Earnings summaries and quarterly performance for WABASH NATIONAL.

Executive leadership at WABASH NATIONAL.

Board of directors at WABASH NATIONAL.

Research analysts who have asked questions during WABASH NATIONAL earnings calls.

Recent press releases and 8-K filings for WNC.

WNC Announces Q4 2025 Results and Q1 2026 Outlook

WNC

Earnings

Guidance Update

Demand Weakening

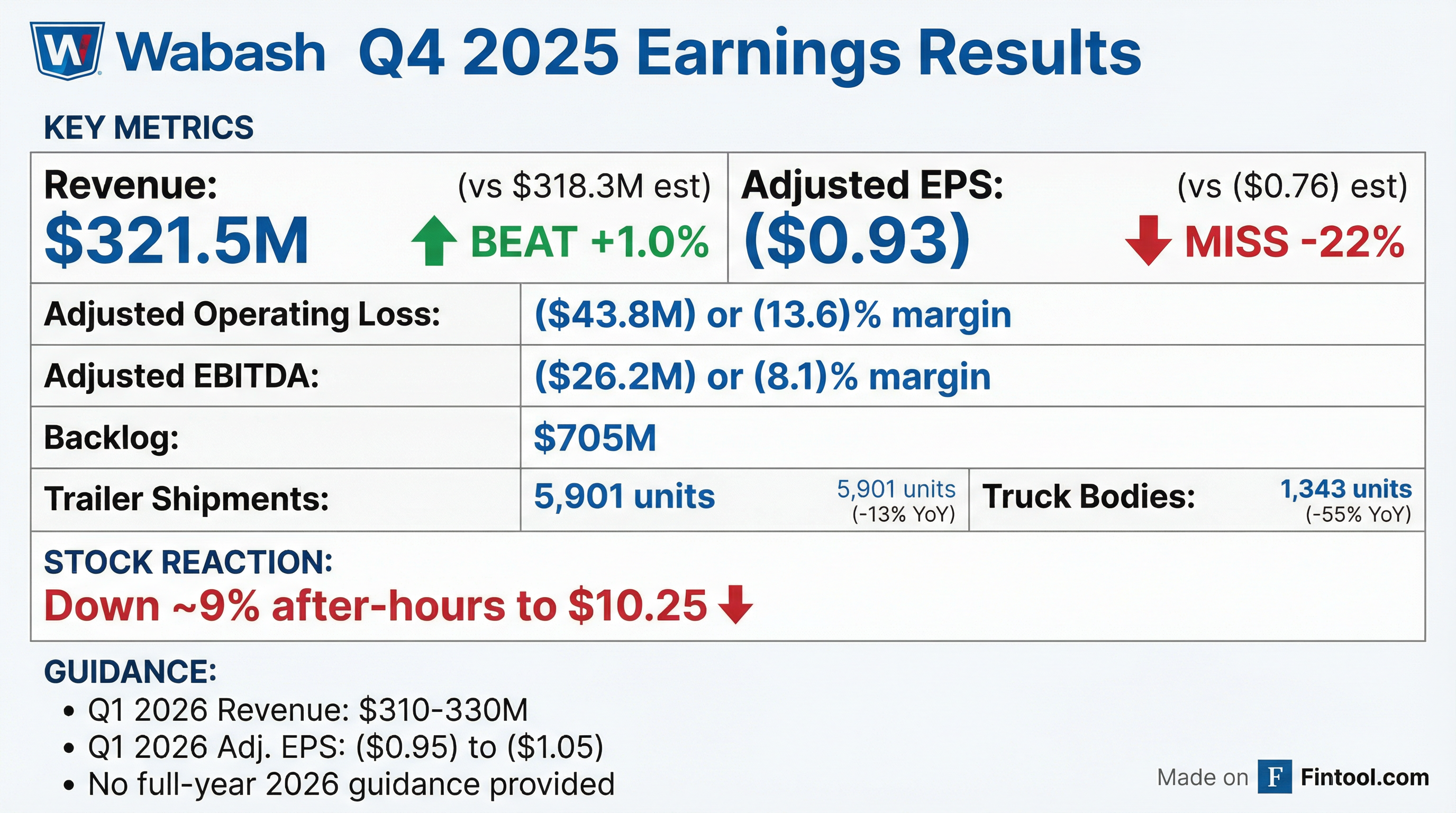

- WNC reported Q4 2025 GAAP diluted EPS of ($1.23) and Non-GAAP adjusted EPS of ($0.93), with revenue totaling $321 million.

- The company provided a Q1 2026 outlook with a revenue range of $310 million to $330 million and an EPS range of ($0.95) to ($1.05), which is expected to be the bottom for the year.

- The market environment is showing early signs of stabilization, with demand improvement anticipated in 2H 2026 and a stronger 2027.

- The Parts & Services segment continued to grow revenue in Q4 2025, both sequentially and year-over-year, reaching $64 million.

- Free Cash Flow for Q4 2025 was ($69.3) million, and net cash used by operating activities was ($57.4) million.

3 days ago

Wabash Reports Q4 2025 Financial Results and Q1 2026 Guidance

WNC

Earnings

Guidance Update

Demand Weakening

- Wabash reported Q4 2025 consolidated revenue of $321 million and an adjusted diluted EPS of -$0.93, with an adjusted operating margin of -13.6%.

- For Q1 2026, the company projects revenue between $310 million and $330 million and adjusted earnings per share in the range of -$0.95 to -$1.05, expecting this to be the weakest quarter of the year for revenue and operating margins.

- Strategic actions in Q4 2025 included the idling of manufacturing facilities in Little Falls and Goshen, leading to approximately $16 million in non-cash charges and an anticipated $10 million in ongoing annualized cost savings.

- The Parts and Services segment showed strong performance, growing 33% year-over-year and approximately 6% sequentially in Q4 2025, and is expected to see nice growth in 2026.

- Despite near-term challenges and limited visibility, Wabash expects full-year 2026 revenue and operating margin to be higher than 2025, driven by growing underlying conditions for strong trailer demand once the freight market recovers.

3 days ago

Wabash Reports Q4 2025 Results and Provides 2026 Outlook

WNC

Earnings

Guidance Update

Demand Weakening

- Wabash reported Q4 2025 consolidated revenue of $321 million, an adjusted operating margin of -13.6%, and adjusted diluted earnings per share of -$0.93.

- For Q1 2026, the company forecasts revenue in the range of $310 million to $330 million and adjusted earnings per share between -$0.95 and -$1.05, expecting it to be the weakest quarter of the year.

- Looking to full-year 2026, Wabash anticipates both revenue and operating margin to be higher than 2025, with an overall improvement from the previous year.

- The Parts and Services segment demonstrated strong performance, growing 33% year-over-year in Q4 2025, and is expected to continue its growth trajectory in 2026.

- The company ended 2025 with $235 million in liquidity and plans to prioritize ABL debt reduction, capital expenditures, and dividends, with potential for share repurchases or high-yield bond paydown thereafter.

3 days ago

Wabash Reports Q4 2025 Results and Provides Q1 2026 Outlook

WNC

Earnings

Guidance Update

Demand Weakening

- Wabash reported Q4 2025 consolidated revenue of $321 million, an adjusted operating margin of -13.6%, and adjusted diluted EPS of -$0.93.

- For Q1 2026, the company expects revenue between $310 million and $330 million and adjusted EPS in the range of -$0.95 to -$1.05, anticipating this to be the weakest quarter of the year.

- The company implemented cost actions, including idling two manufacturing facilities, which led to $16 million in non-cash charges in Q4 2025 and are expected to generate approximately $10 million in ongoing annualized cost savings.

- The Parts and Services segment demonstrated resilience, growing 33% year-over-year and 6% sequentially in Q4 2025, contributing $64.5 million in revenue and $5.1 million in operating income.

- While the transportation industry remains challenging, management observes early signs of stabilization and expects full-year 2026 revenue and operating margin to be higher than 2025, although full-year guidance is not yet issued due to limited visibility.

3 days ago

Wabash National Corporation Announces Q4 and Full Year 2025 Results

WNC

Earnings

Guidance Update

Demand Weakening

- Wabash National Corporation reported Q4 2025 revenue of $321.5 million and a GAAP EPS of $(1.23) per diluted share, with full year 2025 revenue totaling $1.54 billion and GAAP EPS of $5.07 per diluted share.

- The company's total backlog was $705 million at the end of Q4 2025, as the market environment remains challenging with fleets deferring capital spending decisions.

- For Q1 2026, Wabash expects revenue to be in the range of $310 million to $330 million and adjusted earnings per share to be between ($0.95) and ($1.05); however, full-year 2026 guidance was not issued due to limited market visibility.

- Lower than expected truck body production in Q4 2025 resulted in operational inefficiencies, contributing to operating income and EPS being below expectations.

3 days ago

Wabash Announces Fourth Quarter and Full Year 2025 Results

WNC

Earnings

Guidance Update

Demand Weakening

- Wabash (WNC) reported fourth quarter 2025 revenue of $321 million, which was in line with guidance, but GAAP EPS of $(1.23) and Non-GAAP adjusted EPS of $(0.93) were below expectations due to operational inefficiencies from lower truck body production.

- For the full year 2025, the company recorded revenue of $1.54 billion, GAAP EPS of $5.07, and Non-GAAP adjusted EPS of $(2.15).

- Total backlog at the end of Q4 2025 was $705 million, reflecting a challenging market where fleets are delaying capital spending decisions.

- Wabash provided Q1 2026 guidance, projecting revenue between $310 million and $330 million and adjusted EPS between ($0.95) and ($1.05), but did not issue full-year 2026 guidance due to limited visibility.

- The company anticipates demand improvement in the second half of 2026 and a stronger 2027, despite current challenging market conditions.

3 days ago

WNC Announces Strong 2025 Performance with $2.2 Billion in Affordable Housing Acquisitions

WNC

New Projects/Investments

Revenue Acceleration/Inflection

- WNC & Associates closed 2025 with $2.2 billion in affordable housing acquisitions, marking a $400 million year-over-year growth from 2024.

- In 2025, $928 million in investor equity was secured to fund the construction or rehabilitation of over 6,600 rental units across 28 states.

- The company expanded its investor base by adding nine new investors, bringing the total to 175 institutional investors.

Jan 21, 2026, 5:21 PM

Wabash National Corporation Reports Q3 2025 Results, Lowers Full-Year Guidance

WNC

Earnings

Guidance Update

Demand Weakening

- Wabash National Corporation reported Q3 2025 consolidated revenue of $382 million and an adjusted diluted EPS of negative $0.51, both below expectations due to persistent soft market conditions and lower volumes.

- The company lowered its full-year 2025 guidance to midpoints of $1.5 billion in revenue and approximately negative $2 in adjusted EPS, anticipating the fourth quarter to be the weakest of the year.

- A 2019 legal matter was finalized with a settlement, resulting in a Wabash payment obligation of approximately $30 million and a net adjustment of approximately $81 million recorded in Q3 2025.

- The Parts and Services segment delivered $61 million in revenue and $6.6 million in operating income in Q3 2025, marking its third consecutive quarter of sequential and year-over-year revenue growth.

- Wabash ended Q3 2025 with $356 million in total liquidity and expects to be near cash flow break-even for the full year, while reducing its traditional capital investment plans for 2025.

Oct 30, 2025, 4:00 PM

Wabash National Corporation Reports Q3 2025 Results and Updates 2025 Outlook

WNC

Earnings

Guidance Update

Demand Weakening

- Wabash National Corporation reported Q3 2025 GAAP EPS of $0.97 and Non-GAAP adjusted EPS of $(0.51), with revenue of $382 million.

- The company reduced its Q4 outlook to midpoints of revenue of $320 million and EPS of $(0.75), and updated its full-year 2025 adjusted EPS outlook to $(2.00), citing current demand and a challenging market environment.

- Parts & Services revenue grew to $61 million in Q3 2025, both sequentially and year-over-year, contributing to strong third-quarter cash flow with Free Cash Flow of $60.6 million.

Oct 30, 2025, 4:00 PM

Wabash Announces Third Quarter 2025 Results

WNC

Earnings

Guidance Update

Demand Weakening

- Wabash reported Q3 2025 revenue of $381.6 million, marking a 17.8% decrease compared to the same quarter last year, primarily due to softer than expected demand in its Truck Body business.

- The company's Q3 2025 GAAP diluted EPS was $0.97, while Non-GAAP adjusted EPS was $(0.51), missing expectations.

- GAAP operating income for Q3 2025 was $58 million, which included an $81 million gain from the settlement of a Missouri legal verdict.

- Wabash reduced its full-year 2025 revenue outlook to $1.5 billion and its Non-GAAP adjusted EPS guidance to a range of $(1.95) to $(2.05).

- Total backlog for the company stood at approximately $829 million at the end of Q3 2025.

Oct 30, 2025, 10:54 AM

Quarterly earnings call transcripts for WABASH NATIONAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more