Earnings summaries and quarterly performance for Revolve Group.

Executive leadership at Revolve Group.

Board of directors at Revolve Group.

Research analysts who have asked questions during Revolve Group earnings calls.

Dylan Carden

William Blair & Company

6 questions for RVLV

Jay Sole

UBS

6 questions for RVLV

Nathaniel Feather

Morgan Stanley

6 questions for RVLV

Anna Andreeva

Piper Sandler

5 questions for RVLV

Mark Altschwager

Robert W. Baird & Co.

5 questions for RVLV

Matt Koranda

ROTH Capital Partners

5 questions for RVLV

Michael Binetti

Evercore ISI

5 questions for RVLV

Ashley Owens

KeyBanc Capital Markets

4 questions for RVLV

Janine Stichter

BTIG

4 questions for RVLV

Peter McGoldrick

Stifel

4 questions for RVLV

Oliver Chen

TD Cowen

3 questions for RVLV

Simeon Siegel

BMO Capital Markets

3 questions for RVLV

Trevor Young

Barclays

3 questions for RVLV

Janet Kloppenburg

JJK Research

2 questions for RVLV

Janine Hoffman Stichter

Stifel

2 questions for RVLV

Jim Duffy

Stifel Financial Corp.

2 questions for RVLV

Lorraine Hutchinson

Bank of America

2 questions for RVLV

Mary Sport

Bank of America

2 questions for RVLV

Rakesh Patel

Raymond James

2 questions for RVLV

Carson Paull

Evercore

1 question for RVLV

Gabriella Carbone

TD Cowen

1 question for RVLV

Gabriella Garr

TD Cowen

1 question for RVLV

Kathryn Hallberg

TD Cowen

1 question for RVLV

Lorraine Maikis

Bank of America

1 question for RVLV

Lucas Cohen

BMO Capital Markets

1 question for RVLV

Matthew Koranda

Roth Capital Partners, LLC

1 question for RVLV

Randal Konik

Jefferies LLC

1 question for RVLV

Rick Patel

Raymond James Financial

1 question for RVLV

Recent press releases and 8-K filings for RVLV.

- Revolve Group reported double-digit top-line growth and a 44% increase in adjusted EBITDA year-over-year for Q4 2025, with this momentum continuing into the first seven weeks of 2026 with 16% one-year growth.

- The company is targeting double-digit EBITDA margin from its current 8%, driven by gross margin expansion from increasing own brands (which constituted 20% of the business in 2025) and G&A leverage.

- Key growth initiatives include leveraging AI across operations, expanding into new categories such as beauty and men's, growing international sales (currently 21% of business), and cautiously expanding physical retail with potential for one to two new stores later in 2026.

- Revolve also sees a significant opportunity in the luxury sector, with its FWRD segment achieving 14% year-over-year sales growth amidst competitor struggles, and made a minority investment in an apparel brand in early 2026.

- Revolve Group closed 2025 very strong with double-digit top-line growth and a 44% increase in adjusted EBITDA year-over-year in Q4, with this momentum extending into the first seven weeks of 2026, showing 16% one-year growth.

- The company is targeting double-digit EBITDA margin from its current 8%, primarily through gross margin expansion driven by its own brands (which were 20% of the business in 2025) and G&A leverage.

- Key growth strategies include expanding international sales (currently 20% of business), diversifying product offerings into categories like beauty and men's, and investing in physical retail, with plans to open one to two more stores later in 2026.

- Revolve leverages AI extensively across its operations, from developing an internal search algorithm and optimizing supply chain to reducing return rates and enhancing content creation, demonstrating significant efficiency gains and improved customer experience.

- With a strong balance sheet of over $300 million in cash, the company has also deployed $44 million of its share buyback plan and sees a substantial opportunity in the luxury market for its FWRD segment, which achieved 14% year-over-year sales growth.

- Chiron Real Estate Inc. reported a net loss attributable to common stockholders of $7.4 million, or $0.55 per diluted share, for Q4 2025, compared to net income in the prior year period, while Core FFO increased by 6.4% year-over-year to $1.16 per share and unit.

- The company provided full year 2026 Core FFO guidance in the range of $4.30 to $4.45 per share and unit.

- Chiron is changing its common stock dividend from quarterly to monthly payments, maintaining an annualized dividend rate of $3.00 per share, and repurchased 175,634 common shares for $6.0 million in Q4 2025.

- The company completed a public offering of 2,050,000 shares of 8.00% Series B Cumulative Redeemable Preferred Stock for gross proceeds of $51.3 million and noted that a tenant, White Rock Medical Center, LLC, filed for Chapter 11 bankruptcy in January 2026.

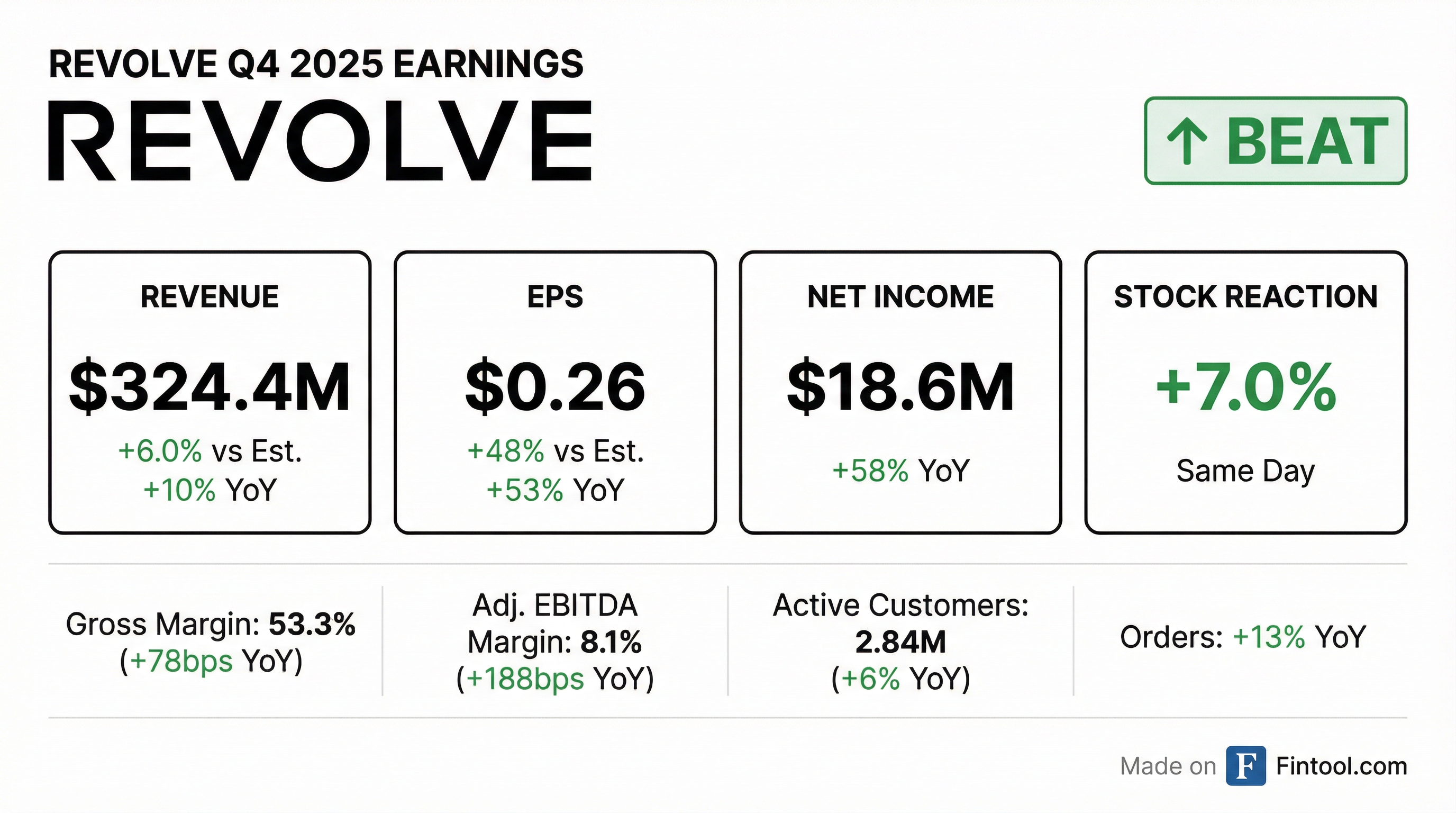

- Revolve Group reported net sales of $324.4 million for Q4 2025, representing a 10% increase year-over-year.

- Net income grew 58% year-over-year to $18.6 million, with diluted EPS at $0.26, a 53% increase compared to the prior year.

- Adjusted EBITDA increased 44% year-over-year to $26.3 million, achieving an 8.1% margin, which is an improvement of 188 basis points.

- The company's gross margin expanded to 53.3%, up 78 basis points year-over-year, primarily reflecting margin expansion in the FWRD segment.

- Active customers on a trailing 12-month basis increased 6% year-over-year to 2,841 thousand, and total orders placed grew 13% year-over-year to 2,445 thousand.

- Revolve Group achieved double-digit top-line growth in Q4 2025, with net sales reaching $324 million, alongside a 53% increase in diluted EPS to $0.26 and a 44% rise in adjusted EBITDA to $26 million.

- For the full year 2025, net sales increased 8% year-over-year, and the company reported a strong start to Q1 2026, with net sales up approximately 16% through the first seven weeks.

- The company plans significant investments in owned brand expansion, AI technology, brand building, and physical retail expansion, aiming for market share gains and long-term growth.

- For full year 2026, Revolve Group expects gross margin to be between 53.7% and 54.2%, with marketing investment projected at 15.3% to 15.8% of net sales due to increased brand marketing efforts.

- For Q4 2025, Revolve Group reported net sales of $324 million, an increase of 10% year-over-year, with adjusted EBITDA of $26 million, up 44%, and diluted earnings per share of $0.26, a 53% increase from the prior year quarter.

- For the full year 2025, net sales increased 8% year-over-year, adjusted EBITDA was $94 million (up 35%), and net income was $61 million (up 25%). The company also generated $59 million in operating cash flow, an increase of 123% year-over-year.

- The FWRD segment demonstrated strong performance, with net sales increasing 14% year-over-year in Q4 2025 and its personal shopping program achieving approximately 100% sales growth in 2025.

- Strategic priorities for 2026 include continued investment in AI technology, expansion of owned brands (which contributed 20% of Revolve segment net sales in 2025), and thoughtful expansion into physical retail.

- The company aims to achieve high single-digit EBITDA margins on a consistent basis and plans significant marketing investments in 2026 to drive accelerated top-line growth.

- Revolve Group reported strong financial results for Q4 2025, with net sales increasing 10% year-over-year to $324 million, and diluted earnings per share (EPS) rising 53% to $0.26.

- For the full year 2025, net sales grew 8% year-over-year, while net income reached $61 million and adjusted EBITDA increased 35% to $94 million.

- The company generated significant cash flow in 2025, with operating cash flow of $59 million (up 123%) and free cash flow of $46 million (up 157%), ending the year with over $300 million in cash and equivalents.

- Key strategic priorities for 2026 include continued investment in owned brand expansion, AI technology, brand building, and physical retail, alongside further international presence expansion.

- The FWRD segment demonstrated robust performance, with net sales growing 14% year-over-year in Q4 2025 and a 33% increase in gross profit dollars, achieving its highest-ever Q4 margin and acquiring the highest number of new customers in its history.

- Revolve Group, Inc. reported robust financial performance for Q4 2025, with net sales increasing 10% year-over-year to $324.4 million, net income rising 58% to $18.6 million, and Adjusted EBITDA growing 44% to $26.3 million.

- For the full year 2025, the company achieved net sales of $1.23 billion, an 8% increase year-over-year, alongside a 25% rise in net income to $61.1 million and diluted EPS of $0.86.

- Operational growth was evident, with active customers increasing 6% year-over-year to 2.84 million and total orders placed up 13% in Q4 2025.

- The company maintained a strong financial position, ending 2025 with $303.2 million in cash and cash equivalents (including restricted cash) and a debt-free balance sheet. Additionally, $2.0 million was used for stock repurchases during the year, with $55.6 million remaining under the repurchase program.

- Revolve Group reported strong fourth quarter 2025 results, with net sales increasing 10% year-over-year to $324.4 million, net income up 58% to $18.6 million, and Adjusted EBITDA growing 44% to $26.3 million.

- For the full year 2025, net sales reached $1.23 billion, an 8% increase year-over-year, while net income rose 25% to $61.1 million and Adjusted EBITDA increased 35% to $93.8 million.

- The company generated $59.4 million in net cash provided by operating activities and $46.2 million in free cash flow for the full year 2025, representing increases of 123% and 157% respectively, and maintained a debt-free balance sheet with $303.2 million in cash and cash equivalents as of December 31, 2025.

- Revolve Group provided a positive outlook for 2026, with net sales increasing approximately 16% year-over-year during the first seven weeks of 2026, and issued gross margin guidance for Q1 and FY 2026.

- Revolve reported strong Q3 results with significant margin growth, primarily driven by tariff mitigation efforts and AI-driven improvements in merchandise assortment algorithms.

- The company observed Q4 trends re-accelerating towards mid-single digits on a two-year stack, with positive consumer behavior noted during the holiday period.

- Revolve is expanding its omnichannel presence with physical stores, including a successful Aspen location and a soon-to-open store at The Grove in Los Angeles, which has shown to attract new customers and benefit online sales.

- Key priorities for 2026 include further investment in physical stores, continued innovation in marketing and own brand launches (e.g., SRG, Halo, Cardi B partnership), and ongoing investments in technology and AI.

Quarterly earnings call transcripts for Revolve Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more