Earnings summaries and quarterly performance for TWO HARBORS INVESTMENT.

Executive leadership at TWO HARBORS INVESTMENT.

William Greenberg

President and Chief Executive Officer

Alecia Hanson

Vice President and Chief Administrative Officer

Nicholas Letica

Vice President and Chief Investment Officer

Rebecca B. Sandberg

Vice President, Chief Legal Officer, Secretary and Chief Compliance Officer

Robert Rush

Vice President and Chief Risk Officer

William Dellal

Vice President and Chief Financial Officer

Board of directors at TWO HARBORS INVESTMENT.

Research analysts who have asked questions during TWO HARBORS INVESTMENT earnings calls.

Harsh Hemnani

Green Street

7 questions for TWO

Bose George

Keefe, Bruyette & Woods

6 questions for TWO

Trevor Cranston

Citizens JMP

6 questions for TWO

Eric Hagen

BTIG

4 questions for TWO

Rick Shane

JPMorgan Chase & Co.

4 questions for TWO

Doug Harter

UBS Group AG

3 questions for TWO

Douglas Harter

UBS

3 questions for TWO

Merrill Ross

Compass Point Research & Trading, LLC

3 questions for TWO

Richard Shane

JPMorgan Chase & Co.

3 questions for TWO

Eric Hagan

BTIG

2 questions for TWO

Jason Stewart

Janney Montgomery Scott LLC

2 questions for TWO

Bose T. George

Keefe, Bruyette and Woods

1 question for TWO

Douglas Michael Harter

UBS Investment Bank

1 question for TWO

Francesco Labetti

Keefe, Bruyette & Woods

1 question for TWO

Jake Katsikas

BTIG, LLC

1 question for TWO

Jason Weaver

Unaffiliated Analyst

1 question for TWO

Kenneth Lee

RBC Capital Markets

1 question for TWO

Mikhail Goberman

Citizens JMP

1 question for TWO

Trevor J. Cranston

Citizens JMP Securities

1 question for TWO

Recent press releases and 8-K filings for TWO.

- Two Harbors announces merger with United Wholesale Mortgage (UWM), which doubles the pro forma MSR portfolio to $400 billion and is expected to deliver meaningful upside for shareholders.

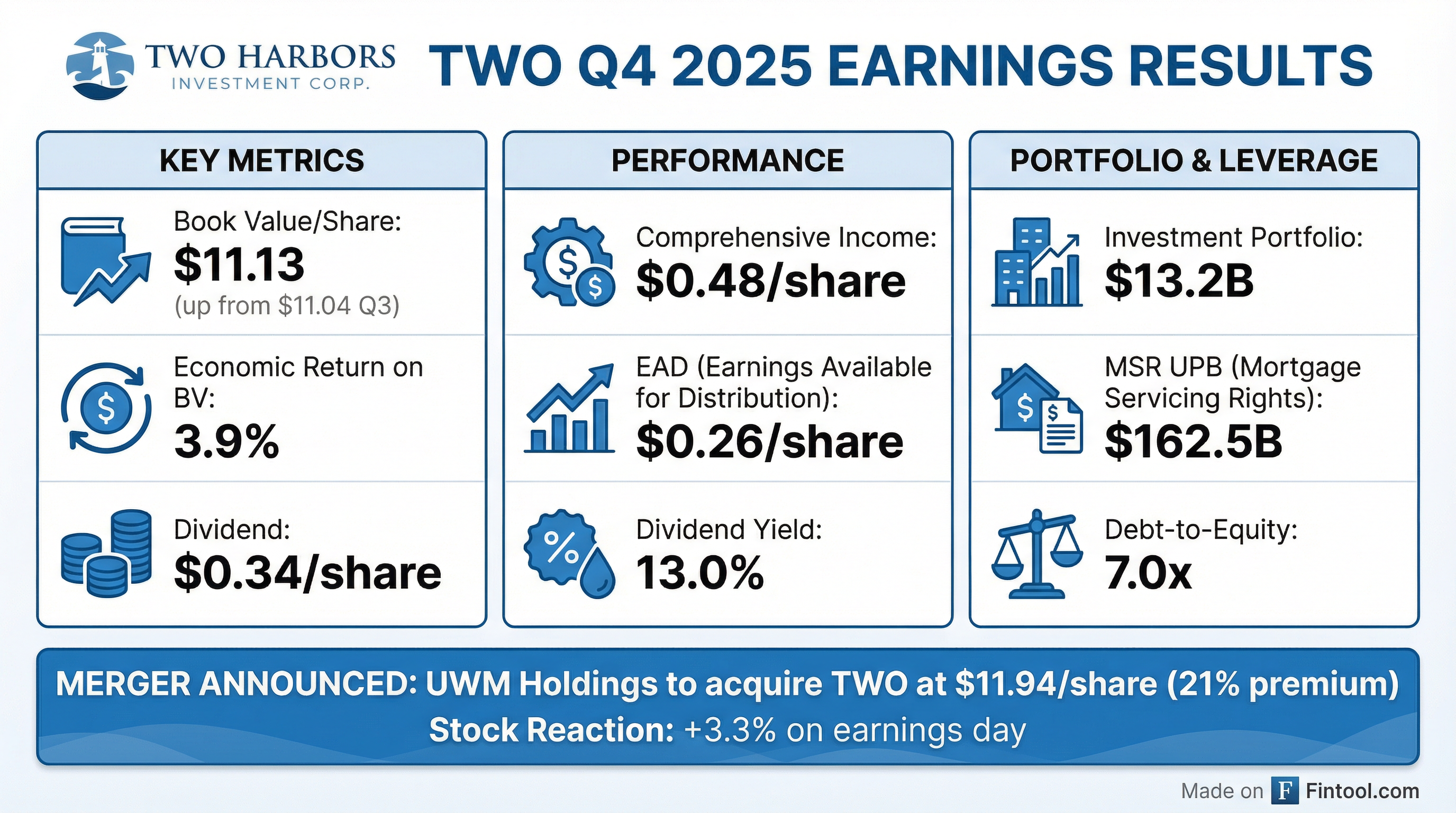

- For Q4 2025, the company reported a total economic return of +3.9% and comprehensive income of $50.4 million or $0.48 per share, with book value increasing to $11.13 per share at December 31st.

- The full calendar year 2025 saw a total economic return on book value of -12.6%, or +12.1% excluding a $3.60 per share litigation settlement expense.

- The company repaid $261.9 million in convertible senior notes on January 15, 2026, and maintained over $800 million of cash on the balance sheet at quarter-end.

- As of January 30th, the book value was up about 1.5%-2%.

- Two Harbors announced a merger with United Wholesale Mortgage (UWM), which is expected to double the MSR portfolio to a pro forma $400 billion and leverage UWM's origination capabilities with Two Harbors' capital markets expertise and RoundPoint's servicing.

- For Q4 2025, the company generated a total economic return of +3.9%, while the full calendar year 2025 resulted in a total economic return on book value of -12.6%, or +12.1% excluding a litigation settlement expense.

- The MSR portfolio saw sales of an additional $10 billion UPB, increasing third-party subservicing to $40 billion and reducing total owned servicing to approximately $162 billion at year-end.

- As of January 30th, the company's book value was up approximately 1.5%-2%. The company has also reduced its leverage and mortgage risk, favoring a paired portfolio construction of MSR and Agency RMBS.

- For Q4 2025, TWO reported a Book Value per Share of $11.13, Comprehensive Income of $50.4 million, or $0.48 per common share, and a Common Stock Dividend of $0.34, achieving a 3.9% quarterly economic return on book value.

- The investment portfolio totaled $13.2 billion as of December 31, 2025, with an Economic Debt-to-Equity ratio of 7.0x. Common equity stood at $1.2 billion.

- The MSR portfolio had a fair value of $2,422 million and an Unpaid Principal Balance (UPB) of $163,773 million at quarter-end. TWO sold $9.6 billion UPB of MSR on a subservicing-retained basis during Q4 2025.

- The Federal Reserve delivered two 25 basis point cuts to its benchmark rate, and the yield curve reached its steepest level since January 2022. 2-year U.S. Treasury yields declined to 3.47%, while 10-year U.S. Treasury yields rose to 4.17%.

- As of December 31, 2025, the company's book value exposure to an Up 25 basis points change in interest rates was -1.1%, and to an Up 25 basis points change in mortgage spreads was -4.0%.

- Two Harbors announced a merger with United Wholesale Mortgage (UWM), which is projected to double the MSR portfolio to a pro forma $400 billion.

- For the fourth quarter of 2025, the company generated a total economic return of +3.9% and comprehensive income of $50.4 million or $0.48 per share.

- Book value per share increased to $11.13 at December 31, 2025, from $11.04 at September 30, 2025, and was up approximately 1.5%-2% as of January 30, 2026.

- For the full calendar year 2025, the total economic return on book value was -12.6%, or +12.1% when excluding a $3.60 per share litigation settlement expense.

- Two Harbors repaid $261.9 million in convertible senior notes in full on January 15, 2026.

- TWO Harbors Investment Corp. (TWO) entered into a definitive merger agreement with UWM Holdings Corporation (UWMC), under which UWMC will acquire TWO in an all-stock transaction. TWO stockholders are set to receive 2.3328 shares of UWMC Class A Common Stock for each share of TWO common stock, valued at $11.94 per share as of December 16, 2025, representing a 21% premium. The merger is anticipated to close in the second quarter of 2026.

- For the fourth quarter ended December 31, 2025, TWO reported a book value of $11.13 per common share and declared a common stock dividend of $0.34 per share.

- The company generated comprehensive income of $50.4 million, or $0.48 per weighted average basic common share, for Q4 2025, resulting in a 3.9% quarterly economic return on book value.

- For the full year 2025, TWO declared dividends of $1.52 per common share and reported a (12.6)% economic return on book value.

- Two Harbors Investment Corp. entered into an Agreement and Plan of Merger with UWM Holdings Corporation and its wholly-owned subsidiary, UWM Acquisitions 1, LLC, on December 17, 2025.

- Under the terms of the agreement, Two Harbors will merge with and into UWM Acquisitions 1, LLC.

- Each outstanding share of Two Harbors common stock will be converted into the right to receive 2.3328 shares of newly issued UWM Class A common stock.

- This transaction represents an equity value of $1.3 billion for Two Harbors.

- All outstanding shares of Two Harbors' Series A, B, and C preferred stock will be automatically converted into corresponding UWM Preferred Stock on a one-for-one basis.

- UWM Holdings Corporation (UWMC) announced a definitive merger agreement to acquire Two Harbors Investment Corp. (TWO) in an all-stock transaction valued at $1.3 billion in equity.

- Under the terms, TWO common stockholders will receive a fixed exchange ratio of 2.3328 shares of UWMC Class A Common Stock for each share of TWO common stock, representing an $11.94 per share value based on UWMC's December 16, 2025 closing price and a 21% premium to TWO's 30-day volume weighted average price.

- The acquisition is expected to nearly double UWM's MSR portfolio to approximately $400 billion and generate approximately $150 million of annual cost and revenue synergies.

- Upon completion, UWM shareholders will own approximately 87% and TWO shareholders approximately 13% of the combined company. The transaction is expected to close in the second quarter of 2026, subject to TWO's stockholder and regulatory approvals.

- Two Harbors Investment (TWO) settled litigation with its former external manager in Q3 2025, making a one-time payment of $375 million. This resulted in a $175.1 million litigation settlement expense, or $1.68 per weighted average common share.

- For Q3 2025, the company reported a total economic return of -6.3% (including the settlement expense) and +7.6% (excluding the expense).

- The company sold $19.1 billion UPB of MSR in Q3 2025 and anticipates another approximately $10 billion UPB to settle by the end of October. These sales were servicing-retained, contributing to RoundPoint's third-party sub-servicing business, which will total roughly $40 billion.

- Two Harbors plans to redeem the full $262 million UPB of its outstanding convertible notes maturing in January 2026. Following the settlement payment and MSR sales, the company ended Q3 2025 with $770.5 million cash on its balance sheet.

- As of the Friday prior to October 28, 2025, the company's book value had increased by approximately 1% quarter-to-date.

- TWO settled litigation with its former external manager for a one-time payment of $375 million, resulting in a $175.1 million litigation settlement expense or $1.68 per weighted average common share in Q3 2025.

- The company reported a total economic return of negative 6.3% for Q3 2025, which would have been a positive 7.6% excluding the litigation settlement expense.

- Portfolio adjustments included the sale of $19.1 billion UPB of MSR in Q3, with an additional $10 billion UPB to settle by the end of October, and a reduction of the RMBS portfolio to $10.9 billion from $11.4 billion.

- The sub-servicing business is expanding, with new client additions bringing combined sub-servicing UPB to approximately $40 billion.

- TWO plans to redeem $261.9 million of outstanding convertible notes maturing in January 2026 and ended Q3 with $770.5 million cash on balance sheet.

- TWO reported a comprehensive loss of $(80.2) million, or $(0.77) per common share, for Q3 2025, resulting in a (6.3)% quarterly economic return on book value.

- Excluding a $175.1 million litigation settlement expense, comprehensive income would have been $94.9 million, or $0.91 per common share, with a 7.6% quarterly economic return on book value.

- Book value per common share decreased to $11.04 as of September 30, 2025, from $12.14 as of June 30, 2025.

- The company declared a common stock dividend of $0.34 per share for Q3 2025.

- The MSR portfolio saw significant activity, including the sale of $19.1 billion UPB of MSR and a decrease in MSR fair value to $2,627 million as of September 30, 2025.

Quarterly earnings call transcripts for TWO HARBORS INVESTMENT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more