Earnings summaries and quarterly performance for SANDISK CORP.

Executive leadership at SANDISK CORP.

Board of directors at SANDISK CORP.

Research analysts who have asked questions during SANDISK CORP earnings calls.

Karl Ackerman

BNP Paribas

7 questions for SNDK

Aaron Rakers

Wells Fargo

5 questions for SNDK

Steven Fox

Fox Research

5 questions for SNDK

Vijay Rakesh

Mizuho

5 questions for SNDK

Jim Schneider

Goldman Sachs

4 questions for SNDK

Joe Moore

Morgan Stanley

4 questions for SNDK

Mark Newman

Bernstein

4 questions for SNDK

Mehdi Hosseini

Susquehanna Financial Group

4 questions for SNDK

Asiya Merchant

Citigroup Global Markets Inc.

3 questions for SNDK

CJ Muse

Cantor Fitzgerald

3 questions for SNDK

Joseph Moore

Morgan Stanley

3 questions for SNDK

Krish Sankar

TD Cowen

3 questions for SNDK

Mark Miller

The Benchmark Company LLC

3 questions for SNDK

Asiya Merchant

Citigroup

2 questions for SNDK

Blayne Curtis

Jefferies Financial Group

2 questions for SNDK

Christopher Muse

Cantor Fitzgerald

2 questions for SNDK

C J Muse

Tanner Fitzgerald

2 questions for SNDK

Matthew Pan

Barclays

2 questions for SNDK

Michael Fednoff

Wells Fargo

2 questions for SNDK

Nam Hyung Kim

Arete Research

2 questions for SNDK

Nam Kim

Arete Research

2 questions for SNDK

Wamsi Mohan

Bank of America Merrill Lynch

2 questions for SNDK

Rupal Singh

Bank of America

1 question for SNDK

Ruplu Bhattacharya

Bank of America

1 question for SNDK

Recent press releases and 8-K filings for SNDK.

- Sandisk's data center business experienced 64% sequential growth last quarter, with expectations for this pace to increase throughout the year, supported by new enterprise SSDs and the upcoming Stargate QLC ESSD.

- The company is actively pursuing Long-Term Agreements (LTAs) with customers to ensure critical supply assurance and dampen market volatility, prioritizing customers willing to make longer-term commitments.

- Sandisk is investing billions in its business and hundreds of millions in R&D annually to achieve mid to high teens bit growth, with BiCS8 expected to be the predominant node by the end of the fiscal year.

- A partnership with SK hynix is progressing on High Bandwidth Flash (HBF) technology for AI inference, with the NAND die expected by the end of 2026 and a system for customers by early 2027, recognizing AI as a significant tailwind for NAND.

- Management views the NAND market as undergoing a fundamental structural transition driven by new buyers and AI use cases, rather than a typical cyclical upswing, and has extended its JV with Kioxia for another 5 years.

- Sandisk highlights fundamental structural changes in the NAND market, with data center demand projected to grow at mid to high 60s in calendar year 2026, making it the largest market segment.

- The company is actively pursuing Long-Term Agreements (LTAs) with customers to better align supply and demand, aiming for a more predictable and sustainable financial model over one to five years.

- Sandisk's data center business demonstrated strong performance with 64% sequential growth in the last quarter, driven by its enterprise SSD portfolio, including the new Stargate product currently in qualification.

- Sandisk is developing High Bandwidth Flash (HBF) technology, focused on AI inference, and expects to have the NAND die ready by the end of this year, with a system for customers available in about a year.

- The company is committed to significant investments, including billions of dollars in the business and hundreds of millions in R&D annually, to achieve high teens bit growth, and has extended its joint venture with Kioxia for another five years.

- Sandisk's CEO believes the NAND market is undergoing fundamental structural changes, with the data center becoming the largest market by calendar year 2026.

- The company reported 64% sequential growth in its data center business last quarter and expects this pace to increase, driven by its enterprise SSD portfolio.

- Sandisk is actively pursuing Long-Term Agreements (LTAs) with customers to ensure supply-demand alignment, dampen market volatility, and secure predictable, sustainable, and financially attractive demand.

- Significant progress is being made on High Bandwidth Flash (HBF) technology, designed for AI inference workloads, with the NAND die expected by the end of 2026 and a system ready for customer use in about a year.

- Sandisk is investing billions in the business and hundreds of millions in R&D to achieve high teens bit growth, and its joint venture with Kioxia for R&D and manufacturing has been extended for another 5 years.

- Sandisk announced the pricing of a secondary public offering of 5,821,135 shares of its common stock at $545.00 per share.

- The shares are being sold by Western Digital Corporation (WDC), Sandisk's former parent, and Sandisk will not receive any proceeds from the sale.

- The offering, which involves a debt-for-equity exchange by WDC, was expected to close on February 19, 2026.

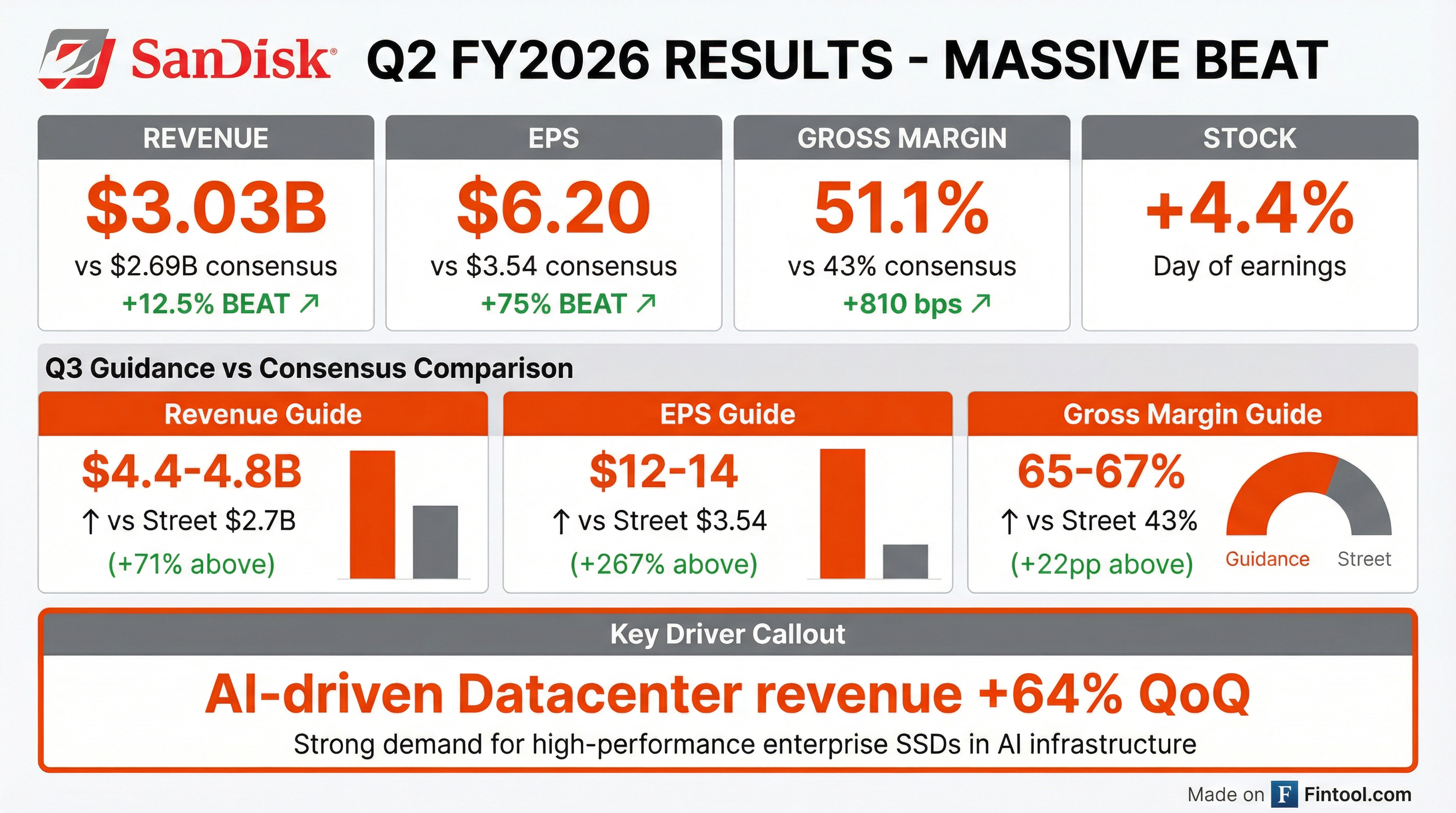

- SanDisk reported Q2 2026 revenue of approximately $3.0 billion and Non-GAAP diluted net income per share of $6.20, with a Non-GAAP gross margin of 51.1%.

- The company experienced strong performance across its end markets, with Datacenter revenue up 64% sequentially, Edge demand meaningfully exceeding supply, and a shift towards premium products in the Consumer segment.

- For Q3 2026, SanDisk anticipates revenue between $4,400 million and $4,800 million, and Non-GAAP diluted net income per share ranging from $12.00 to $14.00.

- SanDisk reported strong Q2 2026 revenue of $3.025 billion, a 31% sequential increase, and non-GAAP EPS of $6.20, both significantly exceeding guidance.

- The company provided robust Q3 2026 guidance, projecting revenue between $4.4 billion and $4.8 billion and non-GAAP EPS between $12 and $14.

- Artificial intelligence (AI) is a significant driver, with data center revenue growing 64% sequentially and expected to become the largest market for NAND in 2026, leading to discussions for multi-year supply and pricing agreements.

- SanDisk extended its Yokkaichi joint venture with Kioxia through December 31, 2034, securing continued product supply.

- SanDisk reported Q2 2026 revenue of $3.025 billion, marking a 31% sequential increase, and non-GAAP earnings per share of $6.20, significantly exceeding guidance.

- The company provided robust Q3 2026 guidance, projecting revenue between $4.4 billion and $4.8 billion and non-GAAP EPS between $12 and $14.

- Artificial intelligence (AI) is a primary growth driver, with data center revenue increasing 64% sequentially in Q2 2026, and the data center market is expected to become the largest for NAND in 2026.

- SanDisk extended its Kioxia joint venture through December 31, 2034, ensuring supply, and has begun signing multi-year agreements with customers, including one with a prepayment component.

- Demand continues to exceed supply, with the company anticipating the market to be even more undersupplied in Q3 2026.

- SanDisk reported Q2 2026 revenue of $3 billion, a 31% sequential increase, and non-GAAP earnings per share of $6.20, significantly exceeding guidance.

- The company provided strong Q3 2026 guidance, expecting revenue between $4.4 billion and $4.8 billion, non-GAAP gross margin of 65% to 67%, and non-GAAP EPS between $12 and $14.

- Artificial intelligence is driving a step change in demand for NAND, with data center and edge workloads expanding, and data center is expected to become the largest market for NAND in 2026.

- SanDisk extended its Yokkaichi joint venture with Kioxia through December 31, 2034, agreeing to pay $1,165 million for manufacturing services over several years.

- Sandisk and Kioxia have extended their joint venture agreements for the Yokkaichi and Kitakami Plants, with the new agreement running through December 31, 2034, an additional five years beyond the previous expiration date.

- As part of this renewed agreement, Sandisk will pay Kioxia USD 1.165 billion for manufacturing services and continued supply availability, with these cash payments to be made in installments from 2026 to 2029.

- The extension aims to ensure stable production of advanced 3D flash memory, leveraging AI-enabled smart manufacturing and economies of scale to address the growing demand driven by generative AI applications.

- Sandisk reported fiscal second quarter 2026 revenue of $3.03 billion, representing a 31% sequential increase and 61% year-over-year increase.

- For Q2 2026, GAAP diluted net income per share was $5.15, and Non-GAAP diluted net income per share was $6.20.

- The company's Datacenter revenue saw a 64% sequential increase, primarily driven by strong adoption among AI infrastructure builders.

- Sandisk expects fiscal third quarter 2026 revenue to be in the range of $4.40 billion to $4.80 billion, with Non-GAAP diluted net income per share projected between $12.00 and $14.00.

Fintool News

In-depth analysis and coverage of SANDISK CORP.

Quarterly earnings call transcripts for SANDISK CORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more