Earnings summaries and quarterly performance for DECKERS OUTDOOR.

Executive leadership at DECKERS OUTDOOR.

Stefano Caroti

Chief Executive Officer and President

Angela Ogbechie

Chief Supply Chain Officer

Anne Spangenberg

President of Fashion Lifestyle

Marco Ellerker

President of Global Marketplace

Robin Spring-Green

President of HOKA

Steven Fasching

Chief Financial Officer

Thomas Garcia

Chief Administrative and Legal Officer

Board of directors at DECKERS OUTDOOR.

Research analysts who have asked questions during DECKERS OUTDOOR earnings calls.

Jay Sole

UBS

9 questions for DECK

Laurent Vasilescu

BNP Paribas S.A.

9 questions for DECK

Jonathan Komp

Robert W. Baird & Co.

7 questions for DECK

John Kernan

Cowen Inc.

6 questions for DECK

Samuel Poser

Williams Trading, LLC

6 questions for DECK

Rick Patel

Raymond James Financial

5 questions for DECK

Adrienne Yih-Tennant

Barclays

3 questions for DECK

Dana Telsey

Telsey Advisory Group

3 questions for DECK

Paul Lejuez

Citigroup

3 questions for DECK

Sam Poser

Williams Trading LLC

3 questions for DECK

Adrian Yee

Barclays PLC

2 questions for DECK

Peter McGoldrick

Stifel

2 questions for DECK

Christopher Nardone

Bank of America

1 question for DECK

Rakesh Patel

Raymond James

1 question for DECK

Recent press releases and 8-K filings for DECK.

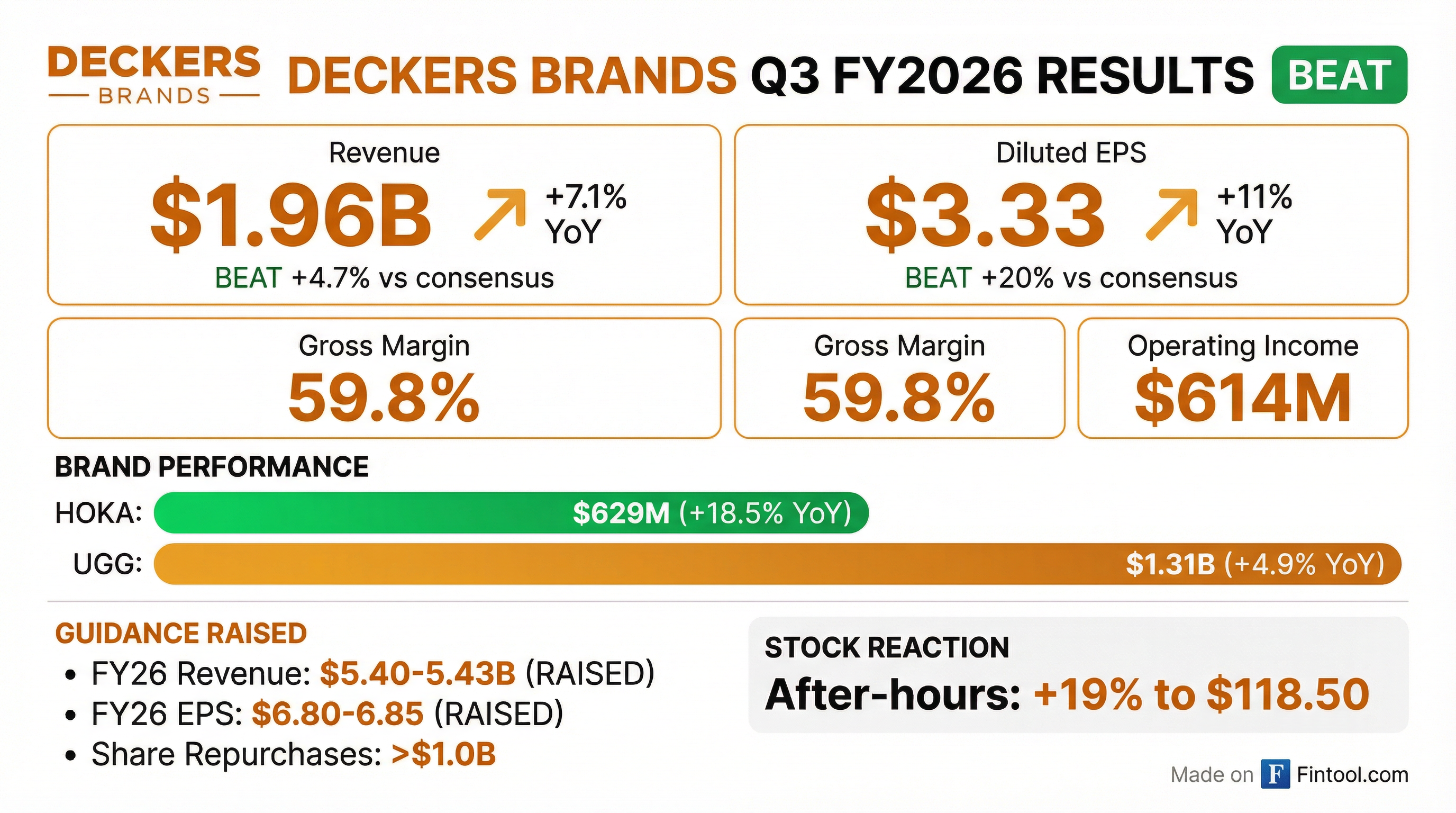

- Deckers delivered $1.96 B in Q3 FY26 revenue, up 7% year-over-year, with HOKA revenue of $629 M (+18%) and UGG revenue of $1.3 B (+5%), driving a record diluted EPS of $3.33 (+11%).

- Gross margin expanded to 59.8%, SG&A was $557 M (28.5% of revenue), and the company closed the quarter with $2.1 B in cash and equivalents and $633 M in inventory.

- Raised FY26 guidance: revenue now expected at $5.40–5.425 B, diluted EPS $6.80–6.85, gross margin ~57%, operating margin ~22.5%, with over $1 B in share repurchases planned for the year.

- Year-to-date through nine months, total company revenue increased 10%, with HOKA up 16%, UGG up 8%, and diluted EPS up 13%, reflecting sustained brand momentum.

- Revenue of $1.96 billion, up 7% year-over-year, driven by HOKA at $629 million (+18%) and UGG at $1.3 billion (+5%) in Q3 FY 2026.

- Gross margin expanded to 59.8%, SG&A was 28.5% of revenue, and diluted EPS reached $3.33, up 11% year-over-year.

- Ended Q3 with $2.1 billion in cash and equivalents, $633 million in inventory, no debt, and repurchased $349 million of shares (average price $92.36), leaving $1.8 billion authorization remaining.

- Raised FY 2026 guidance: revenue now expected at $5.400–5.425 billion, gross margin ~57%, operating margin ~22.5%, and diluted EPS $6.80–6.85.

- Deckers achieved Q3 FY2026 revenue of $1.96 billion (+7% YoY), with UGG at $1.3 billion (+5%) and HOKA at $629 million (+18%).

- Q3 gross margin was 59.8% and diluted EPS was $3.33 (+11% YoY).

- As of December 31, 2025, Deckers held $2.1 billion in cash, repurchased $349 million of shares in Q3, and has $1.8 billion remaining in its buyback authorization; expects >$1 billion repurchases in FY2026, contributing >$0.20 to EPS.

- Raised FY2026 guidance: revenue to $5.4 billion–$5.425 billion, EPS to $6.80–$6.85, gross margin to ~57%, and operating margin to ~22.5%.

- Net sales increased 7.1% to $1.958 billion and diluted EPS rose 11% to $3.33 in Q3 FY2026.

- HOKA brand net sales grew 18.5% to $628.9 million; UGG net sales increased 4.9% to $1.305 billion.

- Direct-to-consumer (DTC) net sales rose 8.1% to $1.093 billion, while wholesale net sales climbed 6.0% to $864.6 million.

- Full-year FY2026 guidance raised: HOKA revenue expected mid-teens% growth; UGG revenue mid-single-digits% growth; EPS to $6.80–$6.85; share repurchases to exceed $1.0 billion.

- Delivered record Q3 FY2026 net sales of $1.958 billion, up 7.1% YoY, and diluted EPS of $3.33, up 11%.

- Raised FY2026 guidance: net sales to $5.400 billion–$5.425 billion, diluted EPS to $6.80–$6.85, with HOKA revenue up mid-teens and UGG up mid-single-digits percent.

- Repurchased 3.8 million shares for $348.5 million in Q3 and expects total repurchases to exceed $1 billion, with $1.8 billion remaining authorization.

- Deckers Brands delivered $1.43 billion in Q2 revenue, up 9% year-over-year, driven by HOKA (+11%) and UGG (+10%) growth.

- Diluted EPS was $1.82, a 14% increase, with gross margin expanding 30 basis points to 56.2%.

- The company ended Q2 with $1.4 billion in cash, $836 million in inventory (up 7%), and repurchased $282 million of shares.

- Reiterated FY2026 guidance: revenue of ~$5.35 billion, EPS of $6.30–$6.39, gross margin of ~56%, and operating margin of ~21.5%, while managing $150 million in unmitigated tariff headwinds, with $75–$95 million offset by mitigation strategies.

Fintool News

In-depth analysis and coverage of DECKERS OUTDOOR.

Quarterly earnings call transcripts for DECKERS OUTDOOR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more