Earnings summaries and quarterly performance for STRATTEC SECURITY.

Executive leadership at STRATTEC SECURITY.

Jennifer L. Slater

Detailed

President and Chief Executive Officer

CEO

AE

Aaron E. Byrne

Detailed

Senior Vice President and Chief Operations Officer

CD

Chey D. Becker-Varto

Detailed

Senior Vice President and Chief Commercial Officer

LM

Linda M. Redmann

Detailed

Chief People Officer

MP

Matthew P. Pauli

Detailed

Senior Vice President and Chief Financial Officer

RP

Richard P. Messina

Detailed

Senior Vice President and Chief Technology Officer

Board of directors at STRATTEC SECURITY.

Research analysts who have asked questions during STRATTEC SECURITY earnings calls.

Recent press releases and 8-K filings for STRT.

STRATTEC Security Corporation Reports Strong Q2 2026 Financial Results with Significant Margin Expansion

STRT

Earnings

Guidance Update

New Projects/Investments

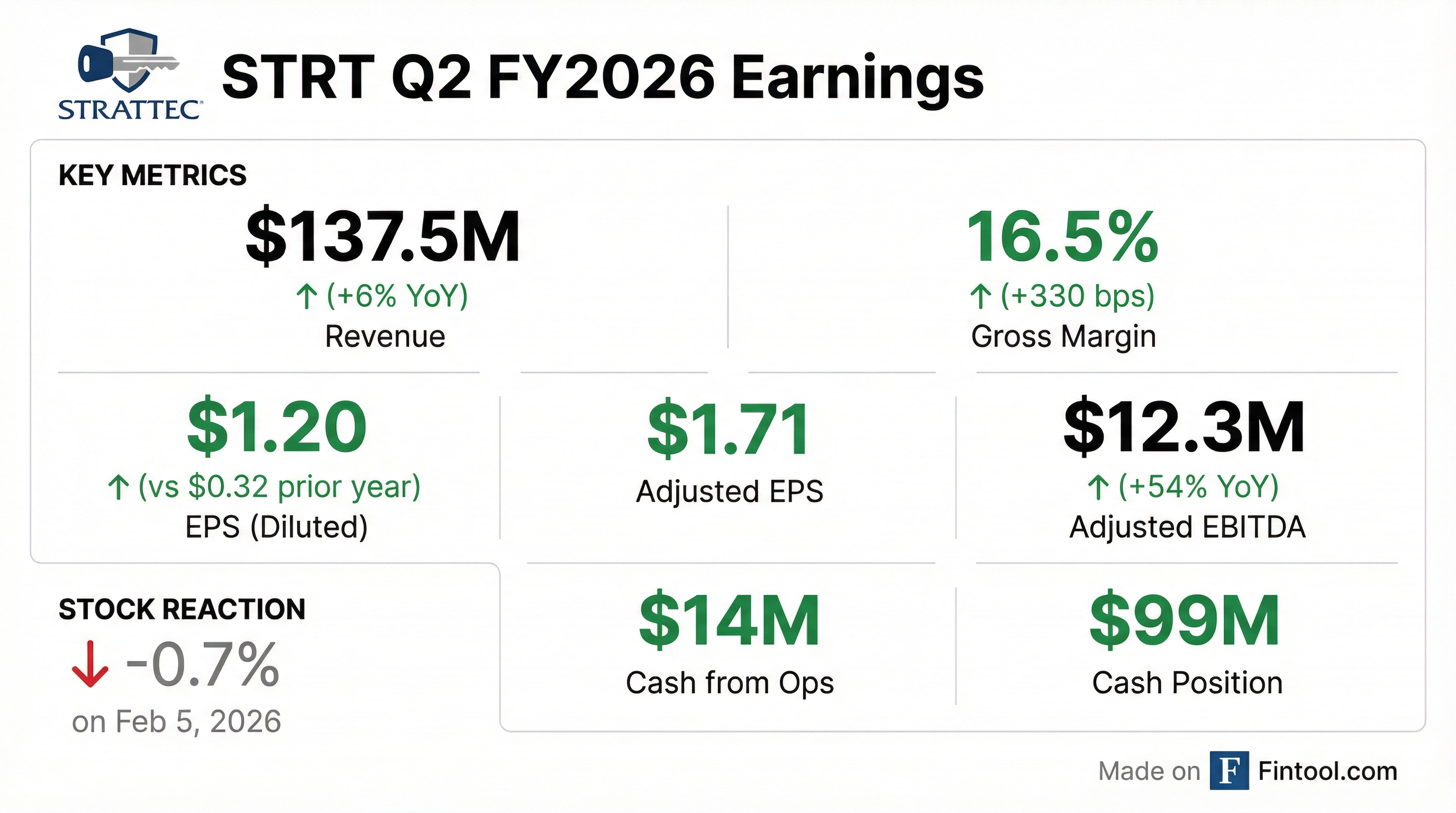

- STRATTEC Security Corporation reported strong Q2 fiscal year 2026 results, with sales of $137.5 million , net income nearly quadrupling year-over-year to $5 million or $1.21 per diluted share, and adjusted diluted EPS growing 163% to $1.71.

- The company achieved significant margin expansion, with gross margin increasing 330 basis points to 16.5% and adjusted EBITDA margin reaching 8.9% for the quarter.

- STRATTEC generated $14 million in cash from operations in Q2, contributing to a year-to-date total of $25 million, and maintains a strong balance sheet with $99 million in cash and only $2.5 million in total debt.

- Management expects second-half fiscal year 2026 sales to be down approximately 3%-4% year-over-year and anticipates annual cash from operations of about $40 million.

- Cost reduction efforts, including a voluntary retirement program, are projected to generate $3.4 million in annualized savings.

15 hours ago

STRATTEC Security Corporation Reports Strong Q2 Fiscal Year 2026 Financial Results

STRT

Earnings

Guidance Update

New Projects/Investments

- STRATTEC Security Corporation reported strong second quarter fiscal year 2026 results, with sales growing 6% to $137.5 million and gross margin expanding 330 basis points year-over-year to 16.5%.

- Net income nearly quadrupled year-over-year to $5 million, or $1.21 per diluted share, while adjusted earnings per share increased 163% to $1.71.

- The company generated $13.9 million in operating cash flow for the quarter, ending with a strong balance sheet that includes $99 million in cash and only $2.5 million in total debt.

- Management anticipates second-half fiscal year 2026 sales to be down approximately 3%-4% year-over-year and expects to generate about $40 million in annual operating cash flow.

15 hours ago

STRATTEC Security Reports Strong Q2 2026 Financial Results with Significant Profit Growth

STRT

Earnings

Guidance Update

New Projects/Investments

- STRATTEC Security Corporation reported strong second-quarter fiscal year 2026 results, with sales growing 6% to $137.5 million and net income nearly quadrupling year-over-year to $5 million, or $1.21 per diluted share.

- The company's gross margin expanded 330 basis points to 16.5% , driven by pricing actions, higher production volumes, and $1.7 million in restructuring savings.

- STRATTEC generated $14 million in cash from operations during the quarter, contributing to a strong balance sheet with $99 million in cash and total debt of $2.5 million.

- Management implemented a voluntary retirement program and other fiscal 2026 restructuring actions, projected to generate $3.4 million in annualized savings.

- For the second half of fiscal year 2026, the company anticipates sales to be down approximately 3%-4% year-over-year.

15 hours ago

Strattec Security Corporation Reports Strong Q2 Fiscal 2026 Results

STRT

Earnings

Guidance Update

Demand Weakening

- Strattec Security Corporation (STRT) reported net sales of $137.5 million, a 6% increase, for the second quarter of fiscal 2026, which ended December 28, 2025.

- Net income attributable to Strattec for the quarter was $4.9 million, or $1.20 per diluted share, with gross margin expanding to 16.5% and Adjusted EBITDA reaching $12.3 million (8.9% of sales).

- The company generated $13.9 million in cash from operations and reported a strong balance sheet with $99.0 million in cash and cash equivalents and $2.5 million in debt as of December 28, 2025.

- Management expects a softer U.S. automotive production market and continued foreign exchange headwinds in the second half of fiscal 2026, while anticipating $3.4 million in annualized savings from restructuring actions.

1 day ago

Strattec Reports Second Quarter Fiscal 2026 Financial Results

STRT

Earnings

Guidance Update

- Strattec reported net sales of $137.5 million for the second quarter fiscal 2026, an increase of 6% compared to the prior year period.

- Net income attributable to Strattec was $4.9 million, or $1.20 per diluted share, for the second quarter fiscal 2026, significantly up from $0.32 per diluted share in the prior year period.

- The company generated $13.9 million in cash from operations during the second quarter fiscal 2026.

- Strattec's gross margin for the quarter improved to 16.5%, compared with 13.2% in the prior year period, partly due to $1.7 million in restructuring savings.

- As of December 28, 2025, Strattec had a strong balance sheet with $99.0 million in cash and cash equivalents and $2.5 million in current borrowings under credit facilities.

1 day ago

STRATTEC Reports Q1 FY26 Financial Results and Strategic Updates

STRT

Earnings

Guidance Update

Revenue Acceleration/Inflection

- STRATTEC reported Q1 FY26 net sales of $152.4 million, an increase of 9.6% year-over-year, driven by higher demand, pricing benefits, favorable sales mix, and new program launches.

- The company achieved a Q1 FY26 gross margin of 17.3%, expanding 370 basis points year-over-year, primarily due to pricing actions, increased production volume, and restructuring savings.

- Adjusted EBITDA for Q1 FY26 was $15.6 million, with the margin expanding 310 basis points year-over-year to 10.2%.

- STRATTEC anticipates near-term headwinds in Q2 and potentially Q3 FY26, primarily due to supply chain disruptions from an aluminum fire, semiconductor chip shortages, and Mexico border issues.

- As of September 28, 2025, the company maintained a strong financial position with $90.5 million in cash and cash equivalents and total debt reduced to $5.0 million, resulting in a debt to total capitalization of 1.9%.

Dec 11, 2025, 6:00 PM

Strattec Reports Strong Q1 FY2026 Sales and Margin Improvement

STRT

Revenue Acceleration/Inflection

Guidance Update

New Projects/Investments

- Strattec reported Q1 fiscal year 2026 sales of $152 million, a 10% increase year-over-year, outperforming the North American automotive market's 5% growth.

- The company achieved a gross margin of 17.3% in Q1 FY2026, with adjusted net income of $9.2 million ($2.22 per share) and adjusted EBITDA of $15.6 million (10% margin), reflecting successful transformation efforts.

- Strattec maintains a strong financial position with $90 million in cash and only $5 million in debt, and expects fiscal year 2026 revenue to closely follow North American production.

- The company is prioritizing growth in security and authorization (including digital key technology) and vehicle access (power access products), and has initiated a process to develop a framework for M&A.

Dec 11, 2025, 6:00 PM

Strattec Reports Strong Q1 FY2026 Financials and Outlines Transformation Progress

STRT

Earnings

Management Change

New Projects/Investments

- Strattec (STRT) reported Q1 fiscal year 2026 sales of $152 million, representing a 10% increase year-over-year, with gross margins improving to 17.3% and adjusted EBITDA of $15.6 million.

- The company maintains a strong liquidity position with $90 million in cash on its balance sheet and only $5 million in debt, while focusing on a business transformation that has led to improved margins and cash generation.

- Strattec anticipates its revenue will closely follow North American production in fiscal year 2026, prioritizing growth in power access and digital key technology, and is developing a framework for potential M&A.

Dec 11, 2025, 6:00 PM

Strattec Presents at Sidoti's Year End Virtual Investor Conference

STRT

Guidance Update

Revenue Acceleration/Inflection

New Projects/Investments

- Strattec (STRT) reported first-quarter sales of $152 million, a 10% year-over-year increase, outperforming the North American automotive market's 5% growth. Gross margins improved to 17.3%, with adjusted net income of $9.2 million ($2.22 per share) and adjusted EBITDA of $15.6 million.

- The company maintains a strong liquidity position with $90 million in cash and only $5 million in debt, generating $11 million in cash from operations in the first quarter.

- Strattec is undergoing a transformation, focusing on improving margins and cash balance, and prioritizing growth in power access products and digital key technology.

- Management expects revenue to closely follow North American production in fiscal year 2026, anticipating a moderate to slightly down market for the first half of calendar year 2026.

- Annual tariffs of $5-$7 million are largely mitigated through various actions, with any remaining impact expected to be a timing lag rather than a long-term hit to the bottom line.

Dec 11, 2025, 6:00 PM

Strattec Security Corp. Reports Strong Q1 FY2026 Results and Transformation Progress

STRT

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Strattec Security Corp. reported Q1 FY2026 sales of $152.4 million, a 9.6% increase year-over-year, outperforming the North American automotive production growth of 4%-5%.

- The company's gross margin improved by 370 basis points year-over-year to 17.3% in Q1 FY2026, attributed to increased volumes, 2025 restructuring savings, and pricing actions.

- Strattec delivered $9.2 million in adjusted net income ($2.22 per share) and $15.6 million in adjusted EBITDA (approximately 10%) for Q1 FY2026.

- The company maintains a strong financial position with $90 million in cash and only $5 million in outstanding debt as of the end of Q1 FY2026.

- Strattec is in the early stages of a transformation journey focused on operational improvements, strategic pricing, and modernizing the business, which has steadily improved margins and cash balance over the past five quarters.

Dec 9, 2025, 3:00 PM

Quarterly earnings call transcripts for STRATTEC SECURITY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more