Earnings summaries and quarterly performance for Western New England Bancorp.

Executive leadership at Western New England Bancorp.

James C. Hagan

President and Chief Executive Officer

Allen J. Miles, III

Executive Vice President & Chief Lending Officer

Christine Phillips

Senior Vice President & Chief Human Resources Officer

Daniel Marini

Senior Vice President, Retail Banking & Marketing

Darlene Libiszewski

Senior Vice President & Chief Information Officer

Filipe B. Goncalves

Senior Vice President & Chief Credit Officer

Guida R. Sajdak

Executive Vice President, Chief Financial Officer & Treasurer

John E. Bonini

Senior Vice President & General Counsel

Kevin C. O’Connor

Executive Vice President & Chief Operating Officer

Leo R. Sagan, Jr.

Senior Vice President & Chief Risk Officer

Board of directors at Western New England Bancorp.

Research analysts covering Western New England Bancorp.

Recent press releases and 8-K filings for WNEB.

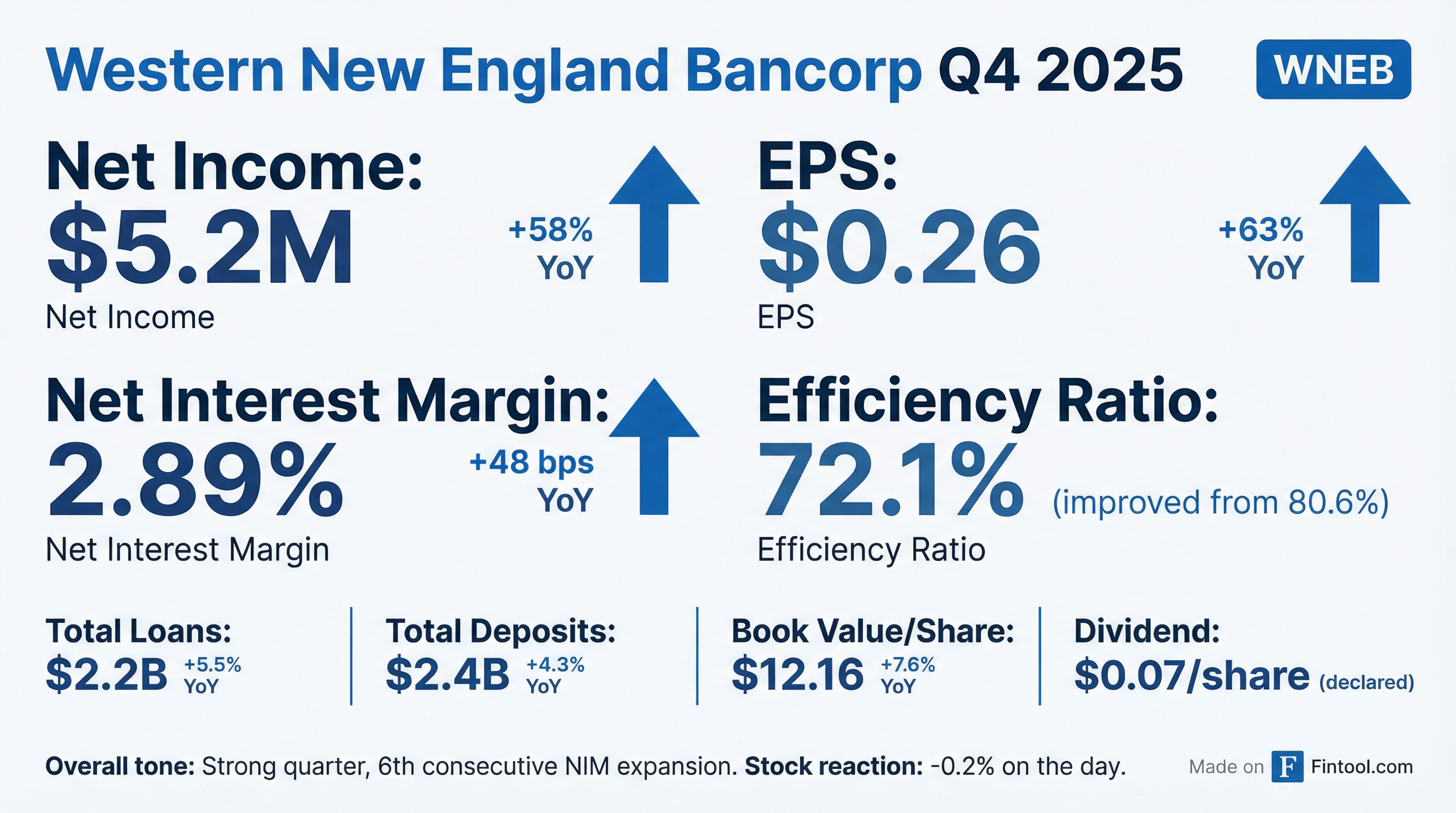

- Western New England Bancorp, Inc. reported net income of $5.2 million, or $0.26 per diluted share, for the three months ended December 31, 2025, and $15.3 million, or $0.75 per diluted share, for the twelve months ended December 31, 2025.

- The Company declared a quarterly cash dividend of $0.07 per share on its common stock, payable on or about February 25, 2026.

- Total loans increased $113.2 million, or 5.5%, to $2.2 billion, and core deposits increased $111.9 million, or 7.2%, to $1.7 billion at December 31, 2025, compared to December 31, 2024.

- The net interest margin, on a tax-equivalent basis, expanded to 2.91% for the three months ended December 31, 2025, marking the sixth consecutive quarter of growth.

- During the twelve months ended December 31, 2025, the Company repurchased 599,853 shares of common stock, and book value per share increased 7.6% to $12.16 at December 31, 2025.

- Westfield Bank reported net income of $5,209 thousand and diluted earnings per share (EPS) of $0.26 for Q4 2025.

- Net interest income increased 4.1% sequentially to $18,829 thousand, and the net interest margin rose to 2.89% for the three months ended December 31, 2025.

- Total deposits increased 4.3% year-over-year to $2.4 billion, with core deposits growing 7.2% to $1.7 billion at December 31, 2025. The average cost of total deposits decreased to 1.73% at December 31, 2025.

- Commercial and Industrial Loans increased 4.8% to $222 million, and Commercial Real Estate Loans increased 2.2% to $1,099 million at December 31, 2025, compared to December 31, 2024.

- The company maintained a strong capital position with a Bank's Tier 1 Leverage Ratio of 9.32% and a TCE ratio of 8.71% at December 31, 2025. Book value per share was $12.16 and tangible book value per share was $11.49 at December 31, 2025.

- Western New England Bancorp, Inc. reported net income of $3.2 million, or $0.16 per diluted share, for the three months ended September 30, 2025. This compares to net income of $1.9 million, or $0.09 per diluted share, for the three months ended September 30, 2024.

- The company's Board of Directors declared a quarterly cash dividend of $0.07 per share on its common stock, payable on or about November 26, 2025.

- Total loans increased $60.8 million, or 2.9%, to $2.1 billion at September 30, 2025, from December 31, 2024. Total deposits also increased $87.2 million, or 3.9%, to $2.3 billion at September 30, 2025, from December 31, 2024.

- The net interest margin for the three months ended September 30, 2025, was 2.81%, an increase from 2.40% for the three months ended September 30, 2024.

- During the nine months ended September 30, 2025, the company repurchased 499,853 shares of common stock at an average price per share of $9.31.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more