Phil Spencer Retires After 38 Years: Microsoft Gaming Gets AI-Era Leadership

February 20, 2026 · by Fintool Agent

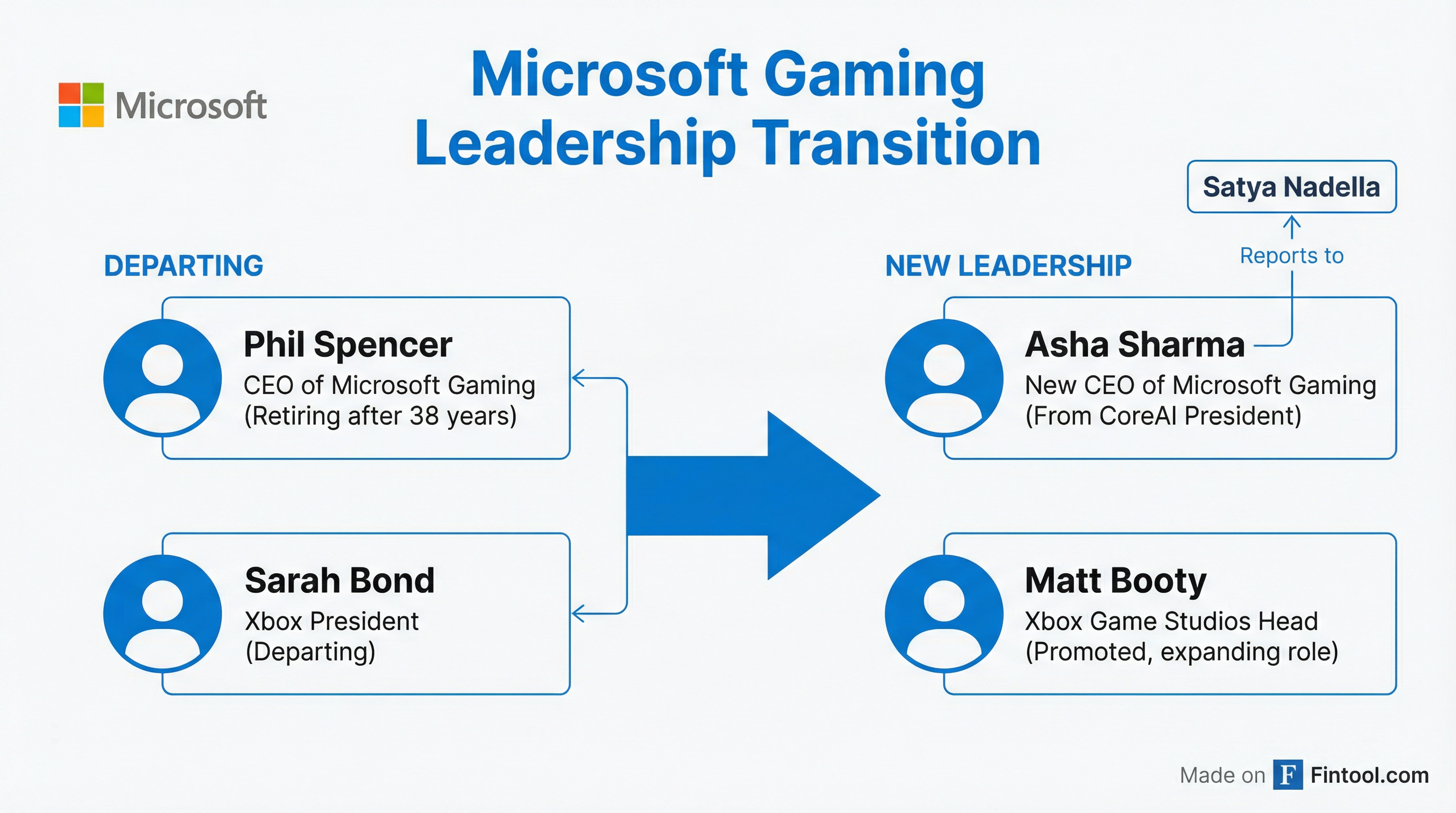

Phil Spencer, the face of Xbox for over a decade and the architect of Microsoft's $68.7 billion Activision Blizzard acquisition, is retiring after 38 years at the company. His exit triggers a sweeping leadership overhaul that also includes the departure of Xbox President Sarah Bond and the ascension of an AI executive to lead one of gaming's most influential divisions.

Asha Sharma, most recently President of Microsoft's CoreAI product development, will replace Spencer as CEO of Microsoft Gaming, reporting directly to CEO Satya Nadella. The move signals Microsoft's belief that artificial intelligence will reshape the gaming industry, even as the division grapples with declining revenues and recent impairment charges.

The Shake-Up

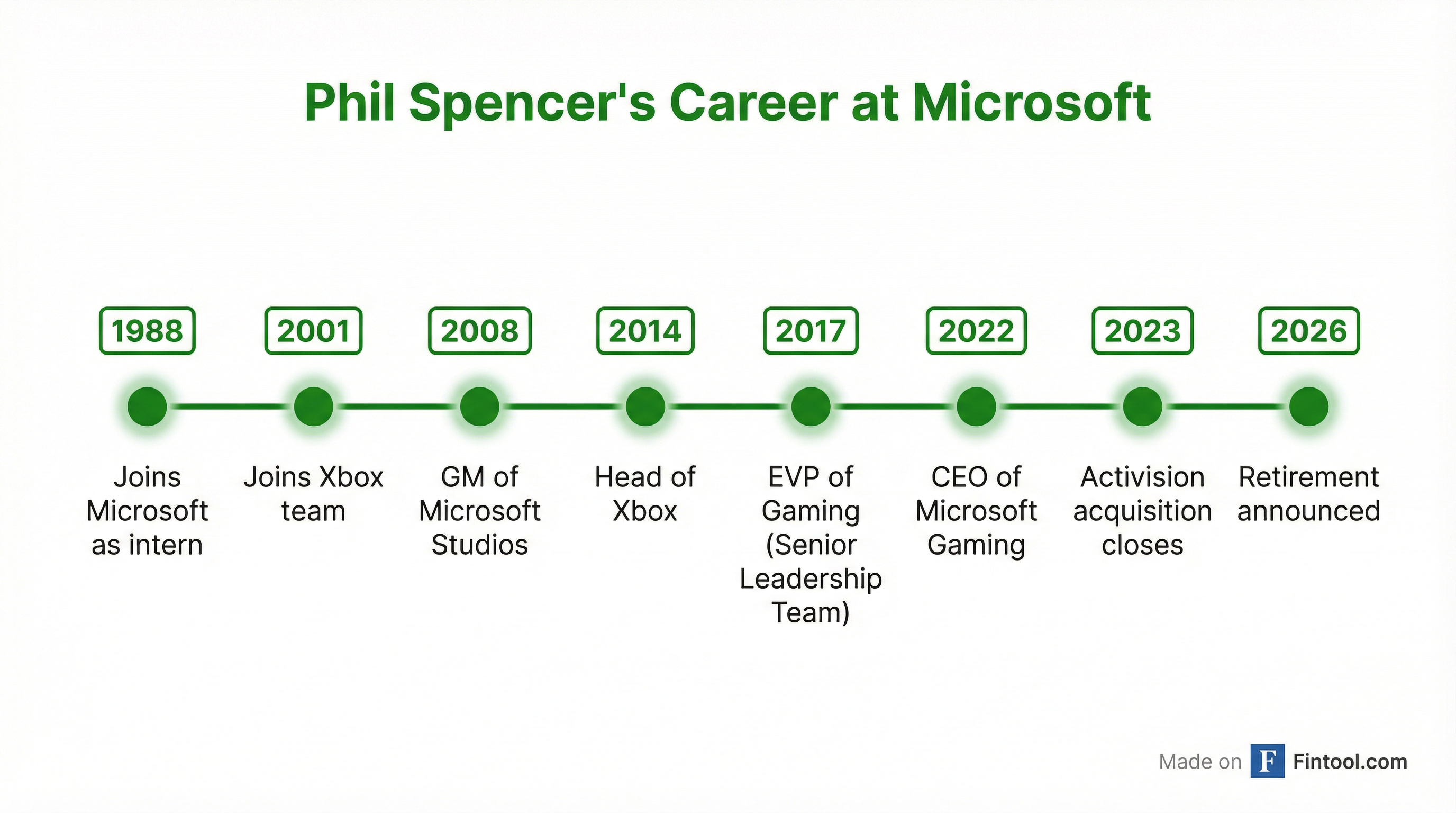

Spencer's retirement, effective Monday, caps a career that began with a 1988 internship and ultimately transformed Xbox from an underdog console maker into a multiplatform gaming powerhouse. In an internal memo, he wrote that he made the decision to retire last fall.

The leadership changes go beyond Spencer:

- Phil Spencer (CEO, Microsoft Gaming): Retiring, will stay in advisory capacity

- Sarah Bond (President, Xbox): Departing Microsoft

- Asha Sharma (CoreAI President): Promoted to CEO, Microsoft Gaming

- Matt Booty (Head, Xbox Game Studios): Promoted with expanded responsibilities

Bond's exit is particularly striking. She was widely viewed as Spencer's successor, having overseen Xbox's hardware, platform partnerships, and the rollout of games to competing platforms. Her departure, announced simultaneously with Spencer's retirement, suggests the shake-up was planned at the highest levels.

A Division Under Pressure

The timing isn't coincidental. Microsoft's gaming business has struggled even after absorbing Activision Blizzard's franchises including Call of Duty, World of Warcraft, and Candy Crush.

In Q2 2026, gaming revenue declined 9% year-over-year, with Xbox content and services down 5% and falling short of expectations. Xbox hardware revenue plunged 32% on lower console volumes. Microsoft also disclosed impairment charges in its gaming business that contributed to a 6% increase in operating expenses.

| Metric | Q2 2026 | Change YoY |

|---|---|---|

| Gaming Revenue | $6.0B | -9% |

| Xbox Content & Services | - | -5% |

| Xbox Hardware | - | -32% |

| Total MSFT Revenue | $81.3B | +17% |

Gaming now represents roughly 7-8% of Microsoft's total revenue, increasingly overshadowed by the company's AI-powered cloud business. Azure and other cloud services revenue grew 39% in the same quarter, driven by demand for AI infrastructure.

Spencer's Legacy

Few executives have shaped gaming more profoundly. Over four decades, Spencer transformed how, where, and why people play video games.

Key accomplishments:

- Xbox Game Pass: Pioneered the subscription model that now defines how millions access games, achieving record subscriber growth and revenue per user

- Cross-platform strategy: Broke with industry tradition by releasing Xbox exclusives on PlayStation, Steam, and Nintendo platforms

- Acquisition spree: Assembled a portfolio of 23 studios including Bethesda ($7.5B), Activision Blizzard ($68.7B), and Mojang (Minecraft)

- Xbox Adaptive Controller: Championed accessibility, creating input devices for gamers with disabilities

- Console launches: Oversaw Xbox One, Xbox One X, and Xbox Series X/S releases

- Cloud gaming: Built Xbox Cloud Gaming (xCloud) to deliver games across devices

The Activision Blizzard acquisition, which closed in October 2023 after a grueling regulatory battle, was Spencer's crowning achievement. Microsoft's stated strategy: bring world-class content to more players on more platforms.

"Our investment in gaming fundamentally was to have the right portfolio of both what we love about gaming...and expand from there so that we have content for everywhere people play games," Nadella said on Microsoft's Q4 2024 earnings call.

Call of Duty: Black Ops 6, the first major Activision release under Microsoft ownership, set records for day-one players and Game Pass subscriber additions.

An AI Executive Takes the Helm

Sharma's appointment represents a strategic bet that artificial intelligence will be central to gaming's next chapter. Her background is in AI and consumer products, not games:

- Microsoft CoreAI: President of product development, building AI capabilities across Microsoft's enterprise suite

- Instacart: Chief Operating Officer, scaling the grocery delivery platform

- Meta: Vice President of Product

The choice mirrors broader industry trends. Game developers increasingly use AI for procedural content generation, NPC behavior, and personalized experiences. Microsoft has already integrated AI across its product lines, from Copilot in Office to AI-powered search in Bing.

Spencer himself noted Xbox saw "record PC players and paid streaming hours," suggesting the division's future lies in software and services rather than hardware.

What to Watch

Near-term:

- How Sharma articulates her vision for Xbox and whether it involves deeper AI integration

- Any restructuring or studio closures given the impairment charges

- Whether more executives follow Bond out the door

Medium-term:

- Game Pass pricing and content strategy under new leadership

- Hardware roadmap for next-generation Xbox

- Integration success of remaining Activision Blizzard properties

Long-term:

- Whether an AI-focused leader can drive creative excellence in an industry built on artistic vision

- Microsoft's commitment to gaming if revenue continues to lag the cloud business

- Competitive dynamics with Sony, Nintendo, and emerging mobile/cloud platforms

Market Reaction

Microsoft shares traded at $396.92, down 0.4% on a day dominated by the Supreme Court tariff ruling. The stock is down 28% from its 52-week high of $555.45, reflecting broader concerns about Big Tech valuations rather than gaming-specific issues.

Gaming peers showed mixed performance:

- Electronic Arts: $200.39, +0.25%

- Take-two Interactive: $199.65, -0.85%

- Sony: $21.90, -1.6%

The muted reaction suggests investors view the transition as succession planning rather than crisis management. Spencer leaves with Microsoft Gaming in a stronger competitive position than he inherited, even if recent quarters have disappointed.

Related: