Microsoft Beats on Revenue and EPS, But Record $37.5B Capex Spooks Investors

January 28, 2026 · by Fintool Agent

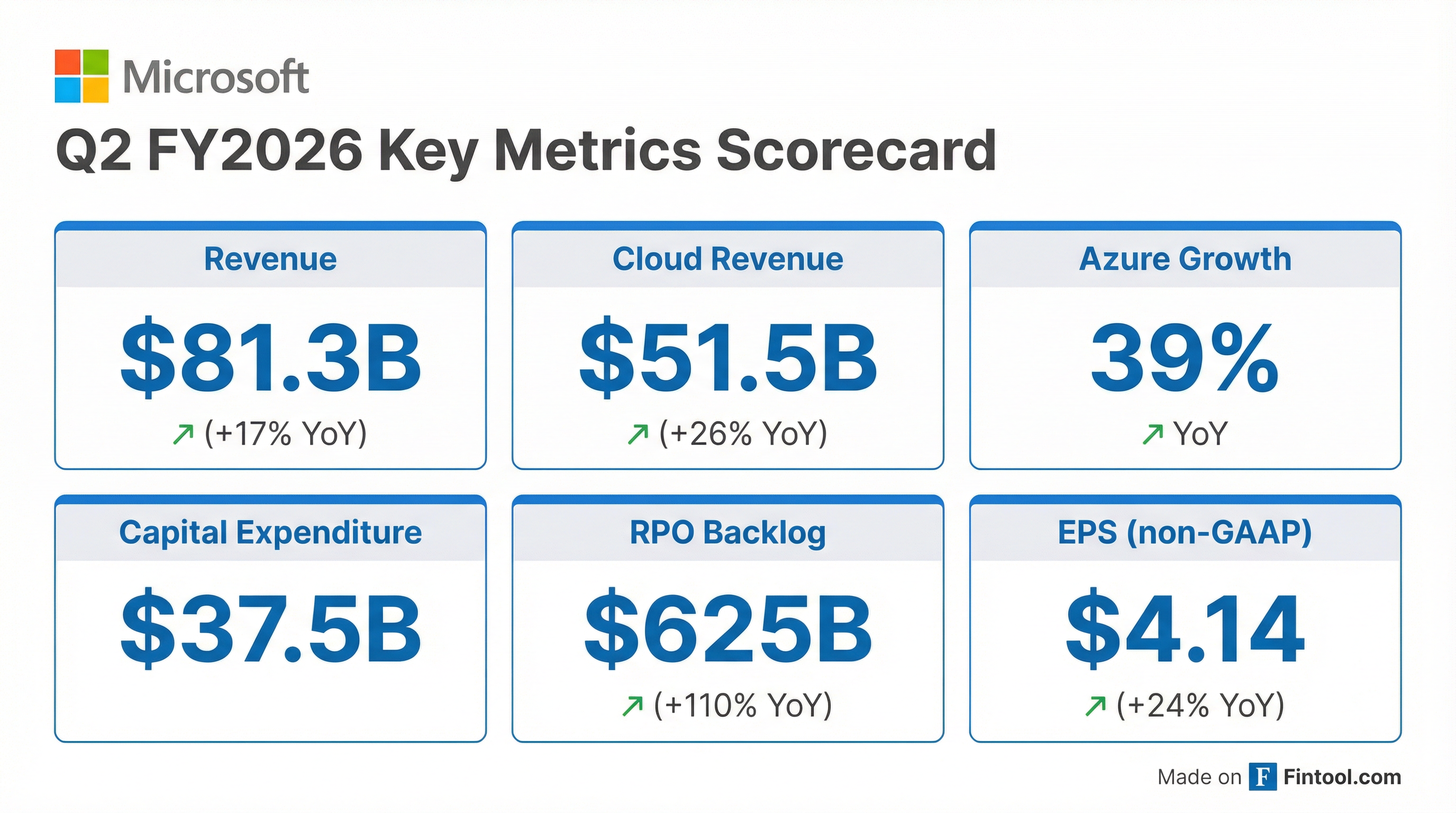

Microsoft delivered another earnings beat on Wednesday, posting Q2 FY2026 revenue of $81.3 billion and non-GAAP EPS of $4.14—both ahead of Wall Street expectations. But investors focused on the record $37.5 billion in quarterly capital expenditure, sending shares down 4% in after-hours trading as questions intensified about the return on Microsoft's massive AI infrastructure bet.

"We are only at the beginning phases of AI diffusion and already Microsoft has built an AI business that is larger than some of our biggest franchises," CEO Satya Nadella said in the earnings release. "We are pushing the frontier across our entire AI stack to drive new value for our customers and partners."

The result: a company firing on all cylinders operationally, with Azure growing 39% and cloud revenue crossing $50 billion for the first time—yet a stock price that reflects growing unease about whether Big Tech's AI spending spree will ultimately pay off.

The Numbers: Beat Across the Board

Microsoft exceeded analyst estimates on every key metric:

| Metric | Q2 FY2026 | YoY Growth | Consensus |

|---|---|---|---|

| Revenue | $81.3B | +17% | $80.3B |

| Non-GAAP EPS | $4.14 | +24% | $3.97 |

| GAAP EPS | $5.16 | +60% | N/A |

| Operating Income | $38.3B | +21% | — |

| Cloud Revenue | $51.5B | +26% | — |

The 60% surge in GAAP earnings per share reflects a $7.6 billion net gain from investments in OpenAI—a one-time boost that underscores the financial entanglement between Microsoft and its AI partner.

Azure Sustains 39% Growth Despite Capacity Constraints

The Intelligent Cloud segment delivered $32.9 billion in revenue, up 29% year-over-year, with Azure and other cloud services growing 39% (38% in constant currency).

This marks the third consecutive quarter of Azure growth at or above 39%, despite what CFO Amy Hood previously described as demand outstripping supply. In Q4 2025, she noted: "We are still seeing demand improve... I thought we'd be in better supply-demand shape by June. And now I'm saying, I hope I'm in better shape by December."

The sustained high growth reflects several drivers that Nadella outlined:

- Cloud migrations: Ongoing on-premises-to-cloud transitions from enterprise customers

- Cloud-native scaling: E-commerce and digital platforms expanding on Azure

- AI workloads: New demand from generative AI applications

Microsoft Cloud revenue—which includes Azure, Microsoft 365, Dynamics 365, and other cloud services—crossed $50 billion in a single quarter for the first time. "Microsoft Cloud revenue crossed $50 billion this quarter, reflecting the strong demand for our portfolio of services," Hood said. "We exceeded expectations across revenue, operating income, and earnings per share."

Record Capex: $37.5 Billion in a Single Quarter

The headline that rattled investors: Microsoft spent $37.5 billion on capital expenditure in Q2, including $29.9 billion in additions to property and equipment plus significant finance leases.

To put this in perspective:

- Q2 FY2025 capex: $22.6 billion

- Q2 FY2026 capex: $37.5 billion

- Increase: 66% year-over-year

Microsoft telegraphed this spending trajectory. In July 2025, Hood guided for Q1 FY2026 capital expenditure "to be over $30,000,000,000 driven by the continued strong demand signals we see." The company has consistently framed the spending as necessary to fulfill a massive contracted backlog.

That backlog now stands at $625 billion in remaining performance obligations (RPO)—up 110% year-over-year—with 45% attributable to OpenAI commitments.

Segment Performance

Productivity and Business Processes ($34.1B, +16%): Microsoft 365 Commercial cloud revenue grew 17%, with continued ARPU expansion from E5 and Copilot adoption. LinkedIn revenue increased 11%. Dynamics 365 grew 19%.

Intelligent Cloud ($32.9B, +29%): Beyond Azure's 39% growth, segment operating income reached $13.9 billion. Gross margin percentage declined four points year-over-year as AI infrastructure scaling weighs on profitability.

More Personal Computing ($14.3B, -3%): The weakest segment, with Xbox content and services down 5% and Windows OEM and Devices essentially flat. Search and news advertising (ex-TAC) grew 10%.

| Segment | Q2 FY2026 Revenue | YoY Growth | Operating Income |

|---|---|---|---|

| Productivity & Business | $34.1B | +16% | $20.6B |

| Intelligent Cloud | $32.9B | +29% | $13.9B |

| More Personal Computing | $14.3B | -3% | $3.8B |

Why the Stock Fell

Microsoft shares dropped 4-7% in after-hours trading despite the operational beat. The disconnect reflects investor anxiety about Big Tech's AI spending trajectory.

The four largest AI spenders—Microsoft, Alphabet, Amazon, and Meta—are expected to spend $505 billion on AI infrastructure in 2026, up from roughly $366 billion in 2025.

Microsoft's stock has struggled over the past six months, falling 11% from its $4 trillion market cap peak even as it consistently beats expectations. The market is demanding evidence that AI spending translates to proportional revenue growth—not just contracted backlog.

The company's remaining performance obligation, while massive at $625 billion, also represents future obligations that must be fulfilled, requiring continued infrastructure investment. It's a flywheel that could compound—or a treadmill that demands ever more capital.

What to Watch

Near-term catalysts:

- Q3 FY2026 guidance (to be provided on earnings call)

- Whether Azure can maintain 38%+ growth as comparisons get tougher

- Gross margin trajectory as AI infrastructure scaling continues

Longer-term questions:

- When will capex growth moderate relative to revenue growth?

- How quickly can Microsoft monetize its $625B contracted backlog?

- Will OpenAI commitments (45% of RPO) drive proportional Azure consumption?