Earnings summaries and quarterly performance for UNIVERSAL INSURANCE HOLDINGS.

Executive leadership at UNIVERSAL INSURANCE HOLDINGS.

Board of directors at UNIVERSAL INSURANCE HOLDINGS.

CG

Carol G. Barton

Detailed

Director

FX

Francis X. McCahill, III

Detailed

Director

JW

Jon W. Springer

Detailed

Director

MM

Marlene M. Gordon

Detailed

Director

MA

Michael A. Pietrangelo

Detailed

Lead Independent Director

OA

Ozzie A. Schindler

Detailed

Director

RD

Richard D. Peterson

Detailed

Director

SP

Scott P. Callahan

Detailed

Director

SA

Shannon A. Brown

Detailed

Director

Research analysts who have asked questions during UNIVERSAL INSURANCE HOLDINGS earnings calls.

Recent press releases and 8-K filings for UVE.

Universal Insurance Holdings Reports Strong Q4 and Full-Year 2025 Results

UVE

Earnings

Dividends

Share Buyback

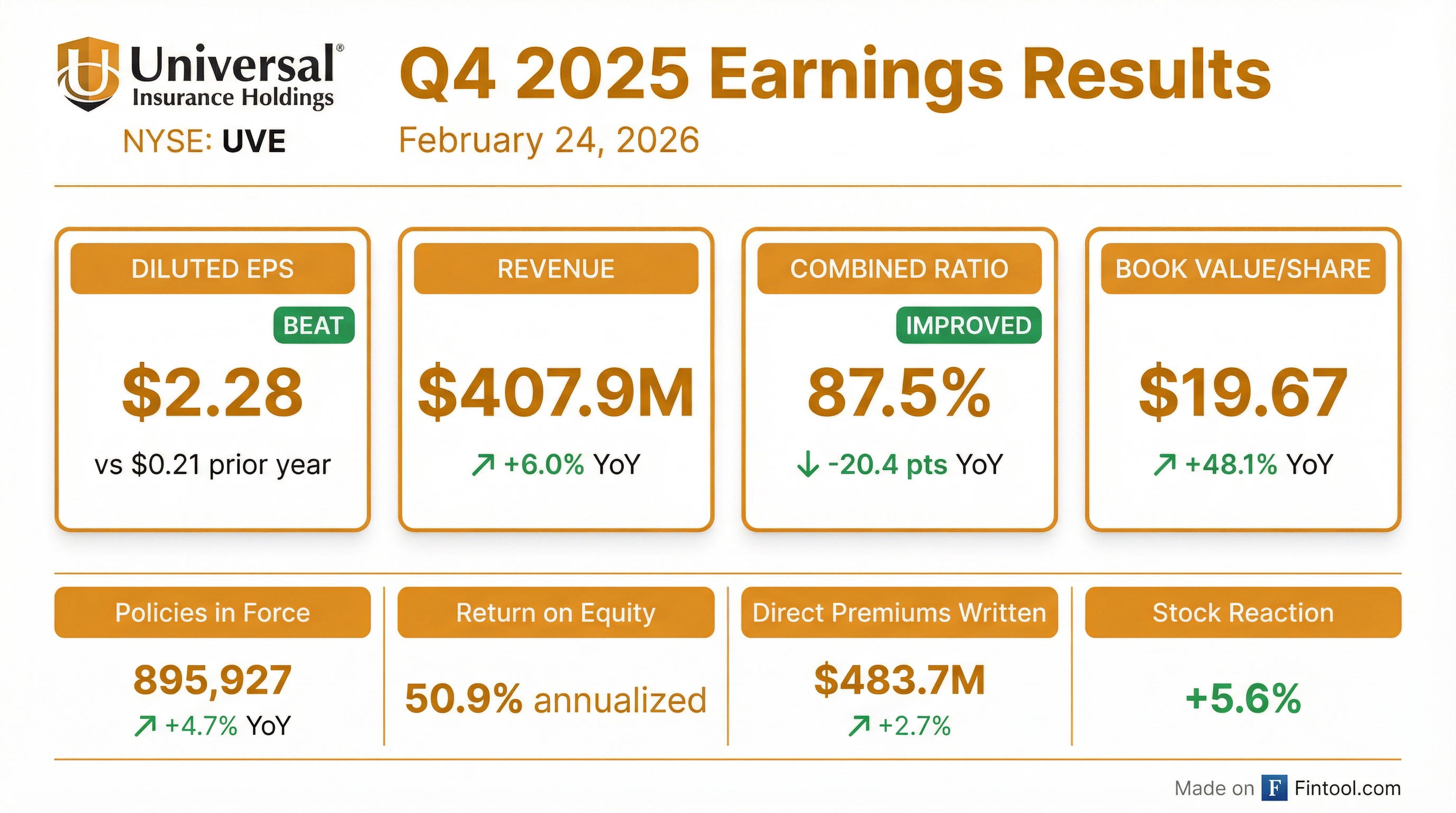

- Universal Insurance Holdings reported strong Q4 2025 diluted GAAP EPS of $2.28 and an annualized return on average common equity of 50.9%.

- For Q4 2025, direct premiums written increased by 2.7% to $483.7 million, and book value per share rose 48.1% year-over-year to $19.67.

- The company achieved a Combined Ratio of 94.1% for the full year 2025 and returned $15.5 million to shareholders in Q4 2025, including $6.9 million in share repurchases and dividends totaling $0.29 per share.

2 days ago

Universal Reports Strong Q4 2025 Results, Announces Share Repurchase and Dividend

UVE

Earnings

Share Buyback

Dividends

- Universal (UVE) reported strong Q4 2025 financial results, with adjusted diluted earnings per common share of $2.17 and core revenue of $403.6 million, marking a 4.4% year-over-year increase. The net combined ratio significantly improved to 87.5%, down 20.4 points from the prior year quarter.

- The company achieved an adjusted return on common equity of over 46% in Q4 2025, attributing positive results to the benefits of Florida's legislative reforms that have stabilized the market.

- Universal is actively managing shareholder returns, having repurchased approximately 210,000 shares for $6.9 million in Q4 2025 and announcing a new $20 million share repurchase program through January 2028. A quarterly cash dividend of $0.16 per common share was also declared.

- The company's capital position is robust, with reserves noted as the strongest in its history, and it is well underway in placing its 2026 reinsurance program, securing substantial first event catastrophe tower capacity and additional multiyear capacity for the 2027 hurricane season.

2 days ago

Universal Insurance Holdings Reports Strong Q4 2025 Results with Significant EPS Growth and Favorable Market Conditions

UVE

Earnings

Share Buyback

Dividends

- Universal Insurance Holdings reported strong Q4 2025 results, with adjusted diluted earnings per common share of $2.17 and core revenue of $403.6 million, up 4.4% year-over-year, contributing to an adjusted return on common equity of over 46%.

- The company's financial performance was bolstered by a significantly improved net combined ratio of 87.5%, a 20.4-point decrease from the prior year quarter, driven by a lower net loss ratio.

- During Q4 2025, Universal repurchased approximately 210,000 shares for $6.9 million and announced a new $20 million share repurchase program through January 2028.

- A regular quarterly cash dividend of $0.16 per common share was declared, payable on March 13, 2026.

- Management highlighted a favorable competitive environment and the positive impact of Florida's legislative reforms, which have stabilized the market and improved retention, alongside securing a substantial portion of their 2026 reinsurance program.

2 days ago

Universal Insurance Holdings Reports Strong Q4 2025 Results and Shareholder Returns

UVE

Earnings

Share Buyback

Dividends

- Universal Insurance Holdings reported strong financial results for Q4 2025, with adjusted diluted earnings per common share of $2.17 and core revenue of $403.6 million, representing a 4.4% increase year-over-year. The net combined ratio improved significantly to 87.5%, down 20.4 points compared to the prior year quarter.

- The company announced shareholder return initiatives, including the repurchase of approximately 210,000 shares at an aggregate cost of $6.9 million during Q4 2025. A new $20 million share repurchase program was announced on January 7, 2026, and a regular quarterly cash dividend of $0.16 per common share was declared on February 4, 2026.

- Management highlighted a robust capital position and the strongest reserves in company history. They are well underway in negotiating and placing the 2026 reinsurance program, with a substantial portion of the first event catastrophe tower already placed, and have secured meaningful additional multiyear capacity for the 2027 hurricane season.

2 days ago

Universal Insurance Holdings Reports Strong Fourth Quarter and Full Year 2025 Results

UVE

Earnings

Share Buyback

Dividends

- Universal Insurance Holdings (UVE) reported diluted GAAP earnings per common share of $2.28 and diluted adjusted EPS of $2.17 for the fourth quarter of 2025. For the full year 2025, diluted GAAP EPS was $6.32 and diluted adjusted EPS was $6.20.

- Direct premiums written increased by 2.7% to $483.7 million in the fourth quarter of 2025. For the full year 2025, direct premiums written totaled $2,140.3 million.

- As of December 31, 2025, book value per share was $19.67, representing a 48.1% increase year-over-year, and adjusted book value per share was $20.60, up 32.6% year-over-year.

- The company achieved an annualized return on average common equity (ROCE) of 50.9% and an annualized adjusted ROCE of 46.1% for the fourth quarter of 2025.

- During the fourth quarter of 2025, the company repurchased approximately 210 thousand shares at an aggregate cost of $6.9 million. A new share repurchase program was announced on January 7, 2026, authorizing up to $20 million in repurchases through January 8, 2028. The Board of Directors also declared a regular quarterly cash dividend of 16 cents per share on February 4, 2026.

3 days ago

Universal Insurance Holdings Reports Strong Fourth Quarter and Full Year 2025 Results

UVE

Earnings

Share Buyback

Dividends

- Universal Insurance Holdings reported diluted GAAP EPS of $2.28 for Q4 2025, an increase of 985.7% from the prior year quarter, and $6.32 for the full year 2025, up 214.4%.

- Total revenues for Q4 2025 grew 6.0% to $407.9 million, and full year 2025 revenues increased 5.5% to $1,603.9 million.

- Profitability saw significant improvement, with the net combined ratio decreasing by 20.4 points to 87.5% in Q4 2025 and by 10.0 points to 94.1% for the full year 2025.

- Book value per share increased 48.1% year-over-year to $19.67 at the end of 2025.

- The company repurchased 210 thousand shares for $6.9 million in Q4 2025, announced a new $20 million share repurchase program, and declared a quarterly cash dividend of 16 cents per share.

3 days ago

Universal Insurance Holdings Announces New Share Repurchase Authorization

UVE

Share Buyback

- Universal Insurance Holdings, Inc. (UVE) announced on January 7, 2026, that its Board of Directors authorized a new share repurchase program.

- Under this program, the company may repurchase up to $20 million of its outstanding common stock.

- The authorization for share repurchases is valid through January 8, 2028.

Jan 7, 2026, 2:13 PM

Universal Insurance Holdings Reports Strong Q3 2025 Earnings and Improved Underwriting Results

UVE

Earnings

Share Buyback

Dividends

- Universal Insurance Holdings (UVE) reported adjusted diluted earnings per common share of $1.36 for Q3 2025, a significant improvement from an adjusted loss of $0.73 in the prior year quarter, and achieved a 30.6% adjusted return on common equity.

- Core revenue grew 4.9% year-over-year to $400 million, driven by higher net premiums earned, net investment income, and commission revenue. Direct premiums written increased 3.2% to $592.8 million, with 22.2% growth in other states offsetting a 2.6% decrease in Florida.

- The net combined ratio improved by 20.5 points to 96.4%, and the net loss ratio decreased 21.5 points to 70.2%, primarily due to the absence of hurricane activity in the current quarter compared to the prior year.

- The company repurchased approximately 347,000 shares for $8.1 million and declared a quarterly cash dividend of $0.16 per share.

- Management highlighted a more conservative reserving process, believing they are in a very strong position regarding current and prior accident year reserves, with $3.9 million related to prior year catastrophe development booked in the quarter.

Oct 24, 2025, 2:00 PM

Universal Insurance Holdings Reports Strong Q3 2025 Results

UVE

Earnings

Share Buyback

Dividends

- Universal Insurance Holdings reported adjusted diluted earnings per common share of $1.36 for Q3 2025, compared to an adjusted loss per common share of $0.73 in the prior year quarter, and achieved a 30.6% adjusted return on common equity.

- Core revenue for Q3 2025 was $400 million, an increase of 4.9% year-over-year, primarily due to higher net premiums earned, net investment income, and commission revenue.

- The company's net combined ratio improved to 96.4%, down 20.5 points from the prior year quarter, largely driven by a 70.2% net loss ratio which was 21.5 points lower than the prior year, reflecting the absence of hurricane activity in the current quarter.

- During the quarter, Universal repurchased approximately 347,000 shares at an aggregate cost of $8.1 million and declared a quarterly cash dividend of $0.16 per share.

- Management emphasized a conservative reserving process and believes the company is in a very strong position regarding current and prior accident year reserves, with potential adjustments to their reserving philosophy to be considered in early 2026.

Oct 24, 2025, 2:00 PM

Universal Reports Strong Q3 2025 Earnings with Improved Underwriting and Capital Returns

UVE

Earnings

Share Buyback

Dividends

- Universal reported adjusted diluted earnings per common share of $1.36 and a 30.6% adjusted return on common equity for Q3 2025.

- Core revenue increased by 4.9% year over year to $400 million, with direct premiums written up 3.2% to $592.8 million, driven by 22.2% growth in other states partially offsetting a 2.6% decrease in Florida.

- The company's net combined ratio improved significantly to 96.4%, down 20.5 points from the prior year quarter, primarily due to a 70.2% net loss ratio which was 21.5 points lower due to the absence of hurricane activity in the current quarter.

- During the quarter, Universal repurchased approximately 347,000 shares for $8.1 million and declared a quarterly cash dividend of $0.16 per share.

Oct 24, 2025, 2:00 PM

Quarterly earnings call transcripts for UNIVERSAL INSURANCE HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more