Earnings summaries and quarterly performance for TWIN DISC.

Executive leadership at TWIN DISC.

Board of directors at TWIN DISC.

Research analysts who have asked questions during TWIN DISC earnings calls.

Recent press releases and 8-K filings for TWIN.

Twin Disc Reports Q2 2026 Results with Record Backlog and Significant Net Income Increase

TWIN

Earnings

Guidance Update

New Projects/Investments

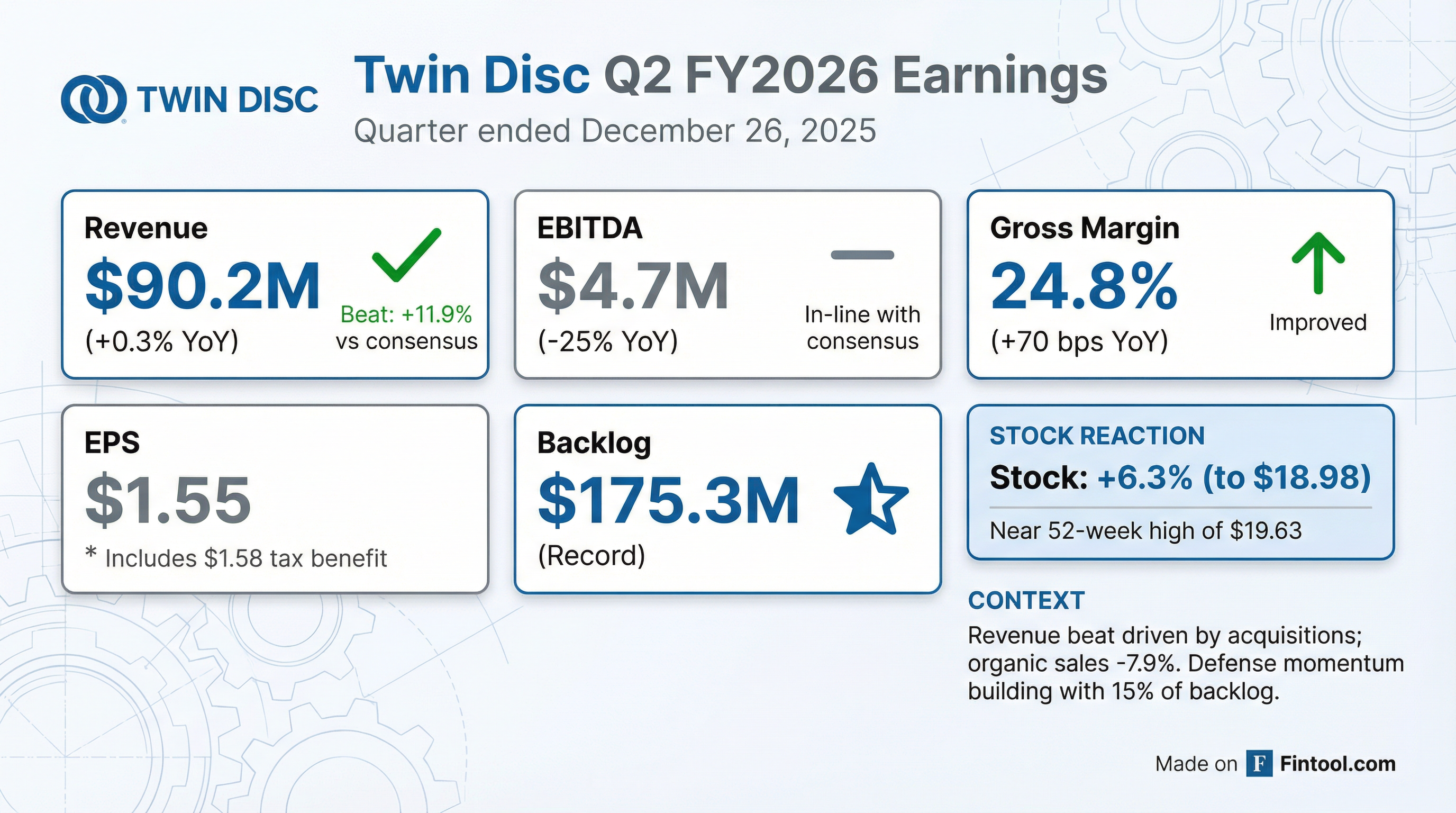

- Twin Disc Inc. reported Q2 2026 sales of $90.2 million, a 0.3% increase year-over-year, though organic revenue decreased 7.9%.

- Net income attributable to Twin Disc surged to $22.4 million (or $1.55 per diluted share) from $919,000 ($0.07 per share) in the prior year, primarily due to a $21.8 million income tax benefit from the reversal of a domestic valuation allowance.

- The company achieved a record backlog of $175.3 million, up 41.4% year-over-year and 7% sequentially, with defense-related opportunities exceeding $50 million and defense backlog growing 18% sequentially.

- Gross margin improved 70 basis points to 24.8% year-over-year but faced sequential pressure from unfavorable product mix, tariff impacts (approximately 3% of cost of sales), and non-recurring operational issues. EBITDA decreased 25% to $4.7 million.

- Management expects tariff impacts to moderate and anticipates good growth in the second half of fiscal 2026, with Q3 and Q4 projected to be stronger quarters, as mitigation strategies take effect and shipment patterns normalize.

3 days ago

Twin Disc Reports Q2 2026 Financial Results

TWIN

Earnings

M&A

- Twin Disc reported Q2 2026 sales of $90.2 million, a 30 basis point increase year-over-year, though organic sales decreased by 7.9% compared to the prior year.

- Earnings Per Share (EPS) significantly improved to $1.55 in Q2 2026 from $0.07 in Q2 2025, primarily driven by a $21.8 million income tax benefit.

- The company generated positive Operating Cash Flow of $4.6 million and Free Cash Flow of $1.2 million in Q2 2026, while its robust six-month backlog reached $175.3 million, higher sequentially.

- Net Debt increased to $29.6 million in Q2 2026 from $9.0 million in Q2 2025, primarily due to the acquisition of Kobelt, resulting in a Net Leverage Ratio of 1.3x.

3 days ago

Twin Disc Inc. Reports Q2 2026 Results with Record Backlog and Increased Net Income

TWIN

Earnings

Guidance Update

New Projects/Investments

- Twin Disc Inc. reported Q2 2026 sales of $90.2 million, a 0.3% increase year-over-year, with organic revenue decreasing approximately 7.9%.

- Net income attributable to Twin Disc for the quarter was $22.4 million, or $1.55 per diluted share, primarily due to a $21.8 million income tax benefit. EBITDA decreased 25% to $4.7 million.

- The company achieved a record backlog of $175.3 million, up 41.4% year-over-year and 7% sequentially, reflecting strong demand across marine, defense, and select industrial applications.

- Tariff impacts were elevated at approximately 3% of cost of sales and contributed to shipment delays, but mitigation strategies are being implemented, including relocating ARFF assembly to a tariff-advantaged environment.

- Free cash flow was $1.2 million for the quarter, a sequential improvement, though working capital remained a headwind due to increased inventory from delayed shipments.

3 days ago

Twin Disc Reports Q2 2026 Results with Record Backlog

TWIN

Earnings

Guidance Update

New Projects/Investments

- Twin Disc reported Q2 2026 sales of $90.2 million, a 0.3% increase year-over-year, with net income at $22.4 million or $1.55 per diluted share, largely due to a $21.8 million income tax benefit. Gross margin improved 70 basis points to 24.8%, but EBITDA decreased 25% to $4.7 million.

- The company achieved a record backlog of $175.3 million, up 41.4% year-over-year and 7% sequentially, driven by strong demand in marine, defense, and select industrial applications. Defense-related opportunities increased 18% sequentially, with a pipeline exceeding $50 million.

- Tariff impacts were elevated at approximately 3% of cost of sales , but management is implementing mitigation strategies, including relocating ARFF assembly to a tariff-advantaged environment, which is expected to significantly improve gross margins in fiscal 2027.

- While land-based transmission sales decreased 8.1% to $17.5 million due to shipment delays, the industrial business grew 22% to $11.5 million. Twin Disc generated $1.2 million in free cash flow for the quarter and expects improved working capital and cash generation in the second half of fiscal year 2026.

3 days ago

Twin Disc Announces Second Quarter Fiscal 2026 Results

TWIN

Earnings

Demand Weakening

M&A

- Twin Disc, Inc. reported Q2 FY2026 sales of $90.2 million, a 0.3% year-over-year increase, and net income attributable to Twin Disc of $22.4 million or $1.55 per diluted share, significantly higher than the prior year due to a $21.8 million income tax benefit.

- The company's gross margin expanded 70 basis points to 24.8%, but EBITDA decreased 25.0% year-over-year to $4.7 million due to higher marketing, engineering, and administrative expenses.

- Twin Disc generated positive Operating Cash Flow of $4.6 million and Free Cash Flow of $1.2 million in the quarter, while its six-month backlog reached a record $175.3 million.

- Total debt increased 79.0% to $44.5 million, and net debt increased $20.7 million to $29.6 million, primarily attributed to the Kobelt acquisition.

3 days ago

Twin Disc Announces Second Quarter Fiscal 2026 Results

TWIN

Earnings

- Twin Disc reported Q2 FY26 sales of $90.2 million, a 0.3% increase year-over-year, although organic sales decreased by 7.9%.

- Net income attributable to Twin Disc was $22.4 million, or $1.55 per diluted share, for Q2 FY26, significantly higher than $919 thousand, or $0.07 per diluted share in the prior year, primarily due to an income tax benefit of $21.8 million related to the reversal of a domestic valuation allowance.

- EBITDA for Q2 FY26 was $4.7 million, representing a 25.0% decrease compared to Q2 FY25, mainly due to higher Marketing, Engineering, and Administrative (ME&A) expenses.

- The company reported a robust six-month backlog of $175.3 million and delivered positive Operating Cash Flow of $4.6 million and Free Cash Flow of $1.2 million during the quarter.

3 days ago

Twin Disc Discusses Diversification, Growth Strategy, and Financial Targets

TWIN

M&A

New Projects/Investments

Guidance Update

- Twin Disc, a global power transmission manufacturer, reported just under $341 million in revenue and a gross margin of just over 27% for the past year.

- The company is actively pursuing a strategy of diversification away from oil and gas, driven by recent acquisitions such as Veth Propulsion, Katsa, and Kobelt, which have significantly expanded its marine and propulsion segment and global footprint. Veth's revenue grew from $45 million to $83 million last year, projected to reach $90-$100 million this year.

- Twin Disc is experiencing strong tailwinds from increased defense spending in the U.S. and Europe, with defense products now representing 15% of its backlog, a 45% increase year-over-year.

- The company is strategically investing in hybrid and electric powertrain solutions, particularly in the marine sector, where these systems offer significantly higher content per sale (e.g., $280,000 for a hybrid system compared to $30,000 for traditional transmissions).

- Twin Disc has set fiscal 2030 targets of $500 million in revenue, 30% gross margins, and 60% free cash flow conversion, with a capital allocation strategy focused on debt reduction, maintaining dividends, and pursuing further bolt-on acquisitions.

Nov 19, 2025, 8:00 PM

Twin Disc Discusses Growth Strategy, Financial Targets, and Market Opportunities

TWIN

M&A

New Projects/Investments

Guidance Update

- Twin Disc reported just under $341 million in revenue and a gross margin of just over 27% for the year. The company targets $500 million in revenue, 30% gross margins, and 60% free cash flow conversion by fiscal 2030, with organic growth expected to reach $400 million.

- Key growth drivers include increased defense spending, which now accounts for 15% of the backlog (a 45% year-over-year increase), and the expansion into hybrid and electric powertrain solutions for marine applications, offering significantly higher revenue per unit.

- The company's M&A strategy focuses on acquiring smaller, regional companies and leveraging its global sales network to scale them, as demonstrated by Veth Propulsion's growth from $40 million to an anticipated $100 million in revenue. Twin Disc's global manufacturing footprint also provides a strategic advantage in managing tariffs.

- Capital allocation priorities are debt reduction to facilitate future acquisitions, maintaining the dividend, and investing in organic growth.

Nov 19, 2025, 8:00 PM

Twin Disc Discusses Fiscal Year Performance, Growth Strategy, and 2030 Targets

TWIN

M&A

Guidance Update

New Projects/Investments

- Twin Disc concluded the year with revenue just under $341 million and a gross margin slightly above 27%.

- The company aims for $500 million in revenue, 30% gross margins, and 60% free cash flow conversion by fiscal 2030, supported by organic growth and strategic acquisitions.

- Defense spending is a significant growth driver, with 15% of the current backlog attributed to defense products, marking a 45% year-over-year increase.

- Acquisitions have been key to growth, exemplified by Veth Propulsion, which grew from $40 million at acquisition to an anticipated $90 million to $100 million in revenue this year.

- Capital allocation priorities include debt reduction, maintaining the dividend, and investing in organic growth and bolt-on acquisitions.

Nov 19, 2025, 8:00 PM

Twin Disc Reports Strong Fiscal First Quarter 2026 Results

TWIN

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Twin Disc reported fiscal first quarter 2026 sales of $80 million, marking a 9.7% year-over-year increase, with organic net sales growing 1.1%.

- The company achieved significant profitability improvements, with gross margin expanding by 220 basis points year over year to 28.7% and EBITDA increasing 172% to $4.7 million.

- Twin Disc ended the quarter with a robust six-month backlog of $163.3 million, up 13% year over year, driven by strong demand in marine propulsion (up 14.6% to $48.2 million) and industrial (up 13.2%). Defense-related projects now comprise 15% of the total backlog.

- The company maintains a conservative net leverage ratio of 1.3 times and is targeting 60% free cash flow as a percent of EBITDA for the fiscal year.

Nov 5, 2025, 2:00 PM

Quarterly earnings call transcripts for TWIN DISC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more