Earnings summaries and quarterly performance for TENNANT.

Executive leadership at TENNANT.

David Huml

President and Chief Executive Officer

Barbara Balinski

Senior Vice President, Chief Transformation Officer

Fay West

Senior Vice President, Chief Financial Officer

Kristin Erickson

Senior Vice President, General Counsel and Corporate Secretary

Richard Zay

Senior Vice President, Chief Commercial Officer

Board of directors at TENNANT.

Research analysts who have asked questions during TENNANT earnings calls.

Steve Ferazani

Sidoti & Company

6 questions for TNC

Aaron Reed

Northcoast Research

5 questions for TNC

Thomas Hayes

CL King & Associates

2 questions for TNC

Tom Hayes

Roth Capital Partners

2 questions for TNC

Aaron Reid

Northcoast Research

1 question for TNC

Edith Priscilla

Northcoast Research

1 question for TNC

Iva Prcela

Northcoast Research

1 question for TNC

Recent press releases and 8-K filings for TNC.

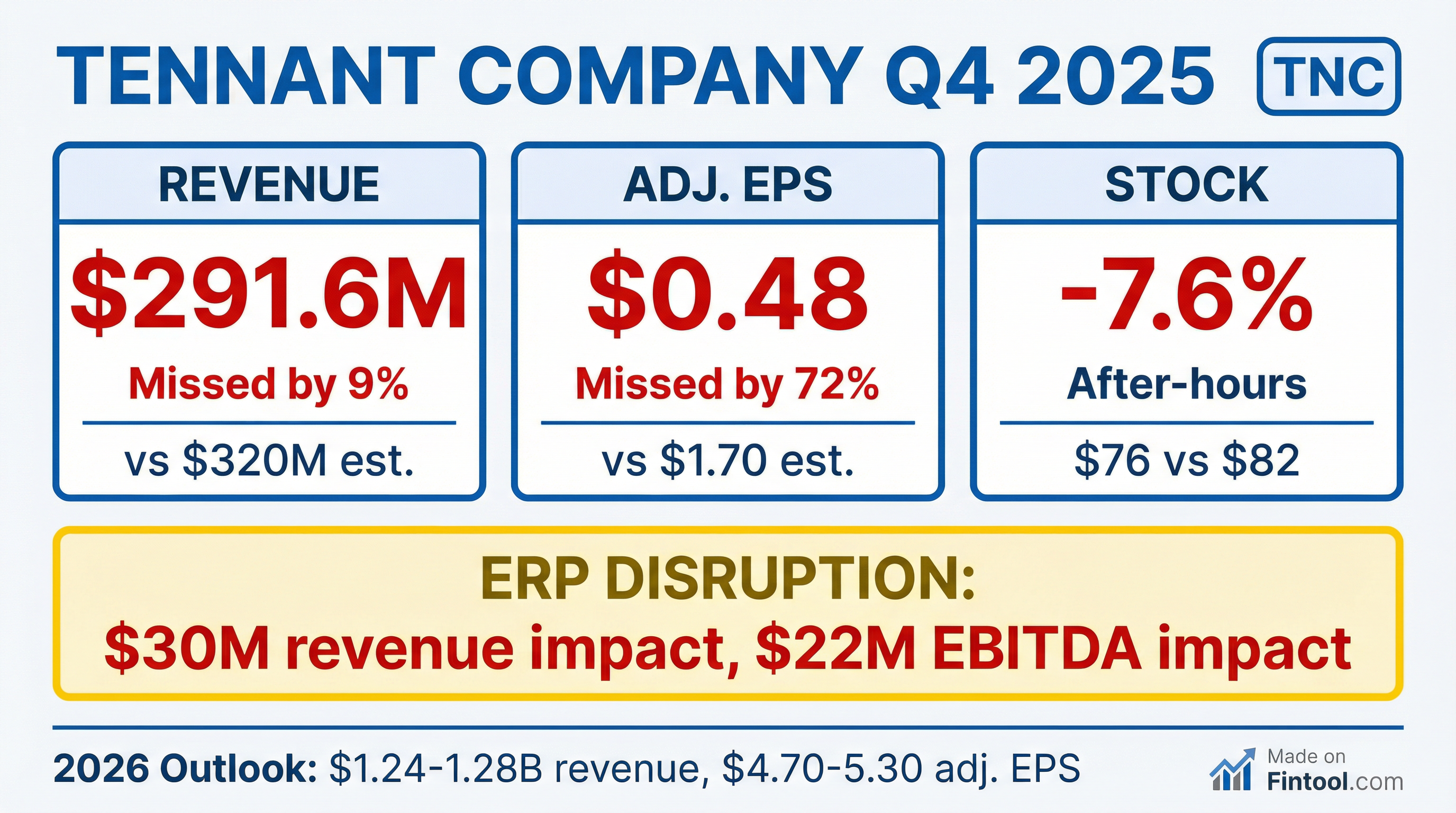

- TNC's Q4 2025 results were materially impacted by the North America ERP system go-live in November 2025, leading to an estimated $30 million reduction in net sales and a $22 million negative impact on adjusted EBITDA.

- For Q4 2025, the company reported a GAAP net loss of $4.4 million and adjusted EPS of $0.48 per diluted share, a significant decrease from the prior year.

- The company anticipates ERP-related operational challenges to persist into early 2026, with system stability targeted by the end of Q1 2026 and significant improvements expected in the second half of the year.

- TNC launched a dedicated Robotics group, which contributed approximately $85 million in sales in 2025, with an aspiration to achieve $250 million in sales by 2028.

- In 2025, TNC returned a substantial $110.4 million to shareholders, including $88.5 million in share repurchases (reducing outstanding shares by about 6%) and $21.9 million in dividends.

- TENNANT's Q4 2025 results were materially impacted by the North America ERP system go-live in November 2025, leading to an estimated $30 million reduction in net sales and a $22 million negative impact on adjusted EBITDA. The company reported a GAAP net loss of $4.4 million and adjusted EPS of $0.48 per diluted share for the quarter.

- For the full year 2025, net sales decreased by 6.5% to $1,203.5 million, and adjusted EPS was $4.57 per diluted share, down from $6.57 in 2024.

- The company expects ERP-related spending in 2026 to exceed $20 million and anticipates system stability by the end of Q1 2026, with efficiency improvements continuing into Q2.

- For full year 2026, TENNANT projects net sales between $1.24 billion and $1.28 billion, adjusted EBITDA between $175 million and $190 million, and adjusted EPS between $4.70 and $5.30 per diluted share (excluding ERP project costs and amortization expense).

- TENNANT aims for its AMR (Autonomous Mobile Robot) revenue to reach approximately $250 million by 2028, building on $85 million in profitable robotics business in 2025.

- TNC's Q4 2025 financial performance was significantly impacted by unexpected challenges from an ERP go-live, resulting in Net Sales of $291.6 million (13.9% organic decline) and Adjusted EBITDA of $25.6 million (8.8% margin), with an estimated $30 million net sales and $22 million Adjusted EBITDA impact from the ERP issues.

- For the full year 2025, TNC reported Net Sales of $1,203.5 million (7.3% organic decline) and Adjusted EBITDA of $167.4 million (13.9% margin), with Adjusted Diluted EPS of $4.57 per share, down from $6.57 in 2024.

- Looking ahead to 2026, TNC anticipates Organic Net Sales Growth of 3.0% - 6.5%, Adjusted EBITDA Margin Expansion of 20-90 bps, and Adjusted EPS of $4.70-$5.30, with ERP stabilization targeted for early 2026 and efficiency improvements throughout the first half.

- In 2025, TNC repurchased ~$88 million in shares and launched TNC Robotics to accelerate Autonomous Mobile Robot (AMR) scaling, targeting $250 million in AMR net sales by 2028.

- Tennant Company's Q4 and full year 2025 results were materially impacted by the North America ERP system go-live in November 2025, which introduced severe system functionality issues. This disruption led to an estimated $30 million impact on net sales and a $22 million negative impact on Adjusted EBITDA in Q4 2025.

- For the full year 2025, Tennant reported a GAAP net loss of $4.4 million and Adjusted EPS of $4.57 per diluted share, down from $6.57 in 2024. Consolidated net sales for the full year were $1,203.5 million, a 6.5% decrease compared to 2024.

- The company expects ERP-related operational challenges to continue early in 2026, with a two-week shutdown of manufacturing and distribution facilities in early January significantly affecting Q1 sales and costs. System stability is anticipated by the end of Q1 2026, with a return to a more normalized operating rhythm by mid-year.

- Tennant provided 2026 guidance projecting net sales between $1.24 billion and $1.28 billion, Adjusted EBITDA between $175 million and $190 million, and Adjusted EPS between $4.70 and $5.30 per diluted share.

- In 2025, Tennant repurchased approximately 1.1 million shares for $88 million, reducing outstanding shares by about 6%, and increased its dividend for the 54th consecutive year. The company also launched a dedicated robotics group and expects AMR revenue to reach approximately $250 million by 2028.

- Tennant Company reported Q4 2025 net sales of $291.6 million and a net loss of $(4.4) million, with Adjusted diluted EPS of $0.48, which included an estimated $0.91 impact from its ERP system implementation. For the full year 2025, net sales were $1,203.5 million and Adjusted diluted EPS was $4.57.

- The ERP system implementation in North America, which went live in November 2025, caused production disruptions and constrained operating capacity, leading to an estimated $30 million unfavorable impact on Q4 net sales and $22 million on Adjusted EBITDA. Operational challenges are expected to continue early in 2026, with a projected return to a more normalized operating rhythm by mid-year.

- For 2026, the company issued guidance forecasting net sales of $1,240 - $1,280 million, organic net sales growth of 3.0% - 6.5%, and Adjusted diluted net income per share of $4.70 - $5.30.

- In 2025, Tennant Company returned $110.4 million to shareholders, comprising $88.5 million in share repurchases and $21.9 million in dividends.

- Tennant Company reported adjusted EPS of $0.48 for the fourth quarter of 2025 and $4.57 for the full year 2025, with operations significantly impacted by an ERP system implementation.

- Net sales for Q4 2025 were $291.6 million, an 11.3% decrease compared to Q4 2024, and full-year 2025 net sales were $1,203.5 million, a 6.5% decrease from 2024. The ERP implementation is estimated to have had an unfavorable impact of roughly $30 million on net sales and approximately $22 million on adjusted EBITDA in Q4 2025.

- The company returned $110.4 million to shareholders in 2025, including $87.7 million in share repurchases (about 6% of outstanding shares) and $21.9 million in dividends.

- For 2026, Tennant provides guidance ranges of net sales between $1,240 million and $1,280 million and adjusted diluted net income per share between $4.70 and $5.30. ERP-related operational challenges are expected to continue early in 2026, particularly affecting Q1 sales and costs, with a return to a more normalized operating rhythm projected by mid-year.

- Tennant Company reported net sales of $303 million for Q3 2025, representing an organic decline of 5.4% compared to the prior year, primarily due to lower sales volumes across all geographies.

- Despite the sales decline, the company expanded gross margins by 30 basis points to 42.7% and improved Adjusted EBITDA margin by 120 basis points to 16.4%. Adjusted EPS increased 5% to $1.46 per diluted share.

- TNC returned $28 million to shareholders in Q3 through dividends and share repurchases, and announced a 5.1% increase to its annual dividend, marking the 54th consecutive year of increase.

- The company successfully completed the APAC go-live for its ERP modernization project and saw year-to-date sales growth of 9% and unit volume growth of 25% in its AMR robotics business.

- For the full year 2025, TNC anticipates net sales to be within its previously guided range of $1.21-$1.25 billion and Adjusted EBITDA between $196-$209 million, though organic growth is now projected to be slightly below the initial guidance range of -1% to -4% due to macroeconomic volatility and tariff-related pressures.

- Tennant Company reported net sales of $303.3 million for Q3 2025, reflecting a 5.4% organic decline compared to $316 million in Q3 2024.

- Adjusted Diluted EPS increased to $1.46 per share in Q3 2025 from $1.39 per share in Q3 2024, and Adjusted EBITDA reached $49.8 million with a 16.4% margin, an improvement of 120 basis points.

- The company returned $28.1 million to shareholders in Q3 2025, comprising $22.7 million in share repurchases and $5.4 million in dividends, bringing the year-to-date capital return total to $72.7 million.

- For the full year 2025, Tennant anticipates an organic net sales decline of (3.0)% – (5.0)% and Adjusted EBITDA margin expansion of 0-50 bps.

- Tennant Company reported Q3 2025 net sales of $303.3 million, a 5.4% organic decline, compared to a prior year quarter that benefited from a significant backlog reduction.

- Adjusted EPS increased 5% year-over-year to $1.46 per diluted share, driven by operational improvements and share repurchases, while adjusted net income rose 2.6% to $27.3 million.

- The company expanded its gross margin by 30 basis points to 42.7% and achieved a 120 basis point increase in adjusted EBITDA margin to 16.4%.

- TNC returned $28.1 million to shareholders through dividends and share repurchases in Q3 2025, and announced a 5.1% increase in its annual dividend to $0.31 per share.

- For full-year 2025, net sales are expected within $1.21 billion to $1.25 billion, but organic growth is projected slightly below the initial negative 1% to negative 4% range; adjusted EBITDA is anticipated near the lower end of the $196 million to $209 million guidance range, partly due to demand softening in North American industrial sectors from tariff uncertainty.

- Tennant Company reported net sales of $303.3 million for the third quarter of 2025, a 4.0% decrease compared to the third quarter of 2024, primarily driven by volume decreases across most geographies.

- The company achieved Adjusted EBITDA of $49.8 million in Q3 2025, an increase of 4.0% from the prior-year period, with an Adjusted EBITDA margin of 16.4%, up 120 basis points.

- Adjusted diluted EPS increased by 5.0% to $1.46 in the third quarter of 2025, compared to $1.39 in Q3 2024.

- Tennant Company announced a 5.1% increase in its quarterly cash dividend to $0.31 per share and returned $28.0 million to shareholders through dividends and share repurchases during the quarter.

- The company is reaffirming its 2025 net sales, Adjusted EBITDA, and EPS guidance based on its business outlook for the fourth quarter.

Quarterly earnings call transcripts for TENNANT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more