Ciena Rejoins S&P 500 After 17 Years as AI Demand Transforms the Dot-Com Survivor

February 5, 2026 · by Fintool Agent

Ciena will rejoin the S&P 500 on February 9, completing a remarkable turnaround 17 years after being removed from the benchmark and replaced by Visa. The optical networking equipment maker's return reflects how AI infrastructure demand has transformed a dot-com survivor into a critical supplier for hyperscalers building the backbone of generative AI.

The stock has surged 197% over the past year, rising from around $85 to $253, with shares touching an all-time high of $285.97 on the day the index addition was announced.

Ciena replaces Dayforce in the index after Thoma Bravo completed its $12.3 billion acquisition of the human capital management software company.

From Dot-Com Darling to AI Infrastructure Leader

Ciena's journey mirrors the arc of the technology industry itself. The company first joined the S&P 500 in August 2001, riding the dot-com and telecom boom that had made it a market darling. But the bust that followed was brutal—Ciena was removed from the index on December 18, 2009, replaced by a newly-public Visa that would go on to become one of the largest companies in the world.

Now the roles have reversed. While Ciena returns, the company it replaces—Dayforce—is going private in a deal backed by the world's largest software-focused private equity firm.

AI: The New Growth Engine

The transformation is powered by artificial intelligence. CEO Gary Smith described the opportunity on the company's Q4 2025 earnings call:

"The simple truth is that AI continues to drive network expansion across all our customer segments, and the scale of investment currently underway is massive and accelerating faster than anything we, or indeed the industry, have seen to date."

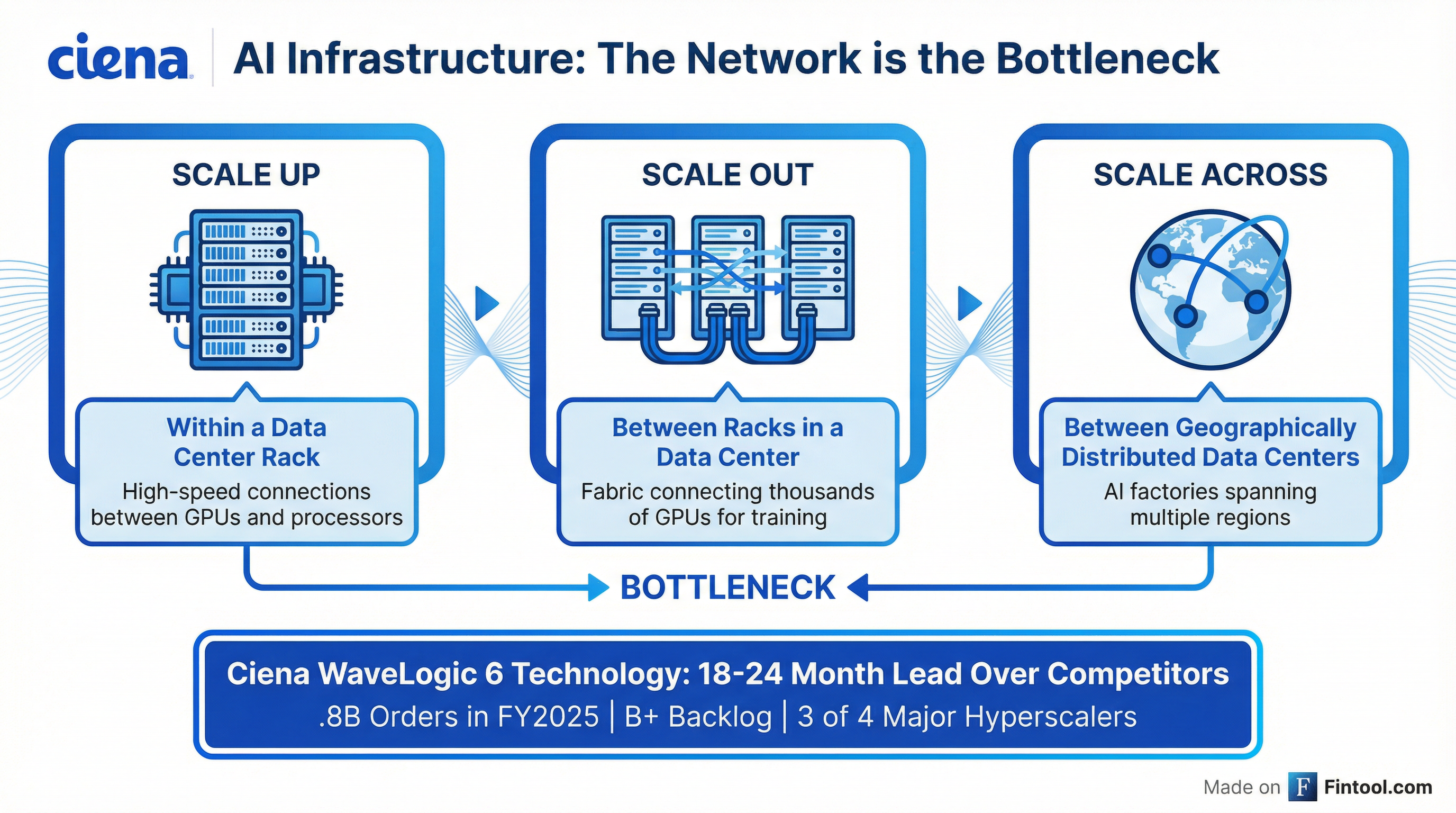

Ciena's "in and around the data center" opportunities—serving AI infrastructure with optical connectivity—grew threefold from 2024 to 2025 and are expected to be a major contributor to 2026 growth.

The company has won deals with three of the four major hyperscalers for their "scale-across" training architectures, which link geographically distributed AI training clusters. These deals are valued in the "hundreds of millions each," according to Smith.

Record Results and Accelerating Guidance

Ciena delivered record results in fiscal 2025, with revenue of $4.77 billion (+19% YoY) and EPS of $2.64 (+45% YoY). The company generated a record $7.8 billion in orders during the year, well above the revenue it generated, resulting in a record backlog.

For fiscal 2026, management guided for approximately 24% revenue growth to $5.7-6.1 billion, which would be the company's fastest expansion since 2011. EPS is expected to more than double to approximately $5.34.*

| Metric | FY 2024 | FY 2025 | FY 2026E | YoY Growth |

|---|---|---|---|---|

| Revenue ($B) | $4.01 | $4.77 | $5.95* | +25% |

| EPS | $1.82 | $2.64 | $5.34* | +102% |

| Orders ($B) | $4.3 | $7.8 | — | +81% |

*Estimates from S&P Global

Customer Concentration: A Double-Edged Sword

The growth comes with concentration risk. Nearly 18% of Ciena's fiscal 2025 revenue came from a single unnamed cloud provider, while AT&T contributed about 11%. This reliance on a small number of large customers creates vulnerability if spending patterns shift.

However, management emphasized that demand is accelerating across both cloud providers and service providers:

- Cloud provider orders are "very strong and ramping across our portfolio"

- Service provider orders were up 70% for the year

- Implementation services revenue increased 34% in fiscal 2025, indicating real deployment activity rather than inventory accumulation

The WaveLogic Moat

Ciena's competitive advantage centers on its WaveLogic coherent optical technology, which management claims provides an 18-24 month lead over competitors. The company has invested heavily in next-generation products:

- WaveLogic 6 Nano 800G pluggables shipped for initial revenue in Q4

- Three additional cloud providers received 800 ZR plugs for testing since quarter end

- The Nubis Communications acquisition positions Ciena for inside-the-data-center opportunities

The optical networking market has consolidated significantly, with Nokia's acquisition of Infinera removing a competitor. This improved industry structure should support pricing power and margin expansion.

What Index Inclusion Means

S&P 500 inclusion typically drives significant buying from index funds and passive investors who must hold the stock. Other technology companies that entered the S&P 500 in 2025—including AppLovin, Datadog, DoorDash, and Robinhood—saw their shares rally ahead of inclusion.

The inclusion reflects a broader shift in the index toward AI infrastructure beneficiaries. As The Wall Street Journal reported, SpaceX and other startups planning IPOs have contacted index providers about potentially joining key indexes more quickly than usual.

Risks to Monitor

Despite the momentum, investors should watch:

- Customer concentration: 18% from one cloud provider creates vulnerability

- Supply constraints: Management acknowledged extended lead times and is expanding capacity

- Valuation: The stock trades at approximately 48x forward P/E, pricing in significant growth

- Margin pressure: Gross margins of ~42% are below the mid-40s target management is working toward

- Insider selling: Recent SEC filings show notable insider sales, though this is common when stocks appreciate significantly

The Bottom Line

Ciena's return to the S&P 500 is more than an index change—it's validation of the company's transformation from dot-com survivor to AI infrastructure leader. The same forces that drove Ciena's collapse in the early 2000s—the need for high-speed networking infrastructure—are now driving its resurgence, this time powered by hyperscaler AI ambitions rather than telecom overbuilding.

The company's $7.8 billion in orders and 24% revenue growth guidance suggest the AI networking supercycle is still in early innings. Whether Ciena can sustain this trajectory depends on its ability to maintain technology leadership, manage customer concentration, and convert its massive backlog into profitable growth.

Related: Ciena · Visa · AT&T · Meta Platforms