Copper Blasts Past $14,000: Biggest One-Day Jump in 15 Years as AI Demand Ignites Metals Frenzy

January 29, 2026 · by Fintool Agent

Copper just recorded its biggest single-day surge in more than 15 years, rocketing to an all-time high above $14,000 per metric ton as a global metals frenzy intensifies.

Benchmark three-month copper on the London Metal Exchange jumped 11% to $14,527.50 per ton Thursday—shattering the previous record of $13,000 set earlier this month—before settling back to $13,612.50 by late trading, still up 4%. The move marked the largest one-day percentage gain since 2011.

The copper surge was part of a broader metals mania. Gold climbed 2.3% to $5,540 an ounce, extending its January gain to about 30%. Silver hit an all-time high. Tin touched another record above $59,000 per ton. Aluminum reached its highest level since April 2022.

For copper miners, the math is extraordinary. At current prices, each pound of copper is worth roughly $6.50—more than double where it traded just two years ago.

The Forces Behind the Surge

Three converging forces are driving the copper frenzy:

1. AI Infrastructure Demand

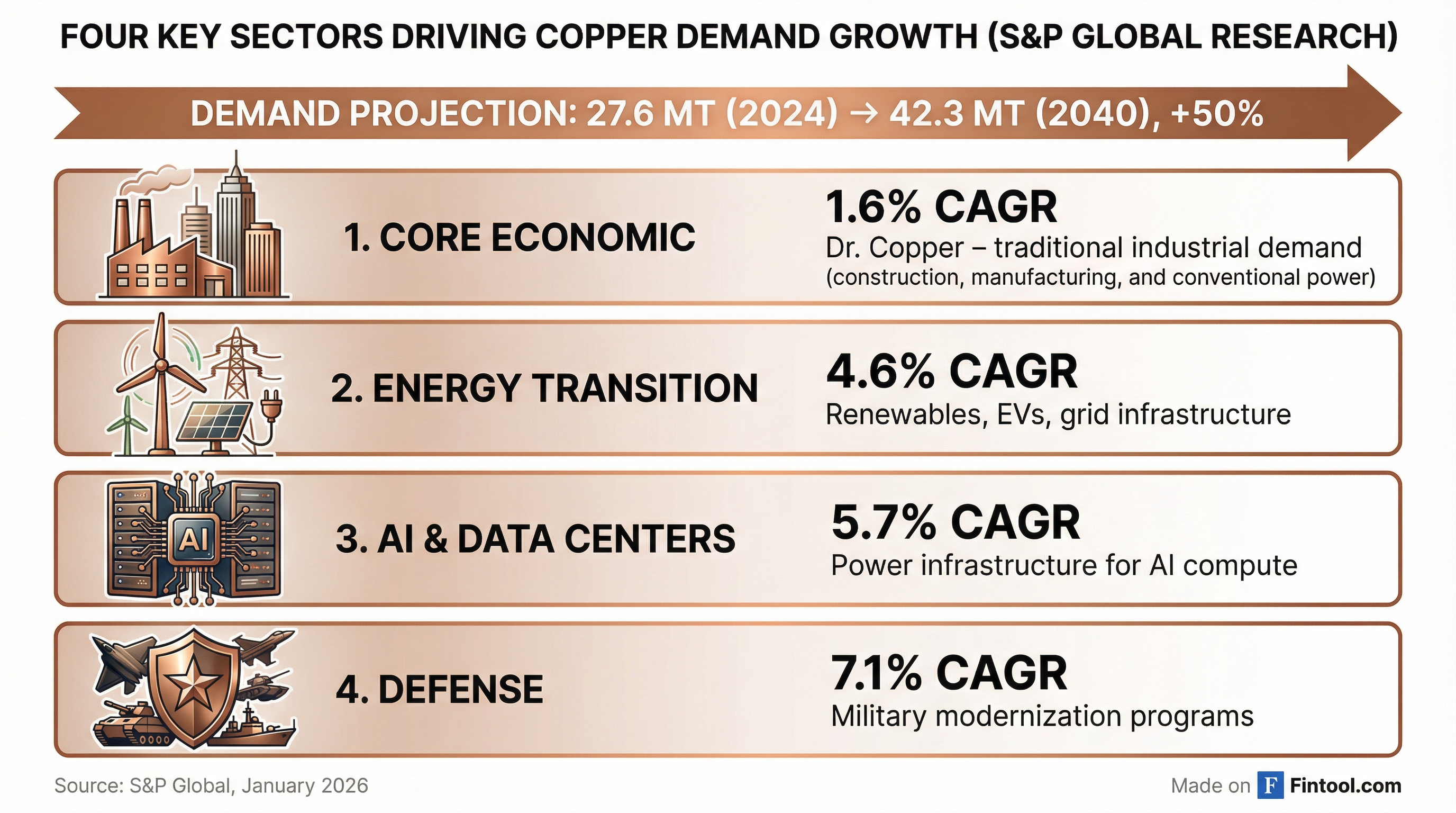

Data centers powering the AI boom require enormous amounts of electricity—and copper is the essential conductor. A new S&P Global study published this month, "Copper in the Age of AI," projects copper demand to hit 42 million metric tons by 2040, up 50% from current levels.

The study, led by S&P Global Vice Chairman Dan Yergin, identifies four key demand drivers with AI and data centers growing at a 5.7% compound annual rate—faster than any other sector. Defense modernization (7.1% CAGR), energy transition (4.6%), and core economic demand (1.6%) round out the picture.

"Across all four vectors, growth in electricity relies heavily on copper as its essential conductor," the study concluded.

2. Dollar Collapse

The U.S. dollar has been in freefall, dropping to multi-year lows against major currencies. A weaker dollar makes commodities priced in the greenback cheaper for foreign buyers, spurring demand.

Speculation that the next Federal Reserve chair will be more dovish than Jerome Powell has added fuel to the rally.

3. Supply Disruptions

Mine outages have tightened physical supply. Freeport-mcmoran is still working to restore production at Indonesia's Grasberg mine following a fatal accident, with copper output there down 38.5% year-over-year in Q4. A strike at Capstone Copper's Mantoverde mine in Chile has added to supply concerns.

Freeport expects Grasberg to reach roughly 85% of normal production by the second half of 2026.

Mining Stocks Surge

Copper mining stocks ripped higher Thursday:

| Company | Ticker | Move |

|---|---|---|

| Ero Copper | ERO | +7.0% |

| Hudbay Minerals | HBM | +6.0% |

| Southern Copper | SCCO | +5.5% |

| Freeport-mcmoran | FCX | +5.0% |

| Taseko Mines | TGB | +4.0% |

| Ivanhoe Electric | IE | +3.0% |

Freeport-mcmoran, the world's largest publicly traded copper producer, has seen its stock surge 69% over the past year to around $61. The company generated $9.9 billion in adjusted EBITDA in 2025 and produced 3.4 billion pounds of copper.

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($B) | $5.7 | $7.6 | $7.0 | $5.6 |

| Net Income ($M) | $352 | $772 | $674 | $406 |

| EBITDA Margin | 30.9%* | 40.9%* | 37.0%* | 24.1%* |

*Values retrieved from S&P Global

"Metal of Electrification"

Freeport calls copper the "metal of electrification"—and the numbers back it up. Over 65% of the world's copper goes into applications that deliver electricity, from power grids to EV charging stations to data center infrastructure.

The company believes "fundamentals for copper are favorable with growing demand supported by copper's critical role in the global transition to renewable power, electric vehicles and other carbon-reduction initiatives, continued urbanization in developing countries, data centers, increased defense spending and growing connectivity globally."

Copper was added to the U.S. Geological Survey's List of Critical Minerals in November 2025, underscoring its strategic importance.

The Bear Case: "Unsustainable"

Not everyone is convinced the rally can last.

"We expect copper to trade in a new higher normal range, but looking across the year, we see prices for copper above $13,000 per ton as unsustainable," said Natalie Scott-Gray at StoneX.

Analysts surveyed by Reuters now expect copper to average $11,975 per ton in 2026—the highest consensus forecast ever, but well below current peaks. The median forecast is up 14% from October, reflecting rapidly shifting sentiment.

The concern: speculative money, particularly from Chinese futures traders, is driving prices beyond what physical supply and demand can justify. January was already the busiest month on record for copper trading on the Shanghai Futures Exchange, and Thursday marked the second-biggest daily trading volumes ever.

"This is all driven by speculative funds," said Yan Weijun, head of nonferrous metals research at Chinese trader Xiamen C&D Inc. "It's likely all Chinese money given the surge is in Asian hours."

The Tariff Wild Card

U.S. trade policy adds another layer of uncertainty. A 50% tariff on semi-finished copper products took effect in August 2025, though refined copper remains exempt for now. The Commerce Department is expected to rule by mid-2026 on whether to impose additional tariffs of 15% on refined copper starting in 2027, potentially rising to 30% in 2028.

The tariff speculation has already distorted global copper flows, with traders shipping metal to the U.S. to capture premiums over London prices. The COMEX-LME spread has widened significantly, with U.S. copper trading at persistent premiums.

What to Watch

The copper rally hinges on several key variables:

-

AI Capex: Meta just guided to $135 billion in 2026 AI spending. Microsoft is deploying record capex. Every dollar of AI infrastructure flows through copper.

-

Grasberg Recovery: Freeport's Indonesia mine restart will significantly impact global supply. The company cut its 2026 copper production outlook by 50 million pounds to 3.4 billion pounds.

-

Dollar Direction: If the greenback continues weakening, commodity prices could stay elevated regardless of fundamentals.

-

Chinese Demand: The Shanghai speculative frenzy shows no signs of abating. Whether physical demand catches up to financial positioning will determine whether prices hold.

For investors, the copper rally is a pure expression of the AI infrastructure theme—but with commodity volatility that can work both ways. Mining stocks offer leverage to the upside, but also carry operational risks from mine accidents, labor disputes, and political instability in key producing regions.

The question isn't whether copper demand will grow. It's whether $14,000 copper has already priced in a decade of that growth.

Related