Saks Global Prepares Chapter 11 Filing as $2.7B Neiman Marcus Merger Unravels

January 9, 2026 · by Fintool Agent

Saks Global, the luxury retail conglomerate formed just 18 months ago through the merger of Saks Fifth Avenue and Neiman Marcus, is preparing to file for Chapter 11 bankruptcy as early as this Sunday, January 11. The collapse marks one of the fastest reversals of fortune in retail M&A history—a $2.7 billion deal that promised to create an American luxury powerhouse instead produced a cash-strapped entity unable to service its debt.

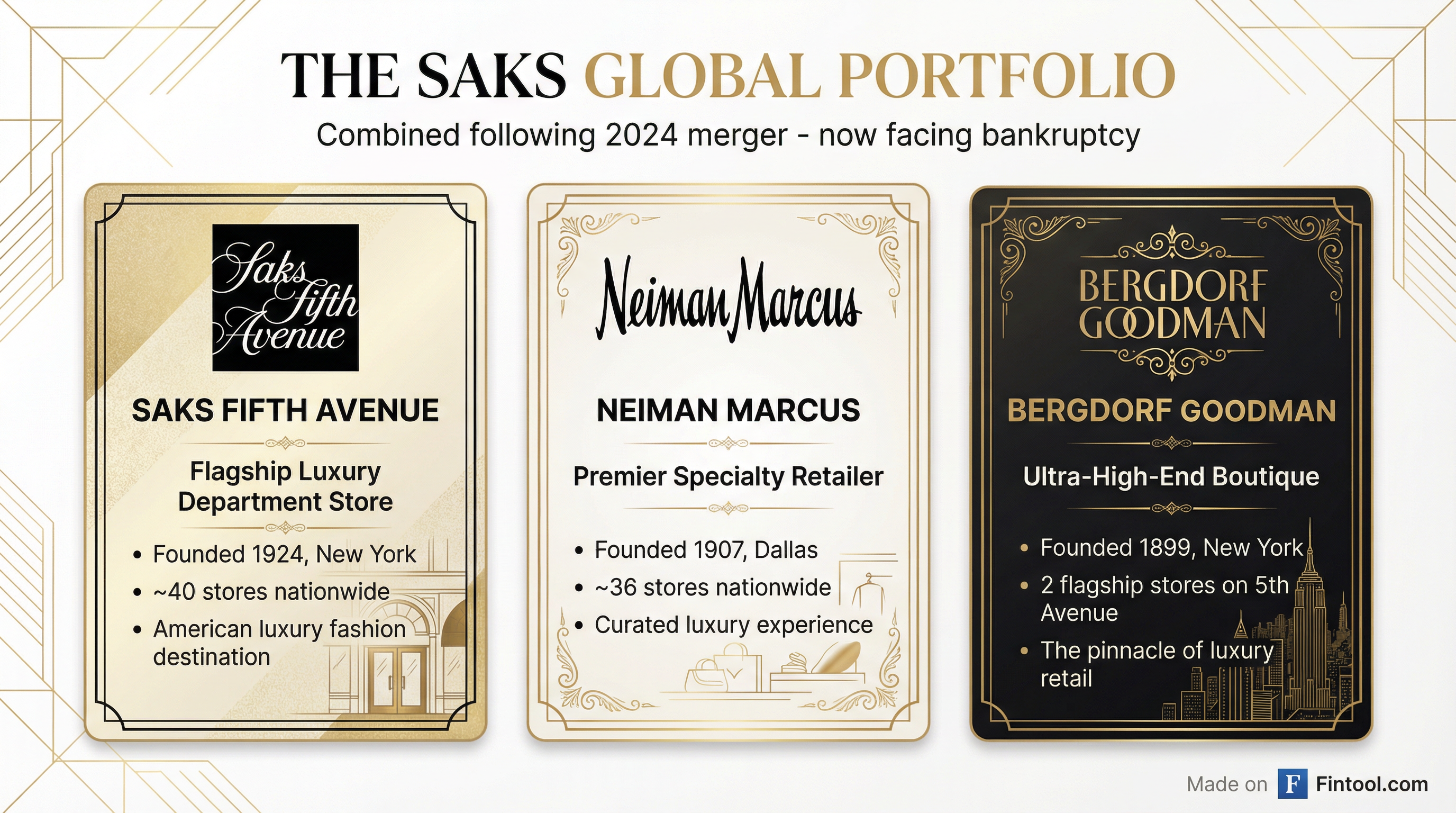

The filing would put three of America's most storied luxury retail brands—Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman—under bankruptcy court protection simultaneously, sending shockwaves through vendors, landlords, and the broader luxury goods industry.

The Trigger: A Missed $100 Million Payment

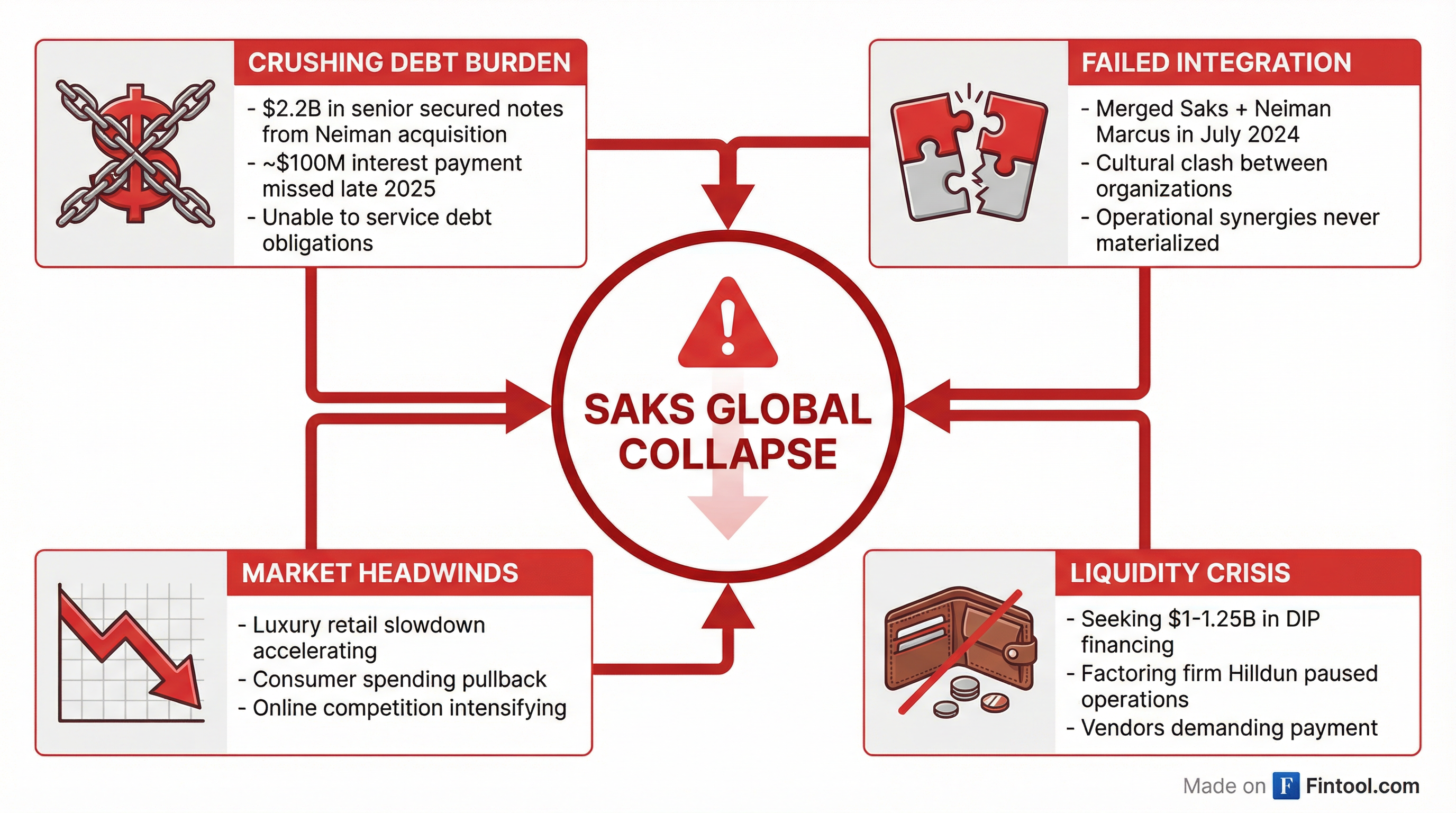

The immediate catalyst for the bankruptcy filing was Saks Global's failure to make approximately $100 million in interest payments on its debt in late 2025. The company had financed its July 2024 acquisition of Neiman Marcus Group with $2.2 billion in senior secured notes—debt that quickly became unmanageable as sales underperformed expectations and integration costs mounted.

Key Deal Terms (July 2024):

| Metric | Value |

|---|---|

| Enterprise Value | $2.7 billion |

| Senior Secured Debt | $2.2 billion |

| Notable Equity Investors | Amazon, Salesforce |

| Controlling Shareholder | HBC (Hudson's Bay Company) |

The deal was supposed to create synergies by combining Saks' brand cachet with Neiman Marcus's Texas-based customer loyalty and Bergdorf Goodman's ultra-high-end positioning. Instead, the merged company found itself drowning in debt servicing costs while struggling to integrate disparate operations.

What Went Wrong

The speed of Saks Global's deterioration stunned even skeptics. Less than 18 months after the deal closed, the company is scrambling to line up bankruptcy financing while vendors halt shipments.

Crushing Debt Load

The $2.2 billion debt load required substantial ongoing interest payments that the combined company's cash flows couldn't support. With luxury retail sales softening industry-wide, Saks Global faced a lethal combination: declining revenues and fixed debt obligations.

Integration Failures

Merging two large retail organizations with distinct cultures, systems, and vendor relationships proved far more difficult than projected. The anticipated cost synergies—often the primary justification for retail M&A—failed to materialize at the pace needed to offset the debt burden.

Market Headwinds

The luxury retail sector has faced mounting pressure as affluent consumers pull back on discretionary spending. Industry-wide, department stores have struggled with the shift to online shopping, changing consumer preferences, and increased competition from mono-brand boutiques.

Liquidity Crunch

The situation deteriorated rapidly in recent weeks. Factoring firm Hilldun, which provides working capital financing to retailers, has reportedly paused its operations with Saks—a critical blow that restricts the company's ability to purchase inventory and pay vendors.

Vendors Sound the Alarm

Third-party data corroborates the distress. Revolve Group, the online fashion retailer, flagged concerns about a "prominent luxury department store chain" during its Q3 2025 earnings call, describing a situation that closely mirrors Saks Global's troubles:

"We've also been closely monitoring the challenges facing a prominent luxury department store chain... They've approached brands requesting extended payment terms, which is a warning sign given their reported declining sales and significant debt obligations from their recent acquisition."

The comment—clearly alluding to Saks—suggests vendors have been aware of payment issues for months. Extended payment terms often presage more serious financial distress.

Timeline to Collapse

The path from transformational merger to bankruptcy took barely 18 months:

| Date | Event |

|---|---|

| July 2024 | Saks Global closes $2.7B acquisition of Neiman Marcus Group, financed with $2.2B in debt |

| Late 2024 | Integration challenges emerge; sales underperform expectations |

| Q3 2025 | Vendors report extended payment term requests |

| Late 2025 | Company misses $100M interest payment |

| Early Jan 2026 | Hilldun pauses factoring operations with Saks |

| Jan 11, 2026 | Expected Chapter 11 filing |

The Scramble for DIP Financing

Saks Global is currently seeking $1 billion to $1.25 billion in debtor-in-possession (DIP) financing to fund operations through bankruptcy. DIP financing is critical for retailers entering Chapter 11—without it, stores cannot maintain inventory, pay employees, or continue operations.

The size of the financing need underscores the depth of Saks Global's liquidity crisis. For context, when Neiman Marcus filed for bankruptcy in 2020 during COVID-19, it secured approximately $675 million in DIP financing. The current ask suggests Saks Global's cash needs are substantially higher.

Key Questions for Creditors:

- Will existing senior secured lenders provide DIP financing, or will new capital be required?

- What happens to the equity stakes held by Amazon and Salesforce?

- Can the company emerge as a going concern, or will assets be liquidated?

Contrast: Nordstrom's Successful Escape

The Saks Global debacle stands in stark contrast to competitor Nordstrom's trajectory. While Saks loaded up on debt to pursue transformational M&A, Nordstrom took itself private in a carefully structured $6.25 billion deal that closed in late 2024.

The Nordstrom transaction saw the founding family partner with Mexican retailer El Puerto de Liverpool to take the company off public markets. The deal valued Nordstrom at $24.25 per share—roughly where the stock traded before going-private discussions emerged.

Nordstrom vs. Saks: Divergent Paths

| Factor | Nordstrom | Saks Global |

|---|---|---|

| Strategy | Go-private with aligned partners | Leveraged M&A consolidation |

| Debt Load | Manageable; family equity | $2.2B+ in new acquisition debt |

| Outcome | Private, patient capital | Chapter 11 bankruptcy |

With Saks Global distracted by bankruptcy proceedings, Nordstrom—now private and free from quarterly earnings pressure—may be positioned to capture market share. Department store competition often operates as a zero-sum game for high-end consumers.

Market Implications

For Luxury Brands

Designer labels that sell through Saks and Neiman Marcus face immediate uncertainty. During bankruptcy, purchase orders may be reduced or cancelled, and payment terms will be dictated by bankruptcy court proceedings. Brands with heavy department store exposure—particularly those without strong direct-to-consumer channels—face the greatest risk.

For Real Estate

Saks Fifth Avenue and Neiman Marcus anchor some of the most prestigious retail real estate in America. Bankruptcy could lead to store closures and lease rejections, impacting mall operators and landlords. The flagship Saks Fifth Avenue store on Manhattan's Fifth Avenue and Bergdorf Goodman across the street represent irreplaceable locations—their fate will be closely watched.

For Remaining Competitors

Macy's, already struggling with its own turnaround efforts, may see both opportunity and risk. While a weakened Saks could cede market share, the bankruptcy also signals broader troubles in the department store model that Macy's shares.

What to Watch

- DIP Financing Outcome: Whether Saks secures the full $1-1.25B it needs, and on what terms

- Store Closure Announcements: Which locations, if any, will be shuttered immediately

- Vendor Response: How luxury brands adjust their department store channel strategy

- Amazon/Salesforce Positions: Whether strategic investors write off their stakes or participate in restructuring

- Emergence Plan: Will the company emerge as a going concern or be liquidated/sold piecemeal?

Related

- Amazon (amzn) - Minority investor in Saks Global

- Salesforce (crm) - Minority investor in Saks Global

- Revolve Group (rvlv) - Flagged Saks payment issues

- Macy's (m) - Department store competitor