OneStream Goes Private in $6.4 Billion Deal, Just 17 Months After IPO

January 6, 2026 · by Fintool Agent

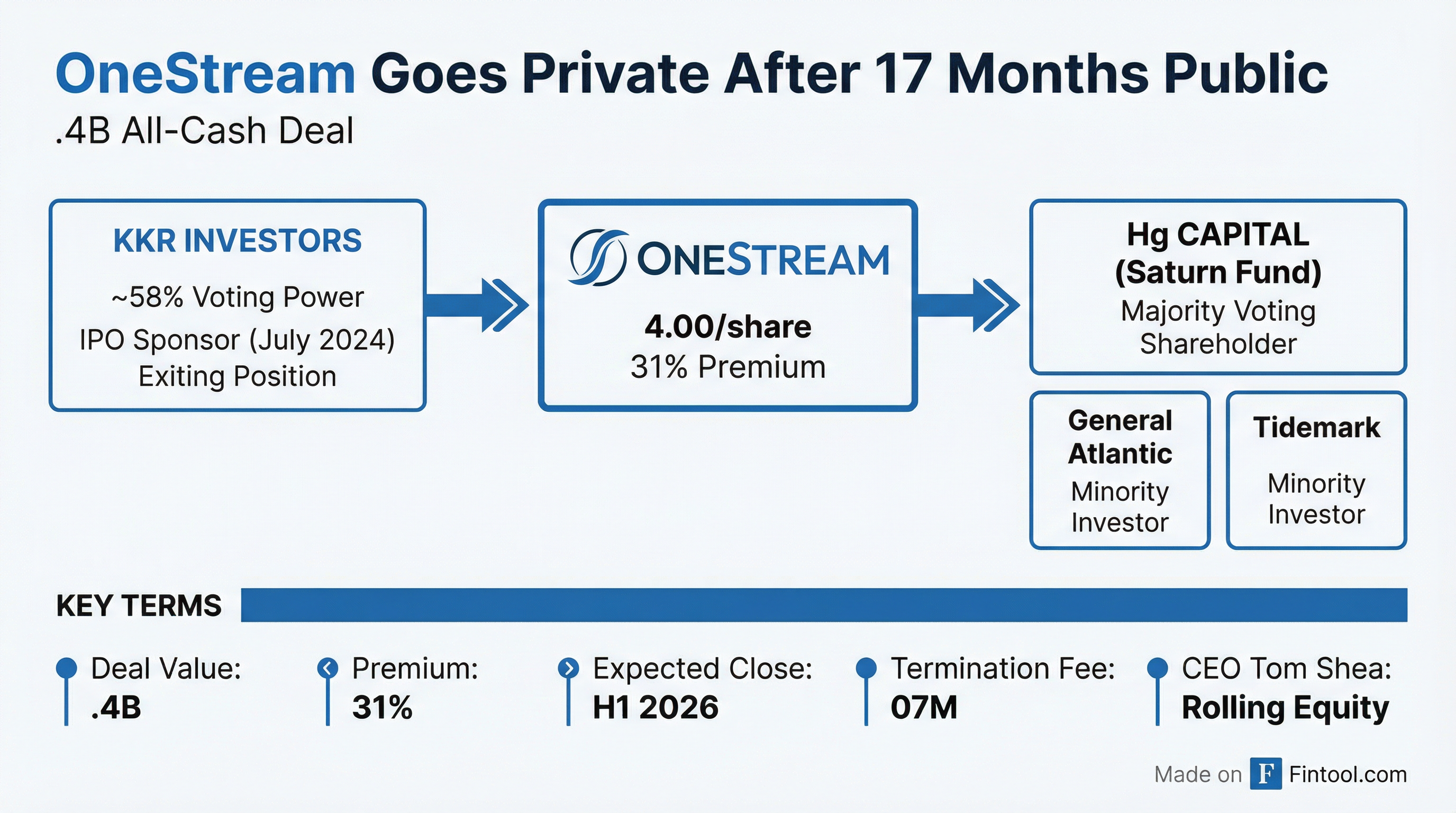

Onestream will return to private ownership just 17 months after going public, agreeing to be acquired by Hg Capital in an all-cash deal valued at approximately $6.4 billion. Shareholders will receive $24.00 per share—a 31% premium to Monday's close—marking a swift end to the Birmingham, Michigan company's tenure as a public company.

The stock surged 28% on the news, closing at $23.61.

The Deal

Hg Capital, a London-based private equity firm with over $100 billion in assets focused on software and services businesses, will acquire all outstanding shares through its Saturn Fund. The transaction includes several notable elements:

- KKR, which took OneStream public in July 2024, held approximately 58% voting power and has agreed to tender all shares

- General Atlantic and Tidemark will become minority investors in the private company

- CEO Tom Shea will roll over a portion of his equity and continue leading the company

- Hg has committed up to $5.6 billion in equity financing to fund the deal

The merger agreement includes a $207 million termination fee if OneStream walks away under certain circumstances, though the deal structure suggests completion is likely. The transaction is expected to close in the first half of 2026, subject to regulatory approvals including Hart-Scott-Rodino clearance.

From IPO to Exit: A Volatile 17 Months

OneStream's public market journey was marked by significant volatility. The company went public on July 24, 2024, pricing at $20 per share and opening at $25.83—a 29% first-day pop that valued the company at roughly $6 billion. KKR and shareholders raised $563.5 million in the offering.

But the stock struggled to maintain momentum. Before today's deal announcement, shares had fallen 35% over the past year, trading around $18. The $24 acquisition price is below the IPO-day close of $25.83 but above the $20 IPO price—leaving early IPO buyers with modest gains while those who bought during the first-day pop faced losses.

For KKR, the exit represents a successful return on their pre-IPO investment, though the public market window proved shorter than typical.

Why Hg Wants OneStream

OneStream operates in the enterprise finance management space, providing software that unifies financial close, consolidation, reporting, planning, and forecasting for CFOs. The company's customer base includes 18% of the Fortune 500, with notable names like Toyota, Ups, News Corp., and General Dynamics.

The company has shown consistent revenue growth:

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $102.6 | $110.3 | $117.5 | $129.1 | $132.5 | $136.3 | $147.6 | $154.3 |

| Gross Margin | 70.3% | 69.1% | 68.5% | 50.1%* | 66.8% | 68.0% | 68.6% | 68.1% |

| Cash Position ($M) | $117.1 | $141.3 | $140.5 | $495.5 | $544.2 | $593.9 | $652.1 | $653.9 |

*Q3 2024 included significant IPO-related costs

Hg sees the acquisition as an opportunity to accelerate OneStream's AI-focused strategy. CEO Tom Shea framed the deal in terms of operational flexibility: "This transaction delivers immediate value to our shareholders and is a vote of confidence in our strategy. We look forward to having the ability to move faster, think bigger and deliver more for our forward-thinking Finance customers."

Hg has extensive experience in financial software, with portfolio companies including Visma (tax and accounting software) and Rhapsody (healthcare).

Take-Private Trend Continues

The OneStream deal fits a broader pattern of software companies retreating from public markets. Valuations for high-growth, unprofitable software companies have compressed significantly since 2022, making some companies more attractive to private equity buyers who can implement operational improvements away from quarterly earnings scrutiny.

The deal also highlights a recurring dynamic: companies that went public during the frothy 2021-2024 period finding that public market valuations don't match their growth profiles. For OneStream, the company was still generating losses—Q3 2025 showed a net loss of $8.9 million—though the trajectory was improving from the $31 million loss in Q4 2024.

Reuters reported that Goldman Sachs dominated M&A advisory in 2025, with $1.48 trillion in deal volume including 38 deals above $10 billion—the strongest period for mega-deals since records began in 1980.

What to Watch

- Regulatory approval: The deal requires Hart-Scott-Rodino clearance and cannot close before April 6, 2026

- No financing contingency: Hg's equity commitment of up to $5.6 billion means no financing risk

- KKR's next moves: With 58% voting power already committed, shareholder approval is effectively secured

- Employee retention: Watch for any changes to the executive team beyond Shea's continuation

The deal is expected to close in H1 2026, with OneStream subsequently delisting from Nasdaq.

Related

- Onestream

- KKR

- General Dynamics (OneStream customer)

- Ups (OneStream customer)