Earnings summaries and quarterly performance for TRANSCAT.

Executive leadership at TRANSCAT.

Lee Rudow

President and Chief Executive Officer

Kristina Johnston

Principal Accounting Officer

Michael Haddad

Chief Information Officer

Michael West

Chief Operating Officer

Theresa Conroy

Senior Vice President, Human Resources

Thomas Barbato

Chief Financial Officer and Treasurer

Board of directors at TRANSCAT.

Research analysts who have asked questions during TRANSCAT earnings calls.

Greg Palm

Craig-Hallum Capital Group LLC

12 questions for TRNS

Edward Jackson

Northland Securities, Inc.

10 questions for TRNS

Martin Yang

Oppenheimer & Co. Inc.

9 questions for TRNS

Scott Buck

H.C. Wainwright

9 questions for TRNS

Maxwell Michaelis

Lake Street Capital Markets

7 questions for TRNS

Max Michaelis

Lake Street Capital

2 questions for TRNS

Ted Jackson

Northland Securities, Inc.

2 questions for TRNS

Recent press releases and 8-K filings for TRNS.

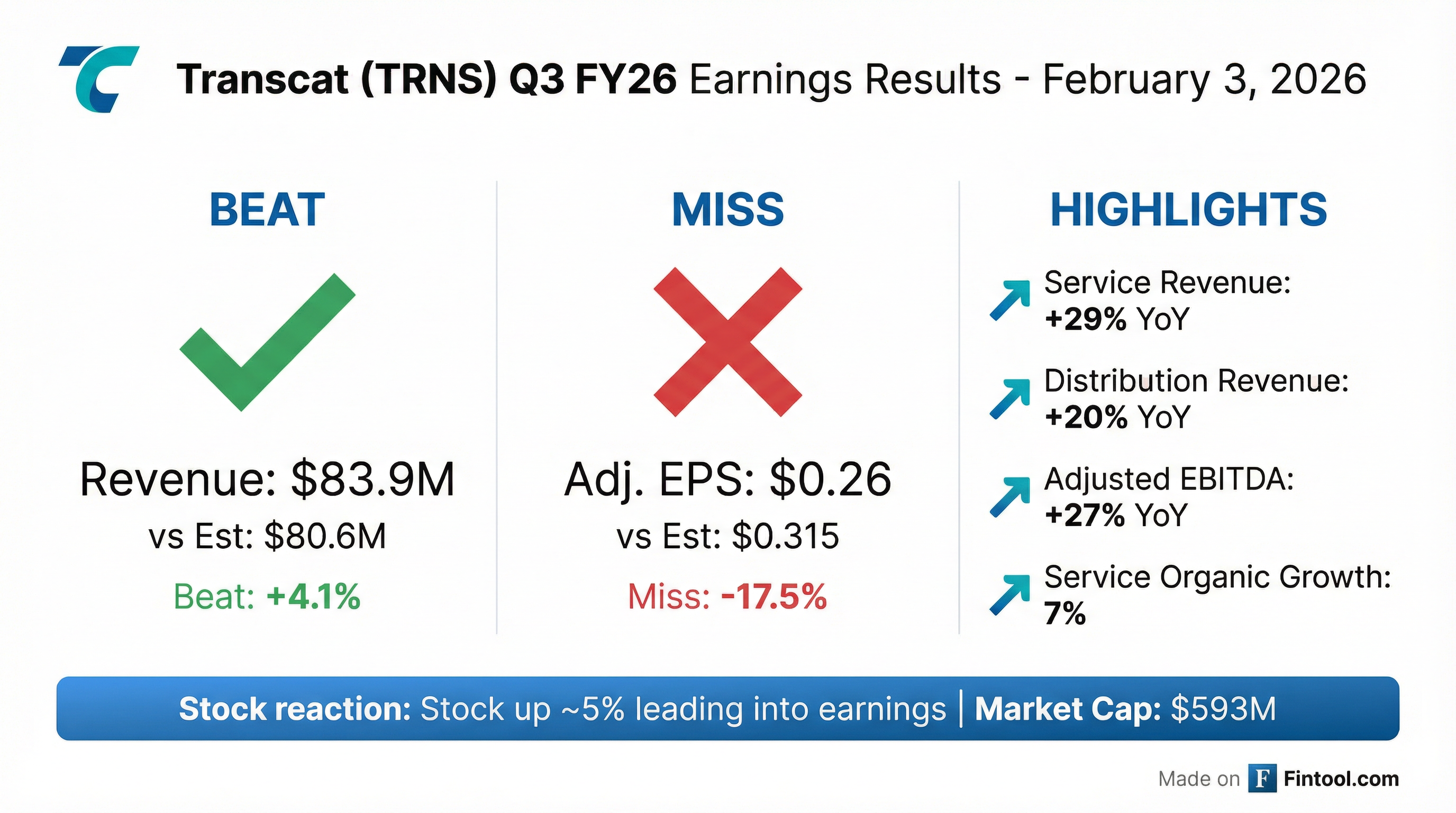

- Transcat reported strong Q3 fiscal year 2026 financial results, with consolidated revenue up 26% to $83.9 million and Adjusted EBITDA growing 27.2% to $10.1 million.

- The service segment achieved 29% revenue growth, including 7% organic growth, marking its 67th consecutive quarter of year-over-year growth, while the distribution segment's revenue increased 20% to $30.2 million.

- The company reaffirmed expectations for high single-digit organic service revenue growth in Q4 fiscal year 2026 and anticipates the CEO succession process to conclude, with clarity by the Q4 report and some additional related expenses.

- Net loss for the quarter was $1.1 million, and Adjusted Diluted Earnings Per Share was $0.26, influenced by higher amortization and interest expenses from recent acquisitions and one-time CEO succession costs.

- For Q3 2026, Transcat's consolidated revenue increased 26% to $83.9 million, with consolidated gross profit rising 28% to $25.3 million, and Adjusted EBITDA growing 27.2% to $10.1 million.

- The service segment revenue grew 29%, including 7% organic growth, and the distribution segment revenue increased 20% to $30.2 million, driven by strong demand and recent acquisitions.

- Adjusted Diluted Earnings Per Share was $0.26, though the company reported a net loss of $1.1 million primarily due to higher amortization, interest expense, and one-time charges related to the CEO succession plan.

- Transcat reaffirmed its expectation for high single-digit organic service revenue growth in Q4 2026 and noted a strong acquisition pipeline to expand its geographic footprint and capabilities.

- The CEO succession process is nearing completion, with additional related expenses anticipated in Q4.

- Transcat reported strong Q3 fiscal year 2026 results, with consolidated revenue up 26% to $83.9 million and Adjusted EBITDA growing 27.2% to $10.1 million.

- The service segment achieved 7% organic revenue growth and 29% overall growth, marking its 67th consecutive quarter of year-over-year growth.

- The company reaffirmed its Q4 organic service revenue growth expectations to be in the high single-digit range.

- A net loss of $1.1 million was recorded, attributed to higher amortization, interest expense, and one-time charges related to the CEO succession plan, which is expected to conclude in Q4 2026.

- Transcat reported Q3 Fiscal 2026 revenue of $83.9 million, a 26% increase year-over-year, driven by 29% growth in Service revenue and 20% growth in Distribution revenue.

- The company posted a net loss of $(1.1) million and diluted EPS of $(0.12) for the quarter, compared to net income of $2.357 million and diluted EPS of $0.25 in the prior year period.

- Adjusted EBITDA increased 27% to $10.1 million, and Adjusted Diluted EPS was $0.26.

- Gross margin expanded 60 basis points to 30.1%, although service gross margins experienced a lag due to start-up costs for new customers.

- Management reaffirmed Fiscal 2026 Service Revenue Expectations and anticipates continued high single-digit service organic revenue growth for Q4 Fiscal 2026.

- Transcat, Inc. announced executive equity retention awards on January 8, 2026, to ensure leadership stability during the CEO succession in FY2026.

- The awards, granted on January 6, 2026, consist of Restricted Stock Units (RSUs) for four executive officers: Thomas L. Barbato (19,772), Theresa A. Conroy (10,380), Michael J. Haddad (5,190), and Michael W. West (12,028).

- These RSUs are scheduled to vest on January 6, 2028, contingent on the executives' continued employment.

- Current CEO Lee D. Rudow will retire in March 2026 and transition to an advisory role through March 2027, with an update on the new CEO expected in early February 2026 during the Q3 FY2026 conference call.

- For Q2 Fiscal Year 2026, Transcat's consolidated revenue increased 21% to $82.3 million, driven by 20% growth in service revenue and 24% growth in distribution revenue.

- Consolidated gross profit grew 26% to $26.8 million, with gross margins expanding 120 basis points, while adjusted EBITDA increased 37% to $12.1 million, with 160 basis points of margin expansion.

- Net income for the quarter was $1.3 million, or $0.14 diluted earnings per share, impacted by higher interest expense, an increased tax rate, and one-time CEO succession plan expenses; adjusted diluted earnings per share was $0.44.

- The company anticipates a return to high single-digit organic service growth and margin expansion in the second half of fiscal 2026.

- Transcat, Inc. reported strong fiscal second quarter 2026 financial results for the quarter ended September 27, 2025, with total revenue increasing 21.3% to $82.3 million and Adjusted EBITDA growing 37% to $12.1 million.

- This growth was driven by Service revenue increasing 19.9% to $52.8 million and Distribution revenue growing 24% to $29.4 million.

- Diluted Earnings Per Share (EPS) was $0.14, and Adjusted Diluted EPS was $0.44.

- Total debt increased to $111.9 million as of September 27, 2025, primarily due to the Essco Calibration acquisition, and the company announced a new 5-Year $150 million syndicated secured credit facility on July 29, 2025.

- Transcat, Inc. announced that CEO Lee D. Rudow plans to retire.

- Rudow will continue in his current role until March 2026 and then transition to an advisory role until 2027 to ensure a smooth leadership transition.

- The Board has formed a Search Committee and is actively searching for a new CEO.

- The company reiterates a positive outlook for FY2026 and expects to return to high single-digit Service organic revenue growth in the second half of fiscal 2026.

Quarterly earnings call transcripts for TRANSCAT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more