Earnings summaries and quarterly performance for VNOM Sub.

Executive leadership at VNOM Sub.

Kaes Van’t Hof

Chief Executive Officer

Austen Gilfillian

President

Matt Zmigrosky

Executive Vice President, General Counsel and Secretary

Al Barkmann

Executive Vice President and Chief Engineer

Teresa L. Dick

Executive Vice President, Chief Financial Officer and Assistant Secretary

Research analysts who have asked questions during VNOM Sub earnings calls.

Leo Mariani

ROTH MKM

8 questions for VNOM

Derrick Whitfield

Texas Capital

7 questions for VNOM

Betty Jiang

Barclays

6 questions for VNOM

Neil Mehta

Goldman Sachs

6 questions for VNOM

Paul Diamond

Citigroup

6 questions for VNOM

Neal Dingmann

Truist Securities

5 questions for VNOM

Timothy Rezvan

KeyBanc Capital Markets Inc.

4 questions for VNOM

Kalei Akamine

Bank of America

3 questions for VNOM

Aaron Bilkoski

TD Securities

2 questions for VNOM

Chris Baker

Evercore ISI

2 questions for VNOM

Arun Jayaram

JPMorgan Chase & Co.

1 question for VNOM

Kaleinoheaokealaula Akamine

Bank of America

1 question for VNOM

Margaret Drefke

Goldman Sachs

1 question for VNOM

Tim Rezvan

KeyBanc Capital Markets

1 question for VNOM

Recent press releases and 8-K filings for VNOM.

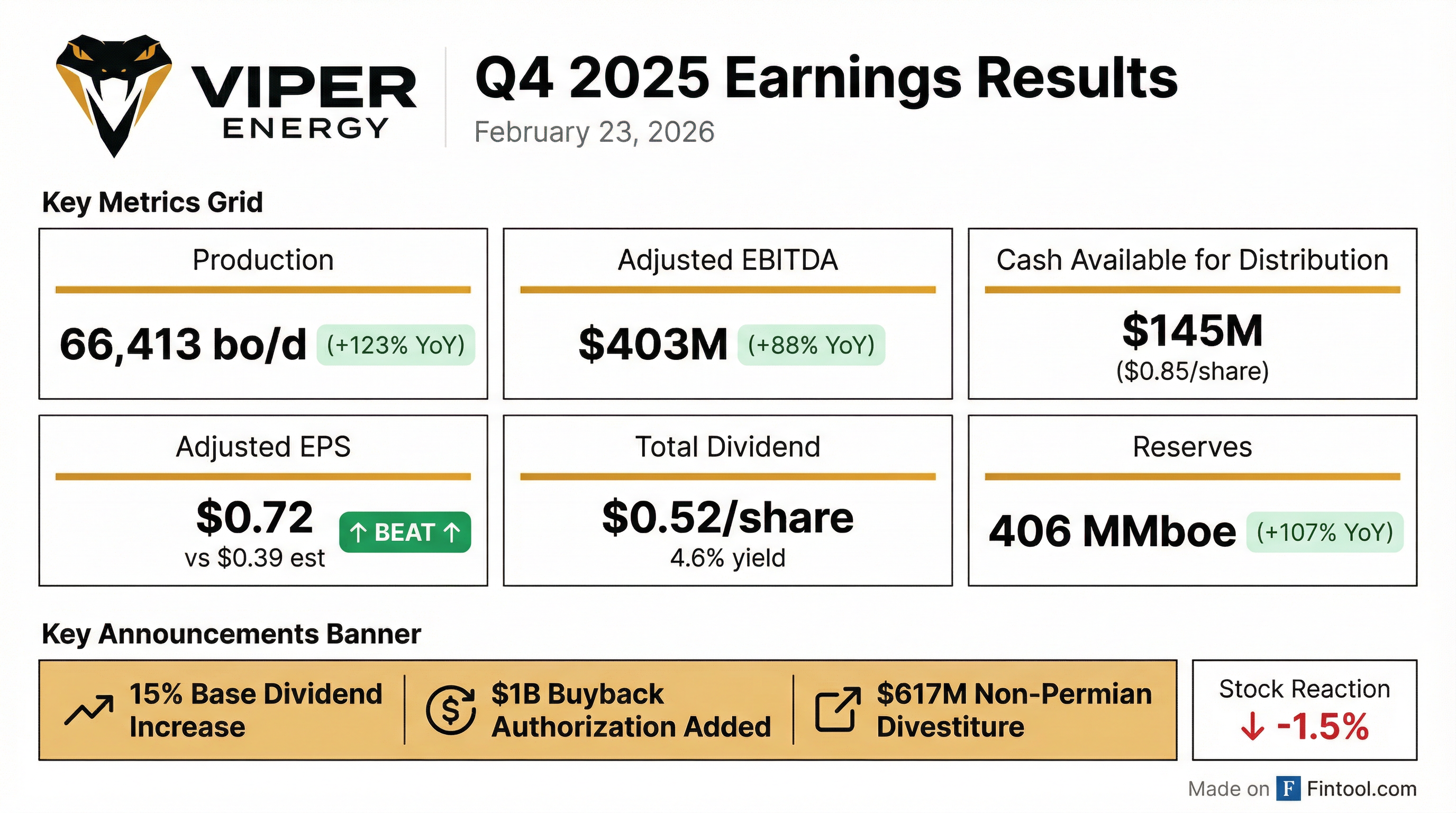

- Viper Energy reported Q4 2025 cash available for distribution of $0.85/share and returned $0.77/share to Class A stockholders, representing a 90% payout ratio. This included a total base-plus-variable dividend of $0.52/share and $94 million in share repurchases.

- The company closed the divestiture of its non-Permian assets on February 9, 2026, for approximately $617 million in net proceeds, which is expected to reduce pro forma net debt to $1.6 billion and increase pro forma liquidity to $1.5 billion as of December 31, 2025.

- Viper Energy provided full-year 2026 average production guidance of 61,000 - 67,000 bo/d (120,000 - 132,000 boe/d) and anticipates mid-single digit percentage organic production growth in 2026 relative to Q4 '25, pro forma for the asset sale.

- Proved reserves at year-end 2025 increased by 107% over year-end 2024 to 406.0 MMBoe, with a reserve replacement ratio of 705%.

- Viper Energy Partners announced a transformational 2025, highlighted by over $8 billion in mineral acquisitions and a 7% year-over-year increase in oil production per share.

- The company significantly strengthened its balance sheet by fully repaying its $500 million term loan and revolver balance, achieving pro forma net debt of approximately $1.6 billion, or just over 1 turn of leverage.

- The board approved a 15% increase to the base dividend and a $1 billion increase to the share repurchase authorization, with plans to return upwards of 100% of cash available for distribution going forward.

- Viper initiated 2026 guidance projecting mid-single digit organic production growth from its Q4 2025 exit rate.

- The company remains a Permian pure play and is open to larger M&A opportunities, though current market conditions make large deals challenging.

- Viper Energy concluded a transformational 2025, marked by over $8 billion of mineral acquisitions, which led to a two and a half times increase in Permian Basin acreage and 7% growth in oil production per share year-over-year. The company initiated 2026 guidance implying mid-single digit organic production growth from its Q4 2025 exit rate.

- The company strengthened its balance sheet by fully repaying its $500 million term loan and outstanding revolver balance, resulting in pro forma net debt of approximately $1.6 billion, or just over 1 turn of leverage.

- The board approved a 15% increase to the base dividend and a $1 billion increase to the share repurchase authorization, with plans to increase the return of capital to upwards of 100% of cash available for distribution following a non-Permian divestiture.

- Viper Energy, Inc. reported a Q4 2025 consolidated net loss of $246 million and a full year 2025 consolidated net loss of $206 million, while generating full year 2025 consolidated adjusted EBITDA of $1.3 billion.

- The company's Q4 2025 average production was 66,413 bo/d (134,000 boe/d), and its proved reserves increased by 107% year over year to 406,035 Mboe as of December 31, 2025.

- Viper declared a Q4 2025 total base-plus-variable dividend of $0.52 per Class A common share and announced a 15% increase in its annual base dividend to $1.52 per share for 2026.

- In Q4 2025, Viper repurchased 2.4 million shares for approximately $94 million and increased its share repurchase authorization by $1.0 billion, with approximately $1.2 billion remaining under the program.

- On February 9, 2026, the company completed the divestiture of its non-Permian assets for approximately $617 million, using the proceeds to fully repay its term loan and revolving credit facility.

- Viper Energy reported a consolidated net loss of $246 million for Q4 2025 and $206 million for the full year 2025, with consolidated adjusted EBITDA of $1.3 billion for the full year.

- For Q4 2025, the company declared a total base-plus-variable dividend of $0.52 per Class A common share and repurchased 2.4 million shares for approximately $94 million.

- The company announced a 15% increase in its annual base dividend to $1.52 per share and boosted its share repurchase authorization by $1.0 billion, bringing the total remaining authorization to approximately $1.2 billion.

- Viper Energy closed the divestiture of its non-Permian assets on February 9, 2026, for net proceeds of approximately $617 million, which were used to repay debt.

- Full year 2025 average production was 48,973 bo/d (95,126 boe/d), and proved reserves increased 107% year over year to 406,035 Mboe as of December 31, 2025.

- Warwick Capital Partners and GRP Energy Capital successfully closed the acquisition of $670 million in assets from Viper Energy, a subsidiary of Diamondback Energy.

- The transaction, with an effective date of September 1, 2025, represents one of the largest recent deals in the U.S. oil and gas royalties sector.

- The acquired portfolio includes 73,500 net royalty acres spanning the DJ, Eagle Ford, and Williston basins.

- The full year 2026 average daily production from these assets is estimated at approximately 4,500 to 5,000 barrels of oil per day, with a total of 9,000 to 10,000 barrels of oil equivalent per day.

- Viper Energy reported a 48% increase in total third-quarter return of capital per class A share versus the second quarter, returning 85% of cash available for distribution to stockholders, including over $90 million in share repurchases and an almost 10% increase in its dividend.

- The company anticipates mid-single-digit organic oil production growth in 2026 from its fourth-quarter 2025 estimated production, implying double-digit year-over-year growth in oil production per share relative to 2025.

- Following the non-Permian asset sale, which is expected to yield approximately $610 million in net proceeds, Viper aims to reduce its net debt closer to its $1.5 billion target, with line of sight to return nearly 100% of cash available for distribution to stockholders.

- The CTO acquisition has bolstered Viper's position, providing broad exposure to third-party operators across the Midland and Delaware basins, with its current acreage capturing almost half of all third-party activity in the Permian.

- Viper Energy reported strong Q3 2025 performance, bolstered by the CTO acquisition and organic growth, with Q4 2025 oil production guidance implying a roughly 20% increase in oil production per share compared to the same quarter last year.

- The company anticipates mid-single-digit organic oil production growth in 2026 from Q4 2025 estimated production, which implies double-digit year-over-year growth in oil production per share relative to 2025.

- In Q3 2025, Viper returned 85% of cash available for distribution to stockholders, including a dividend increase of almost 10% relative to the prior quarter and over $90 million in share repurchases.

- Following the non-Permian asset sale, which is expected to generate $610 million in net proceeds, Viper aims to reach its long-term net debt target of $1.5 billion and return nearly 100% of cash available for distribution to stockholders, with aggressive buybacks planned towards year-end.

- Viper Energy reported Q3 2025 pro forma cash available for distribution of $0.97/share and a total return of capital to Class A stockholders of $0.83/share, representing an 85% payout ratio. This included a total base-plus-variable dividend of $0.58/share and the repurchase of 2.4 million shares for $90 million.

- Average production for Q3 2025 was 56,087 bo/d. The company provided Q4 2025 average production guidance of 65,000 - 67,000 bo/d (net oil) and 124,000 - 128,000 boe/d (net total).

- Viper Energy closed the acquisition of Sitio Royalties Corp. on August 19, 2025, and subsequently refinanced senior notes and legacy Sitio debt, lowering the weighted average interest rate by approximately 150 basis points. The company also entered into an agreement to sell its non-Permian Basin assets for approximately $670 million, with the sale expected to close in Q1 2026.

- As of September 30, 2025, pro forma net debt was $1.6 billion and pro forma liquidity was $1.5 billion. Additionally, $302 million remained on the $750 million share repurchase program.

- Viper Energy, Inc. reported a net loss attributable to Viper of $77 million, or $0.52 per Class A common share, for Q3 2025, primarily due to a $360 million non-cash impairment. Consolidated adjusted net income for the quarter was $156 million, or $1.04 per Class A common share.

- The company declared a total Q3 2025 base-plus-variable cash dividend of $0.58 per Class A common share and repurchased 2.4 million shares for approximately $90 million. This represents a total return of capital of $140 million, or 85% of pro forma cash available for distribution.

- Viper completed the $4.0 billion Sitio Royalties Corp. acquisition on August 19, 2025, and entered into a definitive agreement to sell its non-Permian assets for $670 million, with the divestiture expected to close in Q1 2026.

- Q3 2025 average production was 56,087 bo/d (oil) and 108,859 boe/d (total), with Q4 2025 average daily production guidance initiated at 65,000 to 67,000 bo/d (oil) and 124,000 to 128,000 boe/d (total).

Quarterly earnings call transcripts for VNOM Sub.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more