Earnings summaries and quarterly performance for V2X.

Executive leadership at V2X.

Jeremy C. Wensinger

President and Chief Executive Officer

Daniel G. Demases

Chief Accounting Officer (effective December 5, 2025)

Jeremy Nance

General Counsel

Kenneth W. Shreves

Senior Vice President, Global Mission Support

L. Roger Mason

Chief Growth Officer

Melon Yeshoalul

Chief Human Resources Officer

Michael J. Smith

Corporate Vice President, Treasurer, Investor Relations and Corporate Development

Shawn M. Mural

Senior Vice President and Chief Financial Officer

Board of directors at V2X.

David E. Farnsworth

Director

Dino M. Cusumano

Director

Eric M. Pillmore

Director

Joel M. Rotroff

Director

Mary L. Howell

Non-Executive Chairman of the Board

Melvin F. Parker

Director

Neil D. Snyder

Director

Phillip C. Widman

Director

Stephen L. Waechter

Director

Research analysts who have asked questions during V2X earnings calls.

Kenneth Herbert

RBC Capital Markets

6 questions for VVX

Trevor Walsh

Citizens JMP

6 questions for VVX

Peter Arment

Robert W. Baird & Co.

5 questions for VVX

Tobey Sommer

Truist Securities, Inc.

5 questions for VVX

Andre Madrid

BTIG

4 questions for VVX

Joe Gomes

Noble Capital Markets

3 questions for VVX

Joseph Gomes

G.research, LLC

3 questions for VVX

Kristine Liwag

Morgan Stanley

3 questions for VVX

Mariana Perez Mora

Bank of America

3 questions for VVX

Noah Poponak

Goldman Sachs

3 questions for VVX

John Godin

Citi

2 questions for VVX

Sebastian Rivera

Stifel

2 questions for VVX

Bert Subin

Stifel Financial Corp.

1 question for VVX

Jason Gursky

Citigroup Inc.

1 question for VVX

Recent press releases and 8-K filings for VVX.

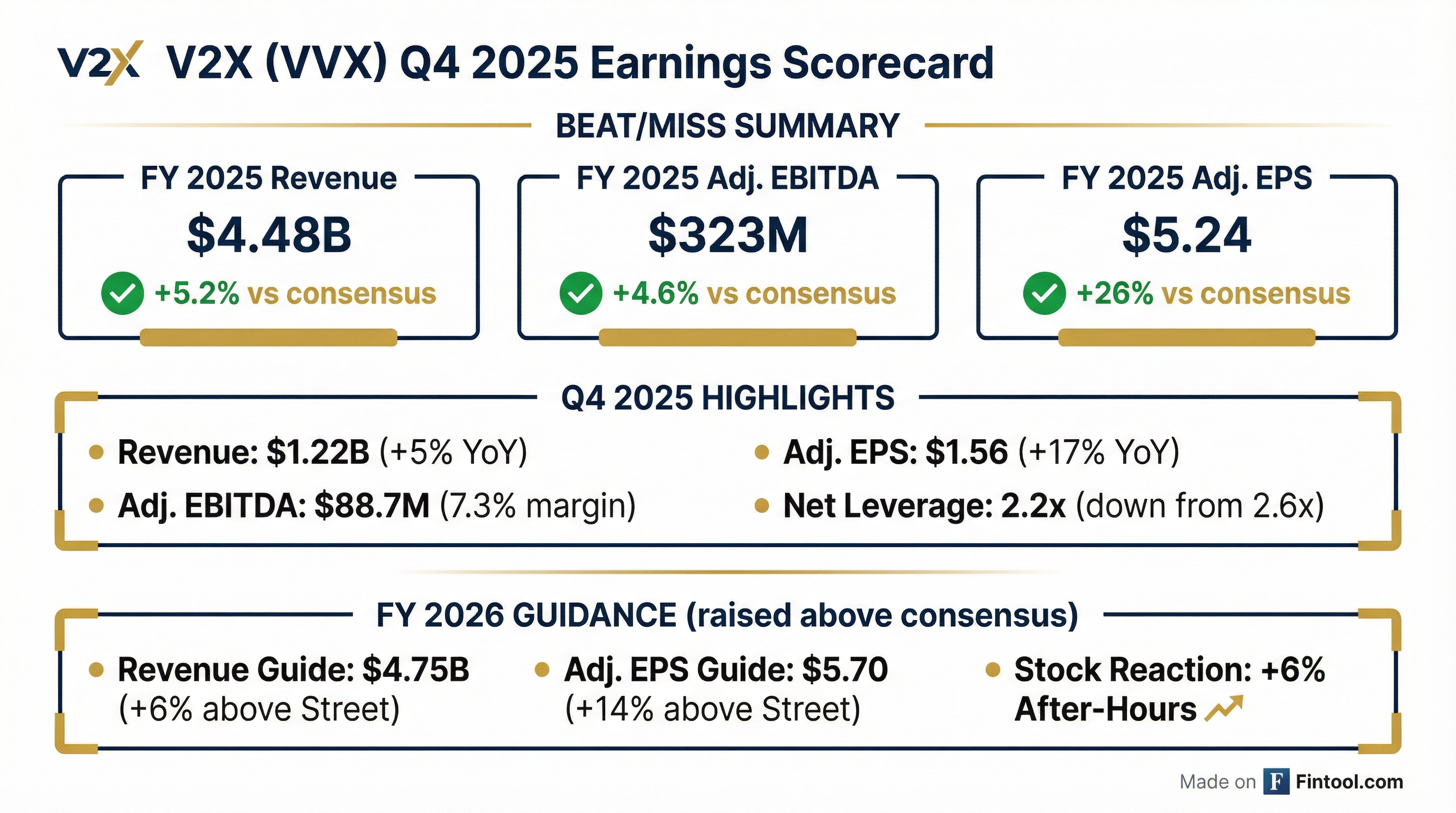

- V2X reported strong financial results for Q4 and full year 2025, with record quarterly revenue of $1.22 billion and full-year revenue of $4.48 billion, representing increases of 5% and 4% year-over-year, respectively.

- For the full year 2025, Adjusted EBITDA reached $323.3 million and Adjusted Diluted EPS was $5.24, marking year-over-year increases of 20% and 21%, respectively. The company also improved its net debt by $116 million, reducing its net leverage ratio to 2.2 times.

- The company provided a positive outlook for 2026, with revenue expected to be between $4.675 billion and $4.825 billion (midpoint $4.75 billion), Adjusted EBITDA between $335 million and $350 million, and Adjusted Diluted EPS between $5.50 and $5.90.

- V2X's backlog stood at $11.1 billion at the end of 2025, and the approximately $4.3 billion T-6 Aircraft Award is expected to be booked in Q1 2026, which is critical for achieving a book-to-bill ratio above 1 in 2026.

- Strategic initiatives include new partnerships with Amazon Web Services for smart warehousing and Google Public Sector for secure AI solutions, aiming to enhance technology-first solutions and drive innovation.

- V2X reported record quarterly revenue of $1.22 billion for Q4 2025, a 5% increase year-over-year, and full-year revenue of $4.48 billion, up 4% year-over-year, hitting the upper end of its 2025 guidance range.

- For the full year 2025, Adjusted EBITDA was $323.3 million with a 7.2% margin, and Adjusted diluted EPS increased 21% year-over-year to $5.24. The company improved its net debt by $116 million to $758 million, resulting in a net leverage ratio of 2.2 times.

- V2X's backlog at the end of 2025 stood at $11.1 billion, with a funded backlog of $2.3 billion. The $4.3 billion T-6 Aircraft Award is expected to be booked into backlog in Q1 2026.

- For 2026, V2X expects revenue between $4.675 billion and $4.825 billion, Adjusted EBITDA between $335 million and $350 million, and Adjusted diluted EPS between $5.50 and $5.90.

- The company is prioritizing investments and expanded partnerships, including recent collaborations with Amazon Web Services for smart warehousing and logistics automation, and Google Public Sector for secure AI solutions.

- V2X delivered strong financial results for Q4 2025, with revenue of $1.22 billion (+5% y/y) and Adjusted EPS of $1.56 (+17% y/y). For the full-year 2025, revenue reached $4.48 billion (+4% y/y) and Adjusted EPS was $5.24 (+21% y/y).

- The company demonstrated continued focus on cash generation, achieving a net leverage ratio of 2.2x by Q4 2025, which represents a $116 million reduction in net debt year-over-year.

- V2X reported a robust total backlog of $11.1 billion, including $2.3 billion of funded backlog, and bookings of $3.8 billion in 2025.

- For 2026, V2X provided guidance with expected revenue between $4.675 billion and $4.825 billion (midpoint $4.750 billion) and Adjusted Earnings Per Share between $5.50 and $5.90 (midpoint $5.70).

- V2X reported strong financial results for Q4 2025, with record quarterly revenue of $1.22 billion (up 5% year-over-year) and Adjusted EBITDA of $88.7 million. For the full year 2025, revenue grew 4% to $4.48 billion, and Adjusted Diluted EPS increased 21% year-over-year to $5.24.

- The company's focus on cash generation led to a $116 million year-over-year improvement in net debt to $758 million, resulting in a net leverage ratio of 2.2 times. Backlog at the end of 2025 stood at $11.1 billion, not including the approximate $4 billion T-6 award which is expected to be booked in Q1 2026.

- V2X provided an optimistic outlook for 2026, projecting revenue between $4.675 billion and $4.825 billion (midpoint $4.75 billion, representing 6% growth). Adjusted EBITDA is estimated at $335 million to $350 million, and Adjusted Diluted EPS is guided to be $5.50 to $5.90, reflecting 9% growth at the midpoint.

- Strategic highlights include significant contract wins, such as two awards valued at over $1 billion each in 2025, and the $4.3 billion T-6 Aircraft Award. The company is also expanding partnerships with technology leaders like Amazon Web Services and Google Public Sector to advance innovation and deliver solutions.

- V2X reported record revenue of $1.22 billion for the fourth quarter of 2025, a 5% year-over-year increase, with adjusted diluted EPS up 17% year-over-year to $1.56.

- For the full year 2025, revenue was $4.48 billion, an increase of 4% year-over-year, and adjusted diluted EPS grew 21% year-over-year to $5.24.

- The company achieved a net debt reduction of $116 million and a 2.2x net leverage ratio by December 31, 2025.

- V2X established full-year 2026 guidance, projecting revenue between $4.675 billion and $4.825 billion and adjusted EBITDA between $335 million and $350 million, indicating 6% growth at the mid-point for both metrics.

- V2X reported fourth quarter 2025 revenue of $1.22 billion, a 5% increase year-over-year, and full-year 2025 revenue of $4.48 billion, up 4% year-over-year.

- Adjusted diluted EPS for Q4 2025 was $1.56, up 17% year-over-year, while full-year 2025 adjusted diluted EPS was $5.24, a 21% increase year-over-year.

- The company achieved full-year 2025 adjusted net income of $166.8 million (up 20% year-over-year) and adjusted EBITDA of $323.3 million.

- V2X reduced its net debt by $116 million in 2025, achieving a 2.2x net leverage ratio.

- For full-year 2026, V2X established guidance projecting 6% revenue and adjusted EBITDA growth at the mid-point, with mid-point revenue of $4,750 million and adjusted diluted EPS of $5.70.

- V2X Inc. has been awarded a seat on the Advanced Technology Support Program 5 (ATSP5), a $25 billion multiple-award Indefinite Delivery/Indefinite Quantity (IDIQ) contract.

- The ATSP5 contract, administered by the Defense Microelectronics Activity (DMEA), is a significant Department of Defense initiative focused on engineering development and technology transition.

- Through this contract, V2X will provide federal and state government agencies with mission-critical solutions, including engineering development, full lifecycle technology support, modernization, and advanced technologies like AI-optimized systems.

- V2X Inc. (NYSE: VVX) was awarded $100 million in classified contracts during the fourth quarter of 2025.

- These contracts are designated to support a broad range of national security missions for multiple U.S. defense and intelligence agencies.

- The awards encompass services and solutions in areas such as cyber operations, special systems integration, unique facility solutions, and contested logistics.

- CEO Jeremy C. Wensinger noted that these awards demonstrate the trust placed in V2X's expertise in intelligence and cyber operations and their strategic growth in this sector.

- V2X, Inc. has announced a key partnership with Google Public Sector to deliver secure, scalable, and accredited artificial intelligence (AI) and cloud solutions to U.S. Government defense and intelligence agencies.

- This collaboration will integrate Google's advanced AI technologies, including generative AI models, into V2X's secure, on-premises, and isolated environments to enhance operational speed, mission resilience, and modernized digital infrastructure.

- The partnership aims to accelerate the development and deployment of safe, secure, and trustworthy AI solutions for applications such as multi-modal data analysis, training and simulation, optimized logistics and sustainment, and risk detection within defense and government environments.

- V2X's President and CEO, Jeremy C. Wensinger, highlighted that this partnership enhances V2X's capacity to integrate and scale industry-leading technologies into critical missions, empowering federal agencies with accelerated decision-making and enhanced security frameworks.

- V2X, Inc. is resuming work on the $4.3 billion T-6 Contractor Operated and Maintained Base Supply (COMBS) contract.

- This follows a U.S. Court of Federal Claims decision to deny a protest and uphold the Air Force's selection of V2X, allowing operations to resume immediately.

- The contract, initially awarded in July 2025, provides supply support for T-6 aircraft and has a period of performance extending through July 2034.

Quarterly earnings call transcripts for V2X.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more