Dow Slashes 4,500 Jobs in AI-Driven Overhaul as Q4 Loss Widens

January 29, 2026 · by Fintool Agent

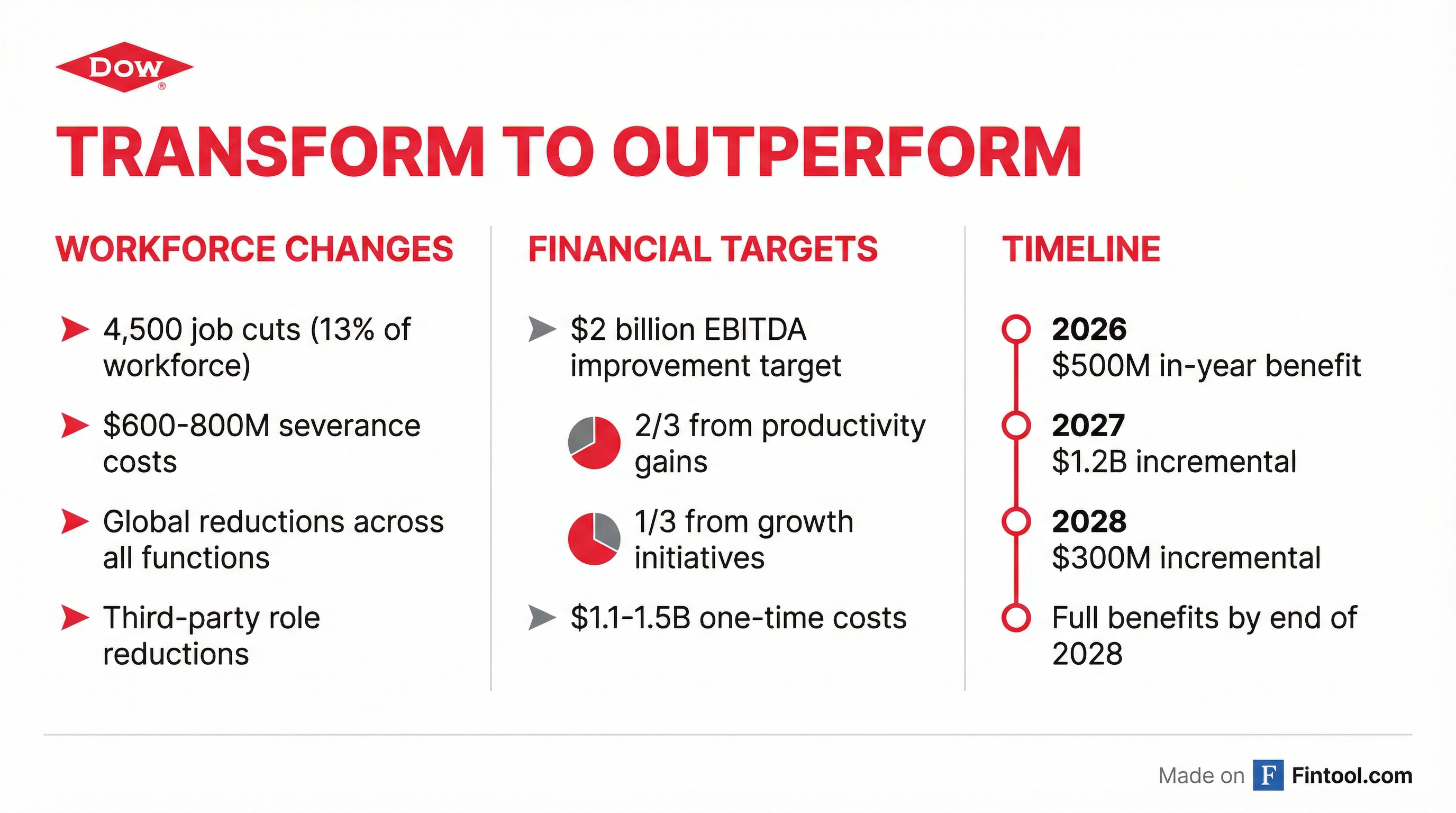

Dow Inc. is cutting 4,500 jobs—roughly 13% of its global workforce—as the chemicals giant launches a sweeping restructuring program called "Transform to Outperform" that leverages artificial intelligence and automation to combat a prolonged industry downturn.

The announcement, made alongside weak fourth-quarter results showing a $1.5 billion net loss, sent shares tumbling approximately 6% to around $26 in early trading—more than 35% below the stock's 52-week high of $40.09.

The Numbers Behind the Pain

Dow's Q4 2025 results underscore why management is taking drastic action:

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Net Sales | $9.5B | $10.4B | -9% |

| GAAP Net Income (Loss) | $(1.5B) | $(35M) | -$1.4B |

| Operating EBIT | $33M | $454M | -93% |

| Operating EBITDA | $741M | $1.2B | -39% |

| GAAP EPS | $(2.15) | $(0.08) | -$2.07 |

For full-year 2025, Dow delivered net sales of $40.0 billion and a GAAP net loss of $2.4 billion—a dramatic reversal from net income of $1.2 billion in 2024.

"Dow's self-help measures continue to gain traction and were evident in our fourth quarter results," said CEO Jim Fitterling, noting the company achieved "well over half" of its targeted $6.5 billion in near-term cash and cost support actions.

Transform to Outperform: A Radical Simplification

The restructuring program represents what COO Karen Carter called "a comprehensive and radical simplification of our operating model."

Key program elements:

- Workforce reduction: 4,500 Dow roles plus third-party contractor reductions

- Severance costs: $600-800 million

- Implementation costs: $500-700 million in additional one-time expenses

- Total one-time costs: $1.1-1.5 billion

Target benefits:

| Year | Expected EBITDA Benefit | Implementation Cost |

|---|---|---|

| 2026 | $500M in-year | $800M-$1B |

| 2027 | $1.2B incremental | $300-500M |

| 2028 | $300M incremental | $0 |

| Total | $2B+ EBITDA uplift | $1.1-1.5B |

Approximately two-thirds of the $2 billion target will come from productivity improvements, with the remaining one-third from growth initiatives.

AI and Automation at the Core

The restructuring isn't just about headcount—it's fundamentally about how Dow operates. Management emphasized that AI and automation will drive step-change productivity improvements across the organization.

"We will also adopt new ways of working," Carter explained. "This includes streamlining all of our end-to-end work processes by leveraging the power of automation and AI, which we expect will result in lower costs and improved efficiency across the entire organization."

Specific AI applications already in use at Dow include:

- Legal: Patent research and case discovery automation

- Operations: Drone and crawler inspections replacing costly scaffolding during turnarounds

- Data analytics: An "intelligent data hub" built over recent years provides high-quality data for AI applications

CEO Fitterling noted this represents "a reengineering or rewiring of the way we do business globally."

Alberta "Path to Zero" Project Delayed

Alongside the restructuring, Dow announced a two-year delay to its flagship Path to Zero integrated ethylene cracker project in Fort Saskatchewan, Alberta. Phase one startup has moved from 2027 to late 2029.

"After careful analysis and collaboration with all of our project partners, we have determined that completing the project with a 2-year delay is the most value-creating option," Fitterling said.

The delay reflects efforts to align capital deployment with market conditions. The project is now expected to deliver returns of 8-10%, down from earlier projections due to capitalized interest costs from the delay. However, low-carbon product premiums—not included in the base model—could add 100-200 basis points to returns.

Part of a Broader Layoff Wave

Dow's announcement comes amid a wave of major corporate layoffs this week:

| Company | Job Cuts | Notes |

|---|---|---|

| Amazon | 16,000 | Third round in recent months |

| Ups | 30,000 | On top of 48,000 cut in 2025 |

| Undisclosed | Partially due to AI adoption | |

| Home Depot | 800 | Corporate roles, mostly remote |

| Dow | 4,500 | 13% of workforce |

Consumer confidence about the job market has plummeted to its lowest level since 2014, reflecting a "no-hire, no-fire" labor market standstill.

Stock Under Pressure

Dow shares have struggled over the past year amid the prolonged industry downturn. The stock fell 6% on the restructuring announcement, trading around $26—a 35% decline from its 52-week high of $40.09.

The chemicals sector has been pressured by:

- Lower integrated margins across polyethylene and polyurethanes

- Weak demand in building and construction end markets

- Overcapacity in global ethylene markets

- Trade uncertainty and tariff impacts

Segment Breakdown: Where the Pain Is

Packaging & Specialty Plastics (50% of revenue): Net sales fell 11% year-over-year to $4.7 billion. Operating EBIT dropped to $215 million from $447 million, though management noted sequential improvement driven by cost savings.

Industrial Intermediates & Infrastructure (28% of revenue): The hardest-hit segment, with operating EBIT swinging to a $201 million loss from $84 million profit a year ago. Building and construction demand remains weak globally.

Performance Materials & Coatings (20% of revenue): The only bright spot, with operating EBIT improving to $25 million from a $9 million loss, driven by strong demand for electronics and mobility applications.

What to Watch

Near-term catalysts:

- Q1 2026 guidance calls for ~$750 million operating EBITDA, a sequential improvement driven by margin expansion and cost savings

- January/February polyethylene price increases gaining traction

- Progress on European asset shutdowns (Barry, UK siloxanes plant by mid-2026)

Risks:

- Restructuring execution and employee retention during transition

- Further integrated margin compression if demand doesn't recover

- Trade policy uncertainty and potential new tariffs

- Sadara joint venture refinancing (strategic review underway)

Long-term thesis: Management believes Transform to Outperform will fundamentally reset Dow's cost structure and competitive position. "We are building on the momentum of our current self-help measures—transforming Dow into a company that is more resilient, consistently delivers growth, enables customer success, and delivers greater shareholder value across the cycle," Carter said.

Related: