Forgent Power Raises $1.06B in First Major AI Infrastructure IPO of 2026

February 4, 2026 · by Fintool Agent

Forgent Power Solutions priced its initial public offering at $19 per share Wednesday, raising $1.06 billion in the first major power infrastructure IPO of 2026. The Minnesota-based maker of electrical distribution equipment for data centers, utilities, and industrial facilities will begin trading Thursday on the NYSE under ticker FPS.

The pricing came in well below Forgent's marketed range of $25-$29, valuing the company at approximately $5.8 billion rather than the initially targeted $8.8 billion. The 34% discount reflects a cautious IPO market even as demand for AI infrastructure reaches fever pitch. Goldman Sachs, Jefferies, and Morgan Stanley led the offering.

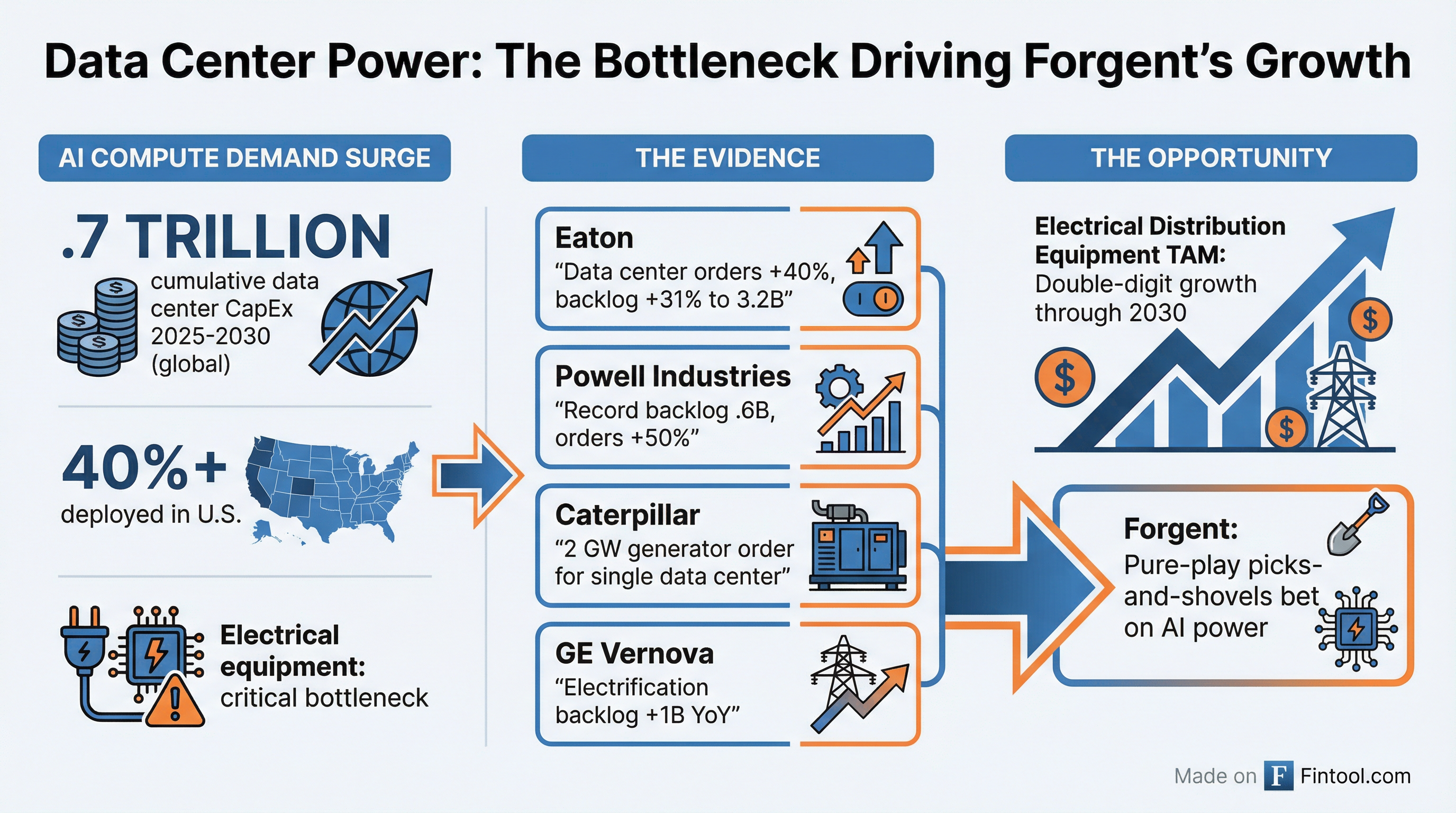

The Picks-and-Shovels Play on AI

Forgent's debut tests whether investors will pay a premium for pure-play exposure to data center power infrastructure—the physical equipment that moves electricity from the grid to AI chips.

The company's product lineup spans automatic transfer switches, transformers, switchgear, power distribution units (PDUs), generator connection cabinets, and prefabricated eHouses—the critical hardware connecting utility power to hyperscale computing loads.

Data centers represented 42% of fiscal 2025 revenue and 47% of backlog, making Forgent one of the most concentrated publicly traded vehicles for AI power infrastructure exposure.

Explosive Growth, Demanding Valuation

Forgent's financial trajectory reflects the surge in data center construction:

| Metric | FY 2024 (Pro Forma) | FY 2025 | Q1 FY 2026 | YoY Growth |

|---|---|---|---|---|

| Revenue | $483M | $753M | $283M | +56% (FY), +84% (Q1) |

| Backlog | $716M | $1.03B | — | +44% |

| Net Income | — | $17.5M | — | — |

The $1.03 billion backlog exceeds total FY 2025 revenue, providing visibility into 2026 and beyond. But at ~7.7x trailing revenue, Forgent is pricing at a premium to diversified electrical equipment peers, even after the IPO discount.

Industry Context: The Power Bottleneck Is Real

Forgent's IPO arrives amid a fundamental constraint in AI infrastructure: electrical equipment is becoming the bottleneck. Recent earnings calls from major industrials confirm the demand surge:

Eaton+0.68% reported Q4 data center orders up 40% with quarterly orders up more than 50%. Electrical backlog grew $3 billion (31% YoY) to $13.2 billion. "Data center demand is accelerating faster than ever, setting us up for an exceptional growth runway," CFO Olivier Leonetti said.

Powell Industries+16.34% hit a record $1.6 billion backlog in Q1, up 14% sequentially, driven by data center orders. CEO Brett Cope noted "the acceleration of order activity driven by data centers leaves us confident in our ability to continue to grow our presence in this dynamic market."

Caterpillar-1.57% announced a 2 GW generator order from a single data center customer—"one of our largest single orders for complete power solutions." The company sees accelerated investment in data centers bolstering overall construction spending.

Ge Vernova-4.36% grew electrification backlog to $35 billion, up $11 billion year-over-year, with the segment recording its largest order quarter in history.

| Company | Market Cap | Electrical Backlog | Data Center Exposure |

|---|---|---|---|

| Eaton+0.68% | $140B | $13.2B | 40% of growth |

| Ge Vernova-4.36% | $203B | $35B (electrification) | Significant |

| Powell Industries+16.34% | $5.3B | $1.6B | Growing share |

| Forgent Power | $5.8B | $1.03B | 42% of revenue |

Values from S&P Global

Deal Structure and Use of Proceeds

Notably, Forgent will retain none of the IPO proceeds for operations. The entire offering consists of redemptions and secondary sales:

- 16.6 million primary shares sold by Forgent—proceeds used to redeem operating subsidiary interests held by Neos Partners

- 39.4 million secondary shares sold by existing owners controlled by private equity firm Neos Partners

Neos will maintain majority voting power post-IPO. The deal closing is expected February 6, with a 180-day lock-up period through August 4, 2026.

What to Watch

Near-term catalysts:

- First-day trading performance Thursday, February 5

- Q2 earnings (likely May-June) for updated backlog and margin trends

- Capacity expansion updates—Forgent is investing to meet demand

Key risks:

- Concentration risk: 42% of revenue from data centers means any slowdown in hyperscaler capex would disproportionately impact Forgent

- Cyclicality: Electrical equipment demand historically follows construction cycles

- Private equity overhang: Neos Partners retains control and may eventually seek to exit remaining stake

- Competition: Large diversified players like Eaton and GE Vernova have significant scale advantages

Bull case: Forgent offers rare pure-play exposure to the most constrained segment of AI infrastructure. If data center construction continues accelerating, the company's 84% Q1 revenue growth and $1B+ backlog suggest significant runway. At $19, investors are getting in at a meaningful discount to initial expectations.

Bear case: The 34% pricing discount signals investor skepticism about the premium valuation. With PE-controlled governance and no retained proceeds, the deal is effectively a liquidity event for Neos Partners rather than growth capital for the business.

Related: