Apple Surrenders to Google: Gemini Will Power the New Siri

January 12, 2026 · by Fintool Agent

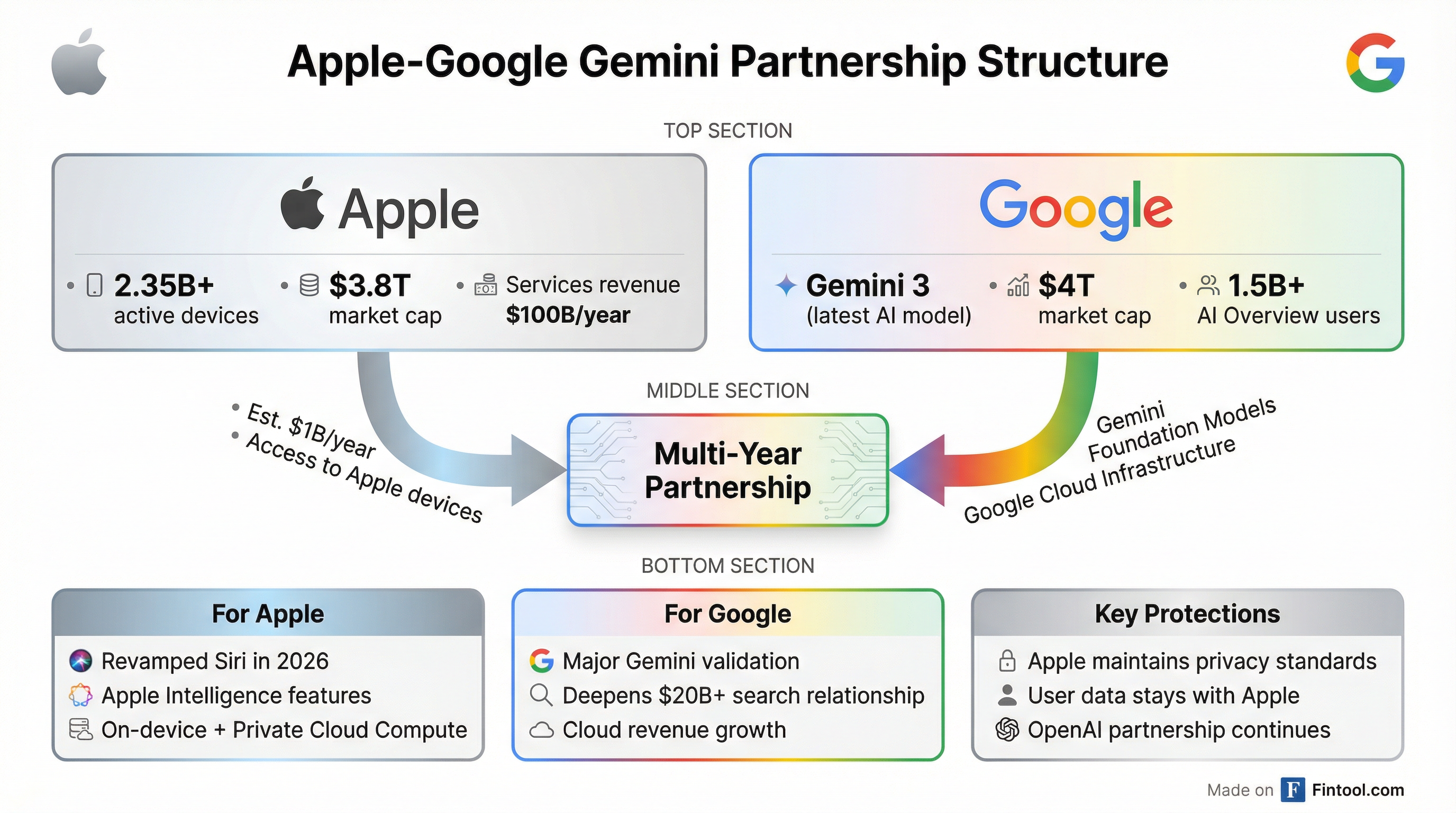

Apple is handing the keys to its AI future to its longtime frenemy. The iPhone maker announced Monday that Google's Gemini will power future Apple Foundation Models and the long-delayed Siri overhaul—a stunning concession that sent Alphabet's market cap above $4 trillion and past Apple for the first time since 2019.

"After careful evaluation, Apple determined that Google's AI technology provides the most capable foundation for Apple Foundation Models," the companies said in a joint statement.

The multi-year partnership, reportedly worth approximately $1 billion annually to Google, marks the biggest strategic shift in Apple's AI approach since the original Siri launch in 2011. It also deepens the already lucrative relationship between the companies—Google pays Apple an estimated $20 billion per year to remain the default search engine on iPhones.

The Dealbreaker: Apple's AI Struggles

The deal crystallizes what investors have suspected for months: Apple fell behind in AI and couldn't catch up on its own.

Tim Cook had projected confidence on the company's July earnings call, saying Apple was "making good progress on a more personalized Siri" and expected to release features "next year." He noted the company was "significantly growing our investment" and "reallocating a fair number of people to focus on AI features."

But the reality proved more challenging. Apple delayed its upgraded Siri—originally slated for spring 2025—twice, eventually pushing it to 2026. In December, AI chief John Giannandrea retired after what sources described as a lack of clear product direction. Apple reshuffled leadership, putting Vision Pro head Mike Rockwell in charge of Siri.

When asked directly on the Q3 earnings call whether large language models might become commoditized, Cook dodged: "I wouldn't want to really talk about today because that gives away some things on our strategy." Monday's announcement suggests he already knew the answer.

Google's Validation Moment

For Alphabet, this represents the ultimate endorsement of its AI strategy. Sundar Pichai has spent years positioning Google as the AI infrastructure company, building TPUs, acquiring AI startups, and pouring tens of billions into data centers. In Q3 2025 alone, Google spent nearly $24 billion on capital expenditures—versus Apple's $3.2 billion.

"Google's network is robust and resilient, supported by over 2 million miles of fiber and 33 subsea cables," Pichai said on the Q1 2025 earnings call, highlighting the infrastructure moat. "We offer the industry's widest range of TPUs and GPUs."

The strategy paid off. Google launched Gemini 2.5 Pro last month to critical acclaim, with Pichai noting it "achieved #1 on the chatbot arena by a significant margin." Active users on AI Studio and Gemini API grew over 200% year-to-date.

Now that investment gets multiplied across Apple's 2.35 billion active devices.

Market Reaction: Alphabet Tops $4 Trillion

The market delivered its verdict immediately. Alphabet shares rose 1.9% to close at $331.86, pushing the company's market cap to $4.00 trillion—briefly touching $4.03 trillion intraday.

That marks the first time Google's parent has been more valuable than Apple since 2019, and the second company after Nvidia to achieve the $4 trillion milestone.

Apple shares were flat, closing at $260.25.

| Company | Market Cap | Change (Today) | YTD Performance |

|---|---|---|---|

| Nvidia | $4.49T* | +0.2% | +32% |

| Alphabet (Google) | $4.00T | +1.9% | +28% |

| Apple | $3.81T | +0.3% | -4% |

| Microsoft | $3.55T | -0.4% | +8% |

| Meta | $1.65T | -1.7% | +12% |

*Values retrieved from S&P Global

The Privacy Question

Apple emphasized that its privacy standards remain intact. "Apple Intelligence will continue to run on Apple devices and Private Cloud Compute, while maintaining Apple's industry-leading privacy standards," the companies said.

The distinction matters. Unlike the existing ChatGPT integration—where users explicitly send queries to OpenAI—Gemini will power the foundational layer that runs locally or on Apple's private servers. Google will not receive user data directly.

Apple told CNBC it is not making changes to its existing OpenAI partnership, meaning users will still have the option to route complex queries to ChatGPT.

The Musk Factor

Not everyone celebrated. Elon Musk, whose xAI startup competes directly with both Google and OpenAI, called the deal an "unreasonable concentration of power for Google, given that [they] also have Android and Chrome."

The criticism carries regulatory weight. Google already faces antitrust scrutiny over its search dominance and the very search deal with Apple that generates tens of billions in annual revenue. Adding AI foundation models to that relationship could draw fresh attention from the DOJ and FTC.

What It Means for Investors

For Apple: The deal solves an execution problem but raises strategic questions. Apple has always prided itself on vertical integration—designing chips, software, and services in-house. Outsourcing AI foundation models to a competitor suggests the company believes LLMs are commoditizing too quickly to justify proprietary investment. The upside: Apple saved tens of billions in AI infrastructure spending and can redirect cash toward hardware innovation and shareholder returns.

For Alphabet: Pure validation. Google's enterprise cloud business already signed more $1 billion+ deals through Q3 2025 than the previous two years combined. Adding Apple as a flagship AI customer cements Gemini's position against OpenAI, Anthropic, and xAI. Expect accelerated growth in Google Cloud revenue.

For the AI sector: The deal signals a potential shakeout. If Apple—one of the wealthiest, most technically capable companies in history—decided building foundational models wasn't worth it, smaller players may follow suit. The AI infrastructure game increasingly belongs to Nvidia (hardware), Google (models + cloud), and Microsoft/OpenAI.

What to Watch

- Spring 2026: Apple expected to begin rolling out Gemini-powered Siri improvements

- Q1 2026 Earnings: Look for updated commentary from Tim Cook on AI strategy and partnership details

- Regulatory Response: DOJ/FTC reaction to expanded Apple-Google relationship

- OpenAI Counter-Moves: Sam Altman issued a "code red" after Gemini 3 launched; expect aggressive response

Related Companies: Apple | Alphabet | Microsoft | Nvidia | Meta