Earnings summaries and quarterly performance for HOME DEPOT.

Executive leadership at HOME DEPOT.

Edward P. Decker

President and Chief Executive Officer

Ann-Marie Campbell

Senior Executive Vice President

Jordan Broggi

Executive Vice President – Customer Experience and President – Online

Richard McPhail

Executive Vice President and Chief Financial Officer

Teresa Wynn Roseborough

Executive Vice President, General Counsel and Corporate Secretary

William Bastek

Executive Vice President – Merchandising

Board of directors at HOME DEPOT.

Ari Bousbib

Director

Asha Sharma

Director

Caryn Seidman-Becker

Director

Gerard J. Arpey

Director

Gregory D. Brenneman

Lead Independent Director

J. Frank Brown

Director

Jeffery H. Boyd

Director

Manuel Kadre

Director

Paula A. Santilli

Director

Stephanie C. Linnartz

Director

Wayne M. Hewett

Director

Research analysts who have asked questions during HOME DEPOT earnings calls.

Michael Lasser

UBS

9 questions for HD

Simeon Gutman

Morgan Stanley

9 questions for HD

Steven Zaccone

Citigroup

9 questions for HD

Zhihan Ma

Bernstein

7 questions for HD

Christopher Horvers

JPMorgan Chase & Co.

6 questions for HD

Seth Sigman

Cantor Fitzgerald

6 questions for HD

Scot Ciccarelli

Truist Securities

5 questions for HD

Steven Forbes

Guggenheim Securities, LLC

5 questions for HD

Zachary Fadem

Wells Fargo

4 questions for HD

Charles Grom

Gordon Haskett Research Advisors

3 questions for HD

Chuck Grom

Gordon Haskett Research Advisors

3 questions for HD

Zach Fadem

Wells Fargo

2 questions for HD

Zack Fadim

Wells Fargo

2 questions for HD

Karen Short

Melius Research

1 question for HD

Recent press releases and 8-K filings for HD.

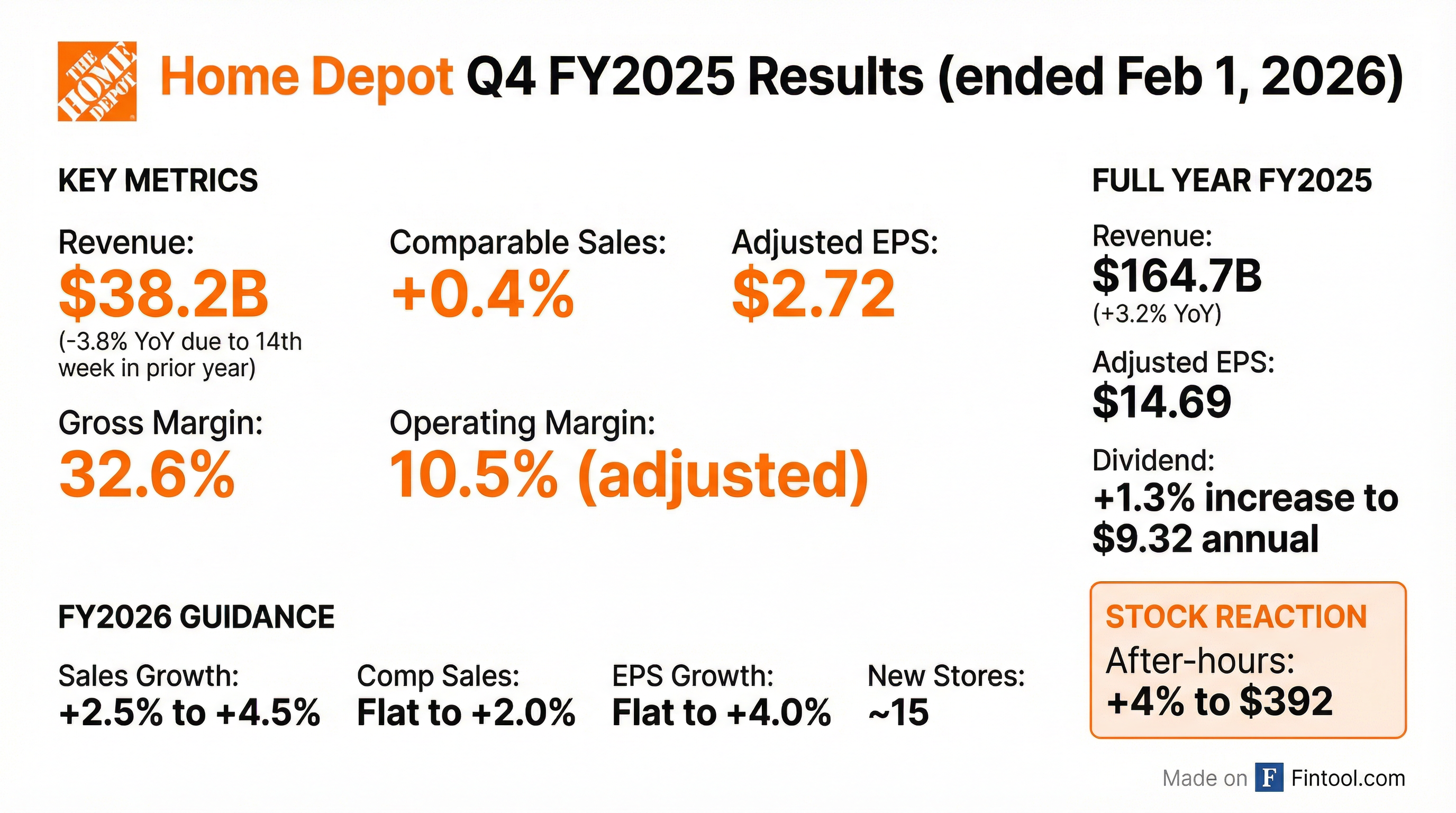

- FY 2025 sales were $164.7 billion (+3.2% YoY), with comparable sales up 0.3% (U.S. comps + 0.5%); Q4 sales were $38.2 billion (–3.8% YoY), comps + 0.4%, and adjusted diluted EPS of $2.72 (vs. $3.13).

- Gross margin was 32.6% in Q4 (–20 bp) and 33.3% for the year (–10 bp); operating margin was 10.1% in Q4 and 12.7% for FY 2025.

- The board raised its quarterly dividend 1.3% to $2.33 per share (annualized $9.32).

- SRS grew organic sales low single‐digits and gained share in a 28%-down roofing market; GMS acquisition (5 months owned) weighed on gross margin by ~20 bp in Q4 and is expected to annualize to ~40 bp in 2026.

- Fiscal 2026 guidance: total sales +2.5%–4.5%, comps flat to +2%, adjusted EPS flat to +4%, gross margin ~33.1%, and SRS organic sales mid-single digits.

- Sales for FY2025 reached $164.7 B (+3.2% YOY), with comp sales +0.3% (U.S. +0.5%); Q4 sales of $38.2 B (-3.8%), comp sales +0.4%; adjusted EPS of $14.69 for FY25 and $2.72 for Q4

- Quarterly dividend increased 1.3% to $2.33 / share, implying an annualized payout of $9.32 / share

- FY2026 guidance: total sales growth of 2.5%–4.5%, comp sales flat to +2%, adjusted EPS flat to +4%, gross margin ~33.1%, adjusted operating margin 12.8%–13.0%

- SRS grew organic sales low-single-digit % in FY25 and is expected to deliver mid-single-digit % organic growth in FY26, with ongoing integration synergies from the GMS acquisition

- Fiscal 2025 sales of $164.7 billion (+3.2% y/y); Q4 sales of $38.2 billion (−3.8%), with comparable sales up 0.4% (total) and 0.3% (U.S.) in Q4; adjusted diluted EPS of $14.69 for the year and $2.72 in Q4

- Gross margin of 33.3% for FY 2025 (−10 bps) and 32.6% in Q4 (−20 bps); FY adjusted operating margin of 13.1%

- Increased quarterly dividend by 1.3% to $2.33/share (annualized $9.32); paid $9.2 billion in dividends and invested $3.7 billion in capital expenditures in FY 2025

- Fiscal 2026 guidance: total sales growth 2.5–4.5%, comp sales flat to +2%, adjusted diluted EPS flat to +4%; gross margin ≈33.1%, adjusted operating margin 12.8–13%

- Fourth quarter fiscal 2025 net sales were $38.2 billion, down 3.8% year-over-year, with comparable sales up 0.4% (U.S. comps +0.3%).

- Q4 net earnings were $2.6 billion (EPS $2.58), with adjusted EPS of $2.72, versus $3.0 billion (EPS $3.02) and $3.13 adjusted in Q4 2024.

- Fiscal 2025 full-year net sales rose 3.2% to $164.7 billion; net earnings were $14.2 billion (EPS $14.23), with adjusted EPS of $14.69.

- Board approved a 1.3% dividend increase to $2.33 per share quarterly (annualized $9.32), payable March 26, marking the 156th consecutive quarterly dividend.

- Fiscal 2026 guidance calls for sales growth of 2.5–4.5%, comparable sales flat to 2.0%, adjusted operating margin of 12.8–13.0%, and adjusted EPS growth flat to 4%.

- Fourth quarter sales were $38.2 billion, down 3.8% year-over-year (one fewer week); comparable sales rose 0.4% (U.S. +0.3%). Full-year sales were $164.7 billion, up 3.2% with comparable sales +0.3%.

- Net earnings for Q4 were $2.6 billion (diluted EPS $2.58), versus $3.0 billion ($3.02) in Q4 2024; FY 2025 net earnings were $14.2 billion (EPS $14.23).

- Quarterly dividend was increased by 1.3% to $2.33 per share (annualized $9.32), payable March 26, 2026.

- Fiscal 2026 guidance calls for total sales growth of 2.5%–4.5%, comparable sales flat to 2%, gross margin ~33.1%, adjusted operating margin ~12.8%–13.0%, and diluted EPS growth flat to 4% (from $14.23).

- SKYX launched its patented SKYFAN and Turbo Heater at major U.S. retailers, including Home Depot with a new SkyPlug page on Homedepot.com, as well as Target, Walmart, and Lowe’s, and joined NVIDIA’s AI Ecosystem Connect Program to advance its smart home projects.

- The company has raised over $33 million since September 30, 2025, including $25 million in straight common equity from one institutional investor at $2.50 per share, and extended $13.5 million in notes to 2030, bolstering its balance sheet for growth.

- SKYX achieved seven consecutive quarters of revenue growth from Q1 2024 through Q3 2025 and plans to deploy over 100,000 products into homes in 2026 via retail and professional channels.

- The firm will roll out AI-driven software across its 60 e-commerce sites to boost conversion rates by up to 30%, and is targeting expansion into hotel renovations and smart city projects in Miami, Texas, Saudi Arabia, and Egypt.

- Home Depot plans to eliminate approximately 800 corporate positions—most remote—with the first separations starting March 31, 2026, including 146 roles at its Atlanta Store Support Center.

- The company requires corporate staff to return to a five-day, in-office schedule effective April 6, 2026.

- CEO Ted Decker said the changes aim to simplify operations, increase speed, and better connect corporate teams with frontline stores; impacted employees will receive separation packages, transitional benefits, and job-placement support.

- The cuts, largely in technology roles, reflect shifts toward automation and AI, and coincided with a 0.8% drop in Home Depot shares to $372.43 ahead of its Feb. 24 earnings release.

- The Home Depot and Google Cloud have deepened their strategic partnership by integrating Google Cloud’s Gemini models and Gemini Enterprise to deliver an AI-first experience across Home Depot’s digital platforms and in-store environments.

- The Magic Apron suite has been upgraded into a conversational AI assistant offering personalized project recommendations, multimodal capabilities (including image upload), and real-time aisle-level wayfinding, with a nationwide in-store rollout planned soon.

- In November 2025, Home Depot launched a beta AI-powered materials list tool for professional customers to generate comprehensive, grouped estimates via voice, text, or uploads; national scaling began in January 2026.

- New AI-driven route intelligence leverages Gemini and Google Maps data to predict and prevent delivery failures by analyzing site access, weather, and road conditions, ensuring reliable last-mile service.

- $1.1 trillion total addressable market in North America with only ~15% share; growth strategy centered on driving core culture, a frictionless omnichannel experience, and winning the Pro customer.

- Reaffirmed fiscal 2025 guidance: ~3% total sales growth, slight positive comp sales, gross margin ~33.2%, adjusted operating margin ~13%, and adjusted EPS down ~5% year-over-year.

- Provided preliminary 2026 outlook: home improvement market could range from –1% to +1%; comp sales flat to +2%; total sales up 2.5–4.5%; adjusted operating margin ~13%; and adjusted EPS growth ~4%.

- Accelerating Pro ecosystem investments: over 1,500 dedicated Pro sales resources, 7,000 Pros on trade credit driving a 30% spend lift, and delivery network expansion into 18 new markets via the Relay program.

- Growth strategy centers on driving the core store network, delivering a frictionless interconnected digital and physical experience, and winning share with professional customers through Home Depot, SRS, and HD Supply platforms.

- Market opportunity spans a $1.1 trillion addressable market with only ~15% share; long-term demand is supported by $16 trillion home equity gains since 2019, 55% of homes over 40 years old, and ~$20 billion of pent-up remodeling need.

- Financial outlook: reaffirmed 2025 guidance of ~3% total sales growth, slight positive comp growth, 33.2% gross margin, 12.6% operating margin, and ~6% EPS decline; 2026 preliminary outlook assumes a home improvement market down 1% to up 1%, flat to +2% comps, 2.5–4.5% total sales growth, ~13% adjusted operating margin, and ~4% adjusted EPS growth.

- Investment priorities include maintaining CapEx at ~2.5% of sales, opening 15–20 new stores per year, and advancing store experience, supply-chain automation, AI applications, and digital tools such as MyApron and an enhanced mobile app.

- Risks stem from elevated mortgage rates (30-year at ~6.3%), limited housing turnover, affordability constraints, and broader macroeconomic uncertainty, which are expected to pressure home improvement demand into 2026.

Fintool News

In-depth analysis and coverage of HOME DEPOT.

Quarterly earnings call transcripts for HOME DEPOT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more