Cloudflare Surges 24% as Viral AI Agent 'Clawdbot' Validates Agentic Infrastructure Thesis

January 27, 2026 · by Fintool Agent

Cloudflare shares surged 24% over two days—adding $15 billion in market cap—after a viral open-source AI agent called "Clawdbot" thrust the company into the spotlight as essential infrastructure for the emerging agentic AI ecosystem. The stock hit $215, its highest level in months, on 3x normal volume.

The catalyst wasn't a product launch or earnings beat. It was developers sharing on social media how they use Cloudflare Tunnels to securely host and run Clawdbot—an AI assistant built on Anthropic's Claude that executes tasks autonomously rather than simply answering prompts. The viral moment validated what CEO Matthew Prince has been telling investors for quarters: as AI shifts from answering questions to taking action, Cloudflare sits at the center of it all.

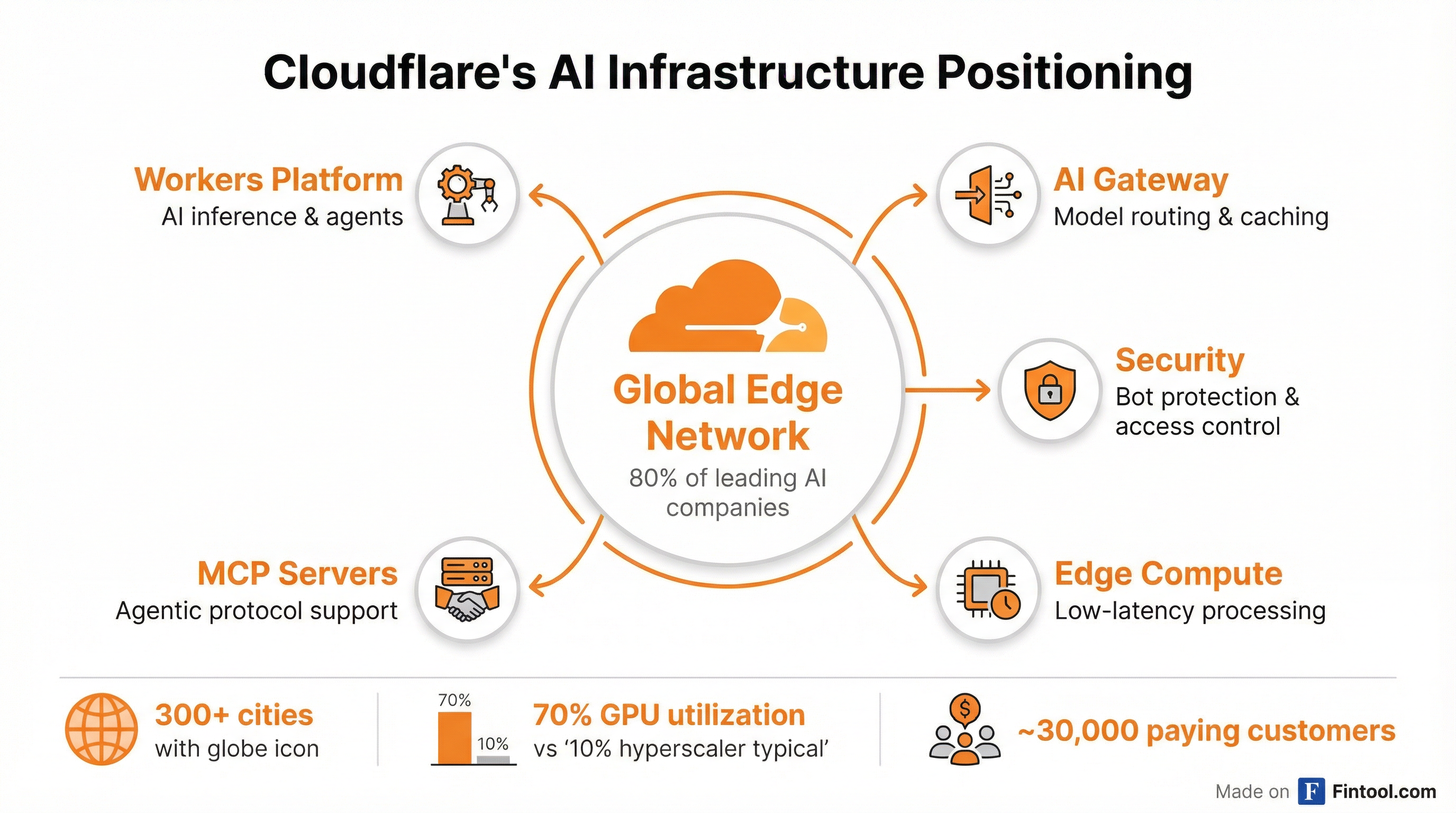

"We estimate 80% of the leading AI companies already rely on us," Prince said on the Q3 2025 earnings call. "A huge percentage of the internet sits behind us. The agents of the future will inherently have to pass through our network and abide by its rules."

The Agentic AI Thesis Comes to Life

Clawdbot represents a new category of AI tools—"agentic" systems designed to execute multi-step tasks autonomously. Unlike chatbots that respond to prompts, these agents browse the web, interact with APIs, manage calendars, and complete workflows with minimal human intervention.

The connection to Cloudflare is architectural. Developers running Clawdbot locally need secure, low-latency connections to the internet. Cloudflare Tunnels provide exactly that—a way to expose locally-run AI agents to the web without opening firewall ports or exposing servers directly. The company's AI Gateway also supports Anthropic's Claude, the model powering Clawdbot.

"As agentic tools like Clawdbot scale—making more API calls, hitting more websites, generating more traffic—we believe NET is positioned to capture that activity," Wolfe Research analyst Joshua Tilton wrote in a note.

"Act Four": Cloudflare's Agentic Web Strategy

Prince has framed the opportunity in theatrical terms. Act One was Cloudflare's reverse proxy products (WAF, DDoS protection). Act Two was forward proxy (Zero Trust, VPN). Act Three is the Workers developer platform. Now, the company is calling its AI and agentic commerce initiatives "Act Four."

"What we're doing to help publishers empower agentic transactions is a big enough deal to us that we've begun to refer to it internally as Act Four," Prince said on the Q2 2025 call. "Now you may not know this, but I was an English literature major in college. I read a lot of Shakespeare, and all of his plays had five acts. So don't think we're done here."

The strategy has multiple dimensions:

- Workers AI: A serverless platform for running AI inference with pay-per-use pricing, avoiding the year-long VM commitments hyperscalers require

- AI Gateway: Routes AI requests efficiently, with some customers seeing 10x price-performance improvement via caching

- MCP Servers: Support for Anthropic's Model Context Protocol, allowing AI agents to securely interact with third-party services

- Pay-per-crawl: A new business model helping publishers monetize AI traffic

The Efficiency Advantage

Prince has been particularly vocal about Cloudflare's cost advantage for AI workloads. The key insight: hyperscalers rent you servers, while Cloudflare sells completed work.

"Where a typical customer is seeing sub-10% utilization across their GPUs, our peak utilization of GPUs is now around 70%," Prince explained on the Q4 2024 call. "That effectively means we can get 7x the amount of work out of $1 of CapEx spent in this area than you can with the various hyperscalers."

The serverless model is particularly suited to AI agents, which have highly variable workloads. Agents sit idle most of the time, then burst when invoked. A hyperscaler model forces customers to pay for provisioned capacity; Cloudflare charges only when inference actually runs.

"Our business is not renting you a machine. Our business is selling you the actual inference task," Prince said. "When the agent is actually invoked and it's doing work, you pay for that. If it's not, you don't pay for it at all."

Financial Momentum

The AI thesis comes amid accelerating financial performance. Revenue grew 31% year-over-year in Q3 2025—the second consecutive quarter of re-acceleration after a slowdown in 2024.

| Metric | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|

| Revenue ($M) | $430 | $460 | $479 | $512 | $562 |

| YoY Growth | 28.2% | 26.9% | 26.5% | 27.7% | 30.7% |

| Gross Margin | 77.7% | 76.4% | 75.9% | 74.9% | 74.0% |

| Cash from Ops ($M) | $105 | $127 | $146 | $100 | $167 |

Large customer growth is particularly strong. Customers paying more than $100K annually increased 23% year-over-year to over 4,000, and revenue contribution from large customers rose to 73% of total. Dollar-based net retention accelerated to 119%, up 5 percentage points sequentially.

Consensus expects continued momentum. Analysts project Q4 2025 revenue of $591 million and full-year 2026 revenue climbing toward $2.6 billion.*

Analyst Upgrades and Price Targets

The Clawdbot-driven surge prompted renewed analyst attention:

-

TD Cowen: Reiterated Buy rating with $265 price target, citing healthy security demand and recent acquisitions including Human Native (AI data marketplace) and the Astro web framework team

-

RBC Capital: Identified Cloudflare as a "Tier 1 AI winner" through its inferencing opportunity, Workers platform, and pay-per-crawl services. Also flagged cybersecurity companies that could benefit from AI agent adoption

-

Citizens: Maintained Market Outperform with $270 target, noting Cloudflare's network is well-positioned to support emerging agentic architectures

At $215, Cloudflare trades at roughly 25x forward revenue and commands a $75 billion market cap. The premium valuation reflects both the re-accelerating growth and the optionality around AI infrastructure.

What to Watch

February 10 earnings: Investors will scrutinize whether AI-related activity is translating into actual traffic and revenue growth. The company hasn't broken out AI-specific metrics, but commentary on Workers AI adoption and AI Gateway usage will be closely parsed.

The hyperscaler response: Microsoft, Google, and Amazon all have edge computing offerings. The question is whether Cloudflare's serverless model and global network provide a defensible advantage for agentic workloads, or whether hyperscalers can replicate the offering.

Model Context Protocol adoption: Cloudflare's partnership with Anthropic on MCP servers is early-stage. Broader adoption of agentic protocols—whether Anthropic's MCP, Google's extensions, or Microsoft's approach—will determine how much traffic flows through Cloudflare's network.

The sustainability question: Prince has cautioned that AI inference is still "de minimis" as a share of revenue. The viral moment generated excitement, but the financial impact of agentic AI on Cloudflare's business remains to be proven.

The Bottom Line

The Clawdbot surge is less about one viral project and more about what it represents: AI is transitioning from chatbots to agents, and agents need infrastructure. Cloudflare has spent years positioning itself at the center of internet traffic, and that positioning is now intersecting with the hottest theme in technology.

"I don't know exactly what the future will look like, but I believe Cloudflare will be one of the key players helping shape it," Prince said. "We'll make sure the tools to participate in that future are available to all businesses, large and small. It's what we've always done."

Whether the stock move holds depends on whether the thesis translates to revenue. The February earnings call will provide the first real test.

*Values retrieved from S&P Global