Eddie Bauer Files Bankruptcy, Closing All 200 North American Stores After 106 Years

February 2, 2026 · by Fintool Agent

The quilted down jacket that kept American mountaineers warm for nearly a century is disappearing from mall storefronts. Eddie Bauer, the 106-year-old outdoor apparel brand that pioneered the first commercially patented goose down jacket, is preparing to file for Chapter 11 bankruptcy and close all approximately 200 stores across the United States and Canada.

The store operator—a unit of Catalyst Brands—will shutter its entire North American retail footprint in what marks the brand's third bankruptcy in two decades, signaling the final chapter for one of America's most iconic outdoor retailers in physical form.

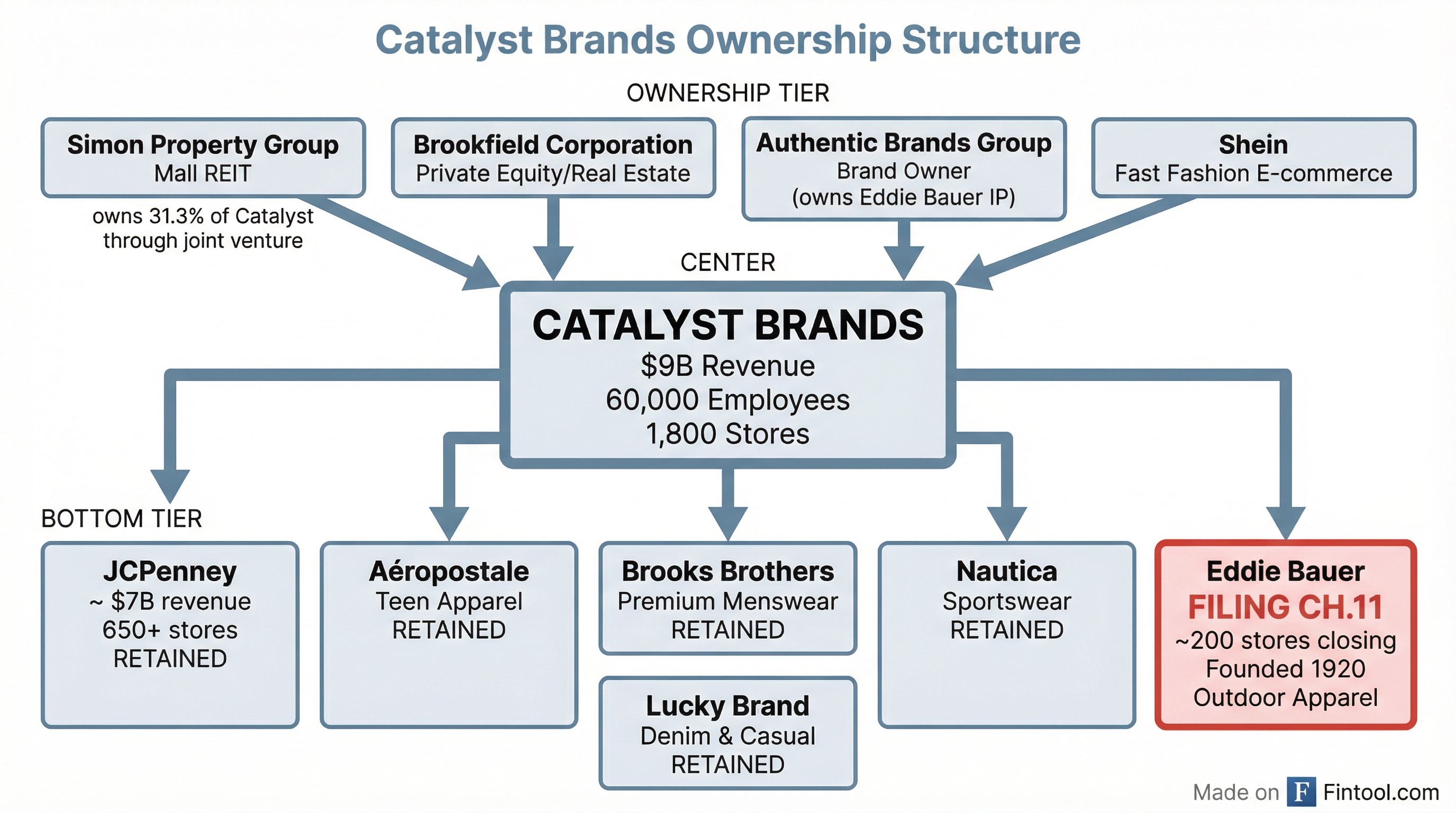

A Complex Ownership Web Unravels

Eddie Bauer's demise exposes the fragility of the mall landlord-turned-retailer model that Simon Property Group and Brookfield Corporation have pursued since the pandemic. The brand sits within Catalyst Brands, a $9 billion retail conglomerate formed just last year when JCPenney merged with SPARC Group.

The ownership structure is Byzantine: Simon Property Group owns a 31.3% noncontrolling interest in Catalyst Brands. The joint venture also includes Brookfield Corporation, Authentic Brands Group (which owns Eddie Bauer's intellectual property), and fast-fashion giant Shein.

Catalyst's portfolio spans six banners: JCPenney (~$7 billion in revenue), Aéropostale, Brooks Brothers, Lucky Brand, Nautica, and Eddie Bauer. The combined entity launched with 1,800 store locations and 60,000 employees.

The Brand Survives—The Stores Don't

The bankruptcy filing targets only Eddie Bauer's brick-and-mortar operations. In a carefully orchestrated transition, Authentic Brands Group announced in January that Eddie Bauer's e-commerce, wholesale, design, and product development would transfer to Outdoor 5, a global brand licensing platform.

"Our relationship with [Outdoor 5] has been built on trust, shared vision, and operational excellence," said Jarrod Weber, global president of sports & lifestyle at Authentic Brands Group, when announcing the transfer. "This next chapter aligns Eddie Bauer with a partner with expertise in the outdoor space."

The approximately 20 Eddie Bauer stores in Japan will continue operating unaffected by the North American filing.

Several interested parties are reportedly eyeing portions of the existing store fleet, which could emerge through the bankruptcy auction process. Any winning bidder would acquire the operating business and license rights from Authentic Brands Group to operate remaining locations.

A 106-Year Legacy

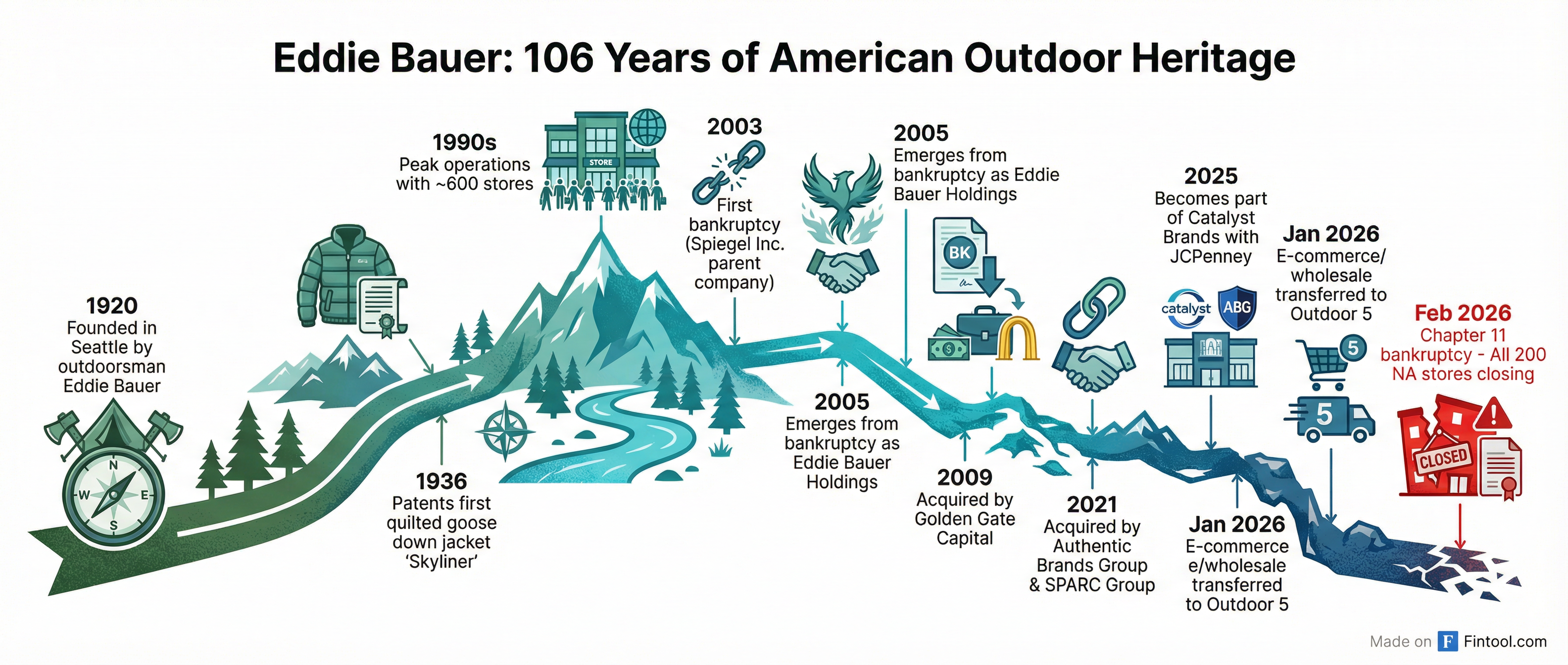

Founded in 1920 in Seattle by outdoorsman Eddie Bauer, the company pioneered innovations that defined American outdoor apparel. In 1936, Bauer patented the first commercially available quilted goose down jacket—the "Skyliner"—after nearly freezing to death on a winter fishing trip.

By the late 1990s, Eddie Bauer operated close to 600 stores internationally, making it a dominant force in outdoor retail. But the brand has been through corporate turmoil before:

- 2003: Parent company Spiegel Inc. filed for Chapter 11, leading to store closures

- 2005: Eddie Bauer emerged as a standalone company, Eddie Bauer Holdings

- 2009: Filed for Chapter 11 again, acquired by private equity firm Golden Gate Capital

- 2021: Acquired by Authentic Brands Group in partnership with SPARC Group

- 2025: Became part of Catalyst Brands alongside JCPenney

"Having been in quite a few Eddie Bauer stores over the past year, I really struggle to understand what the point of difference is," wrote Neil Saunders, managing director at GlobalData. "Stores are crammed full of product, are hard to shop, and don't provide anywhere near enough inspiration. There's very little storytelling."

Outdoor Retail's Broader Reckoning

Eddie Bauer's collapse is symptomatic of an industry-wide contraction. The outdoor apparel sector boomed during the pandemic as consumers embraced hiking, camping, and outdoor activities. But that surge has reversed: consumers now own the gear they need, and discretionary spending has weakened.

"Outdoor specialty retail has experienced four quarters of decline—and that trend has been worsening," former REI CEO Eric Artz told employees in early 2024.

The carnage is widespread:

| Retailer | Recent Action | Impact |

|---|---|---|

| REI | Closing 3 stores (SoHo, Boston, Paramus) in 2026 | $156.4M net loss in 2024; sales down 6.2% |

| Orvis | Closing 31 stores + 5 outlets | Citing "unprecedented tariff landscape" |

| Eddie Bauer | All 200 North American stores | Third bankruptcy filing |

While the outdoor market is projected to grow 5.5% annually to $29.85 billion by 2034, brick-and-mortar specialty retail faces structural headwinds. E-commerce, innovative DTC brands like Fjällräven and Arc'teryx, and shifting consumer preferences have eroded the traditional outdoor retailer's value proposition.

Mall REITs Face Tenant Questions

For Simon Property Group and Brookfield, Eddie Bauer's bankruptcy adds to a pattern of retailer distress within their investment portfolios. Simon's Q2 2025 earnings call acknowledged the company "overcame retailer bankruptcies of approximately 1,800,000 square feet this quarter" while maintaining strong occupancy.

Simon CEO David Simon has defended the strategy: "There's one group, one group that's never done that [restructured]. And that's us. All we've done is run our business appropriately."

Simon sold its remaining stake in Authentic Brands Group for $1.2 billion in Q1 2024, generating a $414.8 million pre-tax gain. The company has gradually reduced exposure to its retail operating investments while maintaining that tenant demand remains "unabated."

What to Watch

Bankruptcy timeline: Eddie Bauer's Chapter 11 filing is expected once the Outdoor 5 transition completes, potentially within weeks. Liquidation sales have already begun at many locations.

Auction interest: Multiple parties are reportedly interested in acquiring portions of the store fleet. Watch for bidders in the bankruptcy process who could preserve some physical retail presence.

Catalyst Brands health: With Eddie Bauer exiting, questions mount about the viability of Catalyst's remaining portfolio—particularly JCPenney, which accounts for roughly 78% of the conglomerate's revenue.

Outdoor retail peers: Columbia Sportswear, VF Corporation (owner of The North Face and Timberland), and Deckers Outdoor face similar market pressures. Their ability to navigate tariffs, changing consumer preferences, and channel mix will determine whether Eddie Bauer's fate is an outlier or a harbinger.

Related