Jensen Huang Called Storage 'Completely Unserved'—Memory Stocks Exploded

January 6, 2026 · by Fintool Agent

"This market will likely be the largest storage market in the world, basically holding the working memory of the world's AIs."

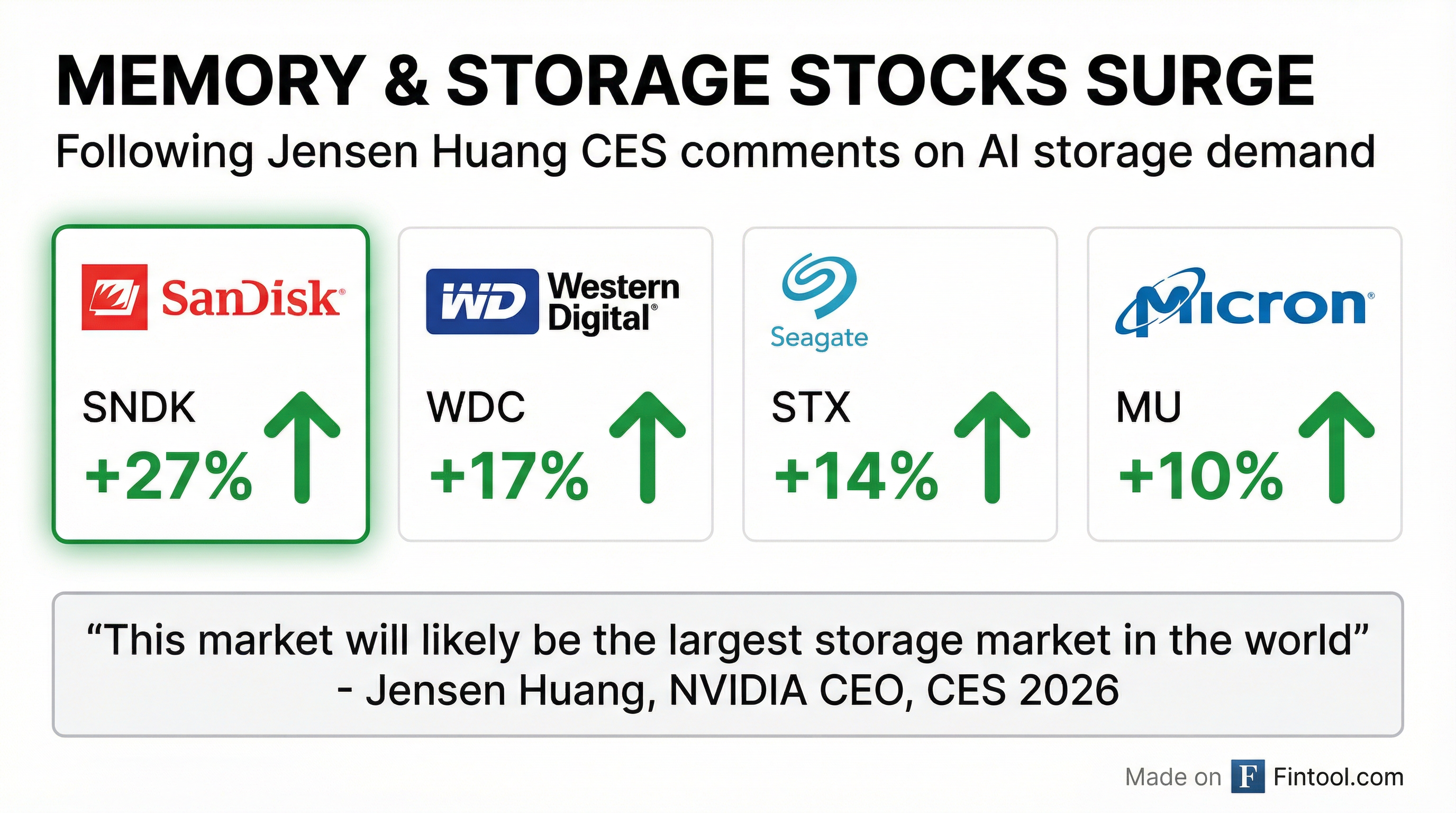

Nine words from Nvidia CEO Jensen Huang at CES 2026 sent memory and storage stocks soaring Tuesday, with Sandisk surging as much as 27% in its best session since February, leading a broad rally across the data storage complex.

One day after declaring HVAC companies obsolete for next-generation data centers, Huang handed a lifeline to a different corner of the AI ecosystem. Storage, he told analysts, is "a completely unserved market today"—and the implications for companies making memory chips and solid-state drives are profound.

The Damage Report (In Reverse)

| Company | Ticker | Intraday Gain | Volume vs Avg |

|---|---|---|---|

| Sandisk | SNDK | +27% | 3x normal |

| Western Digital | WDC | +17% | 2x normal |

| Seagate Technology | STX | +14% | 1.5x normal |

| Micron Technology | MU | +10% | 1.5x normal |

The moves extend what has already been a stunning run for the sector. SanDisk is now up more than 1,000% from its April 2025 lows—the best performer in the S&P 500 over that span—and jumped another 40% in the first three trading days of 2026 alone.

The "Context Memory" Thesis

Huang's bullish comments came during his explanation of NVIDIA's next-generation Rubin architecture and the broader concept of "agentic AI"—systems that reason, plan, and act autonomously rather than simply responding to prompts. These agents require what Huang calls "context memory" and "token memory"—massive amounts of storage to maintain the state and reasoning chains of long-running AI processes.

The key insight: as AI moves from simple chatbots to persistent agents that handle complex, multi-step tasks, storage requirements explode. Training data is one thing, but agents need to remember context across sessions, store intermediate reasoning steps, and maintain audit trails of their actions.

NVIDIA unveiled an "inference context memory" storage platform at CES specifically to address this bottleneck, positioning storage alongside GPUs and networking as a first-class infrastructure investment for AI factories.

Morgan Stanley: DRAM Prices Up 40-70% in Q1

The fundamentals support the hype. Morgan Stanley analysts published a note Tuesday projecting DRAM memory prices will increase 40% to 70% quarter-over-quarter in Q1 2026, while NAND flash prices—the core technology in SanDisk's products—are expected to rise 30% to 35% over the same period.

This follows a year of supply discipline across the industry. Micron CEO Sanjay Mehrotra told investors in September that "AI-driven demand is accelerating, and industry DRAM supply is tight." The company has deliberately slowed NAND node transitions and cut wafer output to rebalance the market.

Micron's Q4 2025 results bear this out:

| Metric | Q2 2025 | Q3 2025 | Q4 2025 | Q1 2026 |

|---|---|---|---|---|

| Revenue | $8.1B | $9.3B | $11.3B | $13.6B |

| Gross Margin | 36.8% | 37.7% | 44.7% | 56.0% |

| Net Income | $1.6B | $1.9B | $3.2B | $5.2B |

Micron's data center business reached a record 56% of total company revenue in fiscal 2025, with gross margins of 52%. The combined revenue from HBM, high-capacity DIMMs, and LP server DRAM hit $10 billion—more than a five-fold increase from the prior year.

SanDisk's Post-Spin-Off Transformation

SanDisk's explosive move reflects its unique position as a pure-play NAND flash company since spinning off from Western Digital in February 2025. The company unveiled its new "SANDISK Optimus" SSD brand at CES—rebranding its internal storage lineup to align with its legacy in flash memory.

| SanDisk Financials | Q2 2025 | Q3 2025 | Q4 2025 | Q1 2026 |

|---|---|---|---|---|

| Revenue | $1.9B | $1.7B | $1.9B* | $2.3B |

| Gross Margin | 32.3% | 22.5% | 26.2% | 29.8% |

| Net Income | $104M | -$1.9B | -$23M | $112M |

*Values retrieved from S&P Global

The company returned to profitability in Q1 2026 as NAND pricing improved, benefiting from the same supply discipline that's lifting the broader memory sector.

Western Digital and Seagate: The Hard Drive Play

While flash memory makers lead the rally, traditional hard drive manufacturers are also benefiting from AI-driven demand. Western Digital CEO Irving Tan told investors that AI tailwinds are pushing the company's exabyte growth projections from the "base" 15% CAGR toward 23%, with revenue growth potentially reaching "mid-teens" versus the "mid to high single digits" previously guided.

The thesis: while SSDs handle hot data and fast access, hard drives remain the only economical solution for storing the massive datasets AI models need for training. As Seagate CEO Dave Mosley explained, "Hard drives are crucial for storing training data, maintaining model checkpoints and preserving both inference and generated content."

Google's Colossus storage system—recently detailed publicly—uses SSDs for fast data access while depending on hard drives for "mass storage and data retention needs due to their scalability and cost benefits."

| Seagate Financials | Q2 2025 | Q3 2025 | Q4 2025 | Q1 2026 |

|---|---|---|---|---|

| Revenue | $2.3B | $2.2B | $2.4B | $2.6B |

| Gross Margin | 34.9% | 35.6%* | 37.5%* | 39.4% |

| Net Income | $336M | $340M | $488M | $549M |

*Values retrieved from S&P Global

The Jensen Huang Effect

Tuesday's moves illustrate just how much the AI narrative has become synonymous with Jensen Huang's pronouncements. One day, HVAC companies lose $15 billion in market cap on his comments about eliminating water chillers. The next, storage companies gain tens of billions on his bullish commentary.

Lynx Equity Strategies analyst KC Rajkumar noted that Huang's comments "provided management discussions about visibility into 2027"—giving investors confidence that AI-driven storage demand has legs beyond the near term.

The broader implication: as NVIDIA's roadmap extends from Blackwell to Rubin to whatever comes next, the definition of what constitutes an "AI stock" continues to expand. Memory, storage, networking, and power infrastructure are all now part of the ecosystem play.

What to Watch

1. Q1 2026 Earnings: Micron reports in late March and will provide the first look at how AI storage demand is translating into actual orders. Watch for HBM revenue updates and data center SSD commentary.

2. NAND Pricing: Morgan Stanley's 30-35% Q1 price increase projection is aggressive. If realized, SanDisk and Western Digital margins could expand significantly.

3. Rubin Deployment: NVIDIA said Rubin-based products will be available H2 2026. As these systems enter production, real-world storage requirements will become clearer.

4. Hyperscaler CapEx: Microsoft, Google, Amazon, and Meta collectively determine where billions in AI infrastructure spending flow. Storage allocation in their CapEx plans will be closely watched.

The memory and storage trade has been one of the best-performing sectors in tech over the past year. Huang's comments suggest the rally may have further to run—but investors are now paying steep multiples for that growth. The question is whether "the largest storage market in the world" lives up to the hype.