Earnings summaries and quarterly performance for VSE.

Executive leadership at VSE.

Board of directors at VSE.

Research analysts who have asked questions during VSE earnings calls.

Jeff Van Sinderen

B. Riley Securities

6 questions for VSEC

Michael Ciarmoli

Truist Securities, Inc.

6 questions for VSEC

Kenneth Herbert

RBC Capital Markets

5 questions for VSEC

Sheila Kahyaoglu

Jefferies

5 questions for VSEC

Louie DiPalma

William Blair

4 questions for VSEC

Joshua Sullivan

The Benchmark Company

3 questions for VSEC

John Godyn

Citigroup

2 questions for VSEC

Jonathan Siegmann

Stifel Financial Corp.

2 questions for VSEC

Louis Raffetto

Wolfe Research

2 questions for VSEC

Noah Levitz

William Blair

2 questions for VSEC

Scott Deuschle

Deutsche Bank

2 questions for VSEC

Evan Page

Jefferies LLC

1 question for VSEC

Josh Sullivan

The Benchmark Company, LLC

1 question for VSEC

Ken Herbert

RBC Capital Markets, LLC

1 question for VSEC

Recent press releases and 8-K filings for VSEC.

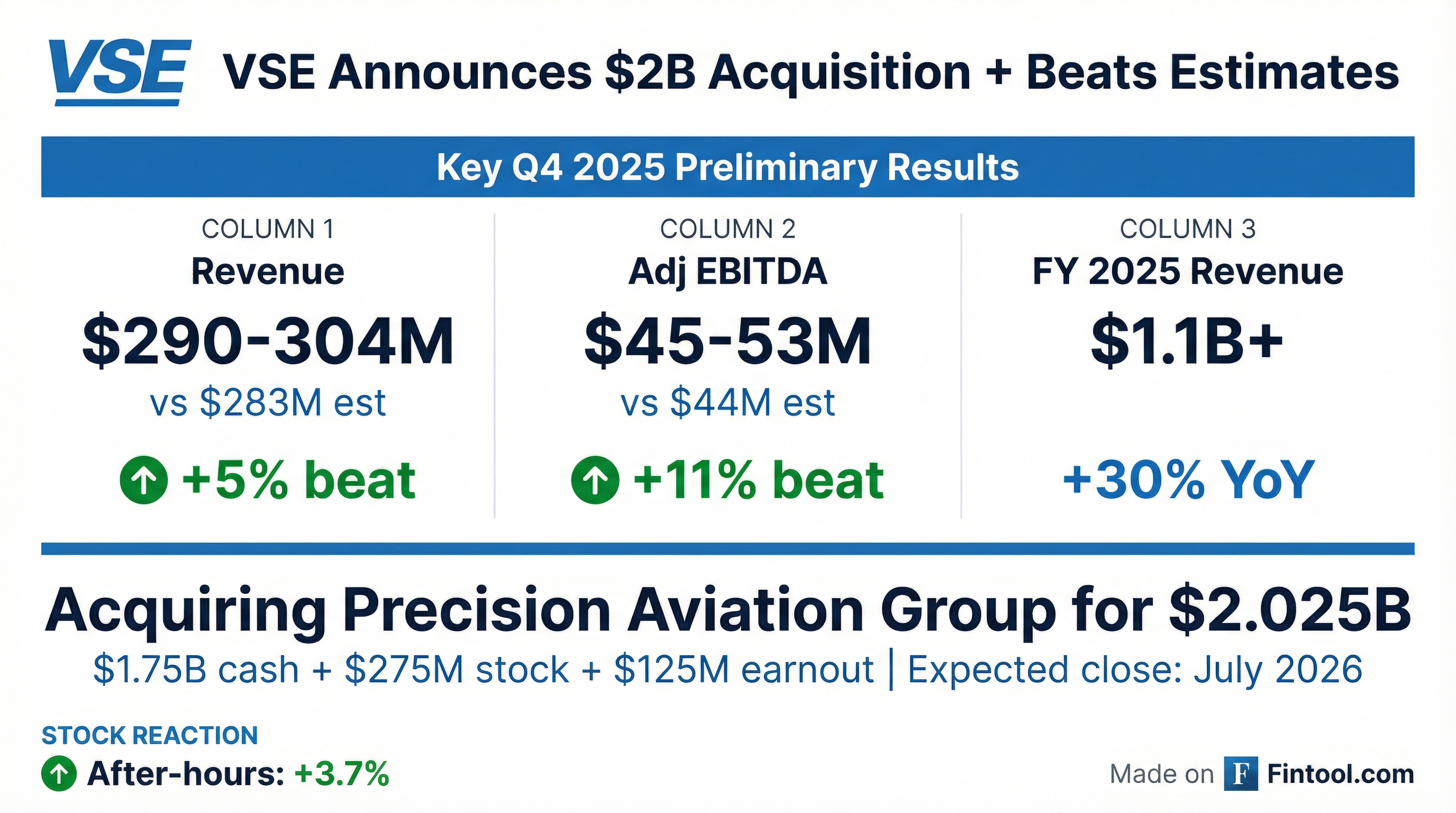

- VSE reported record financial performance for full year 2025, with revenue surpassing $1.1 billion and adjusted diluted EPS reaching $3.92.

- The company announced the transformational acquisition of Precision Aviation Group (PAG) for approximately $2.025 billion, expected to close in late Q2 2026, which is anticipated to significantly expand its aviation aftermarket scale.

- VSE completed its transition to a pure-play aviation aftermarket company in 2025 and provided full year 2026 guidance (excluding PAG) of 19% to 23% revenue growth and adjusted EBITDA margins between 16.8% and 17.3%.

- VSE Corporation reported record financial performance for full year 2025, with revenue of $1.1 billion and Adjusted EBITDA of $183 million, marking its first time surpassing $1 billion in annual revenue.

- The company announced a definitive agreement to acquire Precision Aviation Group (PAG) for approximately $2.025 billion, a strategic transaction expected to close in late Q2 2026, which will significantly expand its scale and capabilities.

- For full year 2026, VSE expects revenue to increase between 19% and 23% year-over-year, with Adjusted EBITDA margins between 16.8% and 17.3%, excluding the impact of the PAG acquisition.

- VSE completed its multiyear transformation to become a pure-play aviation aftermarket company and secured new organic growth awards, including an exclusive manufacturing, distribution, and repair agreement for Pratt & Whitney Canada PT6 engine fuel pumps and a globally exclusive APU components distribution agreement.

- VSE Corporation announced a definitive agreement to acquire Precision Aviation Group (PAG) for an upfront consideration of approximately $2.025 billion, consisting of $1.75 billion in cash and $275 million in equity, with potential for up to $125 million in contingent earnout consideration. This acquisition is expected to significantly expand VSE's scale and enhance its engine and component service capabilities.

- For the full year ended December 31, 2025, VSE reported revenue of $1.1 billion, a 41% increase from FY'24, and Adjusted EBITDA of $183 million, up 56% from FY'24.

- The company's Adjusted diluted earnings per share for FY 2025 increased 87% to $3.92, and its year-end Adjusted Net Leverage ratio was 1.1x.

- VSE secured a new exclusive OEM licensing agreement for fuel pumps supporting the Pratt & Whitney Canada PT6 engine series and launched a globally exclusive, life-of-program APU components distribution solutions program with an OEM, with revenue anticipated to ramp in 2H'26.

- VSE achieved record aviation revenue and profitability in 2025, surpassing $1 billion in annual revenue for the first time, and completed its multiyear transformation to a pure-play aviation aftermarket company.

- For the fourth quarter of 2025, VSE reported $301 million in revenue, a 32% increase year-over-year, and adjusted EBITDA of $52 million, up 55% from the prior year.

- The company announced the transformational acquisition of Precision Aviation Group (PAG) for approximately $2.025 billion, expected to close in late Q2 2026, which is projected to significantly expand scale and strengthen service capabilities.

- VSE provided full-year 2026 guidance, expecting revenue to increase between 19% and 23% year-over-year and adjusted EBITDA margins between 16.8% and 17.3%, excluding the PAG acquisition.

- VSE Corporation reported significant growth for Q4 and full year 2025, with total revenues increasing by 32% to $301.2 million in Q4 2025 and by 41% to $1.1 billion for the full year 2025.

- For the full year 2025, GAAP Net Income rose 176% to $53.5 million, and Adjusted EPS (Diluted) increased 87% to $3.92. The Aviation segment achieved record revenue and profitability, surpassing $1 billion in revenue for the first time.

- The company provided full year 2026 guidance (excluding the Precision Aviation Group acquisition), projecting consolidated revenue growth of approximately 19% to 23% and an Adjusted EBITDA margin between 16.8% and 17.3%.

- VSE completed its transformation into a pure-play aviation aftermarket company with the divestiture of its Fleet segment in April 2025 and announced the definitive agreement to acquire Precision Aviation Group (PAG), expected to close in Q2 2026.

- VSE Corporation reported record financial performance for Full Year 2025, with total revenues of $1.1 billion, a 41% increase year-over-year, and GAAP Net Income of $53.5 million, up 176%.

- The company completed its transformation into a pure-play aviation aftermarket company by divesting its Fleet segment in April 2025, achieving record Aviation segment revenue that surpassed $1 billion for the first time.

- VSE provided Full Year 2026 guidance, projecting consolidated revenue growth of 19% to 23% and an Adjusted EBITDA margin of 16.8% to 17.3%, with this guidance excluding the anticipated Precision Aviation Group acquisition.

- VSE Corporation has achieved a 30% CAGR over the last three years, with approximately half organic and half inorganic growth, and expects organic growth tailwinds to continue into 2026 and 2027.

- The company is targeting 20% adjusted EBITDA margins by the end of 2027, going into 2028, an increase from current margins well north of 15%.

- VSE anticipates being cash flow positive for 2025 after using $52 million of free cash flow in 2024, with a target of 30%-35% EBITDA conversion on a go-forward basis.

- The recent PAG acquisition is expected to significantly improve free cash flow conversion by shifting the business mix to 60% MRO and 40% distribution, as MRO offers stronger cash generation.

- VSE is strategically increasing its focus on intellectual property (IP) through initiatives like OEM Solutions, reverse engineering, and DER repair, which are expected to drive higher margins and further margin expansion beyond 20%.

- VSE Corporation's CEO, John Cuomo, discussed the recent PAG acquisition, highlighting its role in expanding revenue and shifting the business mix towards MRO, which is expected to improve free cash flow conversion.

- The company is strategically focusing on intellectual property (IP) through OEM Solutions, reverse engineering, and DER Repair, aiming to drive higher margins and differentiate its business model.

- VSE has a proven track record of acquiring, integrating, and driving margins, with an integration playbook that de-risks large deals by integrating assets in smaller chunks.

| Metric | FY 2024 | Pre-PAG (Current) | FY 2025 Target | Post-PAG | FY 2027-2028 Target | Long-Term Target |

|---|---|---|---|---|---|---|

| Adjusted EBITDA Margins (%) | N/A | >15 | N/A | N/A | 20 | >20 |

| Free Cash Flow ($USD Millions) | -52 | N/A | Positive | N/A | N/A | N/A |

| EBITDA Conversion from Free Cash Flow (%) | N/A | N/A | N/A | N/A | N/A | 30-35 |

| Leverage Ratio (x) | N/A | N/A | N/A | 2.5-3 | N/A | N/A |

| Max Leverage for Deals (x) | N/A | N/A | N/A | N/A | N/A | 3.5 |

| Business Mix (MRO %) | N/A | 40 | N/A | 60 | N/A | N/A |

| Business Mix (Distribution %) | N/A | 60 | N/A | 40 | N/A | N/A |

- VSE Corporation recently completed the PAG acquisition, which is described as transformational and is expected to generate $15 million in synergies, a figure that management and investors believe may be conservative.

- The company aims to achieve 20% adjusted EBITDA margins by the end of 2027, going into 2028, an increase from current margins well north of 15%, with potential for further expansion beyond 20%.

- VSE has achieved a 30% compound annual growth rate (CAGR) over the last three years, with approximately half organic and half inorganic contributions, and anticipates continued strong market growth in 2026 and 2027.

- The integration of PAG will be a phased process, with tactical integration beginning in early 2027, and the PAG CEO remaining onboard through year-end 2026 to ensure a smooth transition.

- VSE Corporation has transformed into a 100% commercial and business/general aviation aftermarket-focused business, growing revenue in this segment from under $150 million to over $1.1 billion by the end of 2025.

- The company announced the transformational acquisition of PAG, which will create one of the largest MRO footprints globally and is expected to expand consolidated margins to north of 20% within 24 months.

- Post-acquisition, VSE aims to operate under 3.5x leverage and expects to be free cash flow positive in 2025, benefiting from PAG's less working capital intensive nature.

- VSE's competitive advantage lies in its OEM-centric strategy, with over 80% of new business wins coming directly from OEMs, and a strong competitive moat in the business and general aviation and rotorcraft markets.

Fintool News

In-depth analysis and coverage of VSE.

Quarterly earnings call transcripts for VSE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more