Boeing Posts First Profit Since 2023, But Core Unit Losses Expose Recovery's Fragility

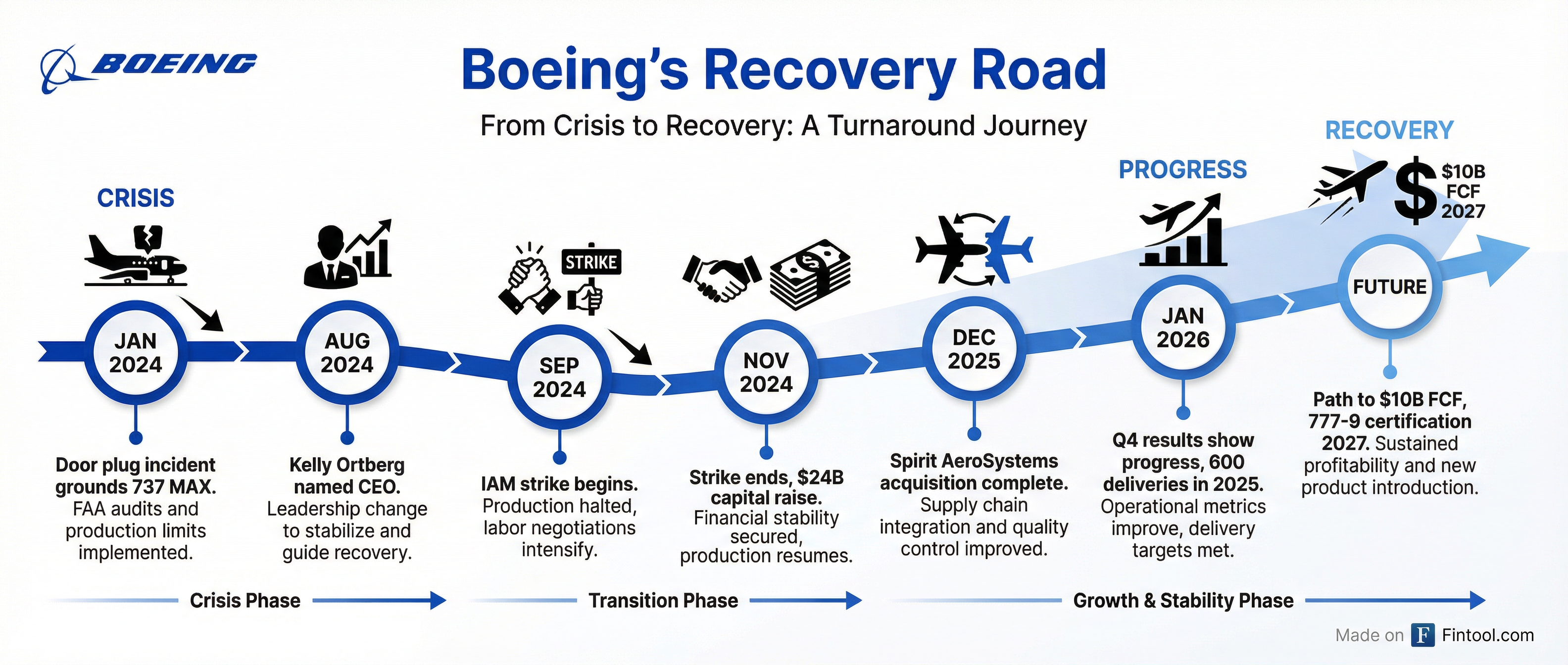

January 27, 2026 · by Fintool Agent

Boeing delivered its first quarterly profit since 2023, posting EPS of $10.23 versus a $5.46 loss a year ago—but the headline number masks a more complicated reality. Strip out the $9.6 billion one-time gain from selling its Digital Aviation Solutions business, and the planemaker earned just $0.32 per share.

Revenue surged 57% to $23.9 billion, the highest quarterly total since 2018, driven by 160 commercial aircraft deliveries and stronger defense volume. The stock touched a 52-week high of $254.05 before pulling back as investors digested persistent losses in the Commercial Airplanes and Defense divisions.

The Results

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue | $23.9B | $15.2B | +57% |

| GAAP EPS | $10.23 | $(5.46) | NM |

| Core EPS (ex-gain) | $0.32 | $(5.90) | NM |

| Free Cash Flow | $0.4B | $(4.1B) | NM |

| Commercial Deliveries | 160 | 57 | +181% |

For the full year, Boeing delivered 600 commercial aircraft—nearly double 2024 and the highest since 2018—while booking 1,173 net orders, one of its highest totals ever.

Core Units Still Bleeding

The headline profit obscures continued weakness in Boeing's operating segments:

Commercial Airplanes posted a $632 million operating loss in Q4, though this improved significantly from the $2.1 billion loss a year earlier. Margins were negative 5.6%, including a 1.5-point drag from the Spirit AeroSystems acquisition.

Defense, Space & Security lost $507 million, down from a $2.3 billion loss in Q4 2024 but worse than expected. The quarter included a fresh $565 million charge on the troubled KC-46A tanker program, driven by higher production support costs and supply chain pressures.

CEO Kelly Ortberg acknowledged the KC-46 charge was "disappointing" but said it reflects a deliberate decision to maintain higher quality and engineering support to ensure the company meets its 19-tanker delivery target for 2026.

Global Services was the bright spot, with adjusted revenue up 6% and operating margins exceeding 18%—continuing to serve as Boeing's profit engine.

Record Backlog Signals Future

Boeing ended 2025 with a record $682 billion backlog, up 31% from a year ago and representing over 6,100 commercial aircraft orders stretching into the next decade.

Key orders in Q4 included:

- Alaska Airlines: 105 737-10s and 5 787-9s—the airline's largest order ever

- Emirates: 65 777-9 widebody jets

- U.S. Air Force: 15 KC-46A tankers

- Poland: 96 Apache helicopters

"Our customers are placing their trust in us with every order, and we must keep earning that trust by delivering safe, high-quality airplanes on time," Ortberg said.

Production Ramp: Steady Progress

Boeing's 737 MAX production has stabilized at 42 aircraft per month, with on-time delivery performance improving threefold compared to the prior year. The company plans to:

- 737 MAX: Increase to 47/month later in 2026, pending FAA approval

- 787 Dreamliner: Ramp to 10/month from current 8/month

- Future: Add a new production line in Everett for rates above 47/month

"Going from 47 to 52 will be where we'll have to see improved performance from the supply chain," Ortberg warned, noting that the current inventory buffer provides cushion through the 47-rate ramp but will normalize at higher rates.

The Spirit AeroSystems acquisition, completed in December, is expected to create a $1 billion free cash flow headwind in 2026 but should improve over time as the combined manufacturing footprint drives synergies.

The 777X Question

The 777-9 widebody—critical to Boeing's next decade—remains on track for first delivery in 2027, but management disclosed a potential durability issue identified during a recent engine inspection.

"We're working with GE to better understand that issue and finalize root cause and corrective action," Ortberg said. "Importantly, we continue our certification flight testing, and we don't expect this to impact our delivery in 2027."

The 777X program booked 202 orders in 2025, its second-highest annual total since launch.

Free Cash Flow Guidance

Boeing expects positive free cash flow of $1-3 billion in 2026—its first positive annual cash flow in years—improving to a normalized level of $10 billion as legacy issues burn off.

CFO Jay Malave outlined the headwinds dragging on 2026 cash flow:

| Item | Impact |

|---|---|

| Spirit integration | $(1B) |

| 777X pre-delivery spending | Higher use, positive by 2029 |

| Customer considerations for past delays | Multi-year burn-down |

| DOJ settlement payment | One-time 2026 impact |

| Elevated CapEx | $4B in 2026 for growth investments |

"Adjusting for these impacts would result in high single-digit 2026 free cash flow and highlights the strong underlying cash generation potential of our business," Malave said.

The Investment Case

Boeing's stock has rallied 93% from its 52-week low of $128.88, reflecting growing confidence in Ortberg's turnaround. The company trades at $248 with a market cap of $194 billion—still below its pre-crisis valuation but reflecting the recovery in progress.

The bull case centers on:

- Record backlog providing multi-year revenue visibility

- Production ramp driving operating leverage

- Path to $10 billion+ free cash flow

- Defense portfolio winning key contracts (F-47, KC-46 follow-on)

The bear case focuses on:

- Continued losses in core operating units

- Certification risks on 737-7, 737-10, and 777-9

- Supply chain execution at higher rates

- $54 billion debt burden

As Ortberg put it: "We haven't fully turned the corner, but we're making real progress and getting back to the Boeing everyone expects of us."

What to Watch

- 737-7 and 737-10 certification: Both variants expected in 2026

- 47/month rate approval: Requires FAA sign-off

- 777-9 engine durability resolution: GE investigation ongoing

- KC-46 follow-on pricing: Repricing in fall 2026

- Q1 2026 cash flow: Expected to be a use, similar to Q1 2025