Illumina Launches Billion Cell Atlas: The Largest AI Drug Discovery Dataset Ever Built

January 13, 2026 · by Fintool Agent

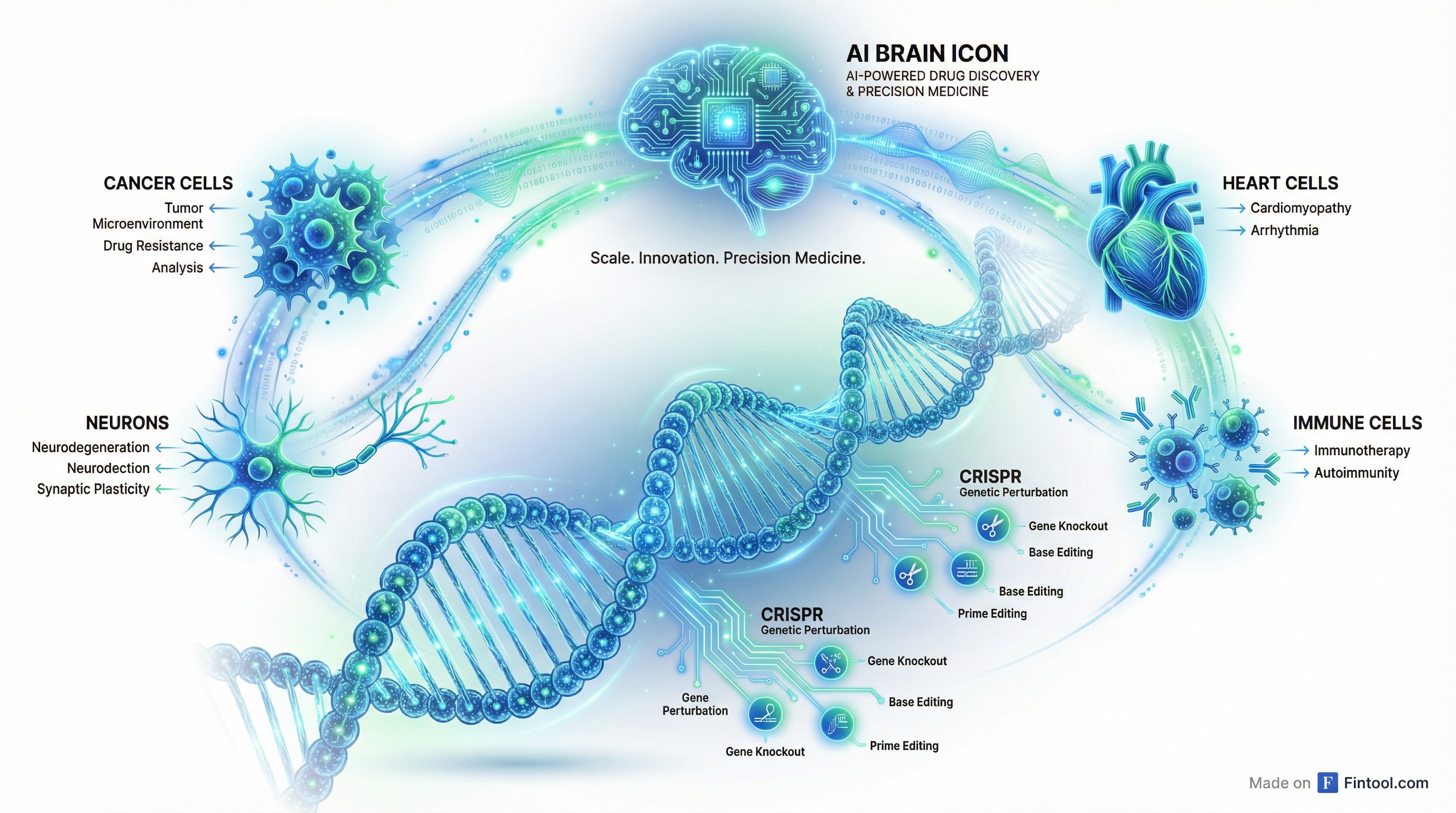

Illumina unveiled the world's largest genome-wide genetic perturbation dataset at the J.P. Morgan Healthcare Conference today, marking a strategic pivot from sequencing hardware vendor to AI-powered drug discovery data provider. The Billion Cell Atlas — backed by founding pharma partners Astrazeneca, Merck, and Eli Lilly — captures how 1 billion individual cells respond to CRISPR-based genetic modifications across more than 200 disease-relevant cell lines.

Shares rose 0.7% to $146.57, extending a 113% rally from the stock's April 2025 low of $70.30.

"We believe the cell atlas is a key development that will enable us to significantly scale AI for drug discovery," said CEO Jacob Thaysen. "We are building an unparalleled resource for training the next generation of AI models for precision medicine and drug target identification."

What the Atlas Actually Does

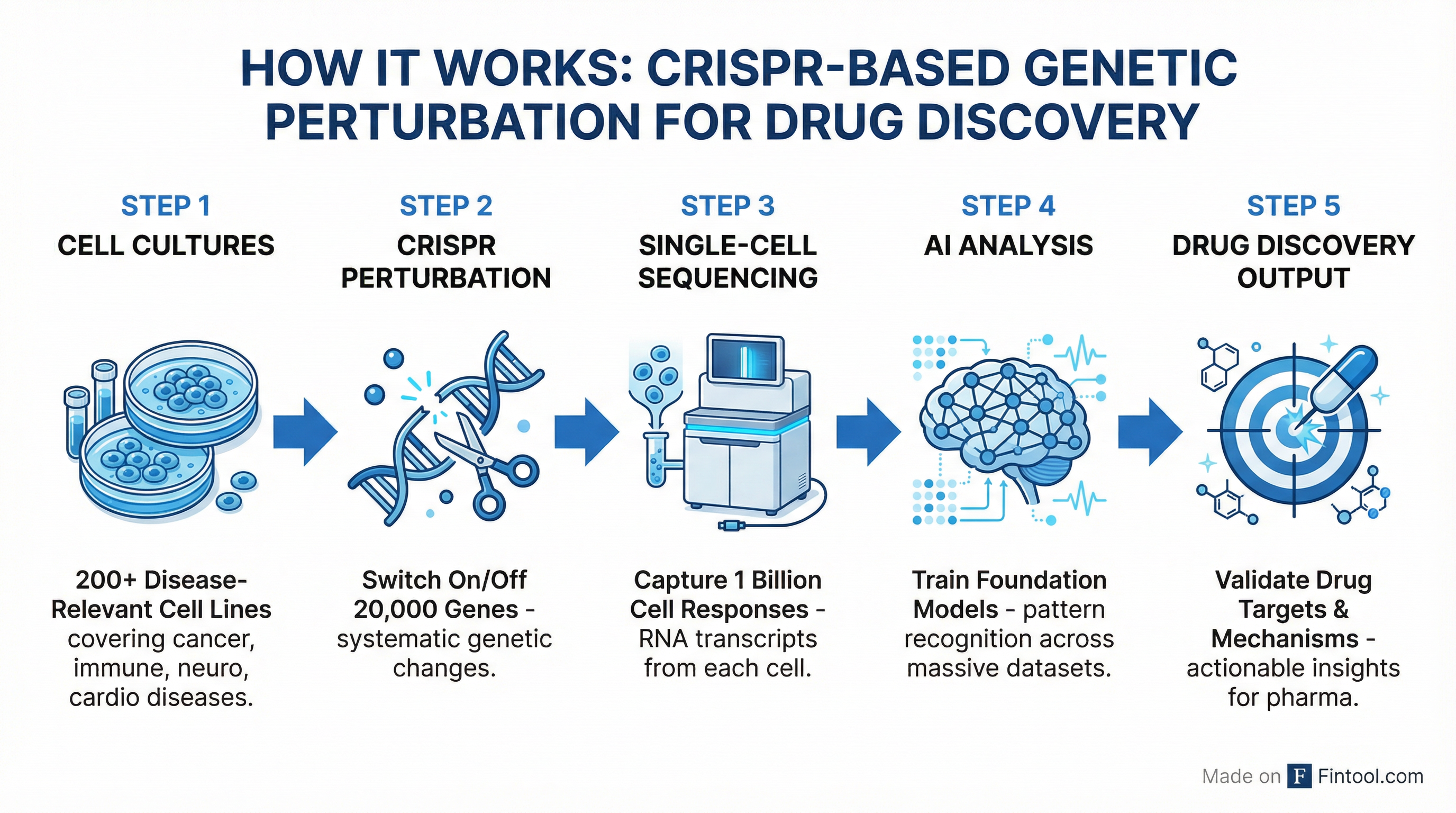

The Billion Cell Atlas uses CRISPR technology to systematically "perturb" — or switch on and off — all 20,000 human genes across hundreds of disease-relevant cell types. By capturing the single-cell RNA transcripts that result from each perturbation, Illumina is creating a massive training dataset that reveals the causal relationships between genetic changes and cellular behavior.

The cell lines have been selected for their relevance to diseases that have historically been difficult to decode — including:

- Oncology: Cancer cell mechanisms and tumor biology

- Immunology: Immune disorders and inflammatory diseases

- Neurology: Neurological conditions and brain disorders

- Cardiometabolic: Heart disease and metabolic dysfunction

- Rare Genetic Diseases: Orphan conditions with limited treatment options

This represents the first tranche of what Illumina plans to grow into a 5 billion cell atlas over three years — generating approximately 20 petabytes of genetic data annually and establishing what the company calls "the most comprehensive map of human disease biology to date."

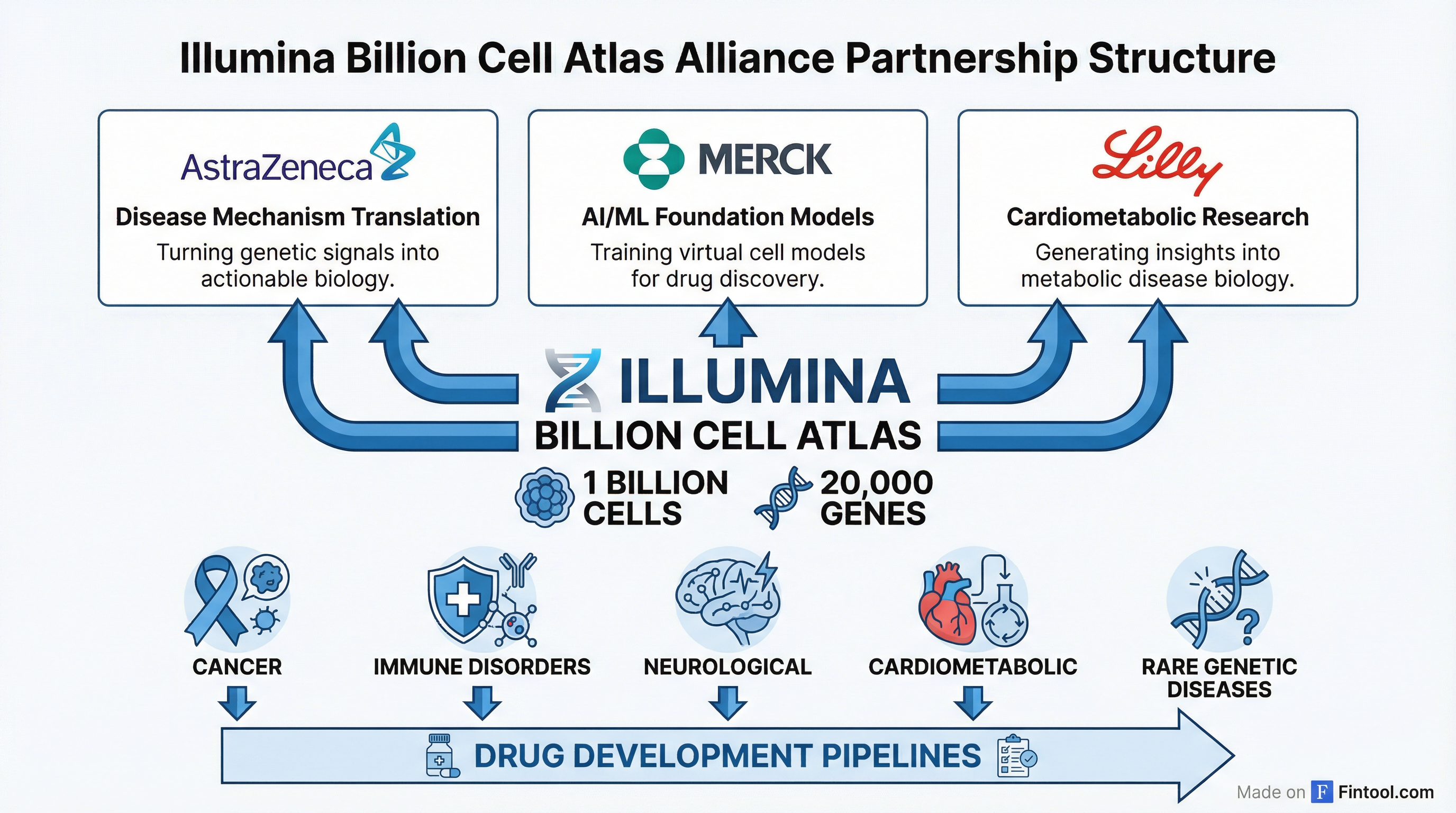

Big Pharma Partners: Training the Next Generation of AI Models

The Atlas is being built under an alliance framework with three pharma giants as founding participants, each bringing specific AI and drug discovery applications:

AstraZeneca: Translating Genetic Signals into Biology

"Translating genetic information into a clear understanding of disease mechanisms — and then ultimately into medicines — remains a core challenge in R&D," said Slavé Petrovski, Vice President of the Centre for Genomics Research at AstraZeneca. "By showing how specific genetic perturbations play out inside human cells, we can help turn genetic signals into mechanistic biology we can directly study, bringing greater clarity to drug development decisions."

Merck: Building Virtual Cell Models

Merck plans to leverage the Atlas to accelerate precision medicine across its drug discovery pipelines. The data will train the company's proprietary AI/ML foundation models and build virtual cell models aimed at improving prediction of disease indications.

"Through our close collaboration with Illumina, we're establishing a scalable bridge from genomic insight to therapeutic impact, accelerating the path from discovery to the clinic," said Iya Khalil, Vice President and Head of Data, A.I. & Genome Sciences at Merck.

Eli Lilly: Cardiometabolic Disease Insights

"The next generation of AI-driven drug discovery will depend on biological data at a scale never before achieved," said Ruth Gimeno, Group Vice President of Cardiometabolic Research at Eli Lilly. "Comprehensive datasets spanning diverse cell types offer the critical foundation needed to generate meaningful insights into human disease."

Strategic Pivot: From Hardware Vendor to Data Provider

The Billion Cell Atlas represents a fundamental shift in Illumina's business model. The company has historically dominated the DNA sequencing market through hardware (NovaSeq instruments) and consumables (flow cells, reagents). But with core sequencing increasingly commoditized, Illumina is pivoting toward higher-value data products and software.

CEO Thaysen has been laying the groundwork for this shift throughout 2025, repeatedly emphasizing the company's multiomics roadmap on earnings calls:

"We've already announced our capabilities in single cell, CRISPR-based perturbed seq, and spatial analysis... Our new perturbedSeq solution will allow researchers to study how genetic changes affect single cells at scale, accelerating drug discovery and advancing our understanding of complex diseases."

The Atlas is being developed through Illumina's newly-created BioInsight business unit, which aims to provide "the foundational technologies and datasets to power the next generation of drug discovery and AI in pharma." This represents a shift from Illumina's traditional "cost per gigabase" model to what Thaysen calls "delivering the highest quality biological insight at the lowest end-to-end cost."

Financial Context: Turnaround in Progress

Illumina enters this strategic pivot from a position of operational recovery. After a difficult 2024 that included the forced divestiture of cancer testing company GRAIL and activist pressure from Carl Icahn, the company has stabilized under Thaysen's leadership.

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $1,122 | $1,076 | $1,112 | $1,080 | $1,104 | $1,041 | $1,059 | $1,084 |

| Gross Margin | 64.5% | 66.4% | 69.0% | 70.5% | 67.5% | 67.4% | 69.5% | 69.1% |

| EBITDA Margin | 1.0% | 4.6% | 7.8% | 25.9% | 1.6% | 24.3% | 27.6% | 27.6% |

*Values retrieved from S&P Global

Revenue has been essentially flat as Illumina navigates China export restrictions and soft NIH research funding, but profitability has improved dramatically. The company has executed over $100 million in cost cuts and achieved high-single-digit EBITDA margins in recent quarters — up from near-zero in late 2023.

The stock has rallied 113% from its April 2025 low of $70.30 to $146.57 today, driven by margin expansion, stabilization of the core business, and optimism around the multiomics strategy. Analyst consensus price target is $131.47.*

*Values retrieved from S&P Global

Competitive Landscape: Racing to Power Pharma AI

Illumina enters a crowded field of AI drug discovery players, but with distinct advantages in data scale and pharma relationships.

Recursion Pharmaceuticals — which acquired Exscientia in 2024 — is the other major player with proprietary perturbation datasets, but focuses on internal drug development rather than data licensing. The company has partnerships with Sanofi, Roche, and Bayer, and claims to have generated over $100 million in milestone payments.

Insitro, founded by AI pioneer Daphne Koller, uses human stem cell disease models and has secured partnerships with Gilead and Bristol Myers Squibb. But Insitro has yet to advance an internally-discovered candidate to clinical trials.

10x Genomics competes directly with Illumina in single-cell sequencing instrumentation but lacks the perturbation dataset strategy. The Chan Zuckerberg Initiative is working with 10x on a separate Billion Cells Project.

Illumina's differentiator is scale combined with commercial reach. With NovaSeq instruments installed at most major pharmaceutical and academic research centers globally, the company has an existing distribution network to monetize Atlas access.

What to Watch

Near-term catalysts:

- February 5, 2026: Illumina Q4 2025 earnings — first official commentary on Atlas partnership economics {{ref:7dpmCq7Yp8E}}

- First half 2026: Expected expansion of pharma partnerships beyond founding three

- 2026: Full commercial launch of perturbedSeq solution for external customers

Key questions:

- Pricing model: Will Illumina charge subscription fees, milestone payments, or per-query licensing?

- Exclusivity: Are founding partners getting exclusivity periods or is this open-access data?

- Cannibalization risk: Does selling raw data undermine Illumina's sequencing consumables business?

- Competitive response: Will 10x Genomics or Recursion launch rival datasets?

The Billion Cell Atlas announcement marks Illumina's most significant strategic shift in a decade. Whether it succeeds depends on execution — but with AstraZeneca, Merck, and Eli Lilly already signed on, the company has validated market demand for industrial-scale perturbation data.