Alphabet Beats Q4 Estimates, Unleashes Massive 2026 AI Spending Plan

February 4, 2026 · by Fintool Agent

Alphabet-1.96% delivered Q4 2025 results that beat Wall Street expectations, reporting approximately $111.4 billion in revenue—up 15% year-over-year—and signaling plans for a "significant increase" in 2026 capital expenditure as the company doubles down on AI infrastructure to maintain its cloud momentum and competitive position in the escalating AI arms race.

Shares initially fell 7% in after-hours trading before recovering as investors digested the implications of massive spending plans alongside strong operating results. The report marks Alphabet's first earnings since joining the exclusive $4 trillion market cap club in January—alongside Nvidia-3.41%, Microsoft+0.72%, and Apple+2.60%.

The Numbers

Wall Street had set a high bar for Alphabet entering Wednesday's report:

| Metric | Expected | Q4 2024 |

|---|---|---|

| Revenue | $111.4B | $96.5B |

| EPS | $2.63-$2.65 | $2.15 |

| Google Cloud | $16.2B | $11.9B |

| YouTube Ads | $11.8B | $10.2B |

The company's trajectory has been remarkable. Revenue grew from $80.5 billion in Q1 2024 to over $102 billion in Q3 2025, representing a 27% increase over just seven quarters.

The AI Capex Supercycle

The real story Wednesday was capital expenditure. Alphabet spent $91-93 billion on capex in 2025—a dramatic acceleration from approximately $52.5 billion in 2024.

The quarterly trajectory tells the story:

CFO Anat Ashkenazi promised more: "Looking out to 2026, we expect a significant increase in CapEx." The company's AI infrastructure chief, Amin Vahdat, told employees in November that Google must "double its serving capacity every six months" to meet AI demand—a requirement that mathematically demands even more aggressive spending.

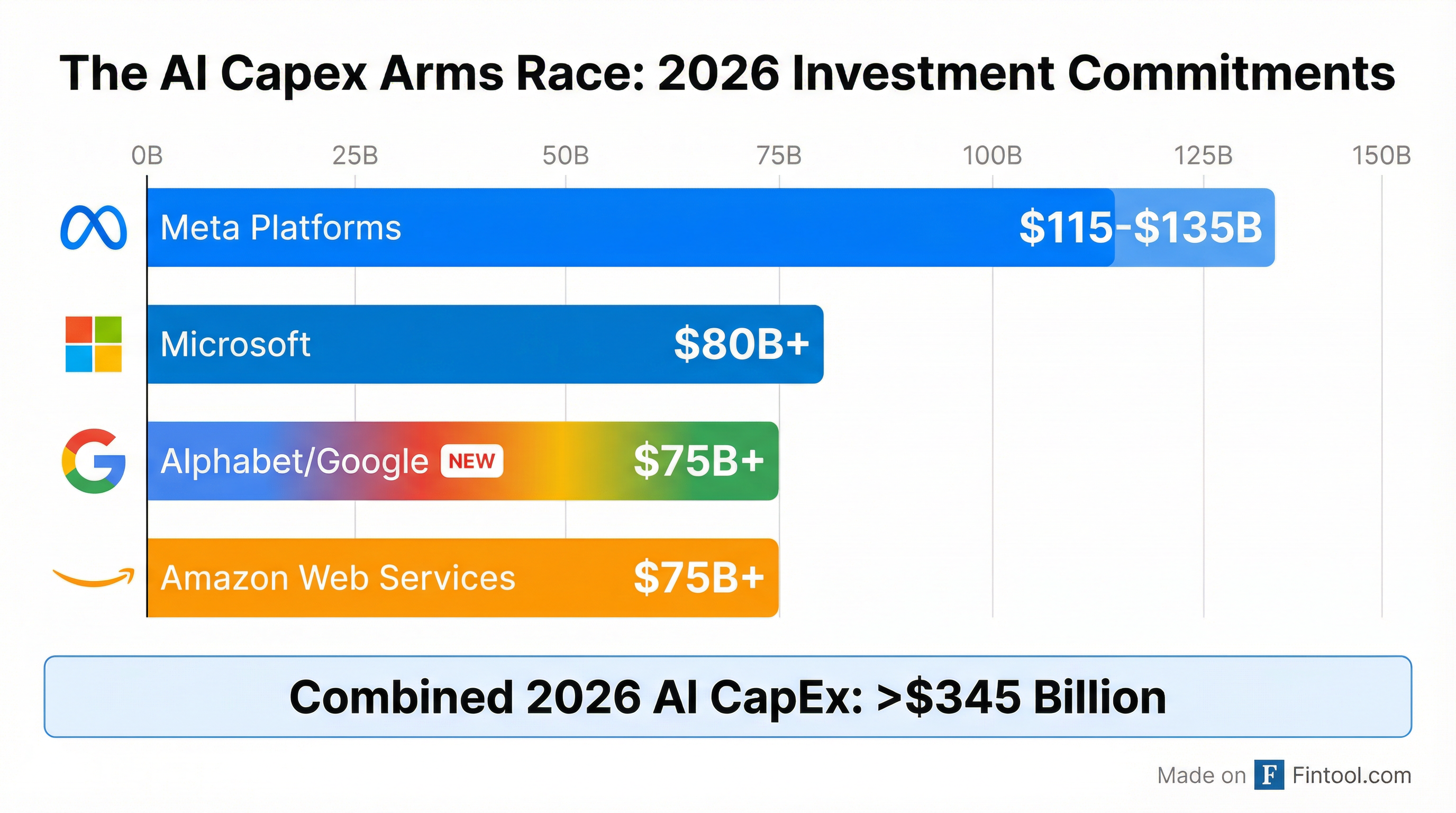

This positions Alphabet squarely in the center of what has become a hyperscaler spending war:

Meta-3.28% set the benchmark last week with guidance of $115-135 billion for 2026—a 73% increase at the midpoint. Microsoft and Amazon are each planning $80 billion or more. Combined, the four largest cloud providers are committing over $400 billion to AI infrastructure this year alone.

The Apple Deal Changes Everything

Wednesday's earnings represent Alphabet's first since the January announcement that Apple+2.60% will use Google's Gemini AI models to power a revamped Siri assistant—a landmark deal that validates Google's position in the AI race.

The deal gives Gemini access to Apple's 2.5 billion active devices, potentially the largest distribution channel for any AI model. Key questions investors want answered:

- Economics: How much does Google earn per Siri query?

- Data rights: Can Google use Apple user data to train Gemini?

- Infrastructure: Will Apple use Google's data centers and TPU chips?

The Apple partnership follows a string of major cloud wins: a $10 billion Meta contract for cloud services, a tens-of-billions deal with Anthropic for TPU access, and an expanded relationship with OpenAI. Google's cloud backlog hit $155 billion in Q3, with CEO Sundar Pichai noting the company secured more $1 billion deals in nine months than in the previous two years combined.

The Investment Calculus

Alphabet's spending surge creates a fundamental question: When does infrastructure investment become infrastructure overkill?

The bull case is straightforward. AI demand is not slowing—it's accelerating. Every major enterprise is racing to deploy AI capabilities, and Google Cloud's 35%+ revenue growth suggests the spending is translating to customer wins. The Anthropic, Meta, OpenAI, and Apple deals provide visible demand for years of infrastructure buildout.

The bear case centers on capital intensity and margin pressure. Meta's Q4 operating margin compressed from 48% to 41% year-over-year as AI capex ramped. Alphabet faces similar pressure, with quarterly capex doubling from $12 billion in Q1 2024 to $24 billion in Q3 2025—while free cash flow has become volatile.

| Metric | Q1 2024 | Q3 2025 | Change |

|---|---|---|---|

| Revenue | $80.5B* | $102.3B* | +27% |

| CapEx | $12.0B* | $24.0B* | +100% |

| Op Cash Flow | $28.8B* | $48.4B* | +68% |

| Free Cash Flow | $11.8B* | $14.0B* | +19% |

*Values retrieved from S&P Global

The math shows cash generation keeping pace with spending—for now. But with 2026 capex potentially exceeding $100 billion, free cash flow conversion could face meaningful pressure.

What to Watch

Several catalysts will determine whether Alphabet's massive AI bet pays off:

Near-term (Q1-Q2 2026)

- Gemini 3 adoption metrics and monetization

- Apple Siri integration launch timeline

- Cloud revenue acceleration from backlog conversion

Medium-term (2026-2027)

- Antitrust remedies following the search dominance ruling

- TPU market share gains versus NVIDIA

- Free cash flow stabilization despite elevated capex

Long-term risks

- AI model commoditization eroding pricing power

- Regulatory constraints on data usage

- Rising energy costs for data center operations

Alphabet's Q4 report confirms what the market already suspected: the AI infrastructure buildout is accelerating, not plateauing. With over $400 billion in combined hyperscaler capex planned for 2026, the winners will be companies supplying the picks and shovels—semiconductor makers, power equipment suppliers, and construction firms.

For Alphabet specifically, the question is no longer whether it can compete in AI. The question is whether $100 billion+ in annual spending generates the returns needed to justify a $4 trillion valuation.