Earnings summaries and quarterly performance for ADVANCED DRAINAGE SYSTEMS.

Executive leadership at ADVANCED DRAINAGE SYSTEMS.

D. Scott Barbour

President and Chief Executive Officer

Bret Martz

Executive Vice President, Sales

Brian W. King

Executive Vice President, Product Management and Marketing

Craig J. Taylor

Executive Vice President, Infiltrator Water Technologies

Kevin C. Talley

Executive Vice President and Chief Administrative Officer

Scott A. Cottrill

Executive Vice President, Chief Financial Officer and Secretary

Thomas J. Waun, Sr.

Executive Vice President, Engineering and International

Board of directors at ADVANCED DRAINAGE SYSTEMS.

Alexander R. Fischer

Director

Anesa T. Chaibi

Director

Anil Seetharam

Director

Kelly S. Gast

Director

Luther C. Kissam IV

Director

M.A. (Mark) Haney

Director

Manuel Perez de la Mesa

Director

Michael B. Coleman

Director

Robert M. Eversole

Chair of the Board

Tanya D. Fratto

Director

Research analysts who have asked questions during ADVANCED DRAINAGE SYSTEMS earnings calls.

Garik Shmois

Loop Capital Markets

8 questions for WMS

John Lovallo

UBS Group AG

8 questions for WMS

Trey Grooms

Stephens Inc.

7 questions for WMS

Bryan Blair

Oppenheimer

6 questions for WMS

David Tarantino

Robert W. Baird & Co.

5 questions for WMS

Collin Verron

Deutsche Bank

4 questions for WMS

Matthew Bouley

Barclays PLC

4 questions for WMS

Matthew Bouley

Barclays

4 questions for WMS

Michael Halloran

Baird

4 questions for WMS

Jeffrey Hammond

KeyBanc Capital Markets

3 questions for WMS

Jeffrey Reive

RBC Capital Markets

3 questions for WMS

Ryan Connors

Northcoast Research Partners

3 questions for WMS

Mike Halloran

Robert W. Baird & Co. Incorporated

2 questions for WMS

Collin Merano

Deutsche Bank

1 question for WMS

Ethan Roberts

Stephens Inc.

1 question for WMS

Jeff Reeve

RBC Capital Markets

1 question for WMS

Recent press releases and 8-K filings for WMS.

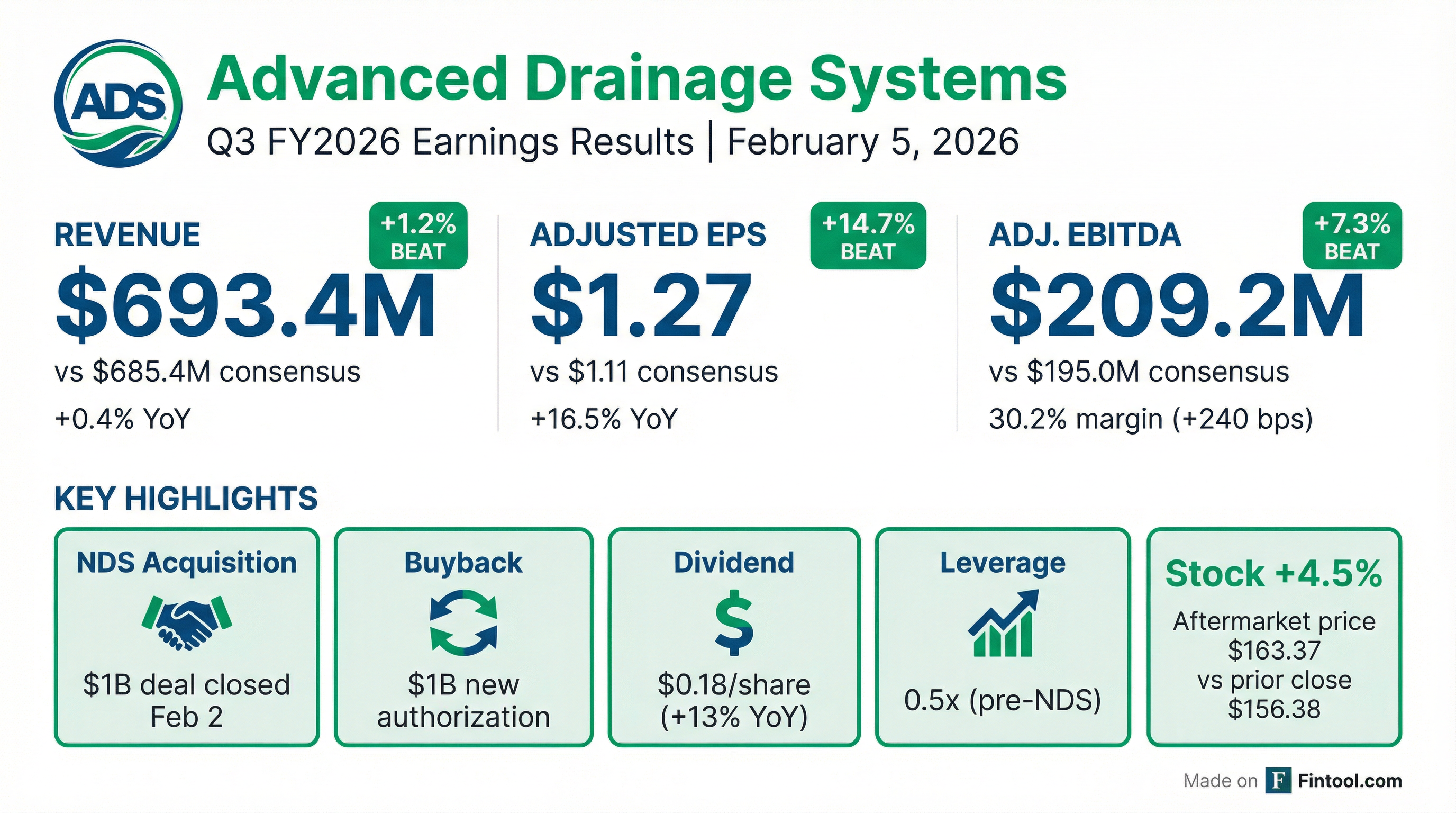

- Advanced Drainage Systems (ADS) delivered strong Q3 2026 results, achieving one of its most profitable third quarters with a 30.2% Adjusted EBITDA margin. This performance was driven by an 8% increase in Allied Products sales and a 2% increase in Infiltrator revenue.

- The company closed the NDS acquisition on Monday, February 2, 2026. For fiscal year 2026, ADS increased its revenue guidance to a midpoint of $3.015 billion and Adjusted EBITDA to a midpoint of $945 million, with an expected Adjusted EBITDA margin between 31.1% and 31.6%. This guidance includes approximately $40 million of revenue from the NDS acquisition at an approximate 20% EBITDA margin for the last two months of the fiscal year.

- ADS announced a new $1 billion stock repurchase authorization, bringing the total authorization to $1.148 billion. Post-NDS acquisition, net leverage is approximately 1.5x, which is within the company's target guardrails of 1x-2x.

- WMS reported Q3 Fiscal 2026 Adjusted EBITDA of $209.2 million , with Allied product revenue increasing 9% and Infiltrator sales showing growth.

- The company completed the $1 billion acquisition of NDS on February 2, 2026, funded with cash on hand, and the Board of Directors approved a $1 billion share repurchase authorization, bringing the total available authorization to $1.148 billion.

- WMS updated its Fiscal Year 2026 guidance, projecting Net Sales between $2,990 million and $3,040 million and Adjusted EBITDA between $930 million and $960 million. The demand environment is mixed, with non-residential and residential markets expected to be down, infrastructure up, and agriculture + international down.

- Advanced Drainage Systems (ADS) reported a strong Q3 2026, achieving a 30.2% adjusted EBITDA margin and a 9% increase in Adjusted EBITDA despite a flat revenue base.

- The company closed the NDS acquisition, funding it almost entirely with cash on hand, which resulted in a post-closing leverage of approximately 1.5 times. NDS is projected to add $40 million in revenue and an approximate 20% EBITDA margin to the fiscal year 2026 guidance.

- ADS raised its fiscal year 2026 guidance, with the revenue midpoint increasing to $3.015 billion and the Adjusted EBITDA midpoint to $945 million, expecting an Adjusted EBITDA margin between 31.1% and 31.6%.

- Year-to-date, ADS generated $779 million in cash from operations, converting over 100% of Adjusted EBITDA into cash, and announced a new $1 billion stock repurchase authorization.

- The non-residential market demand forecast was updated to down low to mid-single digits for the full year, described as a mark-to-market adjustment rather than a sign of market deterioration.

- Advanced Drainage Systems (ADS) reported one of its most profitable third quarters in history for Q3 2026, achieving a 30.2% adjusted EBITDA margin and a 9% increase in Adjusted EBITDA despite flat revenue.

- The company increased its fiscal year 2026 guidance, with the revenue midpoint now at $3.015 billion and Adjusted EBITDA midpoint at $945 million, expecting an Adjusted EBITDA margin between 31.1% and 31.6%. This guidance includes the recently closed NDS acquisition, which is anticipated to contribute approximately $40 million in revenue and a 20% EBITDA margin to the fiscal 2026 figures.

- ADS generated $779 million in cash from operations year-to-date, converting over 100% of Adjusted EBITDA into cash, and announced a new $1 billion stock repurchase authorization, bringing the total authorization to $1.148 billion.

- Advanced Drainage Systems reported Q3 Fiscal 2026 net sales of $693.4 million, a 0.4% increase, with net income rising 14.3% to $94.0 million and diluted earnings per share increasing 14.4% to $1.19.

- The company completed the acquisition of NDS on February 2, 2026, a leading U.S. supplier of residential stormwater and irrigation products, which was primarily funded using cash on hand.

- A new $1 billion stock repurchase authorization was announced, increasing the total available authorization to $1.148 billion.

- Fiscal 2026 guidance was updated, with net sales now expected to be in the range of $2.990 billion to $3.040 billion and Adjusted EBITDA projected between $930 million and $960 million.

- Advanced Drainage Systems (WMS) announced a quarterly cash dividend of $0.18 per share, representing a 13% increase over the prior year's dividend amount.

- The dividend will be paid on March 16, 2026, to shareholders of record as of March 2, 2026.

- The company also announced a new $1 billion stock repurchase authorization.

- These capital return initiatives are predicated on the company's strong balance sheet and formidable cash generation.

- Advanced Drainage Systems reported strong fiscal third quarter results for the period ended December 31, 2025, with net sales increasing 0.4% to $693.4 million, net income rising 14.3% to $94.0 million, and Adjusted EBITDA growing 9.3% to $209.2 million.

- The company completed the acquisition of NDS on February 2, 2026, which is expected to enhance its stormwater and onsite wastewater offerings.

- A new $1 billion stock repurchase authorization was announced, bringing the total existing authorization to $1.148 billion.

- Fiscal 2026 guidance was updated, with net sales now expected to be in the range of $2.990 billion to $3.040 billion and Adjusted EBITDA projected between $930 million and $960 million.

- Advanced Drainage Systems, Inc. (ADS) completed the acquisition of National Diversified Sales (NDS), the water management business of Norma Group SE, on February 2, 2026.

- The acquisition was an all-cash transaction for approximately $1.0 billion, subject to certain purchase price adjustments.

- This transaction expands ADS' water management offerings into residential water management, access box, and irrigation solutions, strengthening its Allied Products portfolio and increasing customer reach.

- Advanced Drainage Systems (ADS) has completed the acquisition of National Diversified Sales (NDS), a water management business from Norma Group SE.

- This acquisition expands ADS' water management offerings into complementary segments, including residential water management, access box, and irrigation solutions.

- The integration of NDS solidifies ADS' position as an end-to-end water solutions provider, strengthening its Allied Products portfolio, expanding distribution, and increasing customer reach.

- Advanced Drainage Systems (WMS) reported strong Q2 2025 financial results, with sales reaching $850.38 million (an 8.7% increase year-over-year) and net income rising to $156 million. Earnings per share exceeded expectations at $1.97 adjusted and $1.99 diluted.

- The company raised its full-year 2026 sales guidance midpoint to $2.95 billion, up from $2.9 billion, signaling confidence in growth driven by acquisitions and increasing demand for stormwater management.

- Advanced Drainage Systems announced a 13% dividend increase, reflecting strong confidence, and its Infiltrator segment experienced a 25% sales increase.

Quarterly earnings call transcripts for ADVANCED DRAINAGE SYSTEMS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more