China Mandates 50% Domestic Equipment for Chipmakers, Threatening $18B in US Sales

December 30, 2025 · by Fintool Agent

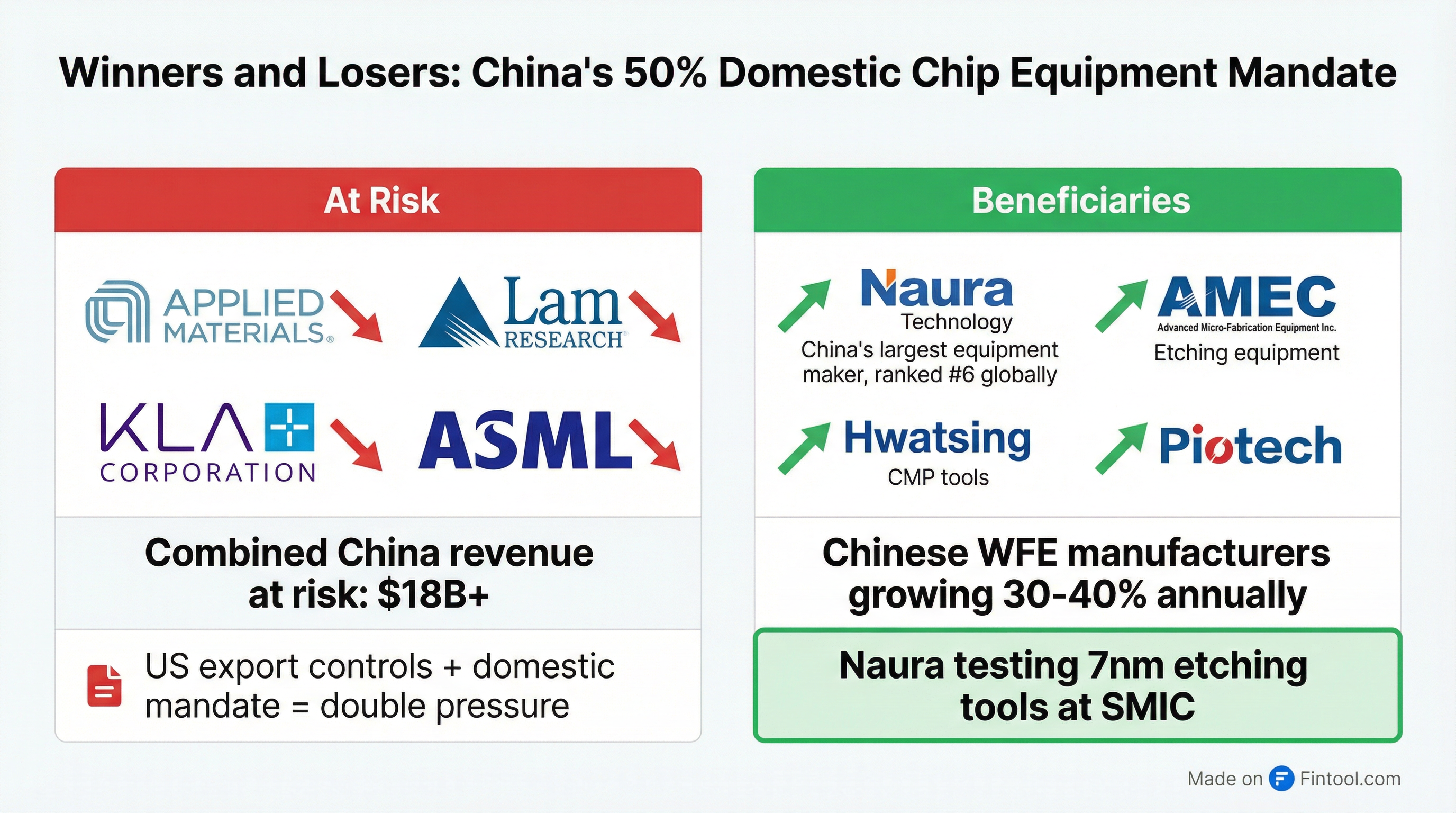

Beijing is requiring Chinese chipmakers to use at least 50% domestically manufactured equipment for any new fabrication capacity, according to a Reuters exclusive citing three people familiar with the matter. The policy—not publicly documented—threatens over $18 billion in combined China revenue for Applied Materials, Lam Research, and Kla Corporation, accelerating the tech decoupling between the world's two largest economies.

Chipmakers seeking state approval to build or expand plants must now prove through procurement tenders that at least half their equipment will be Chinese-made. Applications failing the threshold are typically rejected, though authorities grant flexibility for advanced production lines where domestic alternatives don't yet exist.

"Authorities prefer if it is much higher than 50%," one source told Reuters. "Eventually they are aiming for the plants to use 100% domestic equipment."

The Revenue at Risk

The mandate arrives as US semiconductor equipment makers are already seeing their China exposure decline due to Washington's export restrictions. But the 50% rule forces Chinese fabs to choose domestic suppliers even in areas where foreign equipment remains available—a significant escalation.

| Company | FY25 China Revenue | % of Total | YoY Change |

|---|---|---|---|

| Applied Materials | $8.53B | 30% | Down from 37% |

| KLA Corporation | $4.04B | 33% | Down from 43% |

| Lam Research | $5.87B (TTM) | 31% | Flattish |

Applied Materials CFO Brice Hill acknowledged the shifting dynamics on the company's August earnings call: "We expect China as a percentage of our revenue in Q4 to decrease to approximately 29%... we expect that to last a little bit longer, you know, several quarters longer where the business will be less than 2024."

The company has also accumulated a "significant backlog" of pending export licenses from the US government, with no revenue from those applications included in guidance.

China's Equipment Champions Rise

The policy is already yielding results. Beijing-based Naura Technology—now the world's sixth-largest semiconductor equipment manufacturer—is testing its etching tools on SMIC's cutting-edge 7nm production line, according to Reuters, after successfully deploying tools on 14nm processes.

Chinese equipment manufacturers have been growing 30-40% annually over the past five years, compared to ~10% growth for US, European, and Japanese incumbents. Naura's 2024 revenue is expected to grow 25-44% year-over-year, driven by product breakthroughs and expanded domestic market share.

State-affiliated entities placed a record 421 orders for domestic lithography machines and parts this year worth approximately 850 million yuan (~$121 million), signaling surging demand for locally developed technologies.

Key Chinese Equipment Winners:

| Company | Specialty | Status |

|---|---|---|

| Naura Technology | Etching, deposition, clean | #6 globally; testing 7nm tools at SMIC |

| AMEC | Etching equipment | Advanced capability for dielectric and conductor etch |

| Hwatsing Technology | CMP (polishing) tools | +8pp China market share since 2019; added to US Entity List Dec 2024 |

| Piotech | Deposition equipment | Rapid growth in thin-film deposition |

The "Whole Nation" Approach

President Xi Jinping has been calling for a "whole nation" effort to build a fully self-sufficient domestic semiconductor supply chain. The effort spans the entire supply-chain spectrum—Reuters reported earlier this month that Chinese scientists are working on a prototype of a machine capable of producing cutting-edge chips, an outcome Washington has spent years trying to prevent.

Beijing has poured hundreds of billions of yuan into its semiconductor sector through the "Big Fund," which established a third phase in 2024 with 344 billion yuan ($49 billion) in capital.

China has now reached roughly 50% self-sufficiency in photoresist-removal and cleaning equipment, a market previously dominated by Japanese firms but now locally led by Naura. In dry stripping tools, Naura entered the market for the first time in 2024 and already accounts for 7% market share.

Financial Impact on US Equipment Makers

Despite the headwinds, US equipment makers have shown resilience. All three majors delivered strong fiscal 2025 results:

| Company | FY25 Revenue | YoY Growth | Gross Margin |

|---|---|---|---|

| Applied Materials | $28.4B | +4.4% | 48.7% |

| Lam Research | $18.4B | +23.7% | 48.7% |

| KLA Corporation | $12.2B | +23.9% | 60.9% |

The strength reflects booming demand for AI-related semiconductor production outside China. Taiwan and Korea have picked up significant share as leading-edge logic and memory investments surge. Kla CEO Rick Wallace noted the company doesn't need peak WFE levels to hit its 2026 plan given share gains: "Our share of WFE is approaching 8%... we're pretty well positioned from a share of WFE point of view."

Applied Materials emphasized that outside of China, it "grew faster than our peer group, thanks to our strength in leading edge foundry and DRAM."

Investment Implications

Near-term risks for incumbents:

- China revenue declines will continue for "several quarters" (per AMAT guidance)

- Export license backlogs unlikely to resolve quickly

- Tariff headwinds compound equipment restrictions

Structural shifts favoring non-China exposure:

- Taiwan revenue surged 71% YoY for AMAT in FY25; 92% for KLA

- Korea investment accelerating (+25% YoY for AMAT)

- Advanced packaging and HBM driving incremental demand

The broader picture: US export controls, combined with China's domestic mandate, create a self-reinforcing cycle. Chinese fabs that once preferred US equipment now have no choice but to work with domestic suppliers. As those suppliers gain volume and revenue, they can invest in R&D to close the technology gap faster—a dynamic already visible in etching, CMP, and cleaning equipment.

The question for investors: Can US equipment makers offset China losses with gains elsewhere? The AI capex cycle suggests yes for now. But the 50% mandate—with an eventual target of 100%—signals that China's semiconductor equipment market may be structurally impaired for Western companies for years to come.

What to Watch

- Q1 2026 earnings: First full quarter under widespread 50% enforcement

- Export license decisions: AMAT's "significant backlog" could move the needle if approvals come

- Naura's 7nm qualification: Full production deployment would mark a major milestone

- ASML exposure: Dutch lithography giant's China revenue (~20%) also at risk from domestic alternatives

Related Companies: Applied Materials · Lam Research · Kla Corporation · Asml · Nvidia · Intel · Teradyne