Saks Global Misses $100M Payment, Bankruptcy Filing Imminent

December 31, 2025 · by Fintool Agent

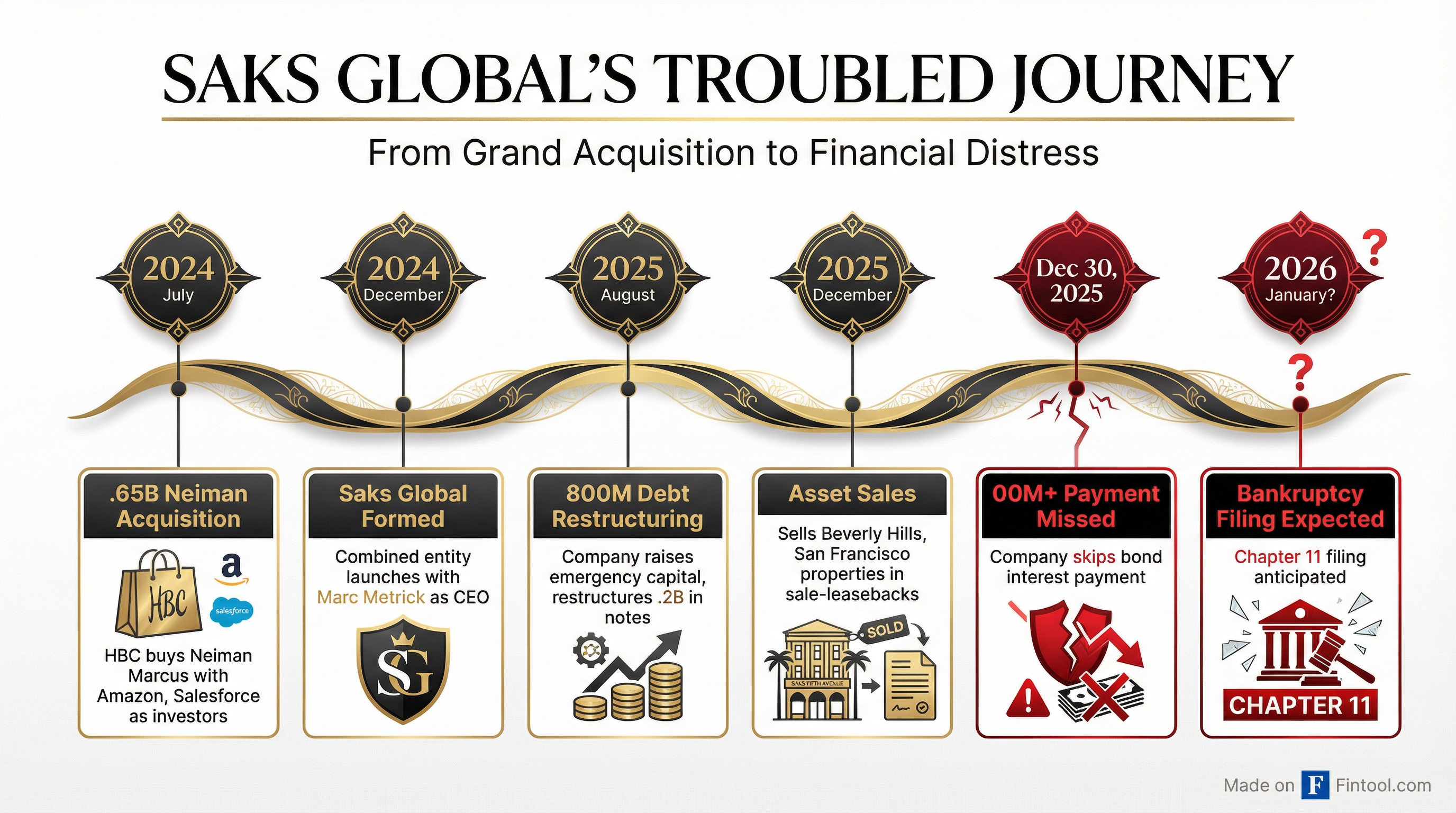

Saks Global Enterprises, the parent company of Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman, missed an interest payment exceeding $100 million on Tuesday, triggering a grace period as the luxury retail conglomerate prepares for a Chapter 11 bankruptcy filing in the coming weeks.

The missed payment, due on $2.2 billion of senior secured notes, comes just 18 months after Hudson's Bay Company raised billions to acquire Neiman Marcus Group and create what was billed as "an unparalleled multi-brand luxury portfolio."

The company is now in confidential talks with creditors about debtor-in-possession financing—the lifeline typically used to fund operations through bankruptcy proceedings.

A Deal That Unraveled in 18 Months

The timeline from triumph to crisis was remarkably short. In July 2024, HBC completed its $2.65 billion acquisition of Neiman Marcus, combining Saks Fifth Avenue, Neiman Marcus, Bergdorf Goodman, and Saks OFF 5TH under a single corporate umbrella.

The deal attracted marquee investors. Amazon.com took an equity stake alongside Salesforce and Authentic Brands Group, hoping to gain insights into how affluent consumers shop while lending tech credibility to the turnaround story.

The capital structure was aggressive from the start: $2.2 billion in senior secured notes, a $1.2 billion term loan from Apollo Global Management, and an asset-based credit facility from a syndicate including Bank of America, Citigroup, Morgan Stanley, RBC, and Wells Fargo.

By August 2025, warning signs had become impossible to ignore. The company completed an emergency debt restructuring that infused $600 million in new money and exchanged the existing senior secured notes—a move that led S&P Global Ratings to downgrade the credit.

Fire Sales and Last-Ditch Maneuvers

In the final weeks of December, Saks mounted a desperate effort to raise cash. On December 29, the company completed sale-leaseback transactions for Neiman Marcus properties in Beverly Hills and San Francisco, reportedly generating between $100 million and $200 million.

The company had also been exploring a minority stake sale in Bergdorf Goodman—its crown jewel property at 57th Street and Fifth Avenue in Manhattan—at a valuation of roughly $1 billion. Reports indicated at least four potential bidders were circling.

None of it was enough. With holiday season results apparently falling short of the robust performance needed to service its debt, Saks let Tuesday's deadline pass without making the payment.

Reports also suggest CEO Marc Metrick may be preparing to step down. Metrick took the helm in December 2024 when Saks Global finalized the Neiman acquisition.

The Brand Empire at Stake

Saks Global encompasses some of America's most storied luxury retail names:

| Brand | Positioning | Notable Locations | Status |

|---|---|---|---|

| Saks Fifth Avenue | Aspirational-to-Luxury | NYC Flagship (since 1924) | Store closures in SF, Canada |

| Neiman Marcus | Luxury Department Store | Dallas (since 1907) | Emerged from bankruptcy in 2020 |

| Bergdorf Goodman | Ultra-Luxury | NYC (57th & Fifth) | 49% stake sale explored |

| Saks OFF 5TH | Off-Price Luxury | Outlet Locations | Closing stores in 2026 |

The combined portfolio represented approximately 150 locations with an estimated $10 billion in annual sales at the time of the merger.

Competitors Circle

While Saks floundered, competitors seized the opportunity. Macy's CEO Tony Spring told analysts in September that Bloomingdale's is "capitalizing on disruption in the marketplace," noting the chain achieved a 5.7% comparable sales gain—its highest second quarter on record.

"Our ambition is to be the leader in local markets that we serve, and our recent performance underscores that Bloomingdale's is gaining momentum," Spring said on the Q2 earnings call. "Our strong heritage of customer service and premium contemporary to luxury positioning is differentiated in the market."

Bloomberg Intelligence data showed transactions at Saks Fifth Avenue and Neiman Marcus fell double digits between January 2024 and October 2025, while Bloomingdale's and Nordstrom posted gains.

| Metric | Macy's Inc. | Trend |

|---|---|---|

| Q2 FY26 Comp Sales | +1.9% | Best in 12 quarters |

| Bloomingdale's Comp | +5.7% | 4th consecutive quarter of growth |

| Bluemercury Comp | +1.2% | 18th consecutive quarter of gains |

"We've been attracting new partners," Spring added, noting brands are increasingly choosing Macy's and Bloomingdale's over struggling competitors.

What Happens Next

A Chapter 11 filing would allow Saks Global to continue operating while restructuring its debt, but the path forward remains uncertain. The company's statement indicated it is "exploring all potential paths to secure a strong and stable future."

Key questions for stakeholders:

- Store closures: Which locations will be shuttered to reduce lease obligations?

- Brand dispositions: Will Bergdorf Goodman be sold as a standalone asset?

- Vendor relationships: Chronic payment delays have already strained supplier relations—bankruptcy could accelerate brand defections

- Amazon's role: Will the e-commerce giant increase its involvement or write off the investment?

The luxury retail analyst community offers a bleak prognosis. "The department store model is not fit for purpose in the 21st century, and certainly not for today's shopper," wrote Mickey Alam Khan of Luxury Daily. "Luxury department stores have to readapt not to real estate, but to luxury shoppers' changed behavior and priorities."

For vendors still owed money by Saks Global, the timing is particularly painful. Law firm ArentFox Schiff published a "bankruptcy survival guide" for fashion brands, warning clients to understand concepts like the 362 automatic stay (which prevents collection actions) and 546(c) reclamation rights (allowing vendors to potentially recover goods shipped within 45 days of filing).

A Pattern Repeats

This would mark the second bankruptcy for Neiman Marcus in five years—the chain filed Chapter 11 in May 2020 amid the pandemic and emerged that September. It would be the first bankruptcy for Saks Fifth Avenue, which has operated since 1867.

The crisis underscores a structural challenge facing luxury department stores: they occupy an uncomfortable middle ground between mass-market retailers and direct-to-consumer luxury brands. Consumers seeking deals can find them at off-price retailers like TJX or Nordstrom Rack. Those seeking exclusivity increasingly buy directly from brands like LVMH's Louis Vuitton or Kering's Gucci, which have invested heavily in their own retail and e-commerce operations.

Amazon's investment—once seen as potentially transformative—now looks like another failed attempt to crack the luxury code. The company's Luxury Stores initiative, launched in 2020, never achieved meaningful scale.

With a bankruptcy filing expected in early January, the focus now shifts to whether Saks Global can emerge as a viable competitor—or whether 2025's combination ultimately accelerated the decline of American luxury department stores.

Related: Macy's Company Profile · Amazon.com · Salesforce