First Brands Founder Indicted in $2.7 Billion Fraud That 'Spooked Wall Street'

January 29, 2026 · by Fintool Agent

Federal prosecutors on Thursday unsealed a nine-count indictment against First Brands founder Patrick James and his brother Edward, accusing them of orchestrating a "yearslong fraud" that siphoned billions from lenders before the auto parts empire collapsed into bankruptcy last fall.

The charges cap a stunning reversal for a company that grew from nothing to $5 billion in annual revenue in just a decade—fueled, prosecutors now allege, by fake invoices, double-pledged collateral, and a web of shell companies designed to hide massive debts from Wall Street firms including Jefferies, UBS, and Blackrock.

The Charges

Patrick James, 61, and his brother Edward James, 60, were arrested Thursday in Ohio on charges including:

- Running a continuing financial crimes enterprise

- Bank fraud

- Wire fraud

- Money laundering conspiracy

Both defendants face decades in prison if convicted. A third executive, former Vice President of Finance Peter Andrew Brumbergs, pleaded guilty as part of the investigation.

"These schemes yielded billions of dollars in financing to First Brands and enabled Patrick James and Edward James to reap millions of dollars in proceeds derived from their fraud," the indictment states.

How the Fraud Worked

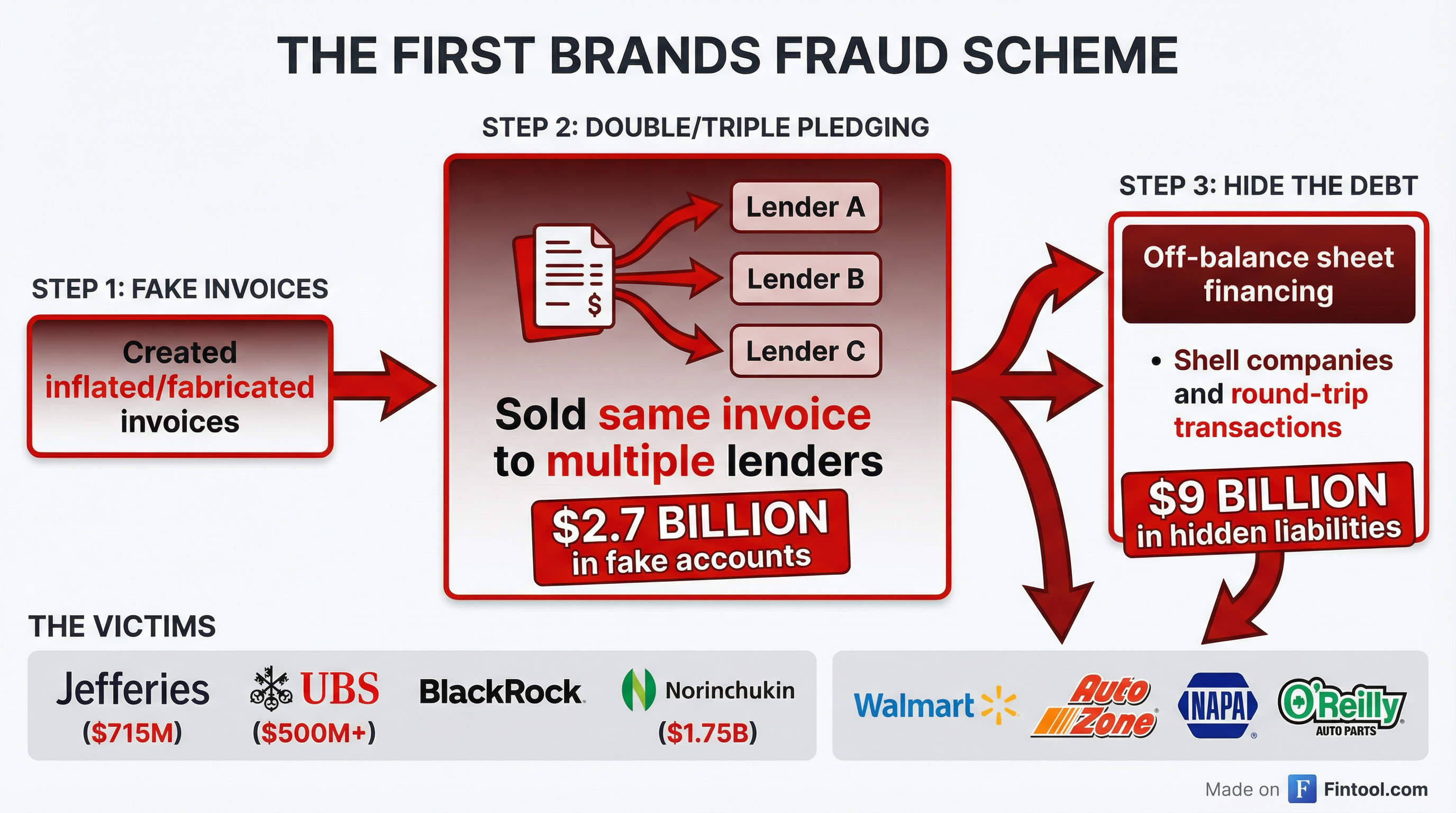

The indictment describes an elaborate scheme that allegedly operated from 2018 to 2025:

Fake and Inflated Invoices: First Brands sold accounts receivable to lenders through a practice called "factoring"—borrowing against invoices owed by retailers like Walmart, Autozone, and O'reilly. But prosecutors allege the company created $2.7 billion in fake accounts by fabricating invoices and inflating real ones.

Double and Triple Pledging: The same collateral was pledged to multiple lenders simultaneously, with prosecutors alleging the James brothers "deliberately concealed massive amounts of debt" and lied to lenders who asked about it.

Round-Trip Transactions: Money was cycled through subsidiaries and shell companies to make First Brands appear larger than it actually was. One such arrangement was described internally as a "round trip," according to court documents.

Off-Balance-Sheet Financing: Billions in debt were hidden from financial statements, with prosecutors alleging the brothers "closed ranks" to prevent creditors and auditors from seeing the company's true condition.

The Wall Street Fallout

When First Brands filed for Chapter 11 protection on September 28, 2025, the ripple effects hit some of Wall Street's biggest names:

| Institution | Exposure | Status |

|---|---|---|

| Jefferies (Point Bonita) | $715 million | $30M loss taken Q4 2025 |

| Norinchukin JV | $1.75 billion | Under investigation |

| Katsumi Global | $1.7 billion | Filed claims |

| UBS | $500+ million | "Readily absorbable" |

| Blackrock | Undisclosed | Exposure confirmed |

JPMorgan CEO Jamie Dimon warned in October that the First Brands collapse could signal broader problems: "When you see one cockroach, there are probably more, and so everyone should be forewarned."

The SEC is now investigating disclosures Jefferies made to Point Bonita investors around the time of the bankruptcy.

Rise and Fall

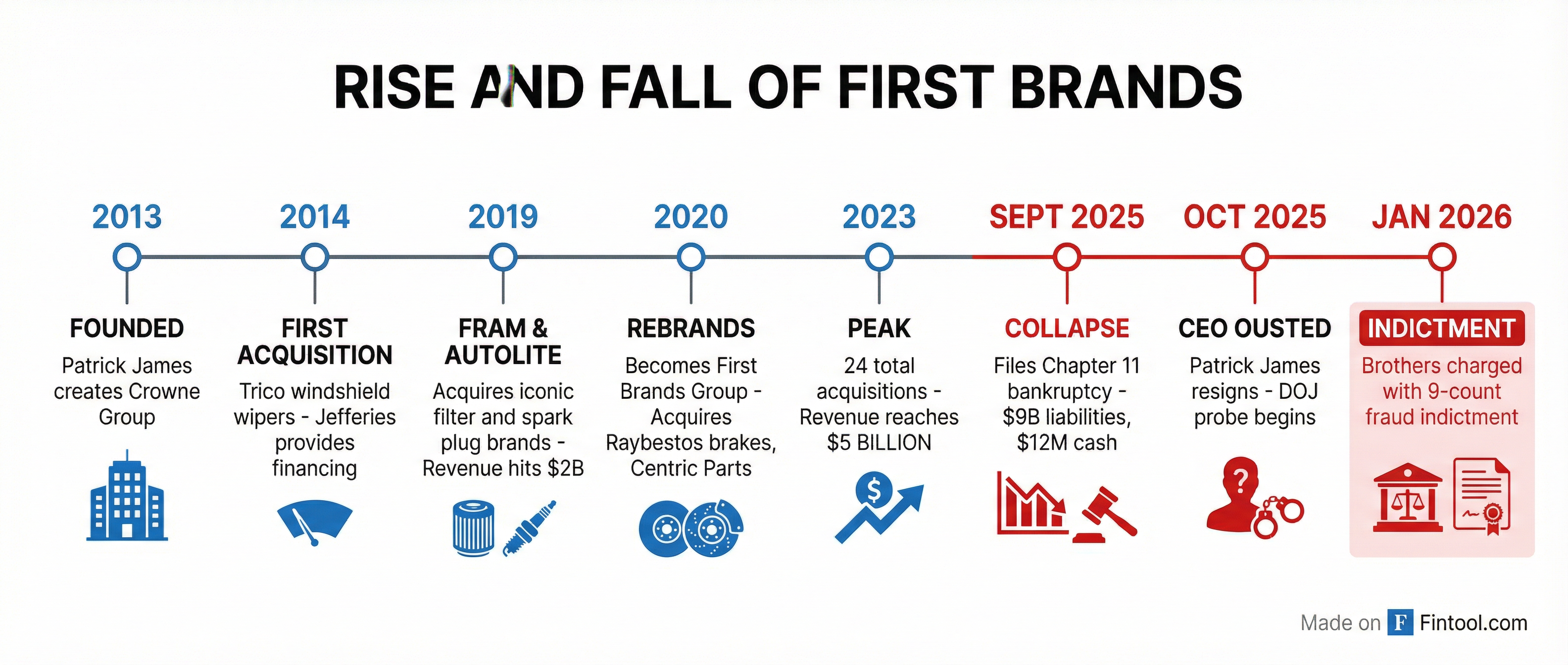

Patrick James founded First Brands in 2013 as Crowne Group, building an auto parts empire through 24 debt-financed acquisitions. The company's portfolio grew to include iconic brands:

- FRAM – Filters

- Autolite – Spark plugs

- Trico/Anco – Windshield wipers

- Raybestos – Brakes

- Centric Parts/StopTech – Performance brakes

- Cardone – Remanufactured parts

- Reese/Draw-Tite – Towing equipment

Revenue grew from $500 million in 2018 to $5 billion in 2024. But prosecutors allege much of that growth was illusory, funded by fraud rather than genuine business expansion.

James resigned as CEO on October 13, 2025, two weeks after the bankruptcy filing. His brother Edward resigned the same day.

What Happens Now

For the Company: First Brands is winding down its Brake Parts, Cardone, and Autolite operations—affecting 4,000 jobs—while seeking buyers for remaining assets. Ford and General Motors have provided $48 million in emergency financing to keep critical supply operations running. A sales process could be finalized in the coming weeks.

For the Defendants: Patrick James's attorney Scott Hartman says his client "is presumed innocent and denies these charges," adding that James "built First Brands from nothing into a global industry leader." Edward James's attorney Seth DuCharme told CBS News his client "has conducted himself with integrity and dignity over decades of hard work."

For Wall Street: The First Brands collapse, coming alongside the Tricolor Auto bankruptcy in September 2025, has intensified scrutiny of private credit markets. Tricolor executives were indicted for similar fraud charges in December.

A civil trial on First Brands' clawback lawsuit against Patrick James is scheduled for June 2026.

The Bottom Line

The First Brands indictment represents one of the largest corporate fraud cases in the auto industry in recent memory. What began as an American dream story—entrepreneur builds automotive empire from scratch—has ended in a cautionary tale about the dangers of opaque financing and inadequate due diligence in private credit markets.

For investors in companies exposed to private credit, the lesson is clear: when Jamie Dimon says there might be more cockroaches, it's worth checking under the floorboards.

Related Companies: Jefferies Financial Group · UBS Group · Ford Motor · General Motors · Walmart · Autozone · O'reilly Automotive · Advance Auto Parts · JPMorgan Chase · Blackrock