Earnings summaries and quarterly performance for POWELL INDUSTRIES.

Executive leadership at POWELL INDUSTRIES.

Board of directors at POWELL INDUSTRIES.

Research analysts who have asked questions during POWELL INDUSTRIES earnings calls.

John Franzreb

Sidoti & Company

9 questions for POWL

Also covers: AZZ, CSV, CTS +10 more

CM

Chip Moore

EF Hutton

6 questions for POWL

Also covers: AMPX, ASPN, CMT +3 more

JB

John Braatz

Kansas City Capital

4 questions for POWL

Also covers: THR

JB

Jon Braatz

KCCA

3 questions for POWL

Also covers: APOG, AZZ, HLIO +5 more

JB

Jonathan Braatz

Oppenheimer & Co. Inc.

2 questions for POWL

Also covers: AZZ, BKE, MYRG +3 more

MS

Manish Somaiya

Cantor

2 questions for POWL

Also covers: CTRI, ECG, MYRG +3 more

A'

Alfred 'Chip' Moore

ROTH Capital

1 question for POWL

AM

Alfred Moore

C.L. King & Associates

1 question for POWL

Also covers: AMPX, CMT, DFLI +5 more

Recent press releases and 8-K filings for POWL.

Powell Industries Reports Strong Q1 2026 Results with Record Orders and Backlog

POWL

Earnings

New Projects/Investments

Revenue Acceleration/Inflection

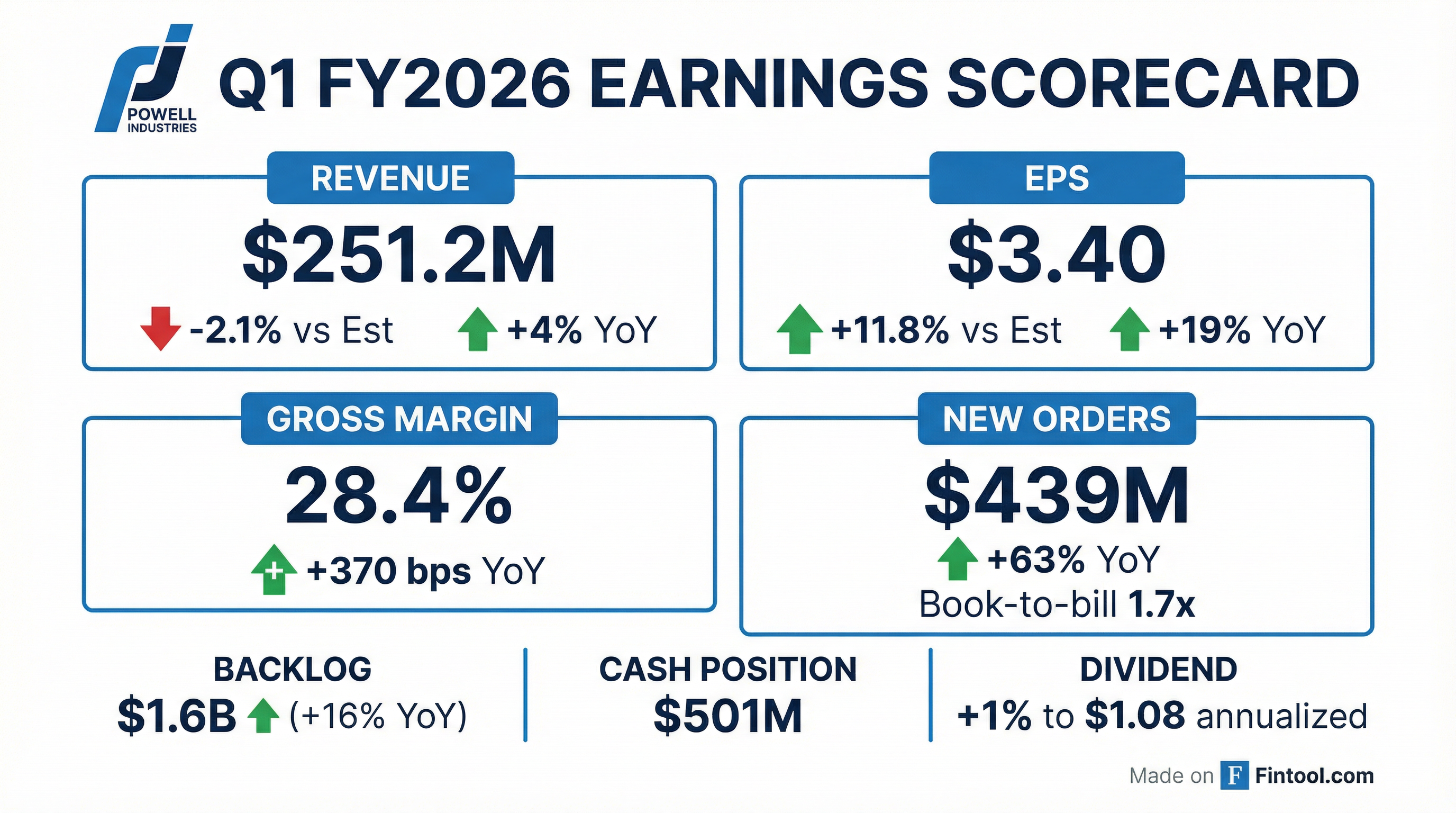

- Powell Industries reported strong Q1 2026 financial results, with net revenue of $251 million (up 4.4% year-over-year), net income of $41.4 million (up 19%), and diluted EPS of $3.40 (up 19%).

- The company achieved record new orders of $439 million in Q1 2026, a 63% increase from the prior year, significantly boosted by a >$100 million LNG project and >$100 million in data center orders.

- This led to a historical high backlog of $1.6 billion, growing 14% sequentially, with the commercial and other industrial market (including data centers) now representing 22% of the total backlog.

- Profitability improved, with gross profit expanding 20% to $71 million and gross margin reaching 28.4%, an increase of 380 basis points year-over-year. The company also maintains a strong balance sheet with $501 million in cash and short-term investments and no debt as of December 31, 2025.

Feb 4, 2026, 4:00 PM

Powell Reports Strong Q1 2026 Results Driven by Record Orders and Backlog

POWL

Earnings

New Projects/Investments

Revenue Acceleration/Inflection

- Powell reported a strong start to fiscal 2026 with revenue growth of 4% compared to the prior year and a 20% expansion in gross profit, leading to a gross margin of 28.4% in Q1 2026.

- Net income for Q1 2026 increased 19% to $41.4 million, generating $3.40 per diluted share.

- The company recorded $439 million in new orders, the highest quarterly total in over two years, which included a large LNG project exceeding $100 million and a $75 million mega data center project.

- This strong order activity contributed to a record-high backlog of $1.6 billion as of the quarter end, with data centers now accounting for approximately 15% of the total backlog.

- Powell is expanding productive capacity, including adding leased facilities and progressing the Jacintoport facility expansion, to support robust demand in key markets, and maintains a strong balance sheet with $501 million in cash and no debt as of December 31, 2025.

Feb 4, 2026, 4:00 PM

Powell Industries Reports Strong Q1 2026 Results with Record Orders and Backlog

POWL

Earnings

New Projects/Investments

Revenue Acceleration/Inflection

- Powell Industries reported Q1 2026 net revenue of $251 million, a 4.4% increase year-over-year, and a gross margin of 28.4%, up 380 basis points from the prior year.

- New orders for Q1 2026 totaled $439 million, the highest in over 2 years, including a large LNG project exceeding $100 million and data center orders over $100 million.

- The company achieved a record backlog of $1.6 billion at the end of Q1 2026, with approximately $933 million expected to convert over the next 12 months.

- Net income increased 19% to $41.4 million, generating $3.40 per diluted share in Q1 2026, and the company holds $501 million in cash with no debt.

- To support growth, Powell is expanding capacity by adding leased facilities and progressing the Jacintoport facility expansion, targeting key markets such as data centers, LNG, and electric utilities.

Feb 4, 2026, 4:00 PM

Powell Industries Announces Strong Q1 Fiscal 2026 Results and Dividend Increase

POWL

Earnings

Dividends

New Projects/Investments

- Powell Industries reported Q1 Fiscal 2026 revenues of $251 million, a 4% increase, and net income of $41 million, or $3.40 per diluted share, up 19% year-over-year.

- New orders surged to $439 million, a 63% increase, boosting the backlog to $1.6 billion as of December 31, 2025, driven by significant data center and LNG megaproject awards.

- The company's Board of Directors approved an increase in the quarterly cash dividend to $0.27 per share, raising the annualized dividend to $1.08 per share.

- Management expressed a positive outlook for Fiscal 2026, anticipating sustained gross margin performance and highlighting a strong cash balance with no debt.

Feb 3, 2026, 9:24 PM

Powell Industries Announces First Quarter Fiscal 2026 Results

POWL

Earnings

New Projects/Investments

Guidance Update

- Powell Industries reported strong First Quarter Fiscal 2026 results, with revenues of $251 million (up 4%) and net income of $41 million (up 19%), or $3.40 per diluted share.

- New orders surged 63% to $439 million, the highest quarterly total in over two years, resulting in a book-to-bill ratio of 1.7 and increasing the backlog to $1.6 billion as of December 31, 2025.

- This growth was significantly driven by higher bookings in the Commercial & Other Industrial sector, including a megaproject order in the data center end market, and a large LNG award.

- Management expressed continued confidence for Fiscal 2026, anticipating sustained gross margin performance and strong demand across Electric Utility, LNG, and the rapidly expanding data center market.

Feb 3, 2026, 9:15 PM

Powell Industries Reports Record Q4 and Full-Year 2025 Results

POWL

Earnings

New Projects/Investments

M&A

- Powell Industries reported a strong fiscal Q4 2025, with revenue increasing 8% to $298 million and record diluted EPS of $4.22.

- For the full fiscal year 2025, the company achieved $1.1 billion in revenue and $14.86 diluted EPS, with gross profit margin improving to 29.4%.

- New orders for Q4 2025 were $271 million, contributing to a year-end backlog of $1.4 billion, of which 60% is convertible in fiscal 2026.

- Strategic initiatives include a $12.4 million investment in capacity expansion for LNG projects and the acquisition of REMSDAC for $18.4 million.

- The company maintains a strong financial position with $476 million in cash and zero debt at the end of fiscal 2025.

Nov 19, 2025, 4:00 PM

Powell Industries Reports Record Q4 and Full-Year 2025 Financial Results

POWL

Earnings

New Projects/Investments

M&A

- Powell Industries reported a record quarterly gross profit of 31.4% and record quarterly earnings per diluted share of $4.22 for Q4 2025.

- For the full fiscal year 2025, revenue increased 9% to $1.1 billion, with net income of $180.7 million and $14.86 per diluted share.

- The company concluded fiscal 2025 with a record backlog of $1.4 billion and a full-year book-to-bill ratio of 1.0 times, with 60% of the backlog expected to convert in fiscal 2026.

- Key strategic moves include the acquisition of REMSDAC for $18.4 million and a $12.4 million investment to expand capacity at its JacintoPort facility, primarily for LNG projects.

- Management anticipates continued strong commercial momentum and expects margins in the upper 20s for fiscal 2026.

Nov 19, 2025, 4:00 PM

Powell Industries Reports Record Q4 and Full-Year 2025 Results, Announces Strategic Investments

POWL

Earnings

New Projects/Investments

Revenue Acceleration/Inflection

- Powell Industries reported a strong finish to fiscal 2025, with Q4 revenue increasing 8% to $298 million and full-year revenue reaching $1.1 billion, up 9% from fiscal 2024. The company achieved record quarterly EPS of $4.22 per diluted share and full-year EPS of $14.86 per diluted share.

- The company's backlog grew to $1.4 billion by the end of fiscal 2025, with 60% convertible into revenue in fiscal 2026. The backlog is increasingly diversified, with electric utility and oil and gas sectors each comprising one-third of the total.

- Strategic investments include a $12.4 million expansion at the JacintoPort facility to support LNG projects, predominantly in fiscal 2026, and the acquisition of REMSDAC Limited for $18.4 million in Q4 2025 to advance its electrical automation strategy.

- Powell anticipates continued strong commercial momentum into fiscal 2026, driven by robust activity in the electric utility, data center, and natural gas markets, despite some softness in traditional oil and gas and petrochemical sectors. The company ended fiscal 2025 with $476 million in cash and zero debt.

Nov 19, 2025, 4:00 PM

Powell Industries Announces Fourth Quarter and Full Year Fiscal 2025 Results

POWL

Earnings

M&A

Guidance Update

- Powell Industries, Inc. reported Q4 Fiscal 2025 revenues of $298 million, an 8% increase, and net income of $51 million, or $4.22 per diluted share, a 12% increase.

- For the full Fiscal Year 2025, revenues totaled $1.1 billion, up 9%, with net income reaching $181 million, or $14.86 per diluted share, an increase of 21%.

- The company's backlog as of September 30, 2025, stood at $1.4 billion, a 3% increase, and new orders for Q4 2025 totaled $271 million.

- Powell Industries completed the acquisition of Remsdaq Ltd. and expects the margin profile recognized in Fiscal 2025 to be sustainable into Fiscal 2026, anticipating another year of solid financial results.

Nov 18, 2025, 9:28 PM

Powell Industries Highlights Strong Financials and Growth Strategy

POWL

New Projects/Investments

Revenue Acceleration/Inflection

Dividends

- Powell Industries (POWL) is an electrical distribution company that achieved a high watermark of revenues of just over a billion dollars last year.

- The company maintains a strong financial position, closing the last fiscal quarter with $433 million in cash and zero debt.

- Key growth areas include the recently acquired UK-based REM Stack automation business for approximately $16 million , and a focus on expanding its services franchise and product portfolio.

- Powell's backlog surpassed $1 billion in 2023 and saw continued strong order cadence, with $880 million of orders booked through the first nine months of the year as of Q3 2025.

- The company's market segments are diversifying, with the utility sector now representing almost a third of the backlog and data centers contributing significantly to the commercial and other industrial sector.

Aug 26, 2025, 8:15 PM

Quarterly earnings call transcripts for POWELL INDUSTRIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more