Amazon Snaps 9-Day Losing Streak After $483B AI Capex Rout

February 17, 2026 · by Fintool Agent

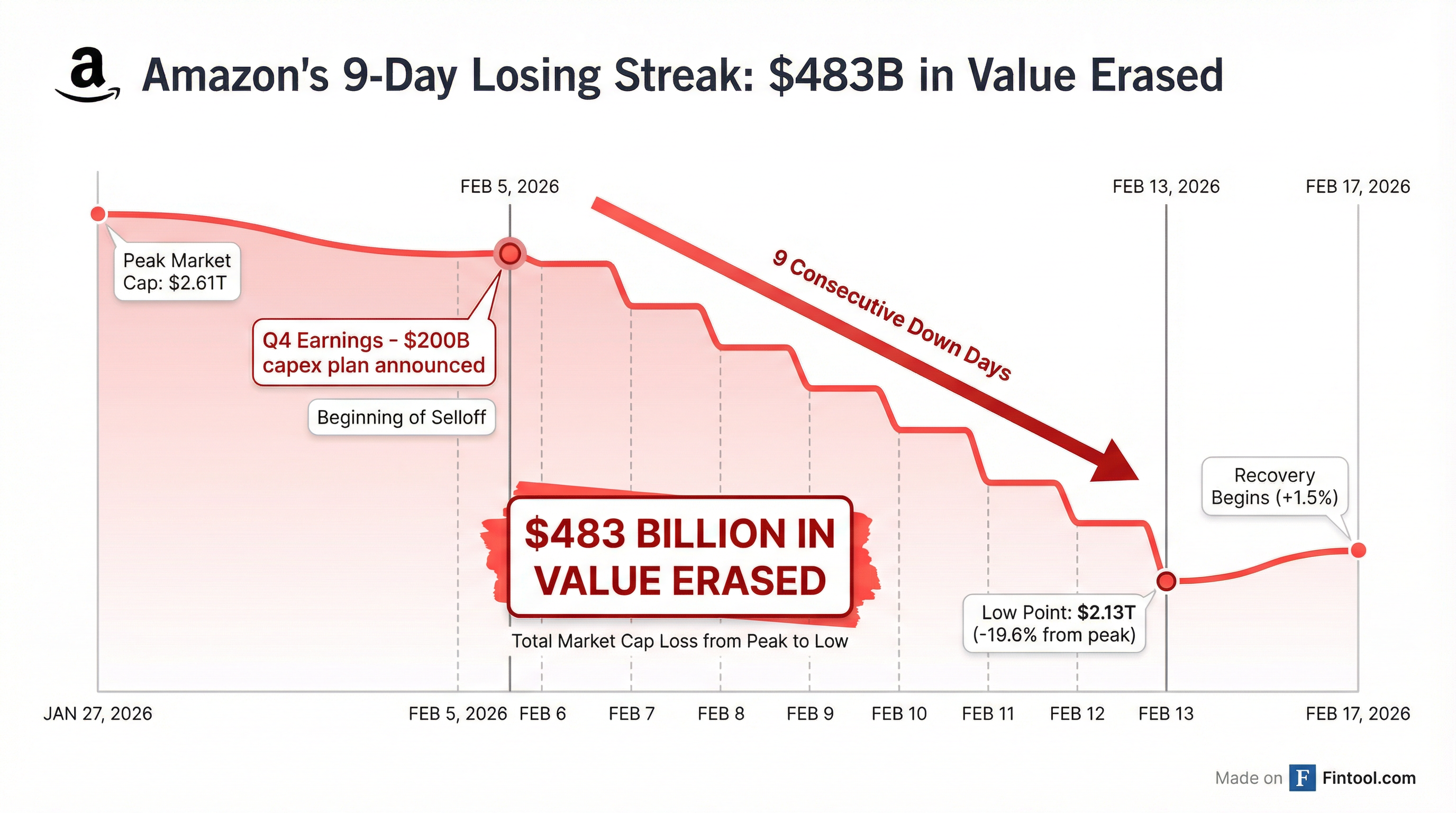

Amazon ended its worst losing streak since 2006 on Tuesday, rising 1.5% to $201.15 after nine consecutive sessions that erased nearly $483 billion in market capitalization. The historic selloff—triggered by the company's disclosure of a staggering $200 billion capital expenditure plan for 2026—has become ground zero for a broader market debate about whether Big Tech's AI spending spree will ever pay off.

The 9-day rout began immediately after Amazon's February 5 earnings call, when management revealed AI infrastructure investments that dwarfed Wall Street expectations by more than $50 billion. From its January 27 peak of $2.61 trillion, Amazon's market cap cratered to $2.13 trillion by February 13—a drop of nearly 20% that ranks among the largest single-stock value destructions in history.

The Numbers That Spooked Wall Street

Amazon's $200 billion capex target for 2026 represents a 52% increase from the $132 billion spent in fiscal 2025. To put this in context, Amazon's quarterly capex trajectory tells the story of a spending acceleration that has alarmed investors:

| Period | Capex ($B) | Revenue ($B) | Capex % of Revenue |

|---|---|---|---|

| Q1 2024 | $14.9* | $143.3 | 10.4% |

| Q2 2024 | $17.6 | $148.0 | 11.9% |

| Q3 2024 | $22.6 | $158.9 | 14.2% |

| Q4 2024 | $27.8 | $187.8 | 14.8% |

| Q1 2025 | $25.0 | $155.7 | 16.1% |

| Q2 2025 | $32.2 | $167.7 | 19.2% |

| Q3 2025 | $35.1 | $180.2 | 19.5% |

| Q4 2025 | $39.5* | $213.4 | 18.5% |

*Values retrieved from S&P Global

The math is stark: Amazon's capex-to-revenue ratio has nearly doubled in two years, from roughly 10% to nearly 20%. At $200 billion for 2026, the company would be spending more on infrastructure than the GDP of most countries.

Jassy's Defense: "We Are Monetizing Capacity as Fast as We Install It"

On the earnings call, CEO Andy Jassy mounted a forceful defense of the spending spree, framing it as the only rational response to unprecedented AI demand:

"We expect to invest about $200 billion in capital expenditures across Amazon, but predominantly in AWS, because we have very high demand. Customers really want AWS for core and AI workloads, and we're monetizing capacity as fast as we can install it."

Jassy pointed to AWS's $244 billion backlog—up 40% year-over-year and 22% quarter-over-quarter—as evidence that demand justifies the investment. He emphasized that AWS grew 24% year-over-year to a $142 billion annualized run rate, calling it "unprecedented" growth at that scale.

The CEO's message to skeptics was blunt: "This isn't some sort of quixotic top-line grab. We have confidence that these investments will yield strong returns on invested capital. We've done that with our core AWS business, and I think that will very much be true here as well."

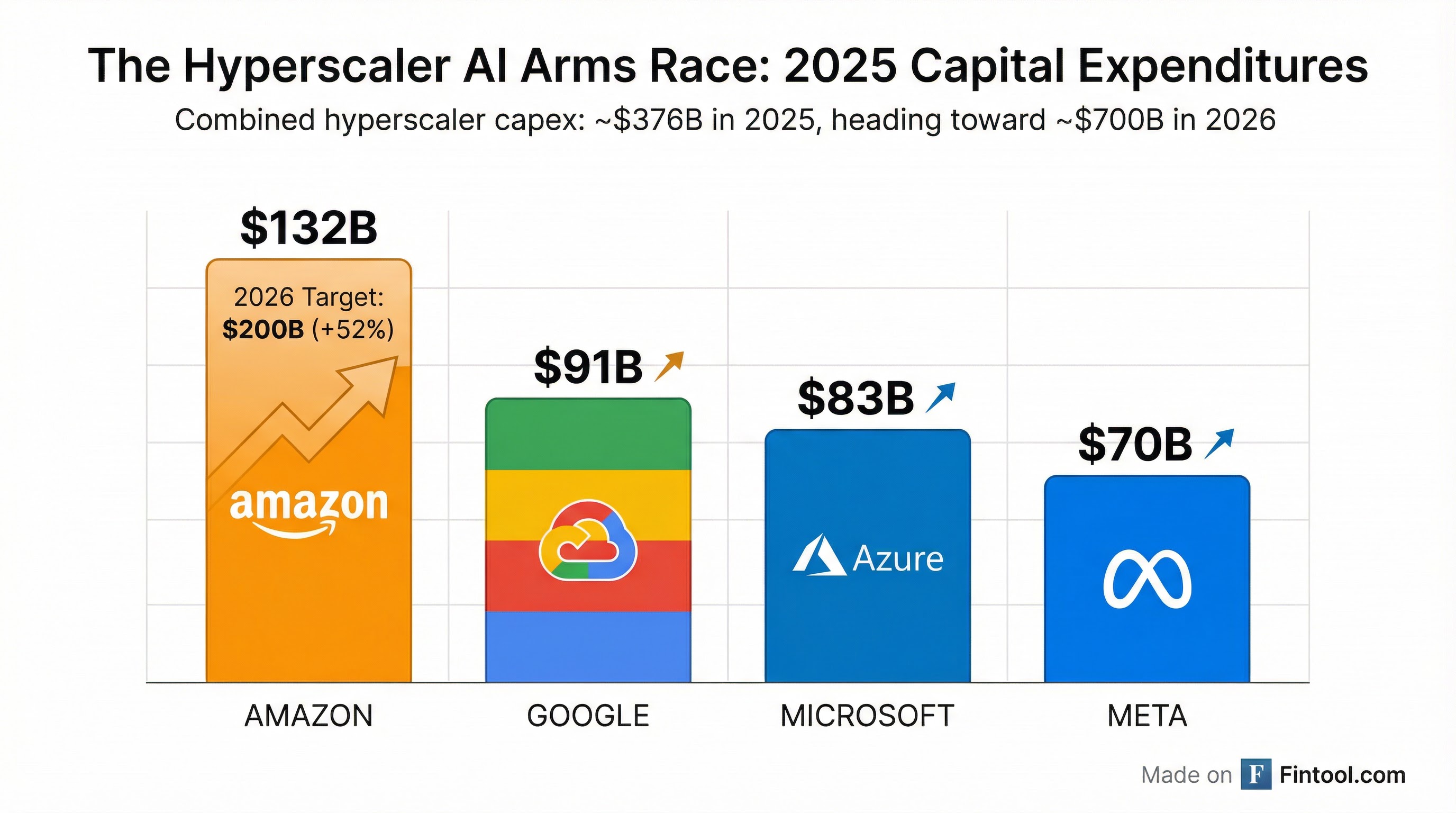

The Hyperscaler Arms Race

Amazon's spending surge is part of a broader escalation among the four major cloud providers. Combined hyperscaler capital expenditures reached approximately $376 billion in 2025 and could approach $700 billion in 2026:

| Company | FY 2025 Capex ($B) | 2026 Trajectory |

|---|---|---|

| Amazon | $132* | $200B (guided) |

| Alphabet | $91 | Accelerating |

| Microsoft | $83* | Azure expansion |

| Meta | $70 | $60-65B guided |

*Values retrieved from S&P Global

The scale of investment has raised fundamental questions about capital efficiency and returns. Microsoft's Q2 2026 capex hit $29.9 billion in a single quarter, while Google's Q4 2025 spending reached $27.9 billion.

Free Cash Flow: The Pressure Point

The concern isn't just about spending—it's about what that spending does to cash generation. Amazon's levered free cash flow has shown significant volatility as capex ramped:

| Period | Cash from Operations ($B) | Capex ($B) | Levered FCF ($B) |

|---|---|---|---|

| Q4 2024 | $45.6 | $27.8 | $20.7* |

| Q1 2025 | $17.0 | $25.0 | $0.2* |

| Q2 2025 | $32.5 | $32.2 | $3.0* |

| Q3 2025 | $35.5 | $35.1 | $3.1* |

| Q4 2025 | $54.5 | $39.5* | $17.5* |

*Values retrieved from S&P Global

The pattern shows cash generation barely keeping pace with capital requirements—and that's before the 52% capex increase kicks in for 2026.

The Broader AI Capex Crisis

Amazon's selloff isn't happening in isolation. The entire hyperscaler complex has faced pressure as investors question whether AI infrastructure spending will ever generate adequate returns:

| Stock | YTD 2026 Return | Status |

|---|---|---|

| Amazon | -11.2% | 9-day losing streak (worst since 2006) |

| Microsoft | -16.1% | 5 consecutive down sessions |

| Alphabet | -4.2% | 5 consecutive down sessions |

| Meta | -1.7% | Outperforming peers |

A Bank of America survey found a record share of fund managers now believe companies are overinvesting—a sentiment that has driven the rotation out of Big Tech into defensive sectors.

What AWS Is Building

The scale of Amazon's investment requires context. Jassy detailed the infrastructure buildout on the earnings call:

-

Power capacity: AWS added 3.99 gigawatts of power in the last 12 months—twice what the company had in 2022 when it was an $80 billion annual run rate business. AWS expects to double this again by the end of 2027.

-

Custom silicon: Amazon's Trainium chips now power "the majority" of its Bedrock AI service, providing both customer price advantages and better unit economics for AWS.

-

Project Rainier: The Anthropic partnership is scaling toward 1 million chips.

-

Agent infrastructure: Amazon launched Bedrock Agent Core and Frontier Agents for autonomous AI workloads, with developer adoption of its Kiro coding assistant growing 150% quarter-over-quarter.

The Bull and Bear Cases

The Bull Case: AWS's 24% growth rate on a $142 billion run rate is extraordinary. Backlog of $244 billion provides visibility. If AI demand materializes as Jassy expects, the current capex cycle could generate massive returns similar to AWS's core infrastructure buildout in the 2010s. Amazon's custom chips and vertical integration provide cost advantages competitors lack.

The Bear Case: The market is saying: prove it. At current spending rates, Amazon needs to generate substantially higher returns than historical cloud investments to justify the outlay. If AI monetization disappoints or competition intensifies, years of heavy spending could compress returns. The near-zero free cash flow in Q1 2025 shows how quickly capital demands can swamp operating cash flow.

What to Watch

The recovery on February 17 may be nothing more than technical—oversold conditions triggering a bounce. Several catalysts will determine whether the selloff was an overreaction or a justified repricing:

-

AWS Q1 2026 results: Any deceleration in cloud growth would validate bearish concerns about capex payback.

-

Capex trajectory: Watch for any management commentary suggesting spending flexibility or guardrails.

-

Competitive dynamics: Microsoft and Google's AI spending and growth rates will provide context for whether Amazon's investment is necessary or excessive.

-

Inference economics: Jassy pointed to inference as "the majority of the long-term AI workloads." Progress on optimization and utilization could improve the return math.

-

Customer wins: Large AI contract announcements would validate the demand thesis.

For now, Amazon has broken the bleeding. Whether $200 billion in AI infrastructure spending proves visionary or reckless will play out over years, not weeks. But with nearly half a trillion dollars in market value erased in two weeks, investors have delivered their initial verdict: show us the returns.

Related: