Amazon's $200 Billion AI Bet Spooks Wall Street Despite Record AWS Growth

February 6, 2026 · by Fintool Agent

Amazon shares tumbled 9% on Friday after the company announced plans to spend approximately $200 billion in capital expenditures in 2026—a figure that exceeded Wall Street estimates by more than $50 billion and crystallized investor concerns about the return on investment timeline for Big Tech's unprecedented AI infrastructure buildout.

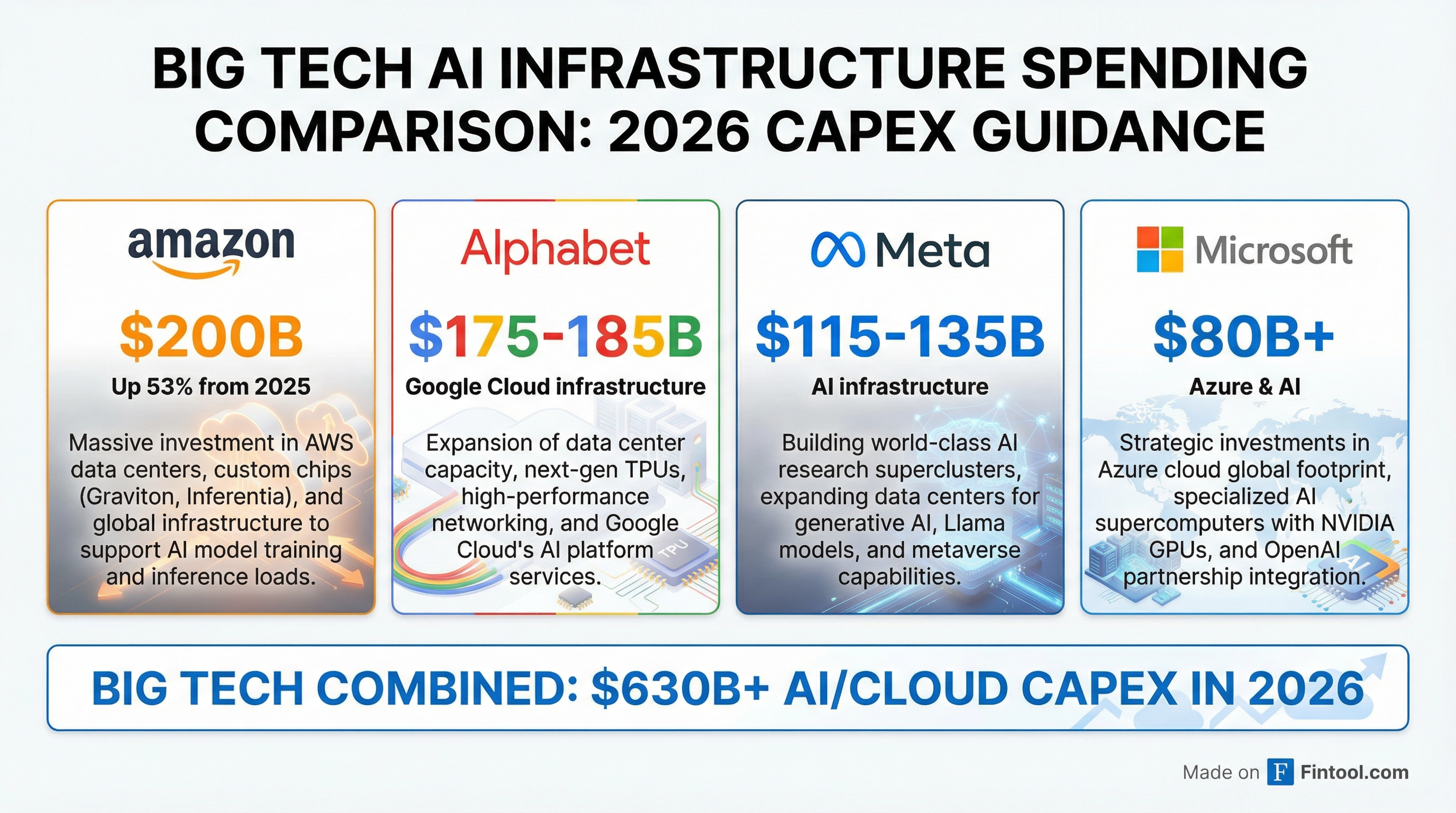

The spending guidance, delivered alongside a strong Q4 earnings report, represents a 53% increase from the $131.8 billion Amazon spent in 2025. It caps an extraordinary week of capex revelations from the tech giants: Alphabet announced plans for up to $185 billion, Meta guided to $115-135 billion, and Microsoft also raised its spending outlook. Combined, the four companies are planning to deploy more than $630 billion on AI and cloud infrastructure this year.

The Earnings Story: AWS Delivers, Guidance Disappoints

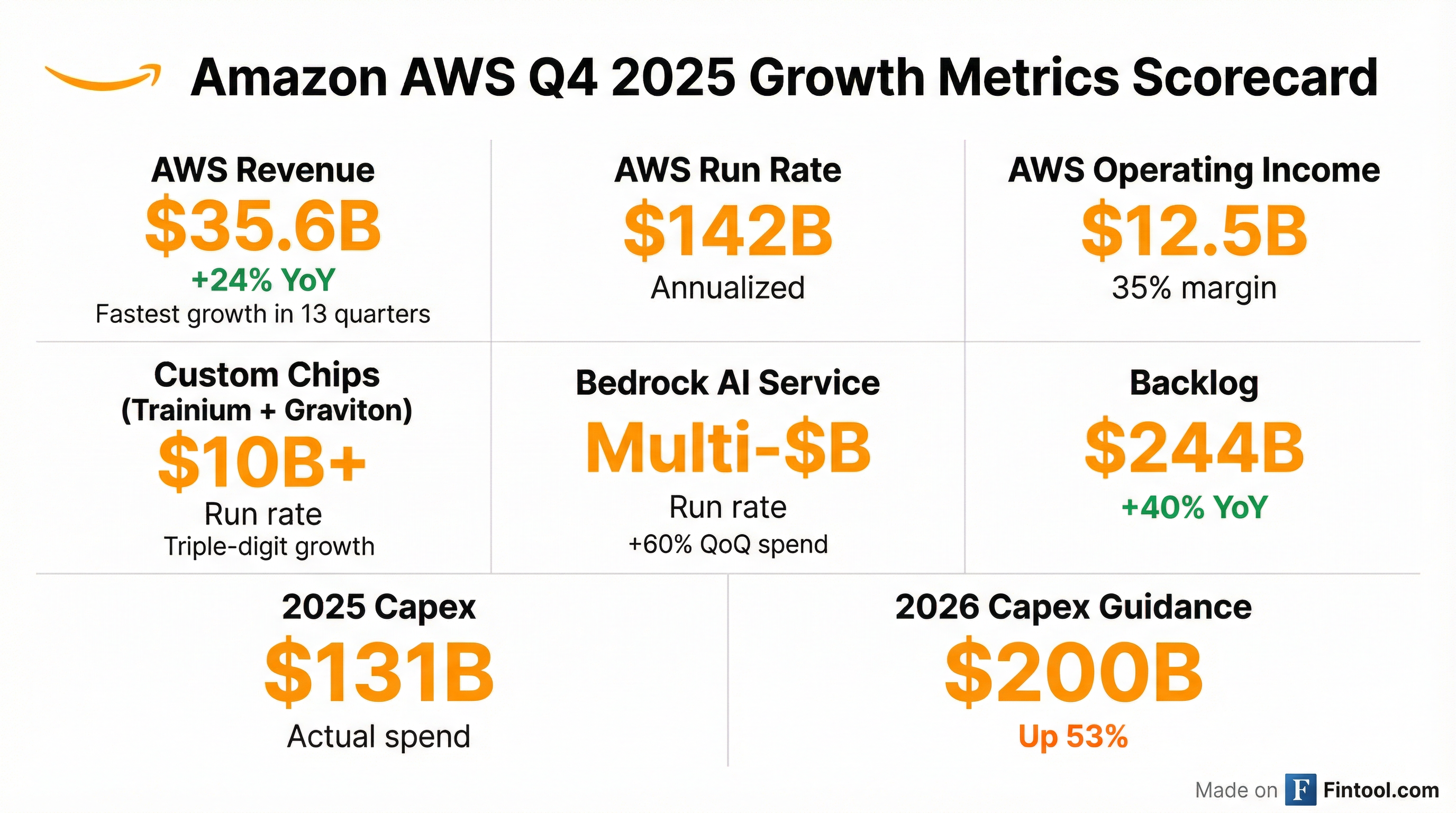

The paradox of Amazon's report is stark: the underlying business is thriving. Q4 revenue reached $213.4 billion, up 12% year-over-year excluding foreign exchange impacts. AWS delivered its fastest growth in 13 quarters at 24% year-over-year, generating $35.6 billion in revenue and $12.5 billion in operating income at a 35% margin.

CEO Andy Jassy emphasized the acceleration: "AWS is now a $142 billion annualized run rate business, and our chips business, inclusive of Graviton and Trainium, is now over $10 billion in annual revenue run rate, growing triple-digit percentages year-over-year."

The numbers tell a story of execution:

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Total Revenue | $213.4B | $187.8B | +14% |

| AWS Revenue | $35.6B | $28.8B | +24% |

| AWS Operating Income | $12.5B | $10.6B | +17% |

| Total Operating Income | $25.0B | $21.2B | +18% |

| Net Income | $21.2B | $20.0B | +6% |

But it was the Q1 guidance that triggered the selloff. Amazon projected operating income of $16.5-21.5 billion—below the $21.2 billion analysts expected at the midpoint—reflecting accelerating investment in Project Kuiper satellite launches and international expansion.

The $200 Billion Question

When analysts pressed for clarity on the massive spending commitment, Jassy was defiant. "This isn't some sort of quixotic, top-line grab," he said on the earnings call. "We have confidence that these investments will yield strong returns on invested capital. We've done that with our core AWS business. I think that will very much be true here as well."

The capex trajectory has been steep:

Jassy framed the investment as demand-driven necessity: "We could actually grow faster if we had all the supply that we could take. We added 3.99 gigawatts of power in the last 12 months—twice what we had in 2022 when we were an $80 billion annual run rate business. We expect to double it again by the end of 2027."

The company's $244 billion backlog—up 40% year-over-year and 22% quarter-over-quarter—supports the demand narrative. But investors remain skeptical about the timeline for monetization.

The Custom Silicon Advantage

A key differentiator in Amazon's pitch is its custom chip strategy. Trainium, Amazon's AI training chip, is now a "multi-billion dollar annualized run rate business" with over 100,000 companies using it. Jassy noted that Trainium offers 30-40% better price performance than comparable GPUs—a critical advantage as AI workloads scale.

Anthropic is training its next Claude model on Trainium2 chips through Project Rainier, with 500,000 chips deployed and expanding. Trainium3, just launched, offers 40% better price performance than Trainium2, with nearly all supply expected to be committed by mid-2026. Development is already underway on Trainium4 (coming 2027) and Trainium5.

Combined with Graviton (its custom CPU offering 40% better price performance than x86 processors), Amazon's silicon business exceeds $10 billion in annual run rate. This vertical integration provides both cost advantages and supply chain security as the AI chip shortage persists.

Big Tech's Collective Bet

Amazon's spending plan is the largest among the hyperscalers, but the collective magnitude is what has investors concerned. Within a single week, the four major cloud players have committed to more than $630 billion in capital expenditures for 2026.

| Company | 2026 Capex Guidance | Change vs 2025 |

|---|---|---|

| Amazon | $200B | +53% |

| Alphabet | $175-185B | 2x |

| Meta | $115-135B | 2x |

| Microsoft | $80B+ | Raised |

MoffettNathanson analysts captured the market's concern: "While the rising capital intensity is not a surprise directionally, the magnitude of the spend is materially greater than consensus expected."

The question that haunts investors is not whether AI is transformative—few doubt that—but whether the returns will materialize fast enough to justify what amounts to a generational bet on infrastructure. Tech executives have made clear they believe the bigger risk is underinvesting. Industry executives have signaled that spending too little on AI would be a much bigger mistake than spending too much, even as combined annual capital spending plans race past half a trillion dollars.

Market Reaction and Valuation Context

Amazon shares closed at $203.73 on Friday, down 8.5% from the prior close of $222.69. The stock now trades 21% below its 52-week high of $258.60.

The sell-side response was measured. At least five brokerages reduced price targets following the results. BMO Capital analyst Brian Pitz argued that investors are "misunderstanding" Amazon's capex: "This is a growth catalyst, not a margin headwind."

Amazon trades at a P/E ratio of 27.0x, compared to Microsoft's 21.6x and Alphabet's 28.4x. The premium reflects AWS's market leadership and growth, but the valuation debate has shifted from revenue growth to capital efficiency.

What to Watch

The next several quarters will reveal whether Amazon's aggressive posture pays off:

- Trainium3 ramp: With supply expected to be fully committed by mid-2026, watch for customer announcements and utilization metrics

- AWS margin trajectory: The 35% operating margin held steady despite investment intensity, but management warned margins will fluctuate

- Free cash flow: Trailing twelve-month FCF collapsed to $11.2 billion as capex surged —a figure that will need to stabilize for investor confidence to return

- Competitive dynamics: Whether Google Cloud and Azure see similar demand acceleration will validate or challenge Amazon's investment thesis

As Jassy put it on the call: "This AI movement is not going to be a couple companies. It's going to be thousands of companies over time." The bet Amazon is making is that it will capture a disproportionate share of that future—and that $200 billion is the price of admission.