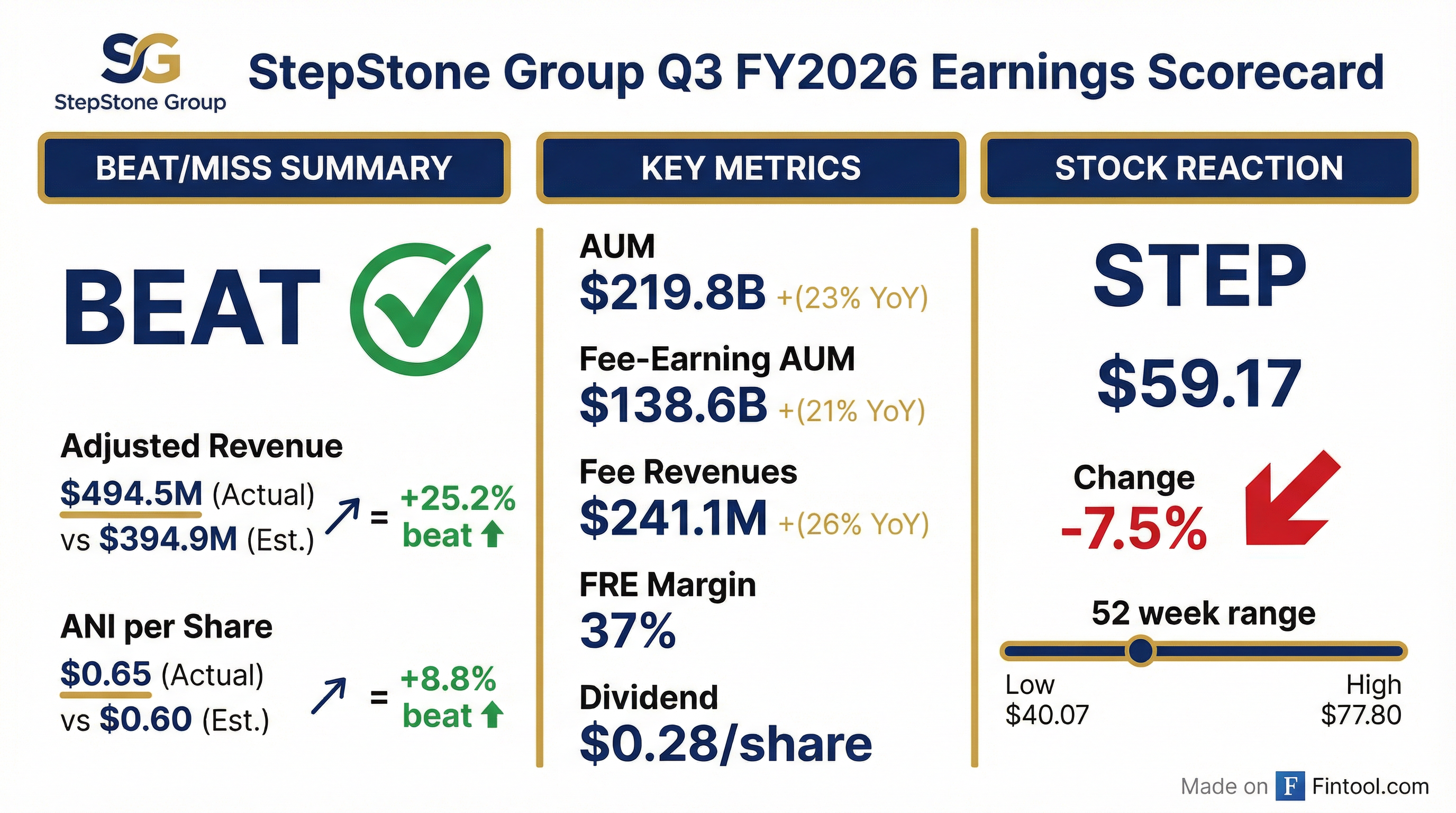

- StepStone Group reported a GAAP net loss of $123 million or $1.55 per share for Q3 2026, primarily due to accounting for the change in fair value of StepStone Private Wealth profits interests. However, the company achieved fee-related earnings of $89 million, representing a 20% increase year-over-year with a 37% FRE margin, and adjusted net income rose to $80 million or $0.65 per share.

- The company generated gross AUM additions of over $8 billion in Q3 2026 and over $34 billion for the calendar year 2025, marking its best 12-month fundraising period ever. The private wealth platform grew to $15 billion, consistently generating over $2 billion in new subscriptions each quarter.

- StepStone estimates its total AUM exposure to software investments is approximately 11%, which reduces to about 7% when excluding venture capital, reflecting a diversified approach to private markets investing and a relatively modest exposure to potential AI disruption risks.

- StepStone Group reported a GAAP net loss attributable to StepStone Group Incorporated of $123 million or $1.55 per share for Q3 2026, primarily due to the change in fair value of the buy-in of StepStone Private Wealth profits and interests. However, adjusted net income for the quarter was $80 million or $0.65 per share, an increase from $0.44 per share in the prior year.

- The company generated fee-related earnings (FRE) of $89 million, up 20% from the prior year quarter, with core FRE increasing 35% to $88 million. Fee revenues for the quarter were $241 million, a 26% increase year-over-year.

- StepStone achieved its best 12-month period ever for fundraising, with gross AUM additions exceeding $34 billion for the calendar year, including over $8 billion in Q3 2026. Total fee-earning assets plus undeployed fee-earning capital (UFEC) grew to over $171 billion, an increase of over $35 billion from a year ago.

- The private wealth platform expanded to $15 billion, with over $2.2 billion in new subscriptions during the quarter. Gross realized performance fees were $253 million, significantly boosted by $207 million in incentive fees from the Spring Evergreen Fund, which delivered exceptional investment returns of 39% over the year.

- StepStone estimates that approximately 11% of its total AUM is invested in software, which reduces to about 7% when excluding venture investments, reflecting a diversified approach to private markets investing and positioning for the evolution of artificial intelligence.

- STEP reported significant growth in its assets for FQ3 2026, with Assets Under Management (AUM) increasing by 23% to $219.8 billion and Fee-Earning AUM (FEAUM) growing by 21% to $138.6 billion compared to FQ3 2025.

- The company's financial performance for FQ3 2026 showed Adjusted Net Income (ANI) per share rising by 48% to $0.65, while fee revenues increased 26% to $241.1 million and Fee-related earnings (FRE) grew 20% to $89.2 million.

- STEP declared a quarterly cash dividend of $0.28 per share of Class A common stock, payable on March 13, 2026.

- Net accrued carry reached $875 million as of FQ3 2026, and investments in the firm's funds increased by 27% to $338 million from December 31, 2024.

- StepStone Group Inc. announced its third quarter fiscal year 2026 results for the period ended December 31, 2025.

- The company reported total revenues of $586.5 million , a net loss of $162.4 million , and a diluted net loss per share of $1.55. On a non-GAAP basis, adjusted net income (ANI) was $79.9 million with ANI per share of $0.65.

- StepStone declared a quarterly cash dividend of $0.28 per share of Class A common stock.

- As of December 31, 2025, total capital responsibility reached $811.1 billion, comprising $219.8 billion in assets under management (AUM) and $591.3 billion in assets under advisement (AUA).

- StepStone Real Estate (SRE) has appointed Jennifer Jones as a Partner to lead the launch of S-Core, a new platform designed to expand its Core/Core+ real estate investment offerings.

- Ms. Jones, who previously spent nearly two decades at UBS leading over $20 billion in transactions, will oversee a global investment mandate for S-Core.

- S-Core will invest in Core and Core+ real estate through various strategies, including secondaries, co-investments, tactical real estate operating company investments, and primary commitments to funds. It will be structured as a series of separate accounts, enabling investors to customize portfolios based on factors like geography and property types.

- Standard Nuclear secured $140 million in a Series A funding round, with StepStone Group among the new investors, to scale production of TRISO fuel made with HALEU for next-generation reactors.

- The company has initiated TRISO fabrication at its Oak Ridge facility (currently 500 kg/year) and aims to expand output to over two metric tons across multiple locations by mid-2026.

- This financing, structured through Convertible Preferred Stock, is intended to accelerate a domestic HALEU/TRISO supply chain, positioning Standard Nuclear as a reactor-agnostic supplier.

- ARC Energy Fund 8 has successfully completed the take-private acquisition of STEP Energy Services Ltd. on December 16, 2025.

- The acquisition was made for a cash consideration of $5.50 per Share.

- As a result of the transaction, STEP Energy Services Ltd. has applied to be delisted from the Toronto Stock Exchange and to cease to be a reporting issuer in Canada.

- Following the completion of the Arrangement, ARC Energy Fund 8, ARC Energy Fund 6, and the Purchaser collectively own 100% of all outstanding Shares of STEP Energy Services Ltd..

- STEP Energy Services Ltd. has received the final court order from the Court of King's Bench of Alberta for a previously announced plan of arrangement.

- Under this arrangement, ARC Energy Fund 8 and other Purchaser Parties will acquire all issued and outstanding common shares of STEP not already owned by certain ARC entities.

- This final court approval follows shareholder approval obtained at a special meeting on December 12, 2025.

- The acquisition is anticipated to close on December 16, 2025, subject to the satisfaction or waiver of conditions outlined in the definitive arrangement agreement dated October 17, 2025.

Quarterly earnings call transcripts for StepStone Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more