Earnings summaries and quarterly performance for TPG RE Finance Trust.

Executive leadership at TPG RE Finance Trust.

Board of directors at TPG RE Finance Trust.

Research analysts who have asked questions during TPG RE Finance Trust earnings calls.

John Nickodemus

BTIG

4 questions for TRTX

Donald Fandetti

Wells Fargo & Company

3 questions for TRTX

Steven Delaney

Citizens JMP Capital

3 questions for TRTX

Christopher Mueller

Citizens JMP Securities

2 questions for TRTX

Gabriel Poggi

Raymond James Financial, Inc.

2 questions for TRTX

Richard Shane

JPMorgan Chase & Co.

2 questions for TRTX

Rick Shane

JPMorgan Chase & Co.

2 questions for TRTX

Stephen Laws

Raymond James

2 questions for TRTX

Christopher Muller

Citizens JMP

1 question for TRTX

William Catherwood

BTIG

1 question for TRTX

Recent press releases and 8-K filings for TRTX.

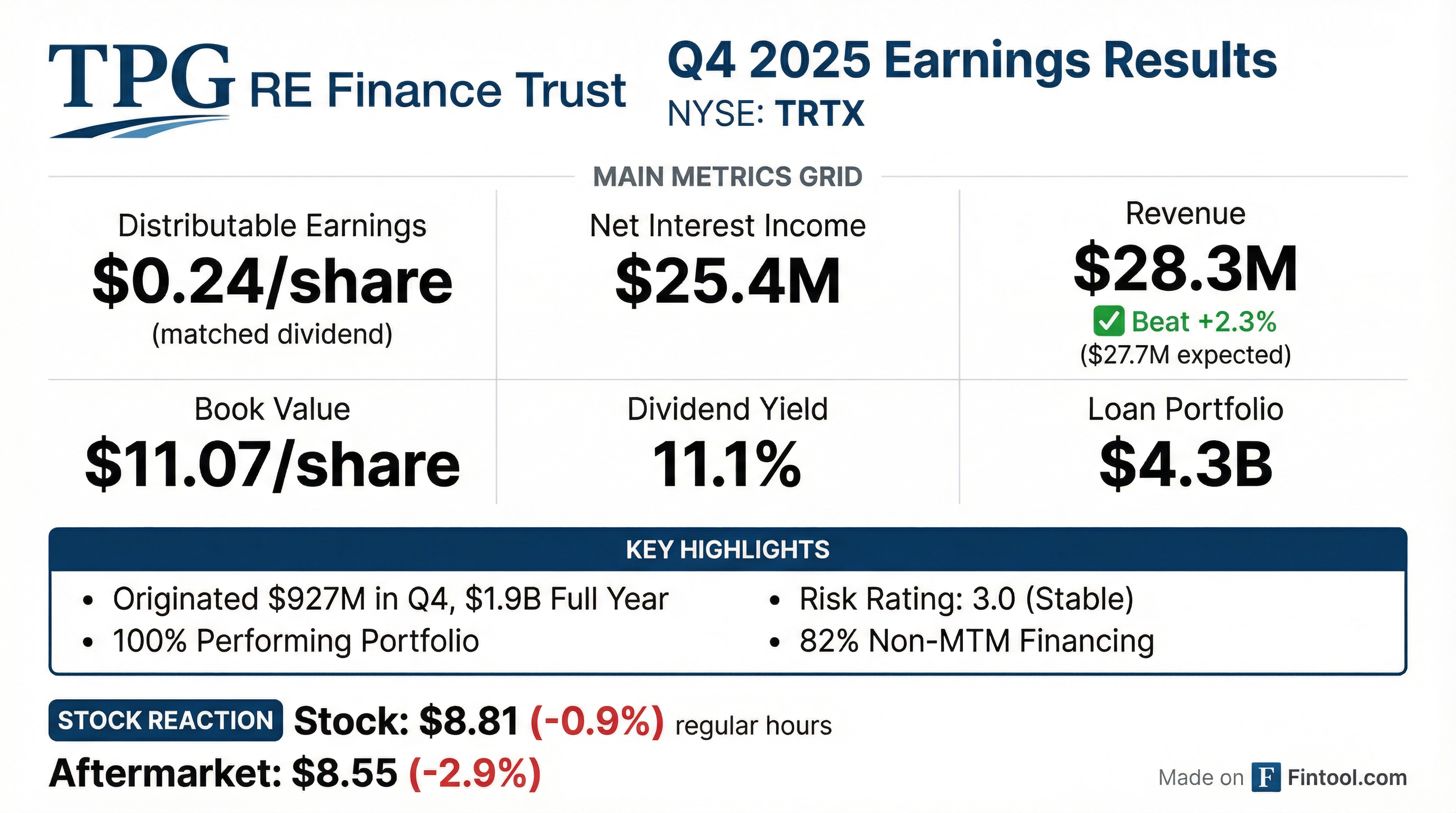

- For the full year 2025, TPG RE Finance Trust (TRTX) reported distributable earnings of $0.97 per common share, covering its annual dividend of $0.96 per share with a 1.01x ratio.

- TRTX achieved 25% year-over-year growth in earning assets by closing $1.9 billion of new investments in 2025, and its loan portfolio was 100% performing at year-end.

- The company's liability structure improved, with 82% non-mark-to-market and a 9% decline in cost of funds to 1.82% year-over-year, supported by $2.2 billion in new CRE CLO issuances.

- TRTX's balance sheet composition shifted significantly, with combined exposure to multifamily and industrial sectors increasing to over 72% by year-end 2025, up from 30% at the beginning of 2022.

- The company plans to increase its leverage ratio towards a target of 3.5-3.75 to 1 and anticipates further growth in industrial exposure, aiming for a 25%-30% range.

- TPG RE Finance Trust reported distributable earnings of $0.24 per common share for Q4 2025 and $0.97 per common share for the full year 2025, out-earning its annual dividend of $0.96 per share with a 1.01x coverage ratio.

- The company closed $1.9 billion in new investments during 2025, including $927 million in Q4 2025, primarily in multifamily (62%) and industrial (38%) sectors, leading to 25% year-over-year growth in earning assets to $4.1 billion.

- The loan portfolio remained 100% performing at year-end 2025, and the company significantly increased its exposure to multifamily and industrial collateral to over 72% of its balance sheet.

- TRTX improved its liability structure to 82% non-mark-to-market and reduced its cost of funds to 1.82% in 2025, while increasing total leverage to 3.02x towards a target of 3.5-3.75x.

- Management anticipates an "incredibly active year" in 2026, driven by a robust pipeline and continued focus on net asset growth and the sale of REO assets.

- TPG RE Finance Trust (TRTX) reported distributable earnings of $0.24 per common share for Q4 2025 and $0.97 per common share for the full year 2025, achieving a 1.01x coverage ratio of its annual dividend of $0.96 per share.

- The company closed $1.9 billion in new investments in 2025, driving 25% year-over-year growth in earning assets and maintaining a 100% performing loan portfolio at year-end.

- TRTX significantly increased its combined exposure to multifamily and industrial collateral to over 72% of its balance sheet (from 30% at the start of 2022) and issued two CRE CLOs totaling $2.2 billion in 2025, improving its liability structure to 82% non-mark-to-market.

- Total leverage reached 3.02x in Q4 2025, with a target range of 3.5-3.75 to 1, and the company anticipates an incredibly robust pipeline and active year for originations in 2026.

- TPG RE Finance Trust, Inc. reported GAAP net income attributable to common stockholders of $0.2 million, or $0.00 per common share, and Distributable Earnings of $18.5 million, or $0.24 per common share, for the fourth quarter ended December 31, 2025. For the full year 2025, GAAP net income was $45.5 million, or $0.57 per common share, and Distributable Earnings were $76.8 million, or $0.97 per common share.

- In 2025, the company originated $1.9 billion of total loan commitments and maintained a 100% performing loan portfolio. The weighted average risk rating of the loan portfolio remained 3.0 as of December 31, 2025.

- TRTX declared a cash dividend of $0.24 per share for Q4 2025 and $0.96 per common share for the full year 2025. The company repurchased 3,200,576 shares for $25.3 million in 2025, increasing book value per common share by $0.13, and approved a new $25.0 million share repurchase program.

- Book value per common share was $11.07 as of December 31, 2025, with an allowance for credit losses of $77.4 million. The company ended the quarter with $143.0 million of near-term liquidity.

- TPG RE Finance Trust, Inc. reported GAAP net income attributable to common stockholders of $0.00 per diluted common share for Q4 2025 and $0.57 per diluted common share for the full year 2025.

- The company generated Distributable Earnings of $0.24 per diluted common share in Q4 2025 and $0.97 per diluted common share for the full year 2025, out-earning its $0.96 per common share dividend for the year.

- TRTX originated $1.9 billion in total loan commitments during 2025 and maintained a 100% performing loan portfolio with a weighted average risk rating of 3.0 as of December 31, 2025.

- The company ended Q4 2025 with $143.0 million of near-term liquidity and repurchased 3.2 million shares of common stock for $25.3 million during 2025.

- TPG RE Finance Trust, Inc. (TRTX) closed a $957,000,000 collateralized loan obligation (TRTX 2025-FL7) on November 17, 2025.

- The CLO issued $616,000,000 in Class A Senior Secured Floating Rate Notes Due 2043, which received "AAAsf" ratings from Fitch and "Aaa(sf)" from Moody's, bearing interest at the Benchmark plus 1.45000%.

- The collateral interests backing the CLO have a weighted average life of less than or equal to 5.5 years from the closing date and a weighted average spread of not less than 2.45%.

- Property types securing the collateral interests are subject to concentration limits, including Industrial Properties not exceeding 60.0% and Office Properties not exceeding 10.0% of the Aggregate Outstanding Portfolio Balance.

- TPG RE Finance Trust, Inc. reported Q3 2025 GAAP Income per Diluted Share of $0.23 and Distributable Earnings per Diluted Share of $0.25.

- The company declared a Q3 2025 Common Stock Dividend of $0.24, leading to an annualized dividend yield of 10.7% based on the November 14, 2025 closing share price.

- As of September 30, 2025, the loan investment portfolio totaled $3.7 billion, was 100% performing, and featured a weighted average all-in yield of 7.75% and a weighted average LTV of 66.2%.

- TRTX maintained $216.4 million in liquidity and reported a Book Value per Share of $11.25 as of September 30, 2025.

- During Q3 2025, the company recorded total loan originations of $279.2 million and total loan repayments of $415.8 million.

- For Q3 2025, TRTX reported GAAP net income of $18.4 million, or $0.23 per common share, and distributable earnings of $19.9 million, or $0.25 per common share, covering its quarterly dividend of $0.24 per common share. Book value per common share increased quarter over quarter to $11.25.

- The company demonstrated significant investment momentum, closing $279 million of new investments in Q3 2025, with an additional $197 million subsequent to quarter end, and expects to close over $670 million in Q4 2025. Year-to-date, closed and in-process investments total over $1.8 billion.

- TRTX enhanced its liability structure by pricing its latest CRE/CLO, FL7, a $1.1 billion transaction with a 30-month reinvestment period, which, along with FL6, provides approximately $1.9 billion of financing capacity at a blended cost of funds of SOFR plus 175 basis points.

- The loan portfolio remains 100% performing with no negative credit migration, and the company ended the quarter with near-term liquidity of $216.4 million.

- Bob Foley will retire as CFO at year-end 2025, transitioning to a Senior Advisor role, with Brandon Fox assuming the role of Interim CFO and Ryan Roberto taking on capital markets and asset management duties.

- For Q3 2025, TPG RE Finance Trust (TRTX) reported GAAP net income of $18.4 million, or $0.23 per common share, and distributable earnings of $19.9 million, or $0.25 per common share, covering its quarterly dividend. Book value per common share increased quarter over quarter to $11.25.

- The company closed $279.2 million in new investments during Q3 2025 and anticipates closing an additional $670 million in Q4, bringing total new investments for 2024 to over $1.8 billion. These investments are primarily focused on multifamily and industrial assets, which constitute approximately 91% of closed and in-process investments.

- TRTX priced a new $1.1 billion managed CRE/CLO, FL7, which includes a 30-month reinvestment period and an 87% advance rate, designed to enhance financing capacity and lower the cost of capital. The loan portfolio remained 100% performing with a weighted average risk rating of 3.0.

- In Q3 2025, the company repurchased 1.1 million common shares for $9.3 million, generating $0.04 per common share of book value accretion. Management plans to increase the debt-to-equity ratio from the current 2.6 times to 3-3.5 times over time to drive balance sheet growth.

- Bob Foley will retire as CFO at year-end to become a Senior Advisor, with Brandon Fox assuming the role of Interim CFO and Ryan Roberto taking on duties for capital markets and asset management.

- For Q3 2025, TRTX reported GAAP net income of $18.4 million or $0.23 per common share, and distributable earnings of $19.9 million or $0.25 per common share, covering its quarterly dividend. Book value per common share increased to $11.25, partly due to the repurchase of 1.1 million common shares for $9.3 million at $8.29 per share.

- The company closed $279 million of new investments in Q3 2025, with an additional $197 million subsequent to quarter end and over $670 million expected to close in Q4, projecting over $1.8 billion in new investments for 2024. The loan portfolio grew by $1.2 billion or 12% net year-over-year, and remains 100% performing with a weighted average risk rating of 3.0.

- Bob Foley will retire as CFO at year-end to become a Senior Advisor to TPG Real Estate, with Brandon Fox assuming the role of Interim CFO and Ryan Roberto becoming Head of Capital Markets and Asset Management.

- TRTX priced TRTX 2025 FL7, a $1.1 billion managed CRE/CLO, which will provide non-mark-to-market, non-recourse term financing with a 30-month reinvestment period. This is expected to generate approximately $100 million of liquidity for new loan investments. The company's liability structure is 87% non-mark-to-market, and total leverage was flat at 2.6x.

Quarterly earnings call transcripts for TPG RE Finance Trust.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more