Pentagon Takes $1 Billion Equity Stake in L3Harris Missile Spinoff

January 13, 2026 · by Fintool Agent

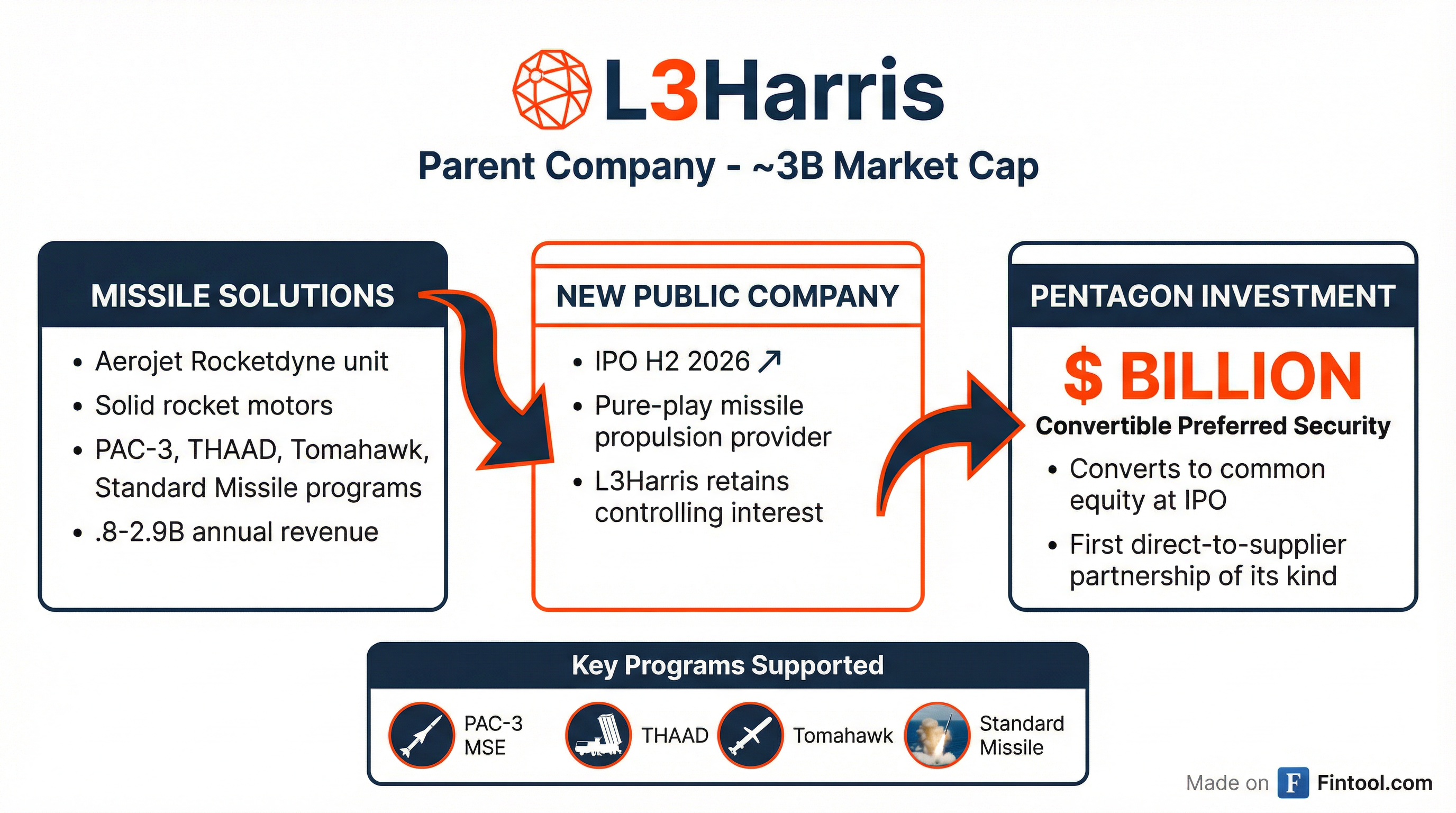

The Pentagon is becoming a shareholder. In a first-of-its-kind transaction, the Department of Defense announced a $1 billion convertible preferred equity investment in L3harris Technologies' Missile Solutions business, which will spin off into a separately traded public company later this year.

L3harris shares surged 5.3% to $357 on the news, adding over $3 billion to the company's market capitalization and pushing the stock to new 52-week highs.

The Deal

The transaction creates a pure-play missile propulsion company backed by guaranteed Pentagon demand:

- $1 billion convertible preferred security from the Department of Defense

- Security converts to common equity upon IPO (planned H2 2026)

- L3Harris retains controlling interest post-spinoff

- Creates a pure-play missile solutions company focused on solid rocket motors

- First "Go Direct-to-Supplier" equity investment in Pentagon history

"We're taking action to build today's 'Arsenal of Freedom' by launching a pure-play missile solutions provider," said Christopher Kubasik, Chairman and CEO of L3Harris. "This new company will serve as a key partner to the DoW in supporting efforts to deter and defeat America's adversaries."

Why It Matters

Solid rocket motors are a critical chokepoint in America's munitions supply chain. The same propulsion systems power the PAC-3 interceptors defending against ballistic missiles, the Tomahawk cruise missiles that strike enemy targets, and the THAAD missiles that form the backbone of theater missile defense.

L3Harris acquired Aerojet Rocketdyne in 2023, gaining control of this strategic capability. The Missile Solutions segment has been on a tear ever since, posting record revenue quarters and double-digit growth as global demand for munitions has surged.

| Metric | Q2 2025 | Q3 2025 | 2025 Guidance |

|---|---|---|---|

| Revenue | $698M | $755M | $2.8-2.9B |

| YoY Growth | +10% | +13% | 10% |

| Operating Margin | 13.3% | 12.7% | Mid-12% |

| Book-to-Bill | 2.0x | — | — |

L3Harris CFO Kenneth Bedingfield, who also serves as President of Aerojet Rocketdyne, described it as "unprecedented demand in the missile solutions business that we expect to continue for an extended period."

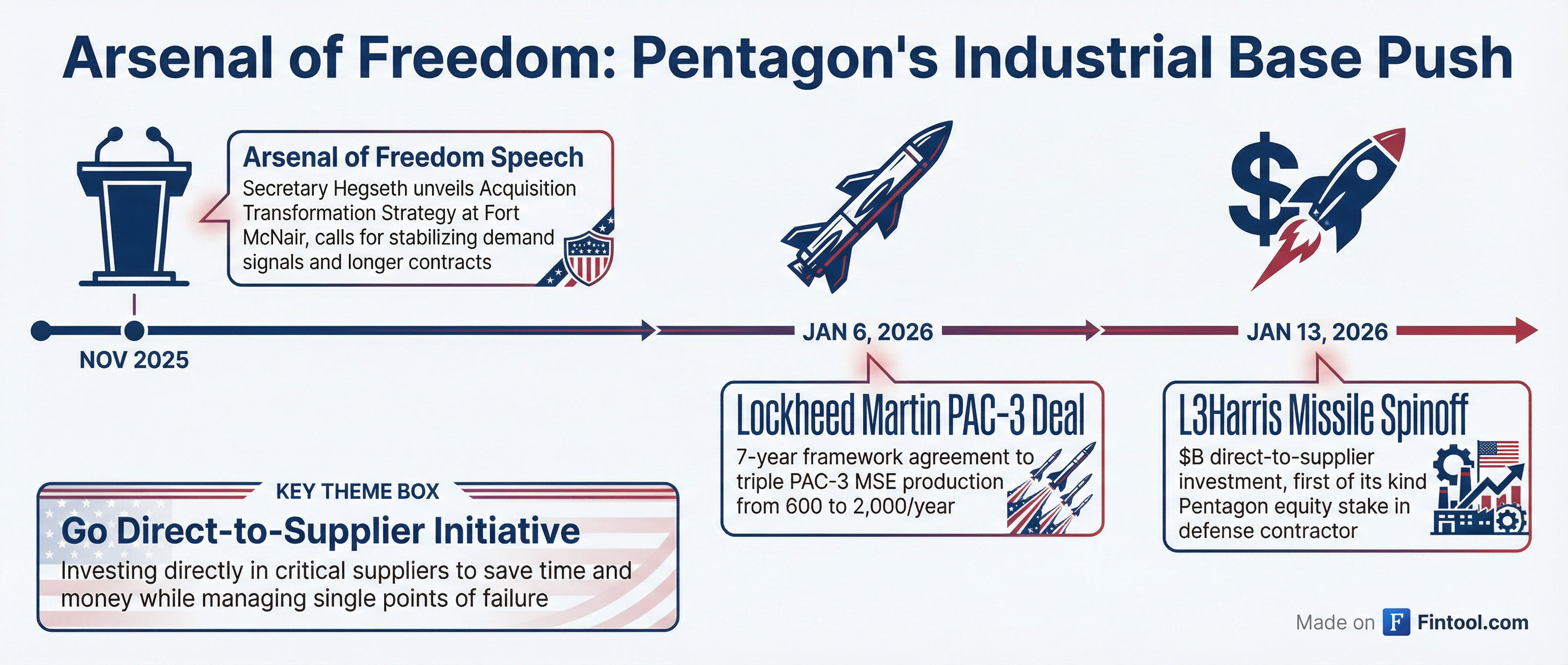

Arsenal of Freedom

The investment is part of a broader Pentagon strategy to revitalize America's defense industrial base. Secretary of Defense Pete Hegseth unveiled the "Arsenal of Freedom" initiative in November, calling for longer contracts and direct investment in critical suppliers.

"We are fundamentally shifting our approach to securing our munitions supply chain," said Michael Duffey, Under Secretary of Defense for Acquisition and Sustainment. "By investing directly in suppliers we are building the resilient industrial base needed for the Arsenal of Freedom."

The L3Harris deal comes just one week after the Pentagon announced a landmark seven-year framework agreement with Lockheed Martin to more than triple production of PAC-3 MSE interceptors from roughly 600 to 2,000 per year. L3Harris' Missile Solutions unit supplies the solid rocket motors for those missiles.

Unusual Structure, Potential Conflicts

The transaction structure—a government convertible preferred security in a defense contractor that converts to common stock at IPO—is unprecedented and may face scrutiny.

Critics may question:

- Conflicts of interest: The government becomes a shareholder in a company it also regulates and buys from

- Market competition: Could preferential treatment disadvantage other suppliers?

- Congressional oversight: The investment uses Industrial Base Analysis and Sustainment (IBAS) authority, but major procurements will require appropriations

On the other hand, the structure aligns government and shareholder interests: if the Missile Solutions company performs well and the IPO succeeds, taxpayers benefit from the equity appreciation.

J.P. Morgan Securities is advising L3Harris on the transaction. Vinson & Elkins is legal counsel.

Investment Implications

The spinoff could unlock significant value for L3Harris shareholders:

-

Pure-play valuation: A standalone missile propulsion company may command premium multiples given the secular tailwind in defense spending and the strategic importance of the capability

-

Growth profile: Missile Solutions is L3Harris' fastest-growing segment with a long runway—management has described the demand outlook as extending "a decade or plus"

-

Government partnership: The Pentagon investment provides both capital and de facto guaranteed demand through multi-year procurement frameworks

-

Parent company focus: L3Harris can sharpen its strategic focus on its Communications Systems, Integrated Mission Systems, and Space & Airborne Systems segments

For the defense sector broadly, the deal signals the Pentagon's willingness to deploy capital directly to secure critical supply chains—potentially benefiting other sub-tier suppliers with strategic capabilities.

What to Watch

-

H2 2026 IPO: The planned public offering will test whether a pure-play missile propulsion company can achieve premium valuation in public markets

-

Congressional scrutiny: Lawmakers may have questions about the unprecedented government equity stake in a defense contractor

-

Capacity expansion: With guaranteed Pentagon backing, expect announcements on new manufacturing facilities and production capacity increases

-

Multi-year contracts: Framework agreements for solid rocket motor procurement should follow, similar to the Lockheed PAC-3 deal structure

Related: